Gold Trends 2017: Price Gains Led by Geopolitical Tensions and Uncertainty

What happened to the yellow metal this year? Here’s a quarter-by-quarter review of the main gold trends of 2017 with commentary from experts.

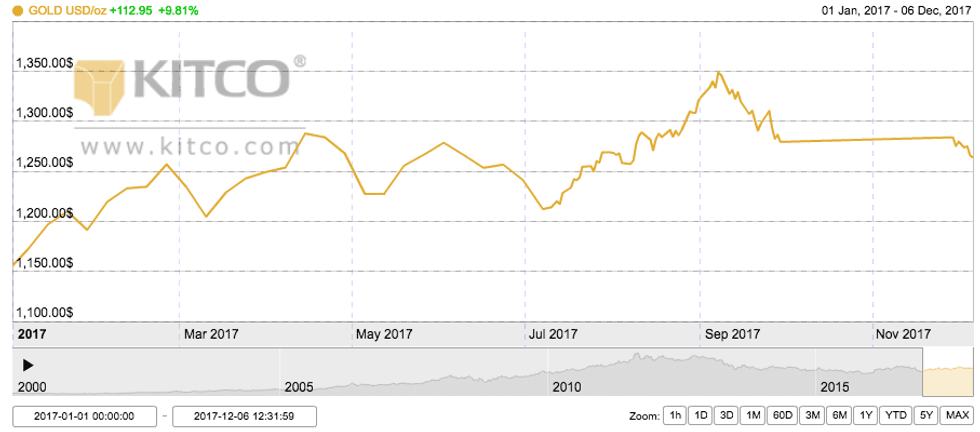

The gold price has gained almost 10 percent since January, despite performing with volatility during the year. In August, the yellow metal broke $1,300 per ounce, although prices have pulled back since then.

As the year comes to a close, the Investing News Network is looking back at the main gold trends this year, from the impact of US Federal Reserve interest rate hikes to widespread geopolitical uncertainty.

Read on to learn what happened in the gold market in 2017, from the key supply and demand dynamics to how analysts thought the market performed in every quarter of the year.

Gold’s price performance from January 1, 2017 to December 6, 2017. Chart via Kitco.

Gold trends Q1: Trump uncertainty drives prices

The gold price made its eighth Q1 gain in 10 years in the first quarter of 2017, buoyed by safe-haven demand from anxious investors.

Concerns about US President Donald Trump and anticipated rate hikes from the Fed caused worries, as did the Brexit process and European elections. All of those factors combined in the first three months of the year to drive the yellow metal’s price.

“The fear trade has driven the market so far this year,” David Govett of Marex Spectron said at the time.

In terms of demand, Thomson Reuters GFMS expected physical gold demand to potentially increase later in the year due to political uncertainty and tension across the globe.

“We are expecting a reduction in global mine output and a gradual demand recovery globally in 2017, resulting in a smaller surplus than in 2016 but a large one nonetheless,” GFMS noted early in 2017.

During Q1, many analysts predicted a bright year for gold, and gold stocks in particular.

“The gold price is looking pretty stable right now, and the gold stocks have really come down relative to the gold price over the last five years. So this is a great time to be a buyer,” Peter Spina, founder and president of GoldSeek, said back in January.

Speaking about the catalysts that could move the price of gold in 2017, Frank Holmes of US Global Investors (NASDAQ:GROW) said that the fear trade and love trade were crucial. “Any time the inflation is greater than what the government is willing to pay you, gold goes up. Any time inflation is less … it goes down. It’s very simple. Follow real interest rates,” he explained.

During the first quarter, gold traded between $1,184.62 and $1,257.64.

Gold trends Q2: Hawkish Fed tone hits the market

The gold price stalled in the second quarter of the year as concerns about geopolitical tension faded away. The Fed increased interest rates for the second time of the year in June — that hurt the yellow metal as gold is highly sensitive to rising rates.

Demand for gold dropped 14 percent year-on-year in the first half of 2017 due to a sharp fall in ETF inflows, according to the World Gold Council (WGC). Total global demand for gold reached 2,003.8 tonnes from January to June, down from 2,318.7 tonnes in the same period the year before.

According to the WGC, total gold supply declined by 8 percent in the second quarter, as mine production remained steady and recycling levels continued to drop.

That said, many analysts continued to be bullish on the yellow metal, including Adrian Day of Adrian Day Asset Management. “As optimism regarding Trump’s policies fades, you will start to see a little more sensitivity to risk in the stock market and that is positive for gold,” he said in August.

Similarly, Peter Schiff, president and CEO of Euro Pacific Capital, said that in his opinion, “there is no limit to how high gold can go, because there’s no limit to how low the [US] dollar can go.”

The yellow metal traded between $1,218.80 and $1,293.60 during the quarter.

Gold trends Q3: Gold climbs above $1,300 as US-North Korea tensions escalate

The gold price gained more than 3 percent in the third quarter, even though September was one of its worst months of the year.

A weaker US dollar and geopolitical tensions between the US and North Korea supported gold over the quarter. Gains were offset by the Fed’s hawkish tone, which pointed to another interest rate hike later in the year and three more in 2018.

Global gold demand fell 9 percent year-on-year in Q3, touching its lowest level in eight years on the back of decreased ETF inflows and lower demand from the jewelry sector, the WGC said. During the period, demand for the yellow metal hit 915 tonnes, down from 1,001.1 tonnes in the same period last year.

Looking over to gold supply, mine production declined 1 percent year-on-year to come in at 841 tonnes, while recycling was down 6 percent, at 315 tonnes.

At the end of the quarter, most analysts agreed that worldwide political developments, as well as the US dollar, were set to be key drivers for the gold price for the rest of the year.

Resource Maven Gwen Preston said at the time that gold’s fundamentals were strong due to “incredible uncertainty around the world, starting with [US President] Donald Trump and going to North Korea. Then continuing with all kinds of economic arguments about the strength of the US economy and the dollar.”

Meanwhile, Brien Lundin, editor of Gold Newsletter and president and CEO of Jefferson Financial, said “gold investors really need to watch monetary policy and the flow of economic data in the US,” when speaking about key catalysts for the precious metal.

Gold traded between $1,212.20 and $1,348.60 during the quarter.

Gold trends Q4: All eyes on US economic policy

The gold price remained almost neutral in the last quarter of the year, and was on track for a quarterly loss of less than 1 percent. Trump’s new Fed chair nomination and the expectation of another rate hike in December were some of the key factors driving prices during the period.

“I’m very satisfied … with gold’s performance this year,” Rick Rule of Sprott US Holdings said. “The fact that gold has done well during a time with minimal turbulence says that it has performed its job in terms of maintaining or increasing people’s purchasing power.”

For his part, Lundin suggested that heading into the end of 2017 the gold price will likely perform as it did at the end of 2015 and 2016. In other words, the Fed will hike rates in December and that will act as “a launching pad for gold going into the new year.”

The yellow metal has been trading between $1,285.50 and $1,298 during the quarter.

For gold market predictions, stay tuned for our gold analyst and company outlooks. You can also read the list of our most popular gold news stories of 2017 by clicking here.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.