January 30, 2024

Magnetic Resources NL (Magnetic or the Company) is pleased to announce an Updated Mineral Resource Estimate from its deposits in the Laverton and Homeward Bound area. The main deposits include Hawks Nest 9 (HN9), Lady Julie Central (LJC), Lady Julie North 4 (LJN4), Mount Jumbo and Homeward Bound South (Figure 2), which are all located in an area with well-endowed regional infrastructure including three processing plants within 35kms.

HIGHLIGHTS

Updated combined Mineral Resources estimate for the whole project area of:

- 22.7Mt @ 1.69g/t Au totalling 1.24Moz of gold at 0.5g/t cutoff.

- Increase of 107% of the total ounces over the 3 February 2023 ASX Release.

Significantly, the contained gold in LJN4 has risen from 204,000oz to 852,000oz Au (a 317% increase). LJN4 is now by far the largest resource in the project area – and it remains open at depth.

Key deposits are close to each other and form part of one mining field. Given the scale of the resource upgrade, consideration is now also being given to a dedicated processing plant.

Magnetic Resources lodged a Mining Lease application over its Lady Julie North 4 discovery. M38/1315 (pending) overlays Magnetic tenements P38/4170 and E38/3127 and covers an area of 238Ha.

Ongoing extension drilling continues looking to extend the size of LJN4 has resulted in a number of compelling intersections. MLDD033 intersected 16m at 4.51g/t Au from 411m, which was a very large 200m step out below the current resource, which is potentially underground mineable and is still open downdip. This section indicates mineralisation continuity of 550m down dip, which is by far the biggest down dip extension identified to date within LJN4.

New hanging wall breccia zone was also discovered in MLJD033 with an intersection of 2m at 15.32g/t Au from 247m, and 8.7m at 2.43g/t Au from 107m and 13m at 1.00g/t Au from 135m in MLJDD032.

MLJRCD826 intersected a 40m thick breccia zone from 270 to 310m, which has assays pending. It is directly 65m down dip from MLJDD031, which intersected 21m at 5.37g/t Au from 198m within a breccia, and is still open down dip and to the south. Further diamond holes are being planned to follow up this 40m thick breccia zone.

MLJRCD802 had our best intersection to date, of 133m at 2.87g/t Au from 173m, which includes 61m at 4.68g/t Au from 243m (1m splits). Assays are pending for the down-dip extension within MLJRC820 from 290m to 453m.

MLJDD034 intersected 6.8m at 12.06g/t Au from 151m (contained within a 11.5m zone with 4.8m of core loss) in a gossanous chert breccia.

Laverton Area

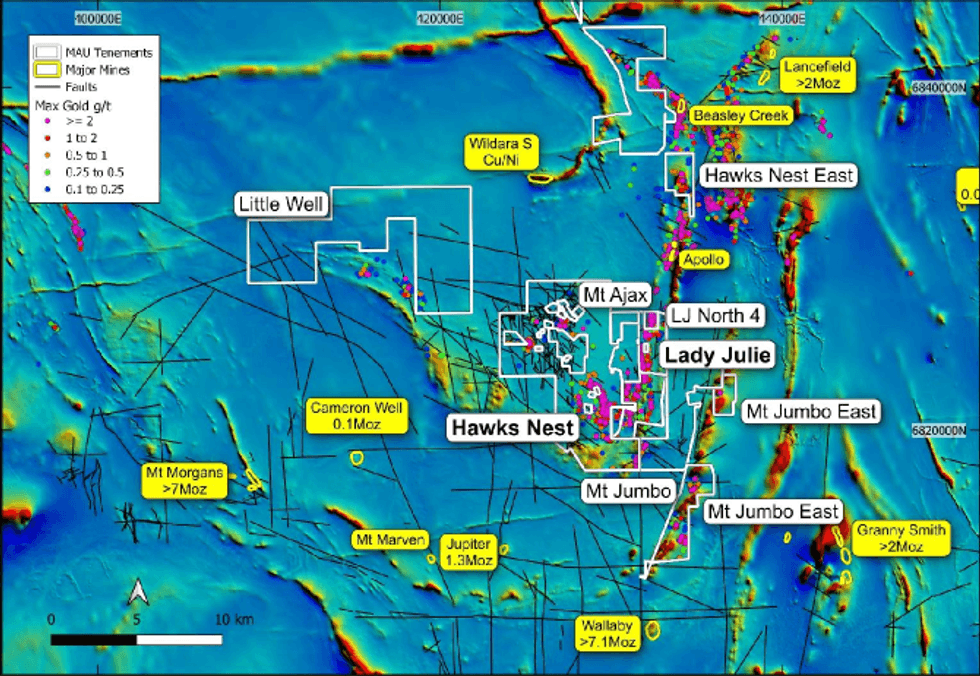

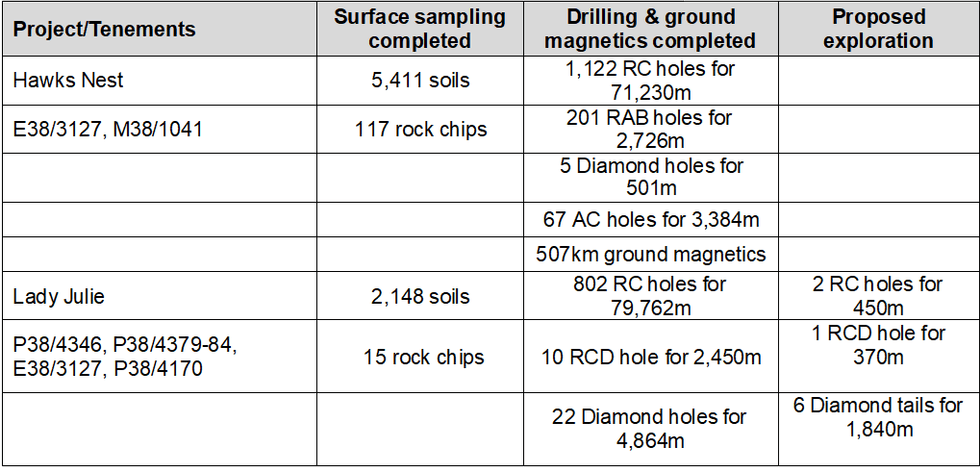

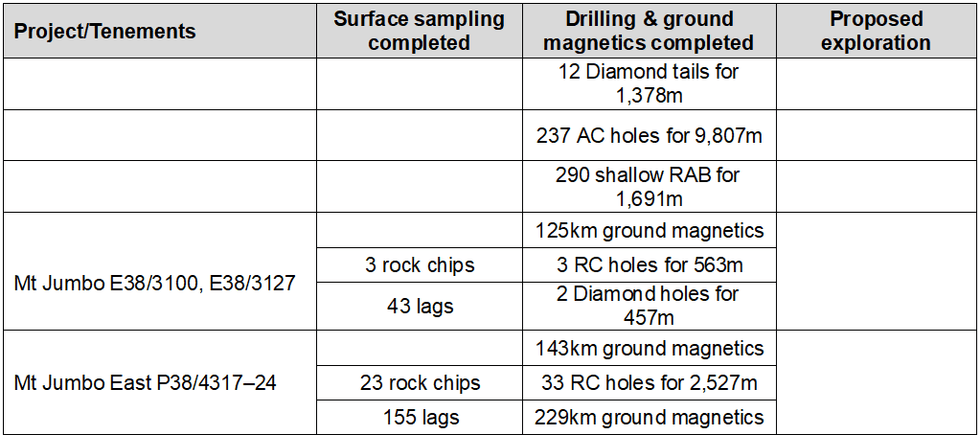

Magnetic Resources NL has 203km2 in the Laverton region comprising E38/3127 Hawks Nest, E37/3100 Mt Jumbo, E38/3205 Hawks Nest East, E38/3209 Mt Ajax, P38/4317–24 Mt Jumbo East, E39/2125, P39/6134-44 Little Well and P38/4346, P38/4379-84, P38/4170 Lady Julie (Figure 1). Table 1 shows the exploration completed to date and recent/proposed exploration.

Mineral Resource Estimate update 24 November 2023

- This update incorporates recent drilling results at Lady Julie North 4 (LJN4) and Lady Julie Central (LJC) since the last resource report in February 2023 (“Expands Mineral Resources estimate ASX release 3 February 2023”).

- Updated combined Mineral Resources estimate for the whole project area of:

- 22.7Mt @ 1.69g/t Au totalling 1.24Moz of gold at 0.5g/t cutoff.

- Increase of 107% of the total ounces over the 3 February 2023 ASX Release.

- Significantly, the contained gold in LJN4 has risen from 204,000oz to 852,000oz Au (a 317% increase).

- LJN4 is now by far the largest resource in the project area – and it remains open at depth; exploration continues for similar deposits along the extensive 12km Chatterbox shear.

- Key deposits are close to each other and form part of one mining field.

- Three processing plants are nearby, within 10–35km away providing scope for toll processing. Given the scale of the resource upgrade, consideration is now also being given to a dedicated processing plant.

- Ongoing extension drilling continues and is expected to result in further resource increases.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

7h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

20h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00