February 11, 2024

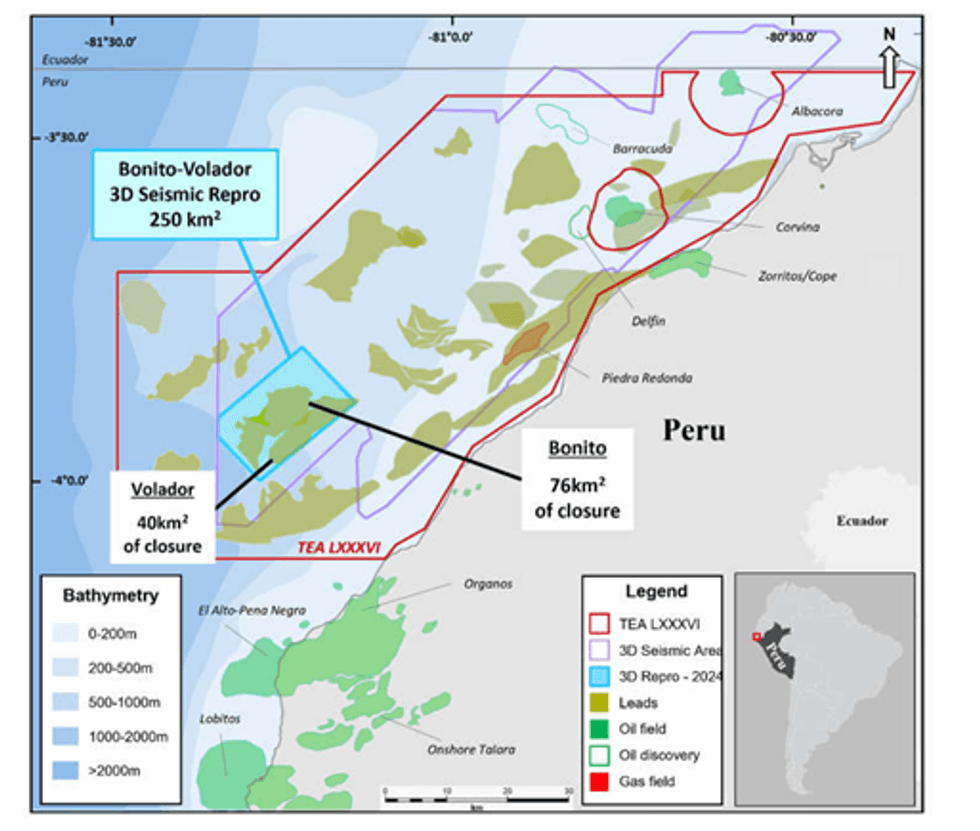

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide a further update on its 4,585km2 Tumbes Basin Technical Evaluation Agreement (TEA or block) offshore Peru. The block comprises over 3,800km2 of existing 3D seismic data and more than 7,000km of 2D seismic.

Highlights

- Commencement of seismic reprocessing targeting the extensive Bonito and Volador prospects in the southern portion of the Company’s 4,585km2 offshore Peru oil and gas block

- The Bonito and Volador prospect area is the first of three prospective areas to be reprocessed – a total of at least 1,000km2 of 3D seismic is to be reprocessed

- Reprocessing expected to enhance structure mapping, improve lithology and fluid discrimination and allow for the estimation of prospective resources and progress through to drill ready targets

The Company propose to reprocess a total of approximately 1,000km2 of 3D seismic data across three discrete highly prospective areas within the offshore block. The first prospective area to be reprocessed is a 250km2 area in the southern part of the TEA incorporating the Bonito and the Volador prospects.

From the interpretation of the historically processed data it is clear that both these prospects have the potential to hold significant hydrocarbon volumes. The reprocessing of the 3D seismic data will enable Global to estimate Prospective Resources and progress the prospects to drill ready status.

Bonito Prospect

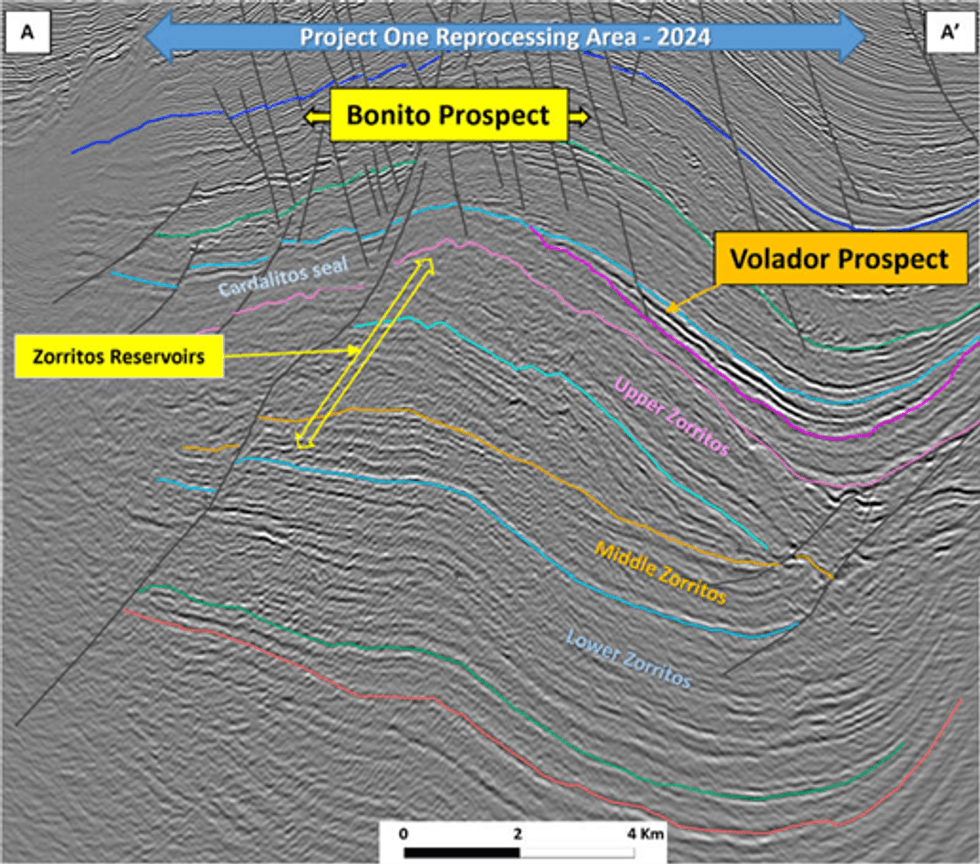

The Bonito prospect is a large anticlinal feature with 76km2 of closure (Figures 2 and 3) where the Zorritos Formation, the primary reservoir in the basin, is at a depth of c. 2,050m (~1,500m sub-sea).

The Tumbes Basin has a complex geological history related to the forces created by the Pacific Plate colliding with, and being subducted beneath, the South American Plate. Periods of faulting and rapid subsidence are interspersed with periods of compression and uplift thought to be responsible for forming the Bonito structure.

Seismic reprocessing should result in improvements to the data quality that will improve both the accuracy of depth mapping and the ability to discriminate lithology and fluids which would ultimately result in the Company’s ability to estimate the potential volumes of hydrocarbons to be contained, select potential exploration well locations and mature prospects to drill ready status.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

13h

Syntholene Energy Corp. Announces Upsize to Previously Announced Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it will be increasing the size of its previously announced... Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00