May 25, 2023

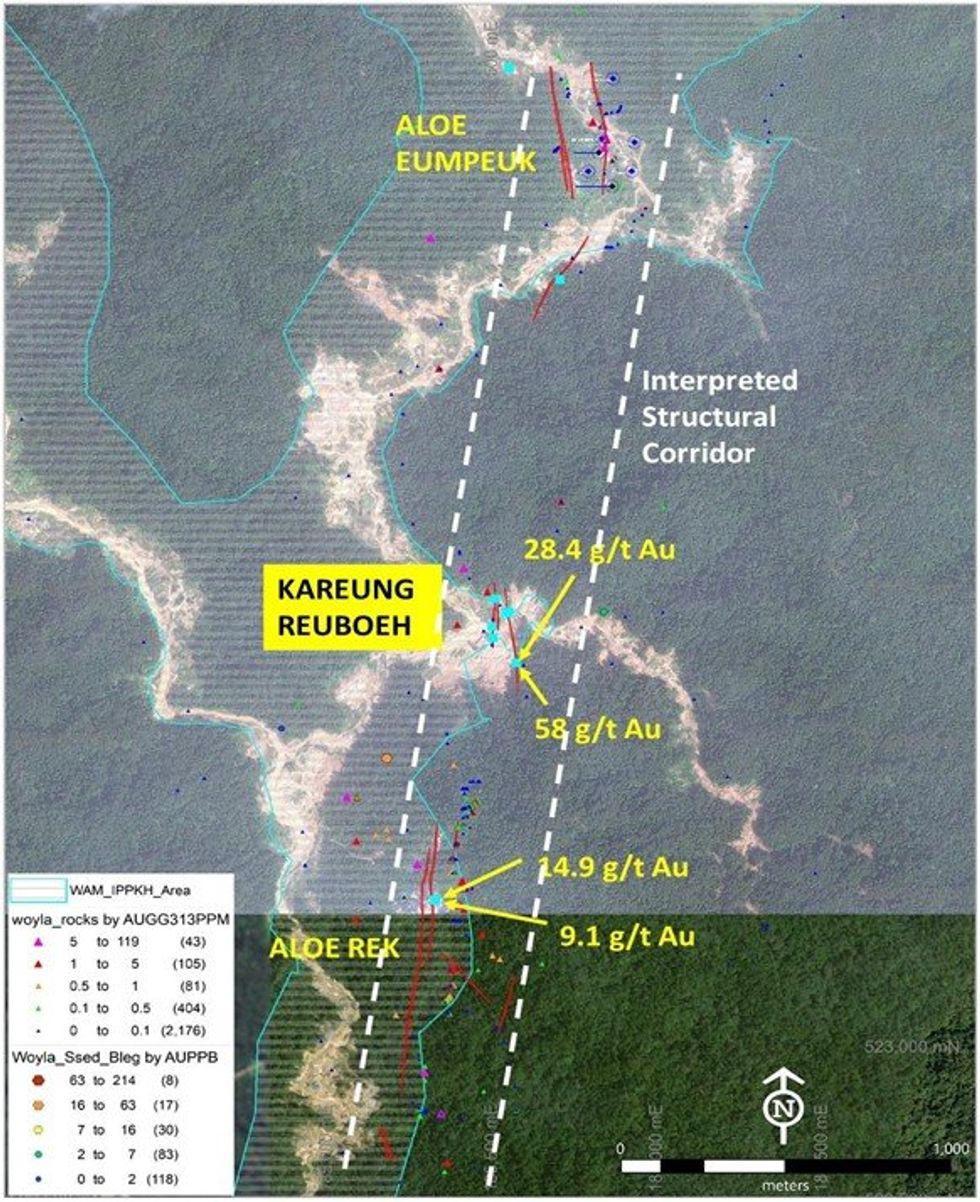

Far East Gold Limited (FEG or the Company) is pleased to announce that recent detailed mapping and surface rock sampling has confirmed the occurrence of high-grade quartz veins south of the Aloe Eumpeuk prospect at the Company’s Woyla project. This discovery indicates the potential for the Aloe Eumpeuk prospect area to link up with the Aloe Rek prospect area, which is located to the southwest, significantly increasing the 13km defined strike length of the Woyla project’s vein system.

Initial sampling of quartz stockwork veins has returned bonanza grade assay results. This is a very significant discovery as the veins were not previously identified by historical exploration and effectively confirms continuation of the structural corridor between the Aloe Eumpeuk and Aloe Rek prospect areas and the potential for additional veins within in it.

HIGHLIGHTS:

- Detailed mapping and rock sampling at the new Kareung Reuboeh prospect approximately 1.5km south of Aloe Eumpeuk has discovered two quartz veins for which assay results indicate significant Au concentration.

- The veins are 1m and 3m in width and occur within the same interpreted structural corridor that hosts the high-grade Aloe Eumpeuk and Aloe Rek quartz vein systems. Four grab samples of exposed quartz veins and quartz stockwork were collected. Two samples of quartz stockwork veins in silicified andesite wallrock in contact with the 3m wide vein returned grades of 28.4 g/t Au, 8.5 g/t Ag and 58 g/t Au, 27.3 g/t Ag. The two grab samples from the 1m wide quartz vein returned 0.08 g/t and 0.48 g/t Au.

- Additional sampling of exposed quartz veins at the Aloe Rek prospect approximately 1km south of Kareung Reuboeh has further confirmed this area as a priority drill target. Grab samples of the quartz vein material collected from artisanal mining pits returned assays of 14.9 g/t Au, 22.1 g/t Ag and 9.1 g/t Au, 20.5 g/t Ag. Both samples show well developed bladed quartz textures and contain abundant arsenopyrite and pyrite. The samples also contain high concentrations of antimony (Sb) of 640 ppm and 228 ppm. These features are consistent with the veins having formed in a high level part of the vein system where high-grade mineralization often occurs.

- The Company continues to drill test the Aloe Eumpeuk and Rek Rinti vein systems and will soon be commencing a detailed UAV magnetic survey over the Rek Rinti prospect area to better define the structural framework hosting the veins and also potential secondary structures that appear to control high-grade Au-Ag mineralisation as seen in the Agam vein zone.

Far East Gold CEO, Mr. Shane Menere commented “The results from recent mapping serve to indicate that there are still plenty of significant discoveries to be made within the Woyla project. The Company will continue to identify drill targets and quickly test them. There is plenty of exploration ahead of us.”

The discovery of high- grade mineralisation at the Kareung Reuboeh prospect area confirms the continuation of the interpreted structural corridor that hosts high-grade Au-Ag-bearing quartz veins at Aloe Rek and Aloe Eumpeuk prospects. Together this represents a distance of 2.5km with demonstrated potential to contain high-grade mineralization. One drill is currently testing vein targets within the Aloe Eumpeuk prospect area.

Click here for the full ASX Release

This article includes content from Far East Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

5h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

22h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00