August 22, 2023

Antler Gold (TSXV:ANTL) focuses on sustainability and on tapping into the cyclical nature of commodity markets by generating and increasing shareholder value and attracting joint venture partners to fund what it considers to be the highest-risk phases of exploration. Antler's strategy is shaped around several key trends including the increasing demand for specialty minerals.

Antler acquires new projects and opportunities in exchange for milestone-based equity and cash payments, production royalty on each asset, and equity interest in individual projects to generate both short-term and long-term value for investors.

With a disciplined approach to mineral property acquisitions, Antler capitalizes on low valuations and preserves capital during periods of market volatility. Through this approach, the company retains exposure to potential multiples in the event of a mineral discovery. It also thrives on a diversified portfolio, giving it even more potential to attract reputable and robust strategic partnerships.

Company Highlights

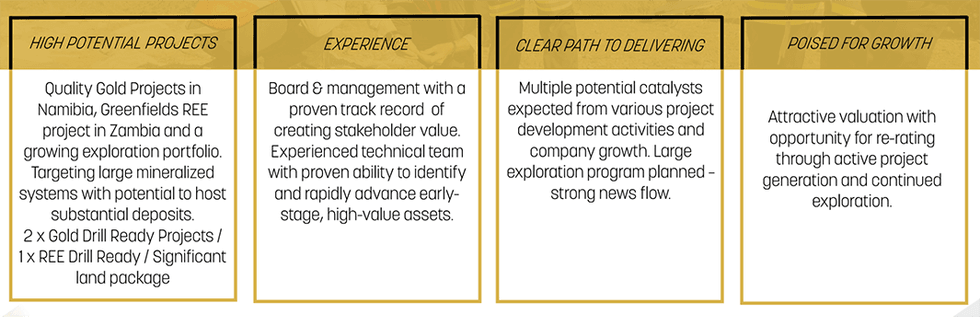

- Antler Gold is a project generation and exploration company focused on discovering economically viable deposits in Southern Africa.

- The company holds several gold projects in Namibia, REE assets in Zambia and a growing strategic exploration portfolio.

- This portfolio contains multiple highly prospective tenures situated in a fertile gold belt.

- Antler's Onkoshi and Erongo gold projects are both high-quality and drill-ready with significant new discovery potential.

- The company's Kesya REE project has the potential to host a significant high-value rare earth deposit.

- Antler employs an experienced management team with a track record of significant discoveries in Africa.

- The company also displays an attractive valuation with considerable opportunity for re-rating and multiple potential catalysts from exploration activities.

- With continued growth through its unique project generation and exploration strategy, the market can expect a strong news flow that seeks to:

- Provide insights into responsible resource extraction processes and sustainable mining practices.

- Convey the value of projects that are economically viable.

- Educate the market about the importance of balancing short-term returns with long-term success.

- Foster a greater appreciation for opportunities in the mining sector.

This Antler Gold profile is part of a paid investor education campaign.*

Click here to connect with Antler Gold (TSXV:ANTL) to receive an Investor Presentation

ANTL:CC

The Conversation (0)

21 August 2023

Antler Gold

Strategic Project Generation in Africa's Rare Earths and Gold Market

Strategic Project Generation in Africa's Rare Earths and Gold Market Keep Reading...

1h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

17h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00