Gold Outlook 2015: Analysts Anticipate a Break from Turmoil

Analysts are calling for the gold price to be weaker at the start of 2015 before gaining momentum after the Fed makes a decision about interest rates. Read on to find out what else market watchers see coming in the year ahead.

For our 2016 gold outlook, click here.

This time last year, the gold market was in a sorry state. Market participants were still reeling from the yellow metal’s fall from grace, and were hoping against hope that it would bounce back in 2014. Unfortunately, it’s fair to say that didn’t happen.

These past couple of months the yellow metal has been battered by the end of QE and a strong US dollar, and slipped past the key $1,200-per-ounce mark as October drew to a close. Though it’s managed to rise a little since then, gold hasn’t been able to keep its head above $1,200 for any meaningful period of time.

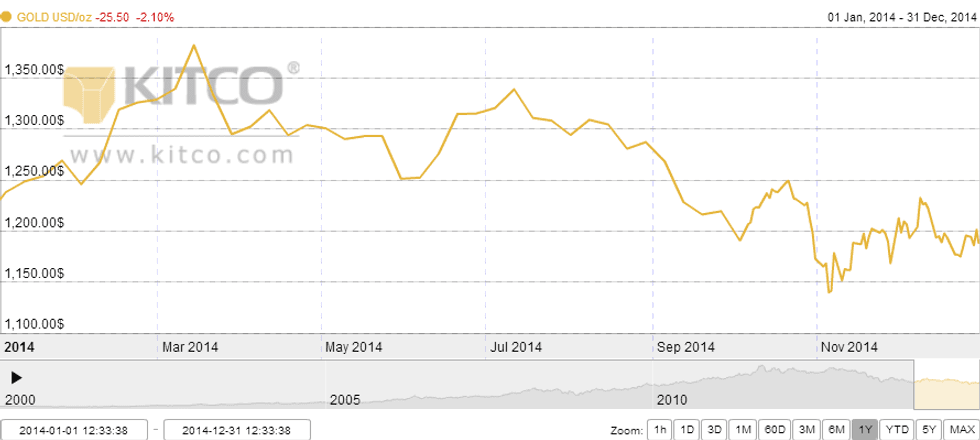

That said, 2014 wasn’t a total wash for gold. As the chart below shows, the precious metal actually fared fairly well until about September, and did particularly well in March, when it breached the $1,350 mark following Ukraine-related tension and concerns about the Chinese economy.

And in fact some analysts are fairly comfortable with gold’s performance this past year. Speaking to Gold Investing News, Derek Macpherson of M Partners commented, “in 2014 one thing that we were looking for was the gold price to stabilize, and I think we saw that. It ended up trading in a fairly tight range over the course of the entire year.”

Similarly, Martin Murenbeeld, chief economist at Dundee Capital Markets, said that while he didn’t have a particularly bullish forecast for gold heading into the year, he also wasn’t overly disappointed by its performance. “In general, things went the way we thought,” he said.

Other key events

All that said, the gold price wasn’t the only thing market participants had an eye on in 2014. Here’s a brief overview of a number of events that rocked the gold sector this past year:

- M&A: 2014 brought a couple of key mergers and acquisitions in the gold space. Midway through the year, Osisko Gold Royalties (TSX:OR) was created in the wake of a friendly takeover of Osisko Mining by Agnico Eagle Mines (TSX:AEM,NYSE:AEM) and Yamana Gold (TSX:YRI,NYSE:AUY), and just five months later, the newly formed company announced plans to acquire Virginia Mines (TSX:VGQ) and become the fourth-largest company in the royalties space. The deal is expected to close in January.

- Gold fix: When the London silver fix came to an end in August, there was much speculation that the London gold fix would be next. Ultimately, the LBMA decided to put ICE Benchmark Administration in charge of the fix. It will take over in the first quarter of 2015 and will put an electronic system in place.

- Swiss gold referendum: The fourth quarter of 2014 brought lots of speculation about the Swiss gold referendum, which was held on November 30. Though there was some hope that a positive vote on the referendum would spur an increase in the gold price, ultimately the movement was voted down, and gold hit a three-week low.

- End of Indian import restrictions: Also in November, India surprised gold market participants by removing its so-called 80:20 gold import rule. Introduced in 2013, its aim was to curb Indian gold imports, and it required traders to export 20 percent of all gold imported into the country. As yet it seems unclear what impact its removal may have on the market — analysts cautioned initially that its effect could be muted.

- Shift from precious metals: Overall 2014 was rife with big names — including Credit Suisse (NYSE:CS), Sheldon Inwentash, Oliver Gross, Sprott (TSX:SII) and Johnson Matthey (LSE:JMAT) — announcing their intention to shift away from precious metals. That might seem like a red flag to investors, but it’s important to note that in most cases the firms and individuals emphasized that they are not making a full break from the sector — just doing some healthy diversification.

It will be interesting to see whether any of these stories experience further developments in 2015.

Gold in 2015

It will also, of course, be interesting to see what happens to the gold price in 2015.

Speaking to that topic, Murenbeeld said he sees the yellow metal averaging $1,202 in the first quarter, rising to $1,277 in Q4 and then hitting $1,311 in the second quarter of 2016. “That’s up a little bit from where we are, but clearly not very dramatic,” he said. “It is predicated on a number of factors, but one of them is continued quantitative easing in many parts of the world,” he continued.

Other firms have come forward with similar predictions. A recent Kitco News article notes that Commerzbank (ETR:CBK) expects gold to average $1,200 in 2015, while Citi Research places it at $1,220. Meanwhile, TD Securities has set it at $1,225 and Natixis (EPA:KN) is estimating $1,140. The consensus of many firms seems to be that, similar to silver, gold will be weaker in the first half of 2015 as investors wait for the Fed to raise interest rates, with that pressure dissipating as the year comes to a close.

That might sound tame, but market participants shouldn’t necessarily sit back and relax. Murenbeeld cautioned that he’s “concerned on two fronts,” with the first being the geopolitical dimension. “It can flare up at any time, and, historically at least, each time we have a geopolitical crisis of some import, gold prices were quick to shoot up 8 to 10 percent,” he said, adding, “there’s lots of reason to expect some kind of geopolitical crisis, be it in connection with Russia, Ukraine or elsewhere in the Middle East, Far East, in Japan, in China. There’s lots of potential.”

Murenbeeld’s second concern, which is of a more economic nature, is about development in Europe. “The European economy is not growing, and we’re not expecting it to grow much this year,” he said.

For his part, Macpherson is a little worried about “the tightening of the capital markets.” As he explained, that’s because it’s resulted in both good and bad projects not receiving funding, and “good projects not getting funded is potentially a problem because they won’t necessarily advance.” That’s an issue for companies — and investors — for obvious reasons, though looking longer term he sees a shrinking project pipeline perhaps improving gold’s supply-demand balance.

Robert Carrington, president, CEO and director of Colombian Mines (TSXV:CMJ), is a little more optimistic. He said in a survey that he expects “there will be a large number of junior companies that fold in H1.” After that point, “the leaner market will see investors more focused on the remaining companies,” with “production and near-production assets [being] the first movers, followed by advanced exploration and eventually, if ever, the early exploration plays.”

All in all, it sounds like the gold market is in for a fairly quiet 2015. And after the turmoil of the last couple of years, maybe that’s a good thing.

This article was originally published on Gold Investing News in December, 2014.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Gold Outlook 2014: Will Gold Bounce Back?

A Brief Overview of the Gold Price Today.