January 23, 2024

Magnetic Resources NL (Magnetic or the Company) is pleased to announce, after a significant 107% increase in overall resource in our Laverton Project to 22.7Mt @1.69g/t totalling 1.24moz of gold at 0.5g/t cut off and LJN4 increased by 317% from 204,000oz to 852,000oz, which was announced on November 23 2023 (Table 1), a number of deeper step out holes were carried out to see whether the LJN4 resource could be extended further at depth. Some compelling and exciting intersections are outlined below.

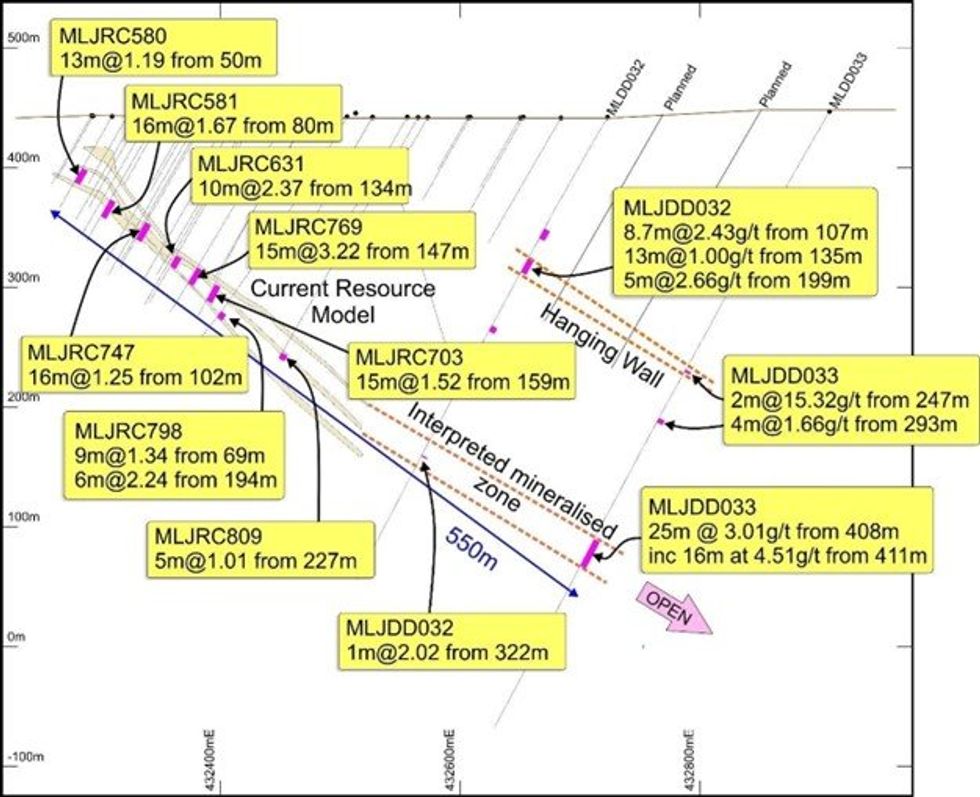

- MLDD033 intersected 16m at 4.51g/t from 411m, which was a very large 200m step out below the current resource (Figure 1). This intersection of 72 gram- metres is potentially underground mineable and is still open downdip. The section in Figure 1 indicates mineralisation continuity of 550m down dip, which is by far the biggest down dip extension identified to date within LJN4. This structure and mineralisation is expected to continue at depth within the Chatterbox shear, which is a regional scale structure that controls many deposits along its length including LJN4, Apollo, Beasley Creek and Wallaby. A seismic survey Magnetic completed (ASX Release 15 February 2021) shows a depth extent of 1.5km.

The above intersection in MLJDD033 occurs partly in a pyrite bearing black shale with intercalated carbonate and minor breccia, and partly in a pyrite-bearing carbonate with pyrite ranging from disseminated to semi-massive, which is a new style of alteration. - New hanging wall mineralisation was also discovered in MLJD033 with an intersection of 2m at 15.32g/t from 247m, and 8.7m at 2.43g/t from 107m and 13m at 1.00g/t from 135m in MLJDD032. These hanging wall intersections are associated with a breccia zone and are planned to be followed up with RC drilling.

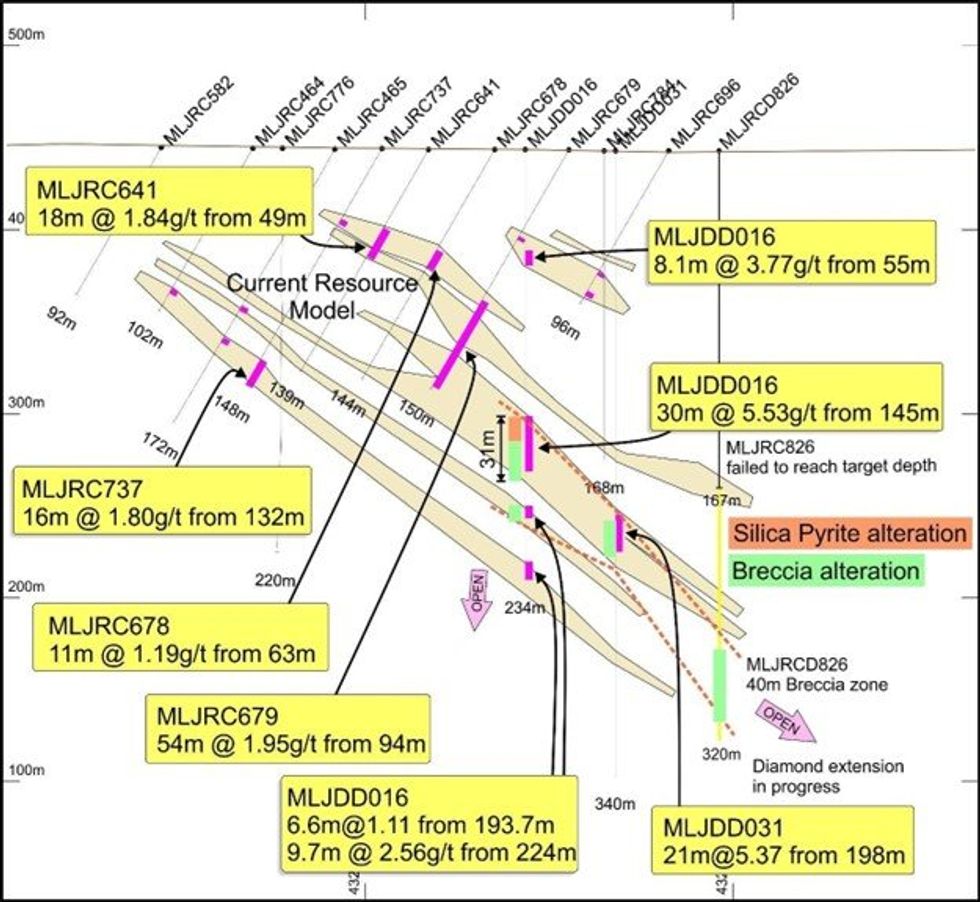

- MLJRCD826 intersected a 40m thick breccia zone from 270m-310m, which visually looks very promising and has assays pending (Figure 2 and 5). It is directly 65m down dip from MLJDD031 which intersected 21m at 5.37g/t from 198m within a breccia. This is in turn 50m down dip from MLJDD016, which intersected 30m at 5.53g/t from 145m, which is also within a breccia.

MLJRCD826 is a large step out and is outside the current resource which augers well for the next resource upgrade. MLJRCD826 is still open down dip and to the south and RC holes are being planned to follow up this promising thick breccia zone. - MLJRCD802 intersected our best intersection to date, of 133m at 2.87g/t from 173m, which includes 61m at 4.68g/t from 243m (1m splits). Assays are awaited for the down dip extension within MLJRC820 from 290m to 453m (Figure 3).

- MLJDD034 intersected 6.8m @12.06g/t from 151m (contained within a 11.5m zone with 4.8m of core loss) in a gossanous chert breccia.

The multiple very thick intersections which often contain silica-pyrite and breccia alteration, are up to 50m thick. These are mainly within a 250m long central zone, which is still open to the south and east.

The central part of the 800m long LJN4 deposit has been infill drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-4.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

37m

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

17h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

18h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

18h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

23h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00