May 20, 2024

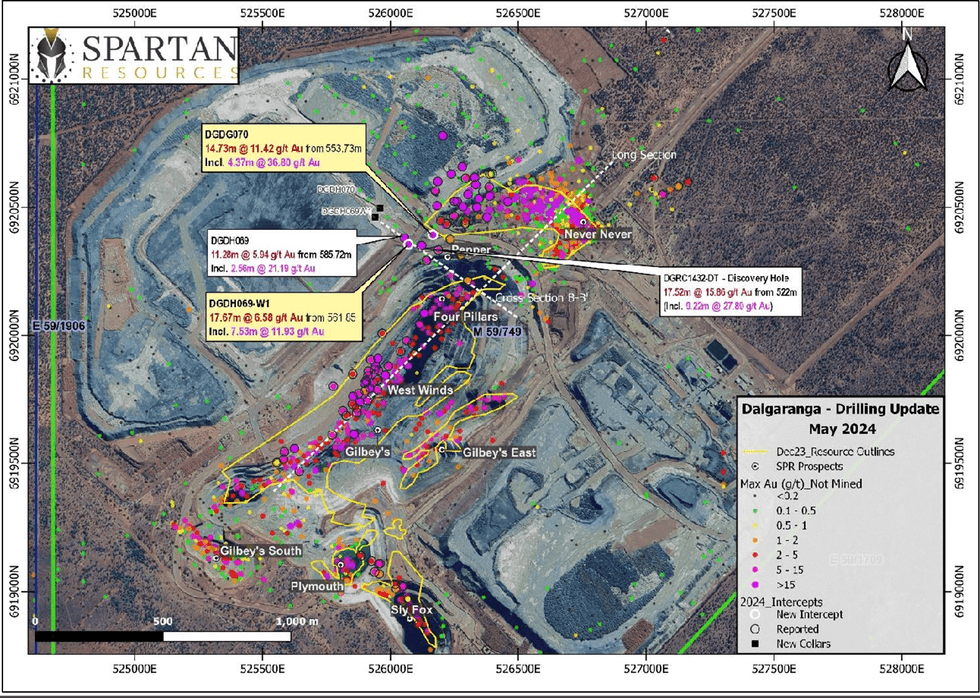

Latest high-grade assays from Pepper Gold Prospect, adjacent to the 0.95Moz Never Never Gold Deposit, show increasing ounces per vertical metre potential

Spartan Resources Limited (Spartan or Company) (ASX:SPR) is pleased to provide an update on exploration activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

Highlights:

- Pepper Gold Prospect – significant new intercepts expand high-grade discovery:

- 14.73m @ 11.42g/t gold from 553.73m down-hole, incl. 4.37m @ 36.80g/t (DGDH070):

- Intercept located approximately midway (~50m north) of the initial “Pepper” discovery hole DGRC1432-DT, which returned 17.52m @ 15.86g/t gold (previously announced)

- 17.67m @ 6.58g/t gold from 561.85m down-hole, incl. 7.53m @ 11.93g/t (DGDH069-W1)

- Intercept located down-dip of the Pepper discovery hole, midway between DGRC1432- DT and DGDH069, which returned 11.28m @ 5.94g/t gold (previously announced)

- Maiden Mineral Resource Estimate to be calculated for the Pepper Gold Prospect as part of the scheduled mid-year resource update for the Dalgaranga Gold Project.

- 14.73m @ 11.42g/t gold from 553.73m down-hole, incl. 4.37m @ 36.80g/t (DGDH070):

This release contains new assay results from recent surface drilling targeting the high-grade growing Pepper Gold Prospect.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “Our focus on drilling, closing the gaps and achieving significant outcomes in front of our established infrastructure continues to deliver in spades with our ongoing drilling success at the recently discovered Pepper Gold Prospect.

“Pepper is located less than 100m south of the high-grade 0.95Moz Never Never Gold Deposit and we couldn’t be happier to see the rapid emergence of another substantial high-grade body of mineralisation next to our flagship deposit with each new drill result.

“We are very confident that Pepper will become a standalone gold deposit and, to ensure that outcome, we will be completing a maiden Mineral Resource Estimate ("MRE”) for this exciting prospect as part of our foreshadowed mid-year MRE update for Dalgaranga.

“With the gold price continuing to hit new records, this is an exciting time to be making new high-grade gold discoveries. And, on the back of a well-supported capital raise, we are now moving rapidly towards developing the underground infrastructure required to chase and grow this high-grade system.

“With rigs still spinning around the clock, investors can look forward to more exciting drill results in the coming weeks, mid-year MRE update for Dalgaranga, the planned commencement of the underground exploration drill drive in the second half of 2024, and the expected publication of a maiden high-grade Ore Reserve for the Never Never Gold Deposit.

“The Spartan team also continues to progress a Feasibility Study to demonstrate what we believe will be powerful metrics from a growing set of high-grade gold structures and maybe even some more high- grade gold discoveries!”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

3h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

5h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

20h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

21h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

21h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

02 February

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00