- WORLD EDITIONAustraliaNorth AmericaWorld

March 11, 2024

Spartan targets further significant growth in high-grade resources and value in 2024, supported by recent successful extensional drilling

Spartan Resources Limited (ASX: SPR) (Spartan or the Company) is pleased to advise that it has calculated a new JORC-compliant Exploration Target for the high-grade Never Never Gold Deposit, part of its Dalgaranga Gold Project in Western Australia.

Highlights:

- New JORC-compliant “Exploration Target” completed for the Never Never Gold Deposit, part of Spartan’s flagship 1.69Moz @ 2.49g/t gold Dalgaranga Gold Project (100%-owned), located in the Murchison Region of Western Australia.

- The new Never Never Exploration Target set out here is inclusive of the recent Never Never Mineral Resource Estimate (“MRE”), updated in December 2023 to:

- 5.16Mt at 5.74g/t Au for 952,900oz gold

- Spartan remains focused on delivering increased shareholder value through high-impact exploration and high-grade resource growth, with:

- Never Never being one of the highest-grade and fastest growing new gold discoveries in Western Australia;

- Never Never sitting immediately adjacent to a 100% owned, well maintained, 6-year- old 2.5Mtpa CIL gold processing plant and associated infrastructure;

- Plus, a technically strong and focused management team with a proven track- record of rapidly growing asset value, rejuvenating existing mines, extending mine lives through exploration success and delivering on targets.

- An extensive 28,500m drilling program is currently underway, with four diamond rigs and one Reverse Circulation rig currently on site.

Exploration Target

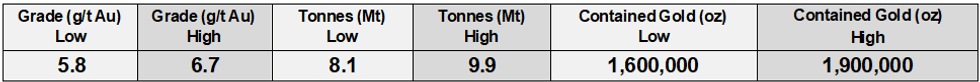

The new Exploration Target comprises:

The potential quantity and grade of the Exploration Target is conceptual in nature and, as such, there has been insufficient exploration drilling conducted to estimate a Mineral Resource. At this stage it is uncertain if further exploration drilling will result in the estimation of a Mineral Resource. The Exploration Target has been prepared in accordance with the JORC Code (2012).

Note: The Exploration target is inclusive of the December 2023 Mineral Resource Estimate released for the Never Never Gold Deposit of 5.16Mt at 5.74g/t Au for 0.95Moz gold1

Exploration Target Basis

During 2023, Spartan drilled 232 holes for 63,943m at Dalgaranga, with 111 holes (48%) for 38,328m (60%) completed at Never Never, growing the MRE from 303.1koz to 952.9koz (214%). To date, Spartan has spent A$14.7M on drilling at Never Never, resulting in a very low discovery cost of A$15.43 per resource ounce.

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

12h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00