April 16, 2023

BMG delivers first Mineral Resource for Abercromby at the Capital Deposit to underpinproject’s potential to deliver significant value

Gold and lithium explorer BMG Resources Limited (ASX: BMG) (BMG or Company) is pleased to announce a maiden Mineral Resource of 11.12Mt @ 1.45 g/t Au for 518koz Au for the Capital Deposit, part of its Abercromby Gold Project in the Wiluna-Agnew region of Western Australia.

HIGHLIGHTS

- Major Abercromby Project milestone with maiden Mineral Resource for Capital Deposit of 11.1Mt @ 1.45 g/t Au for 518koz Au (0.4g/t and 1.25g/t cut-offs for open pit and underground zones respectively)

- Open Pit area: 354koz @ 1.17g/t Au (>0.4g/t Au between surface and 200mbs)

- Underground area: 164koz @ 3.09g/t Au (>1.25g/t Au between 200 and 500mbs)

- 353koz (68%) Au Indicated and 165koz (32%) Au Inferred (using resource constraint above)

- 345koz in oxide and transitional material, 173koz in fresh material

- Higher grade component of the resource is 430koz @ 2.01g/t Au at a 1.0g/t lower cut-off

- Low $8.35/oz discovery cost

- Abercromby is on granted mining leases providing an expedited pathway to mining approvals

- Capital Deposit has open pit potential, with mineralisation starting from near surface extending at depth and along strike beyond Mineral Resource footprint

The maiden Mineral Resource, combined with metallurgical work that confirmed the orebody as free milling across all zones1, is a strong indicator of the potential for a straight-forward open-pit mining operation.

BMG will now commence development studies alongside high-impact expansion drilling to further convert Inferred resources to the higher-confidence Indicated category. BMG is also preparing for further exploration activities across the Abercromby Project area to test large regional gold anomalies to the south, which could deliver further Capital-style discoveries.

BMG Resources Managing Director Bruce McCracken said:

“This large maiden Mineral Resource at Abercromby, delivered at a discovery cost of just $8.35 per ounce, is a step-change in value for BMG. Through efficient use of exploration spend across three major drilling campaigns, BMG has shifted from pure explorer to potential developer with a large resource base and huge potential for further growth.

“Abercromby now has a metric for valuation that BMG can use to quantitatively demonstrate to the market its success in leveraging value from the drill bit.

“Abercromby is well located for development. The potential to monetise the project in a rapidly appreciating gold price environment, underpinned by this maiden resource for the Capital Deposit, places BMG in an enviable position as we continue to pursue sustained, long-term shareholder value.”

The Abercromby Gold Project

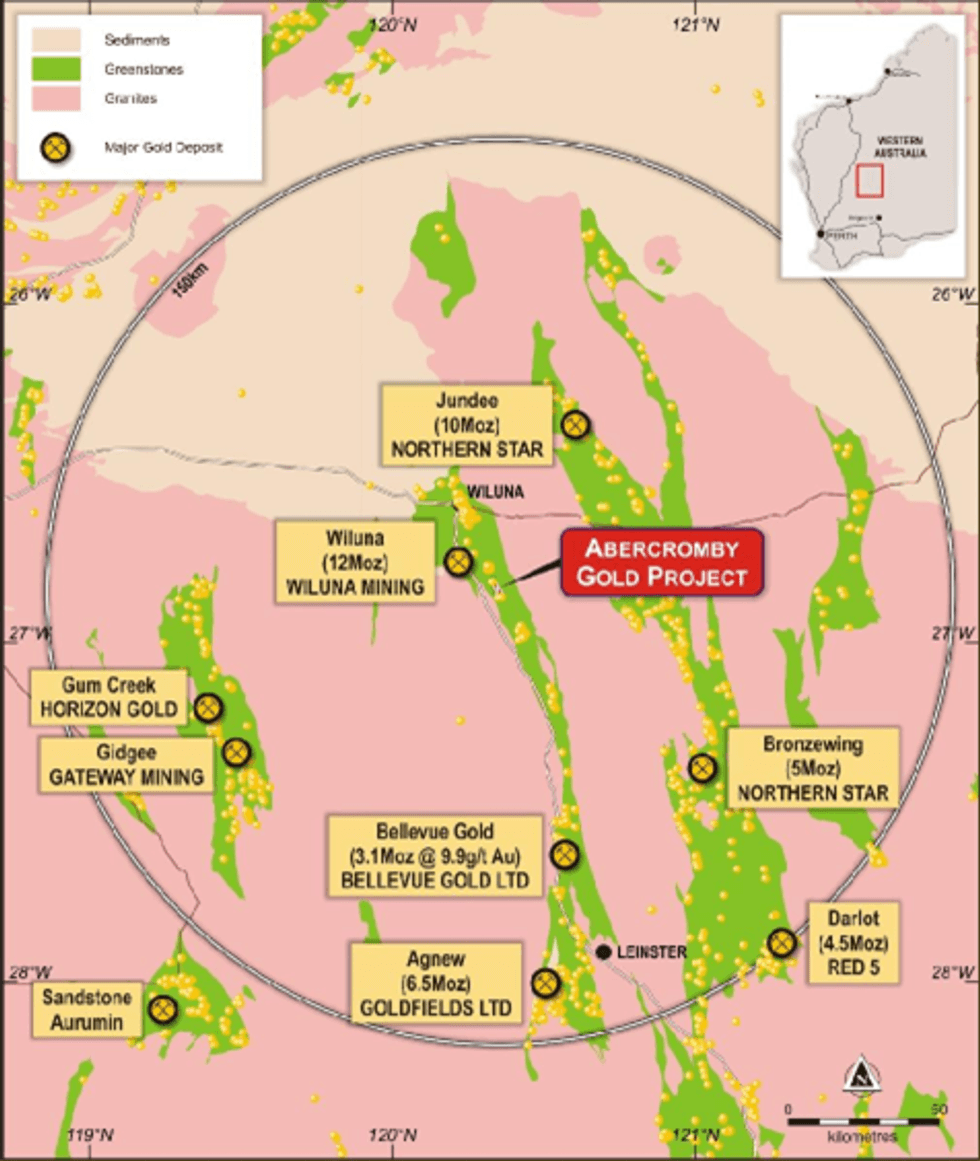

The Abercromby Gold Project is located on the Wiluna Greenstone Belt, one of Western Australia’s most significant gold-producing regions with a gold endowment of +40Moz Au – second only to Kalgoorlie globally in terms of historic production.

The geology at Abercromby is favourable for gold mineralisation, with drilling having intersected multiple thick intervals of high-grade gold mineralisation confirming the presence of a large, high-grade gold system. BMG holds 100% of Abercromby, which comprises the gold and other mineral rights (ex-uranium) of two granted mining leases (M53/1095 and M53/336). The mining leases provide for an expedited development pathway for the Company to secure mining approval.

Since acquiring the project in mid-2020, BMG has completed three reverse circulation and diamond drill programs primarily targeting the high-priority Capital Deposit. The Capital Deposit sits within the northern third of Abercromby’s 12km2 project area.

In parallel to the drill program, BMG has completed metallurgical test work on core samples from the Capital Deposit which confirmed its free-milling status and therefore amenability to conventional carbon-in-leach (CIL) processing, with high gold recoveries achieved. See our ASX announcement dated 6 February 2023 “High Gold Recoveries – Abercromby Metallurgical Test” for full discovery of the outcomes of the metallurgical test work.

The Mineral Resource estimation at the Capital Deposit was completed by ordinary kriging within 3D-modelled mineralisation wireframes and block modelling in Surpac, utilising a comprehensive data set generated by recent work undertaken by BMG as well as work completed by previous owners.

Click here for the full ASX Release

This article includes content from BMG Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMG:AU

The Conversation (0)

8h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

20h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00