February 05, 2023

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce a geophysical interpretation conducted by the Company’s geologists of the recently completed helicopter borne Electro-Magnetic Survey3.

HIGHLIGHTS

- Interpretation affirms structural concurrence between highly anomalous electro-magnetic zones and mineralised lithium clay pans

- Three stratigraphic boreholes planned by March 2023 to aid exploration. Potential to discover economically mineralised brines not excluded

- Three potentially Lithium-rich brine sub basins identified at Bitterwasser, of which two are associated with the existing Mineral Resource at the Eden Pan and mineralisation at the Madube Pan1,2

- Largest Electromagnetic (EM) anomaly (42km by 9km) is perfectly associated with a major fault structure

- Smaller anomalies are associated with the Eden Basin (8km by 2.5km) and the Madube Basin (5km by 1.5km), both associated with oblique trending tension faults/fractures at depths of around 120 m and high lithium content in the clay pans at surface

- The depth of the large basin based on EM interpretation is up to 200m to the basalt basement with high conductivity from 30m below surface, which is the observed depth of the water table

- Historical water boreholes drilled outside the edges of the main anomaly hold elevated TDS values of >6000 mg/l

Jurie Wessels, the Chairman of Arcadia stated: “The interpretation affirmed our geological model and hypothesis that the Bitterwasser Basin area conforms to the structural requisites of possibly becoming a globally significant Lithium province. From the data it is evident that several entrapment sites were formed through tectonic activity where highly conductive brine fluids could be accumulated. In addition, there is a distinct concurrence between structures observed from EM data and the formation of mineralised lithium clay pans. This further enhances the likelihood of the pans, where mineralisation tends to increase to depth, having been mineralised through lithium rich brine water-table fluctuation. By comparing water quality of holes drilled outside of the anomalous areas from publicly available data to the levels of electro- conductivity within EM anomalous zones we expect highly concentrated dissolved solids of salts (brines) to be encountered within the anomalous zones.

Our focus is now to drill three stratigraphic holes to verify the geophysical results, to increase our geological understanding of the Bitterwasser basin and to obtain valuable information regarding the sediments associated within the basin. This will be necessary before we embark on a targeted brine-borehole drilling programme. Although not the objective, it is not excluded that stratigraphic drilling could lead to the discovery of a significant brine deposit at Bitterwasser.”

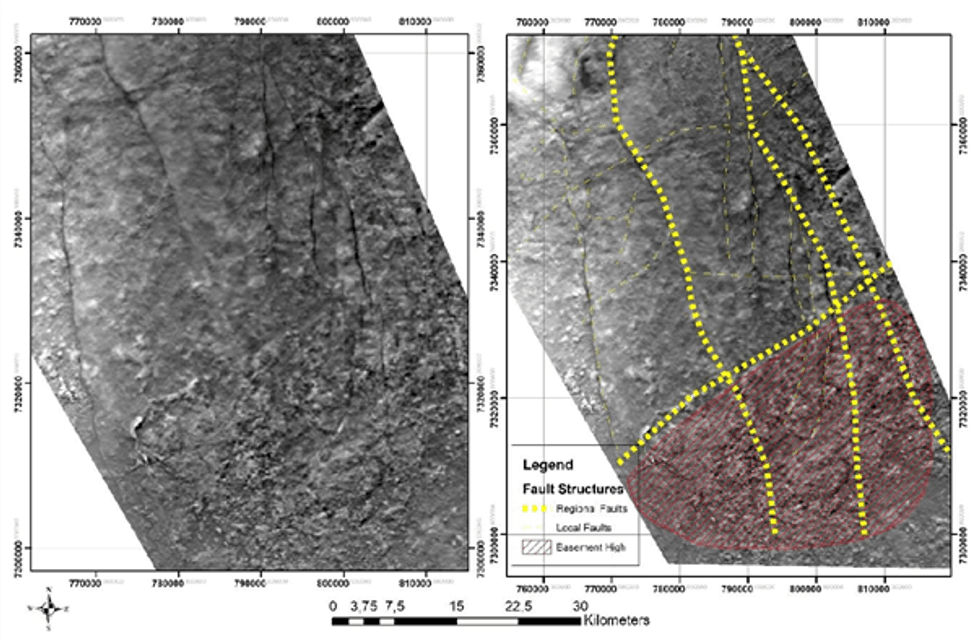

GEOPHYSICAL INTERPRETATION

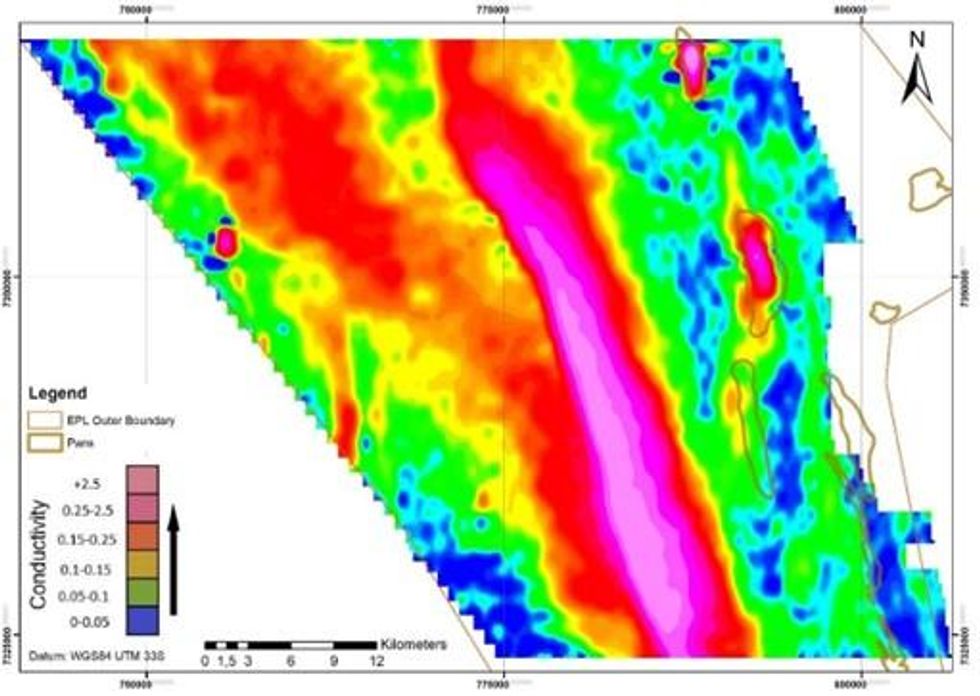

Interpretation of government Magnetic data purchased from the Ministry of Mines and Energy of Namibia indicates the presence of three major north-south trending faults that are considered responsible for the formation of the Bitterwasser half graben structure. Various en-echelon faults (i.e. faults, or tension fractures, that are oblique to major structural trends) are associated with the large north-south trending fault structures (see Figure 1 right-hand image). The north-east southwest trending fault in the southern portion of the magnetic image is considered to have caused an up-lift of the basement basalt. As a result, the barrier for the creation of the Bitterwasser basin was formed thereby creating a closed basin and trapping water flow from the north and acting like a dam wall (indicated by the red striped polygon on the right-hand image).

The interpretation of both the Magnetic and Electro-Magnetic data (as represented in figure 3 below) indicates a well-defined correlation between the anomalies (derived from the Electro-Magnetic data and shown in figure 2) and structural features (derived from the Magnetic data and shown in figure 1). The largest EM anomaly (42km by 9km) is associated with a major north-northwest trending fault structure and the most southern, north-east southwest trending “dam wall” fault. The two smaller anomalies, which are concordant with the Eden Basin (8km by 2.5km) and the Madube Basin (5km by 1.5km) are associated with en echelon faults associated with the two large parallel north-northwest trending fault structures. The formation of the three basins identified so far is thus considered to have been structurally controlled.

This article includes content from Arcadia Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AM7:AU

The Conversation (0)

11 September 2021

Arcadia Minerals

A Battery Metal Explorer Operating Within Resource-Rich Namibia

A Battery Metal Explorer Operating Within Resource-Rich Namibia Keep Reading...

23 September 2022

Drilling Completed At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that its drilling contractor Hammerstein Mining and Drilling completed a 551m... Keep Reading...

29 August 2022

Drilling Commenced At Karibib Copper-Gold Project

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that it instructed Hammerstein Mining and Drilling to execute a 526m RC... Keep Reading...

29 July 2022

Quarterly Activities Report – June Quarter 2022

Arcadia Minerals Limited (ASX:AM7, FRA:8OH) (Arcadia, AM7 or the Company), the diversified exploration company targeting a suite of battery metal projects aimed at Lithium, Tantalum, Nickel, Copper and Gold in Namibia, is pleased to provide its quarterly activities report for the period ending... Keep Reading...

09 May 2022

Kum-Kum Nickel Project Mineral Systems Approach Results

Arcadia Minerals Ltd (ASX:AM7, FRA:8OH) (Arcadia or the Company), the diversified exploration company targeting a suite of projects aimed at Tantalum, Lithium, Nickel, Copper and Gold in Namibia, is pleased to announce that the Department of Earth Sciences at the University of Stellenbosch... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00