June 27, 2022

First RC Assays Increases Confidence and Prospectivity at Depth as Diamond Drilling Commences at Manna

The Manna Lithium Project hosts a maiden Inferred Mineral Resource of 9.9Mt @ 1.14% Li2O (100% basis)1. After acquiring an 80% interest in Manna from Breaker Resources (ASX: BRB) in December 2021, GL1 engaged Snowden Optiro to undertake a Mineral Resource estimate using data compiled by Breaker Resources, including RC and DD results.

Highlights

- Significant intervals of lithium mineralisation intersected from early reverse circulation (RC) drilling at the Manna Lithium Project (Manna)

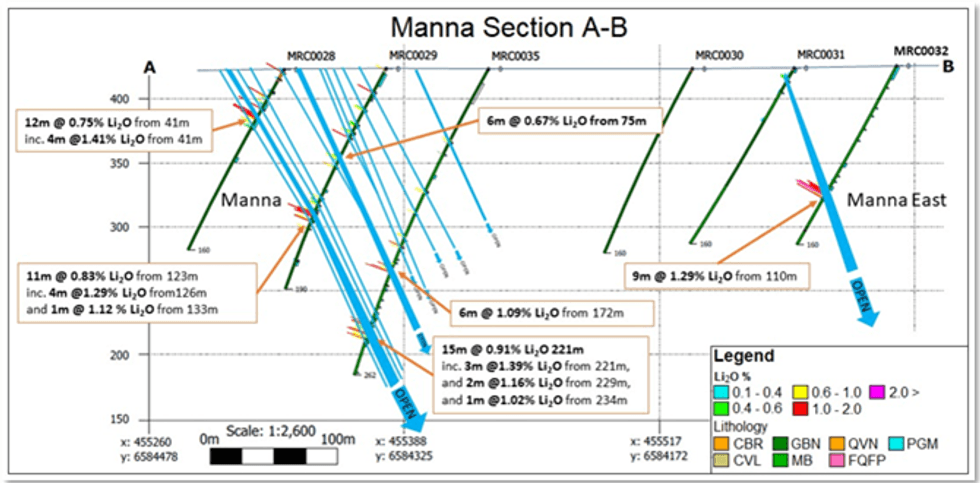

- The program validates previous drilling and resource information, further extending the orebody at depth which remains open (refer Figure 2.).

- Drilling intercepts across the same Pegmatite shows continuity with depth:

- MRC0028 returned 12m @ 0.75% Li2O from 41m

- inc. 4m @ 1.41% Li2O from 41m

- MRC0029 returned 11m @ 0.83% Li2O from 123m

- inc. 4m @ 1.29% Li2O from 126m

- and 1m @ 1.12% Li2O from 133m

- MRC0035 returned 15m @ 0.91% Li2O from 221m

- inc. 3m @ 1.39% Li2O from 221m

- and 2m @ 1.16% Li2O from 229m

- and 1m @ 1.02% Li2O from 234m

- Additional pegmatite intercepts showing continuity with depth:

- MRC0034 returned 13m @ 0.84% Li2O from 46m

- MRC0035 returned 6m @ 1.09% Li2O from 172m

- Manna East Pegmatite showing increasing width with depth:

- MRC0032 9m @ 1.29% Li2O from 110m

- Ongoing drilling will further target lithium mineralised pegmatites both along strike and at depth

- Experienced drilling contractor, Mt Magnet Drilling (Mt Magnet), commences diamond drilling (DD) program at Manna

- Initial 4,000m program will be GL1’s first DD campaign at Manna since acquisition of project in December 2021

- The diamond core drilling is specifically targeting the Pegmatites at depths below the RC drilling program currently underway

- MRC0028 returned 12m @ 0.75% Li2O from 41m

Growing multi-asset West Australian lithium company Global Lithium Resources Limited (ASX: GL1, “Global Lithium” or “the Company”) is pleased to announce the first lithium assay results from its initial RC drilling program at the Manna Lithium Project, located 100km east of Kalgoorlie.

Whilst they are early-stage results from this program, the assays provide GL1 with significant confidence in the Manna Lithium Project and confirm the findings from previous drilling undertaken by Breaker in 2018.

The assay results highlighted above are the first to be reported from the Company’s maiden 20,000m RC program at Manna, which commenced in May and is being undertaken by experienced contractor Profile Drilling Services.

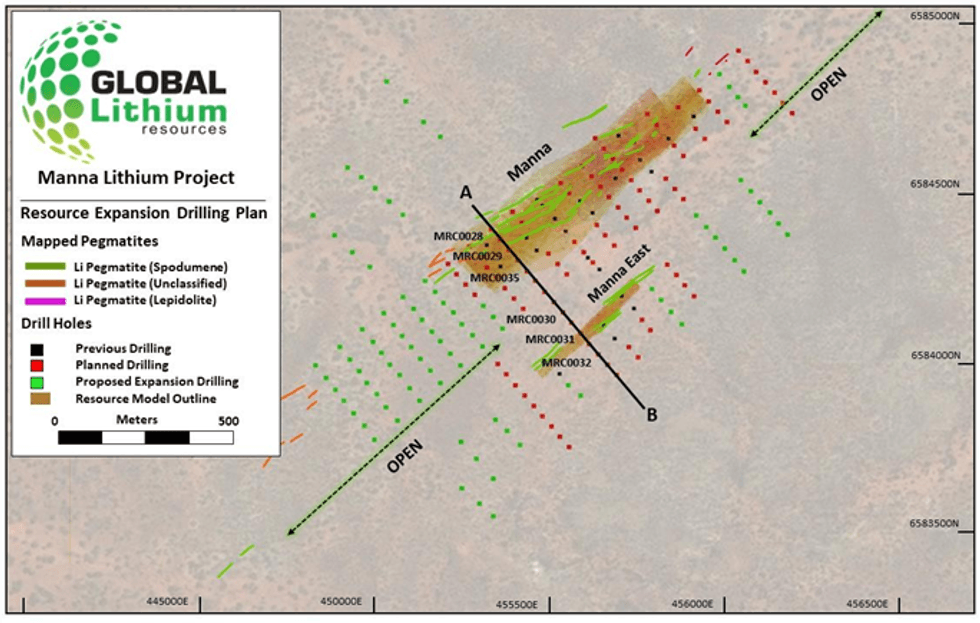

Figure 1 – Showing the resource expansion drilling plan.

Figure 2 – Cross Section A-B showing the interpreted pegmatites projected against assay results along the drill trace line.

Diamond Drilling Commences at MannaIn addition, the Company is pleased to report that diamond drilling (DD) has commenced at the Manna Lithium Project on schedule. Earlier this year, experienced contractor Mt Magnet Drilling was appointed to undertake the DD program which will initially comprise 4,000m of drilling. Mt Magnet is a Western Australian-based drilling services company which specialises in DD mineral exploration drilling.

The DD program has been designed to test and expand the deposit at depth below the RC program. GL1 will progress the DD program in parallel with ongoing RC drilling program and intends to update shareholders with further results in Q3, 2022. A geotechnical logging program of the core will run in parallel with the metallurgical test program to enable the potential commencement of feasibility study work on the deposit.

The Company anticipates a Mineral Resource update at the Manna Lithium Project to follow the completion of the RC and DD programs along with additional metallurgical test work in Q4 2022.

Click here for the full ASX Release

This article includes content from Breaker Resources NL (ASX: BRB), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRB:AU

The Conversation (0)

29 June 2022

Breaker Resources

Transitioning From Explorer to Developer in Western Australia

Transitioning From Explorer to Developer in Western Australia Keep Reading...

22h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00