April 30, 2024

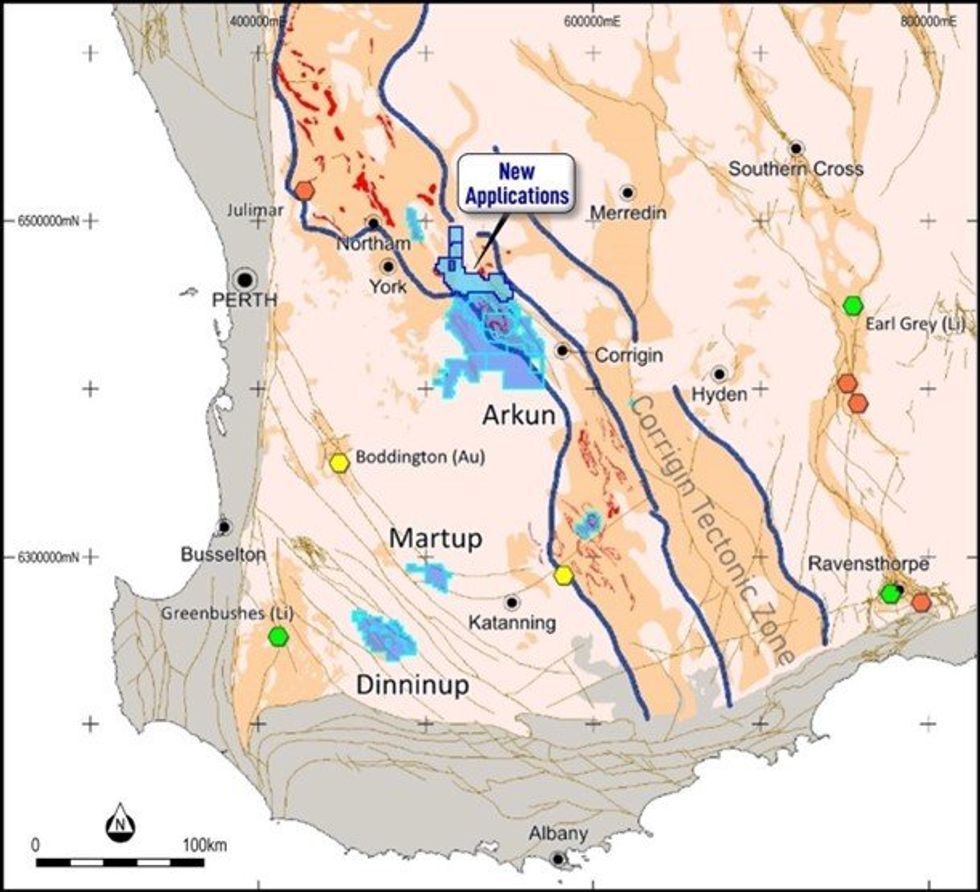

Impact Minerals Limited's (ASX:IPT) is pleased to announce that it has been awarded $180,000 under the WA Government’s Exploration Incentive Scheme (EIS) to co-fund drilling of the Caligula copper prospect at the company’s 100% owned Arkun Project located 150 km east of Perth in the emerging mineral province of southwest Western Australia (Figure 1 and ASX Release January 4th 2024).

- Co-funding of up to $180,000 awarded under the WA Government’s EIS scheme to drill the large and significant Caligula copper target identified in soil geochemistry data and Mobile Magneto-Telluric (MMT) data.

- Caligula comprises a 5 km by 1 km soil geochemistry anomaly containing copper-silver-cobalt+/- tellurium-bismuth-molybdenum associated with numerous conductors identified in the MMT data that may represent disseminated or massive sulphides.

- Infill and extensional soil geochemistry surveys have been completed to help define specific drill targets with assays due this Quarter.

- The statutory approvals process for a drill programme has now commenced.

- The aircore drill programme at the Hyperion Prospect, which forms part of IPT’s broader Arkun Project, has been completed. Hand-held XRF data is being interpreted to help select samples for assaying, with results expected later this Quarter.

The Caligula prospect comprises a large soil geochemistry anomaly that is coincident with several significant conductors identified in helicopter-borne Mobile Magneto-Telluric (MMT) data that may represent disseminated or massive sulphides (ASX Releases 9th August 2023 and January 24th 2024).

Caligula is 15 km west of the Hyperion Rare Earth Element prospect anomaly, where an aircore drill programme was recently completed (ASX Releases January 4th 2024 and April 19th 2024). The Arkun project was also recently expanded with three new tenement applications (Figure 1 and ASX Release March 14th 2024).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “This award validates our exploration programmes at Arkun over the past few years. Caligula is one of many geochemical and geophysical targets we have at the project and so the information we will gain from the proposed drill programme will add immensely to our knowledge of this poorly exposed and poorly explored area. We will now start the statutory approvals process for the drilling. We have just completed our maiden drill programme at Hyperion to test for Rare Earth Elements and are interpreting the handheld XRF data to select samples for assaying, and we are looking forward to those results”.

Soil Geochemistry Results

The Caligula prospect comprises an area of anomalous copper-in-soils that extends over about 5,000 metres north-south and up to at least 2,000 metres east-west. It is open to the east and the southwest (Figure 2). The copper is associated with anomalous silver and cobalt and, in the southern part of the anomaly, also has a strong association with bismuth, tellurium and lesser molybdenum (Figure 2). Details about the soil geochemistry results were included in the ASX Release of January 24th 2024.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

8h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

9h

Precious Metals Price Update: Another Week of Volatility for Gold, Silver, PGMs

It's been another week of strong volatility in precious metals prices.Gold, silver and platinum have posted new all-time highs in 2026, but so far February has been more choppy seas than smooth sailing. A complex web of push-and-pull factors are at play in the precious metals market. Let’s take... Keep Reading...

9h

55 North Mining: The Economic Upside of US$5,000 Gold and High-grade Project Next to Alamos Gold

With gold prices maintaining their historic trajectory toward US$5,000 per ounce, gold exploration companies with high-grade assets offer immediate economic leverage. 55 North Mining (CSE:FFF,FWB:6YF) is emerging as a primary beneficiary of this. We sat down with CEO Bruce Reid as he discussed... Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00