August 30, 2023

Carbonxt (ASX:CG1) is a cleantech company that develops and markets specialized Activated Carbon products, primarily focused on the capture of contaminants in industrial processes that emit substantial amounts of harmful pollutants. The Company produces and manufactures Powdered Activated Carbon and Activated Carbon pellets for use in industrial air purification, waste water treatment and other liquid and gas phase markets.

[All results in AUD]

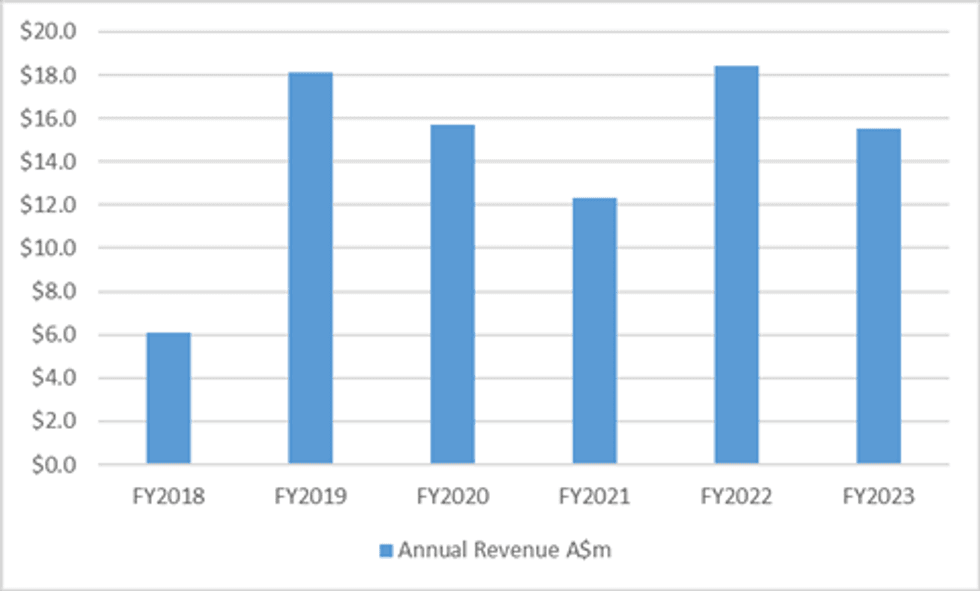

- Revenues decreased 15.8% compared to FY22 primarily due to planned downtime during the year at both activated carbon plants to install updated equipment which resulted in lower production and sales than typical for the period, as well as the Group's largest customer deferring sales into FY24 due to an unplanned outage at its operations.

- The first quarter of FY24 has started very strongly with revenues exceeding AUD $3m in the quarter thus far compared to AUD $2.3m in the prior quarter. These revenues reflect higher than expected powdered activated carbon sales due to relatively higher temperatures, as well as the anticipated receipt of deferred pellet sales from our largest customer.

- Annual gross margin of 30%, down from 34% in FY22 principally due to the plant outages and lower sales from the pellet business line due to the deferral of the largest customer mentioned above.

- Underlying EBITDA for FY23 was a loss of $2.2m, compared to FY22 EBITDA result that was close to breakeven.

ANNUAL REVENUE

Activated Carbon Pellets

- Pellet sales volume to the Company’s largest customer (an electric utility) was 2,600 tons for FY23, compared to over 4,000 tons in the prior year. Pellet sales represented 65% of revenue in FY23, down from 70% of revenue in the prior period.

- Lower volume was driven by an unscheduled plant outage at the customer’s facility, as well as the customer having sufficient on-hand inventory.

- As a result of the impending commencement of operations at the Kentucky facility (see below) where the Company will have new pellet capacity of 5,000 tons per annum (50% of 10,000 tons total plant capacity) of high-quality pellets, we have made the strategic decision to move to one-shift operations at our existing ACP facility. This change will enable us to meet all existing orders and save over AUD $1.5m per annum in operating costs. The change to the operating regime was effected post balance-date in August 2023.

Powdered Activated Carbon

- The production of low-cost renewable powdered activated carbon supports strong margins in the contaminant-reduction pellet product line.

- PAC accounted for 35% of revenue and 54% of sales volume.

- The installation of a new mill in December 2022 has improved operating efficiencies and reliability.

- Feasibility studies have been undertaken to install a second mill, which would provide redundancy for the present mill as well as provide capacity for up to 5,000 tons per annum of incremental PAC volume. Any decision on this investment will be dependent on winning new offtake contracts and progress with the Kentucky operations.

FY24 GROWTH OPPORTUNITIES

Company Outlook

- On 31 May 2023, the Company signed final documentation for the construction of a state-of- the art Activated Carbon facility in Kentucky. Carbonxt’s initial investment of USD $5.0m for a 33.3% stake in NewCarbon Processing LLC, (“NewCarbon”) the entity established to own the Activated Carbon business. Carbonxt has the right to invest a further USD $5.0m over the next approximately 12 months to move to a 50% ownership percentage.

- The next payment due is USD 0.5m when all major equipment has been delivered to site, which is currently scheduled by NewCarbon for the end of this current quarter.

- Kentucky Carbon Processing, LLC has transferred the existing waste-to-energy power station to NewCarbon and is converting those assets into an activated carbon manufacturing facility.

- The Board visited the site in early August 2023 and met with KCP. Progress on construction is well progressed and on-schedule. KCP is taking the cost overrun risk of delivering the plant, with an initial capacity of 10,000 tons per annum. KCP are confident and clearly competent in delivering the plant.

Upcoming legislation for PFAS

PFAS, or per and polyfluoroalkyl substances, are a large chemical family of over 4,700 chemicals. They are often referred to as “forever chemicals” as they barely degrade. Long-term exposure to these chemicals is linked to significant health risks. In early 2023, the US EPA announced new legal limits for six PFAs of 4 parts per trillion. These limits would be the first- ever national drinking water standard for the United States of America.

Click here for the full ASX Release

This article includes content from Carbonxt Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CG1:AU

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

24 July 2025

Carbonxt Group

Purpose-built advanced carbon for healthier communities

Purpose-built advanced carbon for healthier communities Keep Reading...

30 January

Q2 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q2 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

04 January

Placement to Fund Further Investment in New Carbon

Carbonxt Group (CG1:AU) has announced Placement to Fund Further Investment in New CarbonDownload the PDF here. Keep Reading...

28 October 2025

Q1 FY26 Quarterly Activities Report & Appendix 4C

Carbonxt Group (CG1:AU) has announced Q1 FY26 Quarterly Activities Report & Appendix 4CDownload the PDF here. Keep Reading...

16 October 2025

Convertible Note and Placement

Carbonxt Group (CG1:AU) has announced Convertible Note and PlacementDownload the PDF here. Keep Reading...

15 September 2025

Completion of Non-Renounceable Pro-Rata Entitlement Offer

Carbonxt Group (CG1:AU) has announced Completion of Non-Renounceable Pro-Rata Entitlement OfferDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Carbonxt Group Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00