CSE: GTCH

OTCQB: GGLDF

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) ("Getchell" or the "Company") announces that as part of the planned 2023 drill program to expand the Mineral Resource at the Fondaway Canyon gold project ("Project") the Company has received authorization from the US Bureau of Land Management to construct an additional 12 drill pads.

The Fondaway Canyon gold project is host to a large, near and at surface Mineral Resource Estimate (" MRE ") reporting:

- Inferred Mineral Resource of 38.3 million tonnes at an average grade of 1.23 g/t Au for 1,509,100 ounces of gold;

- Indicated Mineral Resource of 11.0 million tonnes at an average grade of 1.56 g/t Au for an additional 550,800 ounces of gold;

- Strong gold mineralization in the most peripheral drill holes leaves the mineral resources open in most directions for further expansion and indicates a substantially larger body of mineralization than delineated to date; and

- The drill plan is designed to expand the mineral resources and upgrade Inferred resources to Indicated.

"Having released a continuous series of exceptional drill results over the last three years, it is important to step back and appraise the potential of the Fondaway Canyon project as a whole," states Getchell President Mike Sieb . "What becomes immediately obvious is the strong and prevalent gold mineralization encountered in the most peripheral drill holes, signifying a robust mineralizing system that has yet to be truly tested. This causes us to seriously wonder how big it can be, and the additional 12 drill pads will enable us to conduct step-out drilling and start to answer that very important question."

Permitted Drill Pads

The Company has received authorization from the US Bureau of Land Management to construct twelve additional drill pads under its Notice level permit for the Fondaway Canyon gold project that has brought the total number up to 26 property wide. The additional 12 permitted drill pads allow the Company to step out and potentially increase the already sizable mineral resource, as well as further delineate the mineralization internal to the current MRE to upgrade Inferred Resources to Indicated.

The remaining 22 drill pads covering the Central Area span a considerable 500m x 650m area, a 270% increase in extent from the previously permitted pad coverage. These 22 drill pads provide an excellent drill array, sufficient to support more than one drill campaign with multiple directional holes intended from each drill pad. For reference, from just six drill pads in the Central Area the Company has drilled 26 drill holes over three drill campaigns.

Mineralization Wide Open

Of the 26 drill holes drilled in the Central Area, only 18 were used in the Mineral Resource Estimate due to the resource model data inclusion cut off in late September 2022 . These 18 drill holes were responsible for a doubling of the Mineral Resource Estimate from historical levels. The balance of the drilling not included in the MRE – nine holes drilled in the latter half of 2022 – all intersected substantive mineralization.

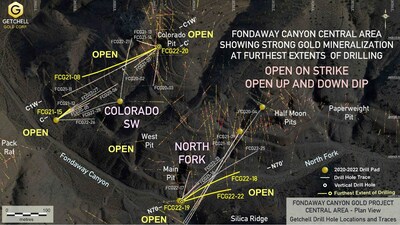

Upon completion of the 2022 drill program the limits of the gold mineralization had yet to be encountered, remaining open in most directions and with strong gold mineralization observed in the most peripheral drill holes (i.e. the furthest extent of drilling). These are highlighted in yellow on the plan map of the Central Area below (Fig. 1).

Six drill holes on the periphery of existing drilling have been selected to illustrate the continued strength and degree of openness of the gold mineralization at the furthest edge of drilling.

Three drill holes into the Colorado SW Zone:

| i. | | FCG22-20: open up dip to the NE; |

| ii. | | FCG21-08: open on strike to the NW; and |

| iii. | | FCG21-15: open down dip to the SW. |

Three drill holes into the North Fork Zone:

| i. | | FCG22-18 and FCG22-22: open on strike to the SE; and |

| ii. | | FCG22-19: open down dip to the SW. |

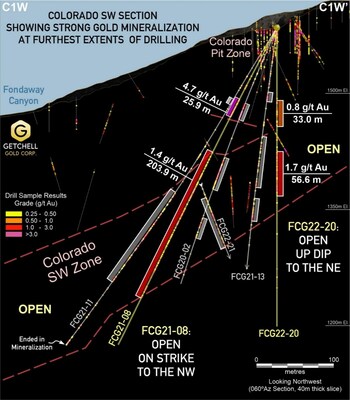

As shown in the Colorado SW cross section C1W (Fig 2), the most northwestern extents of drilling, the trend of the gold mineralization is well defined, displaying high consistency along a 300m down-dip drill length, maintaining good thickness, and shallowly dipping. These are all highly favourable attributes to look for in a deposit in terms of both level of confidence and future potential.

Hole FCG22-20, drilled vertically from the base of the Colorado Pit, a historic small-scale open pit, intersected two gold intervals grading 0.8 g/t Au over 33.0m and 1.7 g/t Au over 56.6m . The mineralization remains open with the plan to drill on section to the northeast to extend the mineralization up-dip towards the surface.

Hole FCG21-08, drilled to the southwest from the Colorado Pit, intersected a lengthy gold interval grading 1.4 g/t Au over 203.9m . The mineralization remains open with the plan to drill off section to the northwest to extend the mineralization along strike.

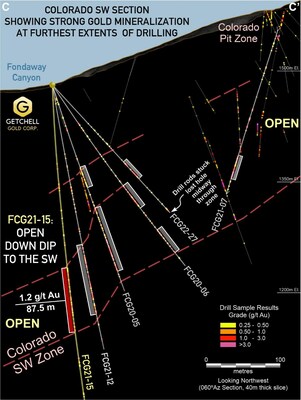

The Colorado SW cross section C (Fig 3), adjacent and to the southeast of section C1W, continues to show the well-defined trend of the gold mineralization. Hole FCG21-15, drilled steeply to the northeast, intersected 1.2 g/t Au over 87.5m . This is the furthest down-dip hole drilled on the Colorado SW zone and leaves the mineralization wide open in this direction with the plan to drill to the southwest to extend the mineralization down-dip.

By themselves, these three holes display highly noteworthy intercepts, but when considered that the gold intervals encountered are at the furthest extents of drilling, a significantly larger body of mineralization is indicated at Fondaway Canyon than delineated to date.

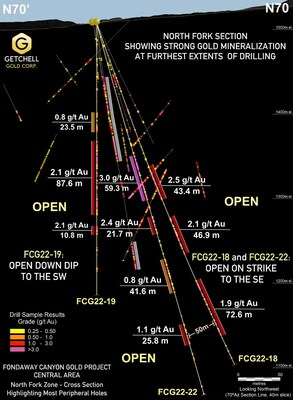

In the North Fork cross section N70 (Fig 4), the most southeastern and southwestern extents of drilling are shown. The North Fork zone differs from the Colorado SW zone as it is generally higher grade, appears less constrained, and reveals the potential thicker and deeper roots of the mineralizing system.

Hole FCG22-18 and FCG22-22, drilling to the northeast at the Fondaway Canyon and North Fork branch junction, tested the southeastern extents of the mineralization and intersected multiple significant gold intervals spanning over 200 metres down hole distance.

Hole FCG22-18 intersected three gold intervals grading 2.5 g/t Au over 43.4m , 2.1 g/t Au over 46.6m , and 1.9 g/t Au over 72.6m ; and hole FCG22-22 intersected four gold intervals grading 3.0 g/t Au over 59.3m , 2.4 g/t Au over 21.7m , 0.8 g/t Au over 41.6m , and 1.1 g/t Au over 25.8m . The mineralization is fully open along strike to the southeast with the drill plan intending to step out to extend the mineralization in this direction.

Hole FC22-19, set up on the same drill pad, is a vertical hole and the furthest down-dip intersection of the North Fork zone. Multiple significant gold intervals were encountered spanning 145 metres down hole distance comprising 0.8 g/t Au over 23.5m , 2.1 g/t Au over 87.6m , and 2.1 g/t Au over 10.8m . The mineralization is fully open down dip to the southwest with the drill plan intending to test the extent of the mineralization further in this direction.

These three holes have encountered exceptional drill intercepts of significant extents and grade, and when considering that these gold intervals are at the furthest extents of drilling, the indication of a substantially larger body of mineralization than delineated to date is reaffirmed at Fondaway Canyon

Scott Frostad , P.Geo., is the Qualified Person (as defined in NI 43-101) who reviewed and approved the content and scientific and technical information in the news release.

Engagement of ECON Corporate Services (dba: Investorideas.com)

The Company is also announcing the engagement of Investorideas.com, an online media company, to provide investor relations, news publishing, content creation, and communication consulting services to the Company for a period of one year. Content produced by Investorideas.com for the Company may appear on the Investorideas.com website, through Newswire services, and emailed to Investorideas.com subscribers.

In connection with the engagement of Investor Ideas, the Company has granted ECON Corporate Services a total of 60,000 stock options exercisable at a price of $0.20 per share for a period of five years. Investor Ideas does not have a pre-existing relationship with the Company.

Notes on the Mineral Resource Estimate:

- The independent and qualified person for the mineral resources estimate, as defined by NI 43-101, is Michael Dufresne, P.Geo., from APEX Geoscience Ltd.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resources tabulated above as an indicated or measured mineral resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the mineral resources discussed herein will be converted into a mineral reserve in the future. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The mineral resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum standards on mineral resources and reserves, definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council (CIM 2014 and 2019).

- The Mineral Resources Estimate is underpinned by data from 518 reverse circulation and diamond drillholes totalling 52,395m of drilling that intersected the mineralized domains.

- The mineral resource is reported at a lower cut-off of 0.3 g/t Au for the conceptual open pit and 2.0 g/t Au for the conceptual underground extraction scenario. The lower cut-off grades and potential mining scenarios were calculated using the following parameters: mining cost = US$2.70 /t (open pit); G&A = US$2.00 /t; processing cost = US$15.00 /t; recoveries = 92%, gold price = US$1,650.00 /oz; royalties = 1%; and minimum mining widths = 1.5 metres (underground) in order to meet the requirement that the reported Mineral Resources show "reasonable prospects for eventual economic extraction".

- The effective date of the Mineral Resources Estimate is December 12, 2022 , and a technical report on the Fondaway Canyon project titled "Technical Report Mineral Resource Estimate Fondaway Canyon Project, Nevada, USA " was filed by the Company on SEDAR on February 3, 2023 .

About Getchell Gold Corp.

The Company is a Nevada focused gold and copper exploration company trading on the CSE: GTCH and OTCQB: GGLDF. Getchell Gold is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a significant in-the-ground historic resource estimate. Complementing Getchell's asset portfolio is Dixie Comstock , a past gold producer with a historic resource and two earlier stage exploration projects, Star (Cu-Au-Ag) and Hot Springs Peak (Au). Getchell has the option to acquire 100% of the Fondaway Canyon and Dixie Comstock properties, Churchill County, Nevada .

Mr. William Wagener , Chairman & CEO

Getchell Gold Corp.

1-647-249-4798

info@getchellgold.com

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the amendment of the Warrants. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

SOURCE Getchell Gold Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2023/09/c1216.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2023/09/c1216.html