June 07, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide an exploration update following assay results from its first drillhole at the Auld Creek Prospect.

Highlights

- Siren’s second drillhole ACDDH005 at the Auld Creek prospect has intersected the Fraternal Shoot.

- ACDDH005 intersected 17.9m at 2.3g/t Au, 0.1% Sb for 2.6g/t AuEq from 59.4m, including:

- 3.9m @ 3.3g/t Au, 0.1% Sb for 3.6g/t AuEq, and

- 10.0m @ 2.8g/t Au, 0.1% Sb for 3.1g/t AuEq.

- Results confirm existing drillholes that include:

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq,

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @ 13.8g/t AuEq, and

- 34.0m @ 1.6g/t Au, 0.7% Sb or 34.0.0m @ 3.3g/t AuEq.

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq.

- Assay results for the second hole ACDDH006 are still pending.

- The thickness and consistency of the first holes at Auld Creek is very encouraging and consistent with recent trench results and historical drillholes.

Background

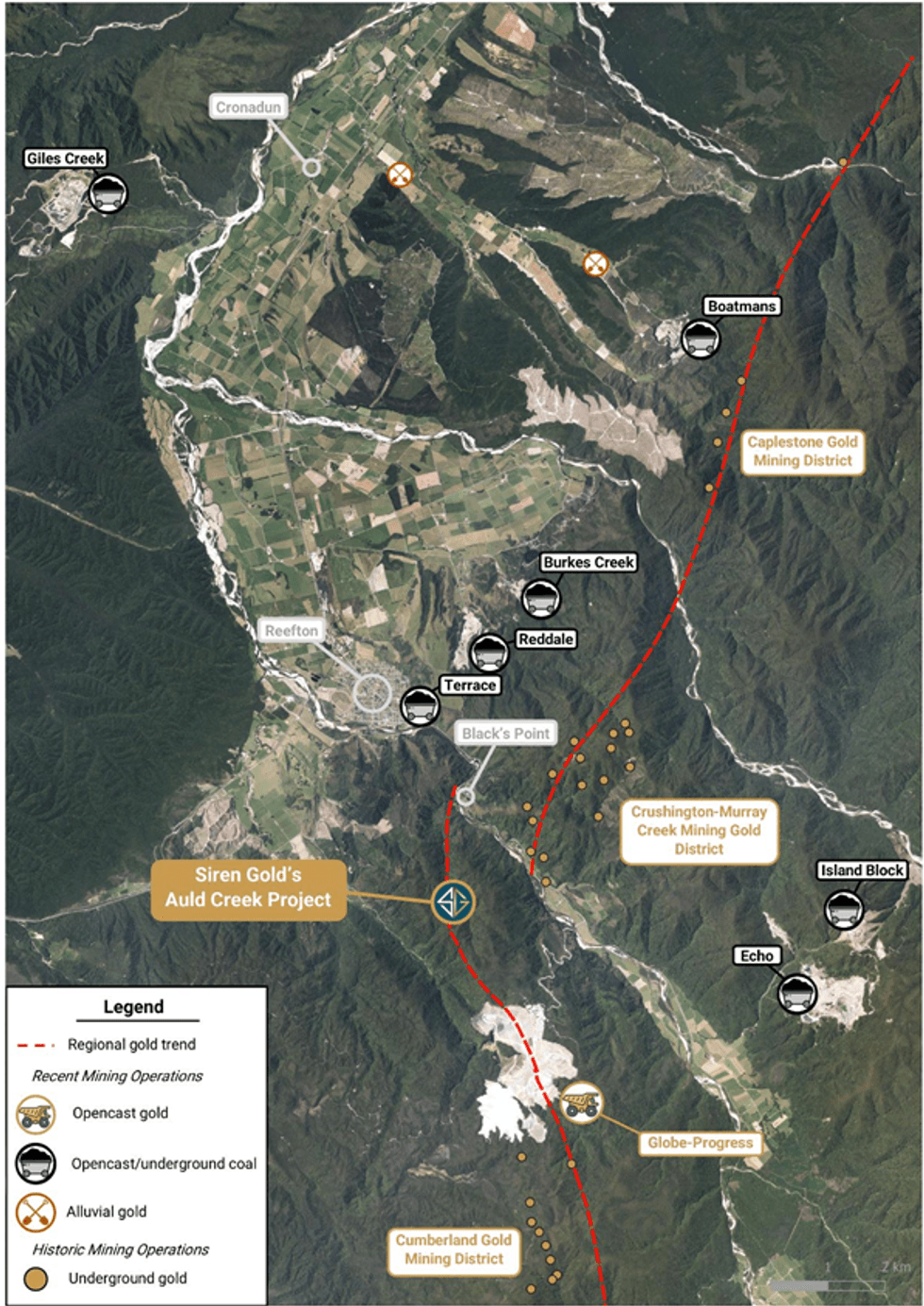

The Auld Creek Prospect is contained within Siren’s Golden Point exploration permit and is situated between the highly productive Globe Progress mine, which historically produced 418koz @ 12.2g/t Au, and the Crushington group of mines that produced 515koz @ 16.3g/t Au (Figure 1). More recently OceanaGold (OGL) mined an open pit and extracted an additional 600koz of gold from lower grade remnant mineralisation around the historic Globe Progress mine. Collectively these mines produced 1.6Moz at 10g/t Au.

Within 20kms of the Auld Creek Project at Reefton there are 18 mines, including seven coal mines and the Globe Progress gold mine. A coal handling facility and train loadout are located at the northern end of Reefton town.

The Auld Creek Prospect represents high-grade gold-antimony (Sb) mineralisation that was potentially offset to the west, along NE-SE trending faults between Globe Progress and Crushington.

The gold-antimony mineralisation extends from Auld Creek south through Globe Progress and the Cumberland prospects and on to Big River, a strike length of 12kms with 9kms in Siren’s permits and the remaining 3kms in the Globe Progress reserve area.

The Auld Creek arsenic soil anomaly now extends for over 700m along strike. Trenching along the soil anomaly has clearly defined the high-grade Au-Sb mineralisation in the Fraternal, Fraternal North, Bonanza and Bonanza West Shoots (Figure 2).

The Reefton Goldfield can be correlated with the Lachlan Fold that contains epizonal gold-antimony deposits like Fosterville and Costerfield. Siren’s Auld Creek epizonal deposit contains high grade gold and massive stibnite veins.

Siren has used the same gold equivalent formula (𝐴𝑢𝐸𝑞 = 𝐴𝑢 g/𝑡 + 2.36 × 𝑆𝑏 %) used by Mandalay Resources Ltd for the Costerfield mine (refer Mandalay Website: Mandalay have adopted CY2022 metal prices of US$1,750 / ounce gold and US$13,000 / tonne antinomy).

Fraternal Shoot

Previously reported Fraternal diamond downhole intercepts include:

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq (RDD087),

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @13.8g/t AuEq (RDD086),

- 34.0m @ 1.6/t Au, 0.7% Sb or 34.0m @ 3.3g/t AuEq (RDD085), and

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq (ACDDH004).

Significant drillhole intersections are shown in Figure 2 and Table 1.

Siren’s recently commenced diamond drilling program is focused on depth extension of the interpreted south plunging Fraternal shoot, with initial holes drilled to the south of current drilling (Figure 2).

The second drillhole ACDDH005, was targeted near the interpreted top edge of the shoot, approximately 50m below trench FTTR005 (8.3m @ 2.1g/t Au, 0.45% Sb or 8.3m @ 3.2g/t AuEq) as shown in Figure 3. ACDDH005 intersected a downhole length of 17.9m @ 2.3g/t Au, 0.1% Sb or 17.9m @ 2.6g/t Au (Table 1). This includes 4m @ 0.25g/t in centre of the shoot, with a hanging wall intersection of 3.9m @ 3.6g/t AuEq and a footwall intersection of 10m @ 3.1g/t AuEq. The true width of the shoot is interpreted to be around 12m (Figure 4).

The first drillhole, ACDDH004, was targeted at the Fraternal Shoot, approximately 50m down plunge from trench FTTR001 (8.4m @ 19.7g/t Au, 5.3% Sb or 8.4m @ 32g/t AuEq), and intersected 20.7m that averaged 5.9g/t Au, 2.6% Sb for 12.0g/t AuEq (Table 1), with the first 4.6m averaging 10.7g/t Au, 3.9% Sb for 19.9g/t AuEq (refer to ASX announcement dated 8 May 2023). The true thickness of the intersection is interpreted to be approximately 13m (Figure 5).

ACDDH006 was drilled 175m down plunge (from the surface) near the bottom of the interpreted shoot (Figure 3). A thinner 6m mineralised zone was intersected (Figure 4) with results awaited. The thickness of the mineralisation is consistent with nearby RDD0086 and trench FTTR003 near the bottom of the shoot.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

1h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

18h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00