September 28, 2022

Auric Mining Limited (ASX: AWJ) (Auric or the Company) is pleased to announce that it has received firm commitments to place 15,697,224 shares to raise $1,130,200 and an offer to shareholders under a Share Purchase Plan.

Placement

Auric will raise $1,130,200 (before costs) through a placement of 15,697,224 shares at an issue price of $0.072 per share (Placement Shares), together with 7,848,612 options, being 1 free attaching option exercisable at $0.15 and expiring 31 March 2024 (Placement Options) for every 2 Placement Shares subscribed for and issued (Placement). A lead manager’s fee of 1% and a placement fee of 5% of the value of the funds raised is payable to Finexia Securities Ltd (AFSL 485 760). Lazarus Capital Partners Pty Ltd acted as corporate advisors.

The Placement Shares and Placement Options will be issued without shareholder approval utilising the Company’s existing placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A. The Placement Shares will rank equally with existing fully paid ordinary shares on issue in the Company and quotation of the Placement Shares is expected to occur on Thursday, 6 October 2022.

The share issue price is at an 11% discount to the 15-day VWAP.

The Placement Options will be issued pursuant to ASX Listing Rule 7.1. The Placement Options will be issued under the Prospectus to be issued under the SPP (refer below).

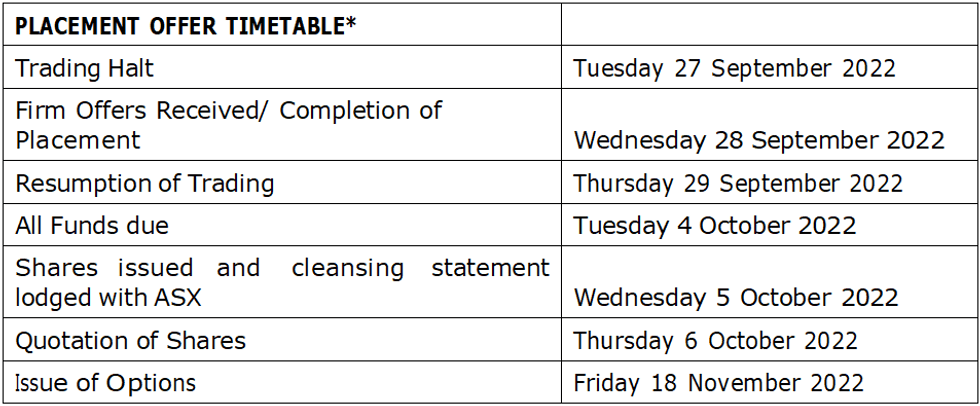

*The above dates are indicative and subject to change.

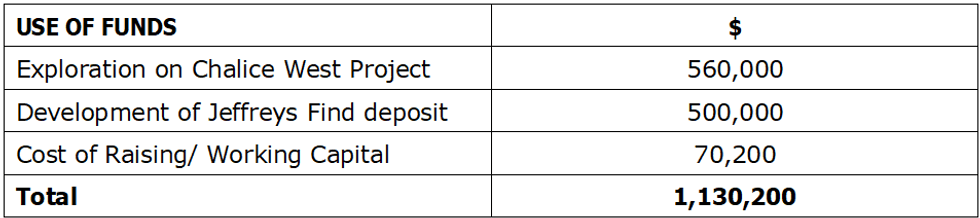

It is the intention of the Directors to apply funds from the Placement as follows:

Share Purchase Plan (SPP)

In conjunction with the Placement, Auric will offer eligible shareholders the opportunity to participate in a SPP on the same terms as the Placement to raise

$750,000 with the capacity to accept oversubscriptions for an additional $500,000. The SPP is priced at $0.072 per share and will also include 1 free attaching Option for every 2 shares subscribed for, exercisable at $0.15 and expiring 31 March 2024. The SPP will enable Auric’s retail and existing shareholder base to participate in the growth of the Company on the same terms as the Placement.

The Company may elect to accept additional subscriptions or alternatively close the SPP early and/or scale back applications.

Shareholders with a registered address in Australia or New Zealand at 5.00pm (AEDT) on 28 September 2022 will be invited to participate in the SPP.

Key terms of the SPP are:

- Up to $30,000 per eligible shareholder, across all of their holdings.

- AWJ intends to raise up to $750,000 before oversubscriptions (the Board reserves the right to accept additional subscriptions, close the SPP early and/or scale back applications in its absolute discretion).

- Further information regarding the SPP (including terms and conditions of the SPP) will be provided to eligible shareholders in the Prospectus, which will be made available to eligible shareholders shortly. Eligible shareholders wishing to participate in the SPP will need to apply in accordance with the instructions in the Prospectus.

- Participation in the SPP is optional.

The SPP Shares and Options will be issued under a Prospectus to be lodged on or about 17 October 2022.

Click here for the full ASX Release

This article includes content from Auric Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

09 August 2024

Auric Mining

Western Australian gold producer, explorer and developer with world-class deposits

Western Australian gold producer, explorer and developer with world-class deposits Keep Reading...

2h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

20h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00