Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to provide an update on its exploration activities in Brazil by announcing its new Heavy Rare Earth Element ("HREE") ionic clays project, "Carina Module" (the "Project") located in the State of Goias, Brazil. The results of its initial auger drilling campaign[1], which was comprised of 1,693 meters of drilling within 236 drill holes, demonstrate the discovery of a new HREE deposit hosted in ionic clays. While the initial auger drilling campaign was shallow, with an average depth of 7.2 meters, it has unveiled a potential for expansion, both laterally and at depth, accompanied by the prospect of enhancing HREE grades

Highlights

- Size Potential: The mineralized area of the Carina Module spans approximately 1,400 hectares, with potential for lateral expansion. In contrast, the mineralized area of the Company's Penco Module in Chile covers approximately 140 hectares.

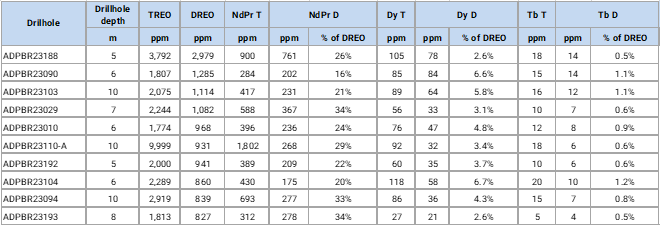

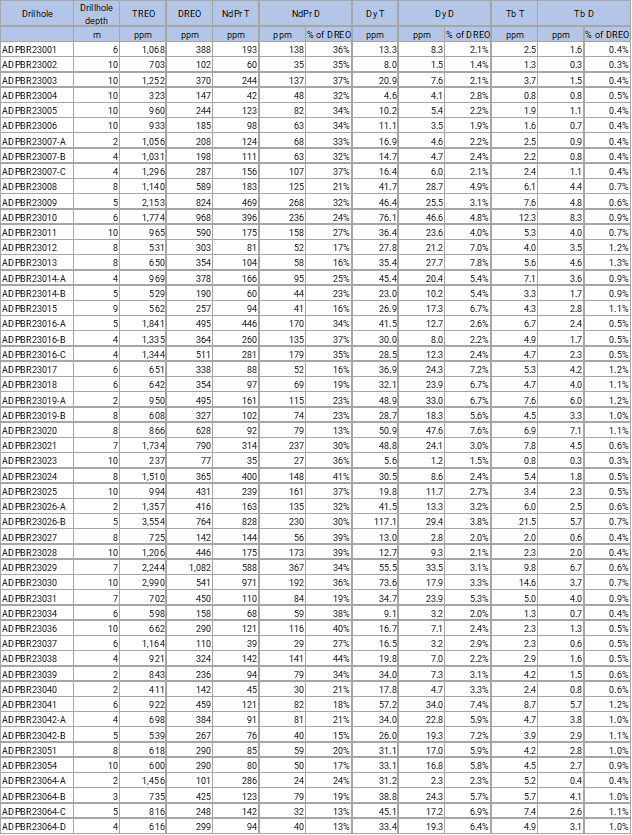

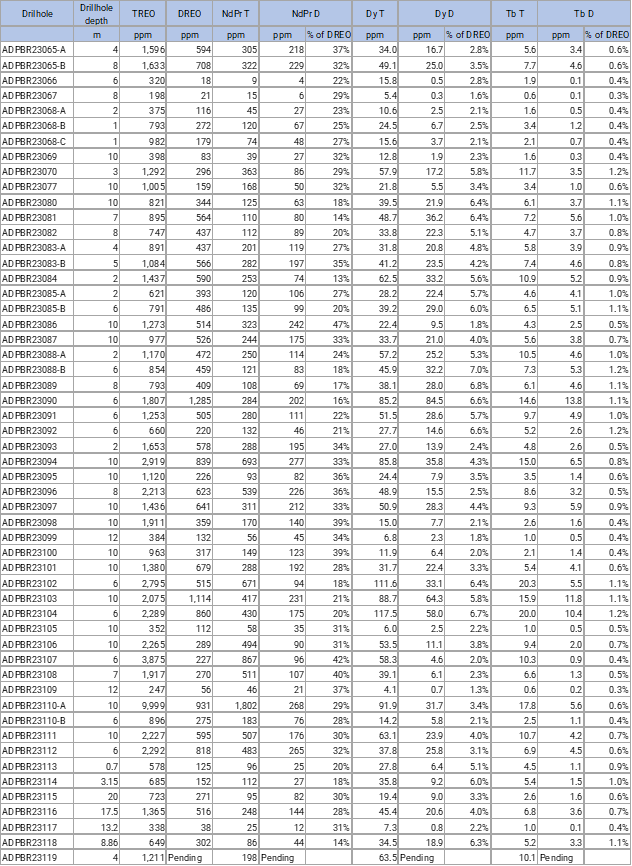

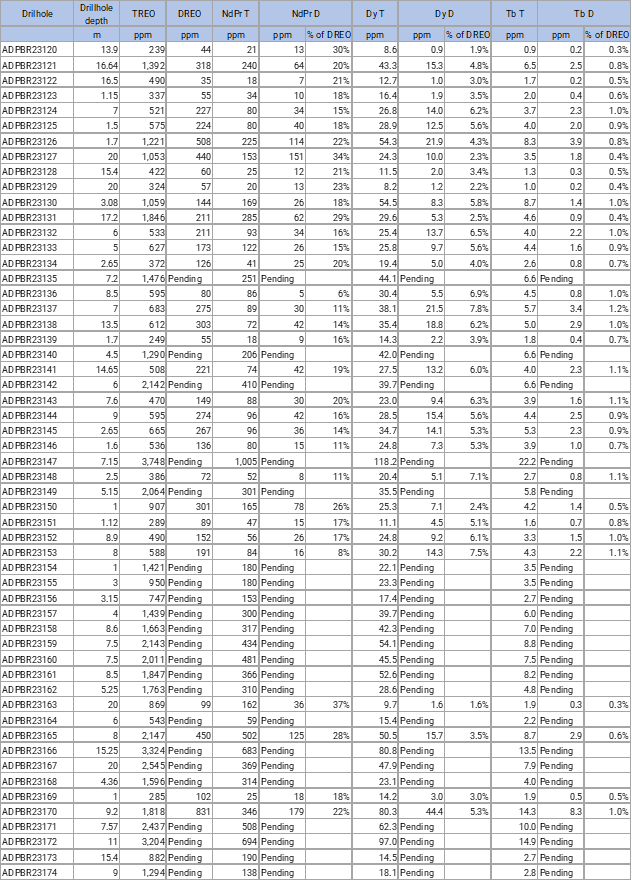

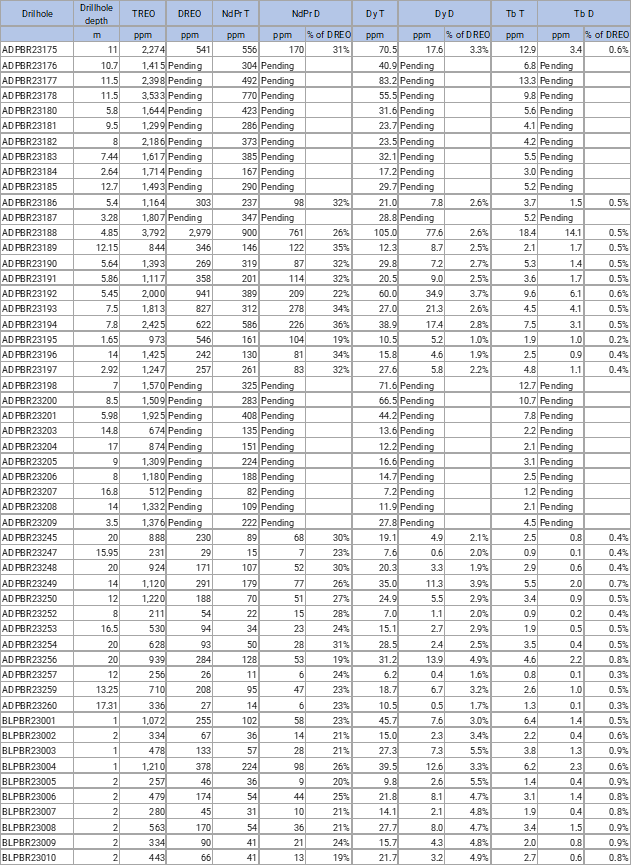

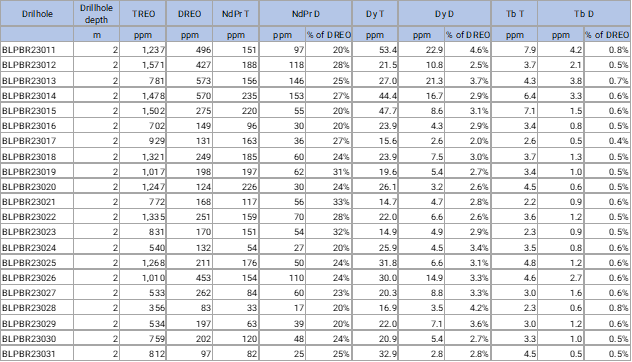

- Prospective Grades: The drilling results shows the potential for high Total Rare Earth Oxides[2] ("TREO") with average grades at 1,229 ppm. From an average drilling depth of 7.2 meters, 71.2% of the drillholes include 5.7 meters with TREO average grades at 1,367 ppm and Desorbable Rare Earth Oxides[3] ("DREO") at 449 ppm. A selection of high-grade drillhole results are shown in Table 1 below, with the full set of results included in Table 3 at the end of the document.

- Rich in HREE and LREE: The desorbable results demonstrate an outstanding distribution of HREE and Light Rare Earth Elements ("LREE"). In particular, 71.2% of drillholes reveal desorbable dysprosium ("Dy2O3 D") and terbium ("Tb4O7 D") grades at 18.1 ppm (≈4.1% of the rare earths basket distribution) and 3.1 ppm (≈0.7% within the rare earths basket distribution), respectively. In addition, desorbable neodymium oxide ("Nd2O3 D") and praseodymium oxide ("Pr2O3 D") grades show a summed value of 123 ppm (≈27.5% of the rare earths basket distribution).

- Metallurgical Compatibility: The metallurgy of the Penco Module, which utilizes an ammonium sulfate leaching solution, is well-suited for the Carina Module's ionic clays. 71.2% of drillholes show an average exchangeable fraction[4] for TREO of 36.6%, with the highest value recorded at 78%; total dysprosium oxide ("Dy2O3 T") exhibits an average exchangeable fraction of 46%, with the highest value at 78%, and Terbium oxide ("Tb4O7 D") exhibits an average exchangeable fraction of 52%, with a peak at 91%.

- Depth Potential: The average drill depth of the auger drilling campaign was 7.2 meters, which did not allow us to consistently reach the bottom limits of the lower Pedolith and Saprolite. However, over 70% of drillholes indicate a high anomalous exchangeable fraction in the last interval, suggesting that the deposit remains open at depth.

Table 1. Summary of Carina Module´s top 10 drillhole results (see location in Figure 2 below)

Ramon Barua, CEO, commented:

"The Carina Module's initial exploration results mark an important milestone in our journey to establish Aclara as a leading multi-country and multi-modular HREE company. The Carina Module is located in Goias, a state that promotes responsible mining endeavors and has a well-established track record and expertise in evaluating projects of this nature. The results validate our growth strategy and provide the Company with geopolitical diversification whilst we continue to advance the permitting on our Penco Module in Chile. Like the Penco Module, the Carina Module deposit shows potential to contain significant amounts of dysprosium and terbium, which are scarce and critical to establishing a western based, high performance magnet supply chain necessary for electric vehicles and wind turbines.

As we progress, the results are expected to validate the effectiveness of our in-house-developed exploration model in finding HREE-enriched ionic clay deposits. Although the initial auger drilling campaign was relatively shallow, the results are expected to support a solid maiden mineral resource. Our forward-looking plan includes conducting deeper drilling campaigns to fully assess the asset's potential. Concurrently, we will diligently work on estimating our maiden resource statement and conducting a Preliminary Economic Assessment to expedite engineering processes, with the ultimate goal of achieving production in the earliest possible timeframe."

Initial Auger Drilling Campaign Summary

A total of 1,731 meters of drilling within 238 auger drill holes was carried out from February to August 2023 as part of a scouting drilling campaign covering approximately 1,400 hectares within the area defined as the Carina Module (see Figures 2 and 3). The primary objectives of the drilling initiative were to:

- contribute to the definition of a maiden resource estimate of a size necessary to support a new production module;

- provide guidance for future reverse circulation drilling campaigns, needed to fully assess the asset's potential both laterally and at depth; and

- establish the metallurgical compatibility of the ionic clays found in the Carina Module with the metallurgical process developed for the Penco Module.

The drilling campaign used manually operated augers ideally suited for a scouting campaign requiring shallow drill depths and easy and quick access to drill sites and varying terrains. The images in Figure 1 below show an example of the auger drilling methodology performed at the Project.

Figure 1. Auger drilling campaign at Carina Module project

General Project Description

The Carina Module is located in the north-eastern part of the State of Goiás, in central Brazil. The site can be accessed via paved roads from Goiânia (the capital of the Goiás state) or Brasília (the national capital of Brazil). Both Goiânia and Brasília are major cities with modern infrastructure and services and offering commercial airports for domestic and international flights. From a district perspective, access to the site is via a 50km gravel road and the supply of electricity, water, and sanitation is provided by the Brazilian government utilities. At the site, domestic water is obtained from wells, and electrical supply can be obtained from an electrical substation located 90km from the Project.

The State of Goiás is also the home of the ion-adsorption clay project managed by Mineração Serra Verde, which has successfully obtained the required environmental and operating permits needed to construct and operate their mine and processing facility and which recently commenced commercial production. This demonstrates that the Goiás State has a positive track record in evaluating projects of this nature and could play an important role in the potential development of the Carina Module.

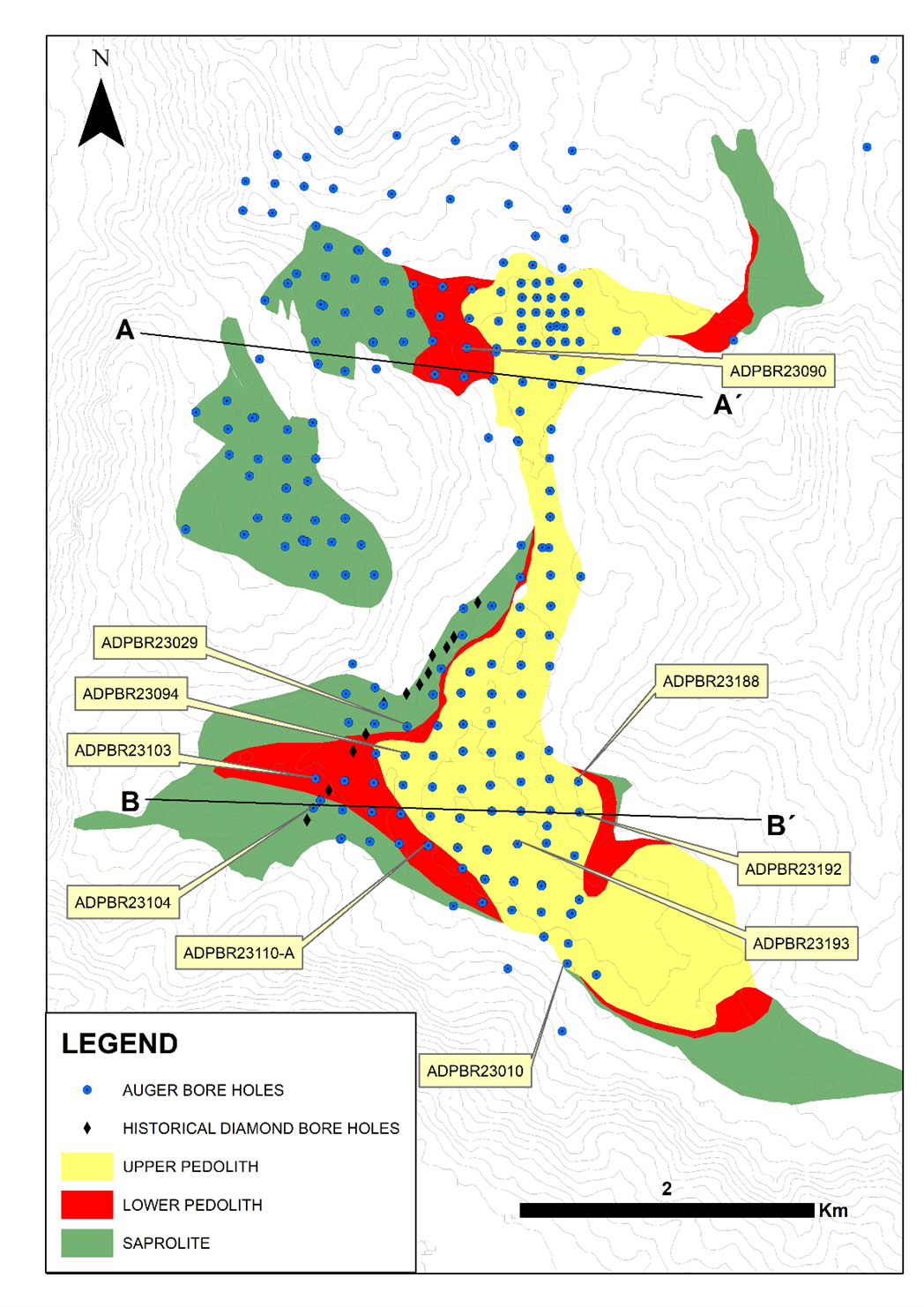

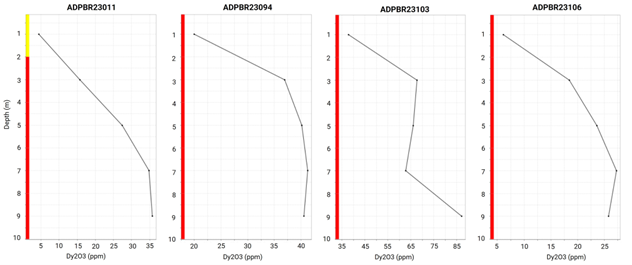

Figure 2 shows the Project area, covering approximately 1,400 hectares, which is characterized by a complete regolith profile (Pedolith and Saprolite horizons), as tested by the auger drilling campaign. The assay results showing the total Rare Earth Elements ("REE"), NdPr, Dy and Tb content and the exchangeable REE, NdPr, Dy and Tb fraction are displayed in Table 3. The table also displays the recoveries, corresponding drill hole depths, average composite grades (ppm), and shows the last interval of some boreholes, indicating that high REE grades remain open at depth. Figures 3 and 4 show examples of 4 drillholes with high desorbable dysprosium grades increasing at depth, the full extension of which will be tested in a future drilling campaign.

Figure 2. Carina Module map with executed auger drillholes, historic bore holes and the zone contour of the geological potential. Auger boreholes are displayed by blue dots. Some of the best drillholes, referenced in Table 1, show their regolith profile and the dysprosium exchangeable fraction curve (Dy D (ppm)) illustrated in Figure 3. The black diamond dots represent historical diamond drillholes completed by the previous owner within the Project area.

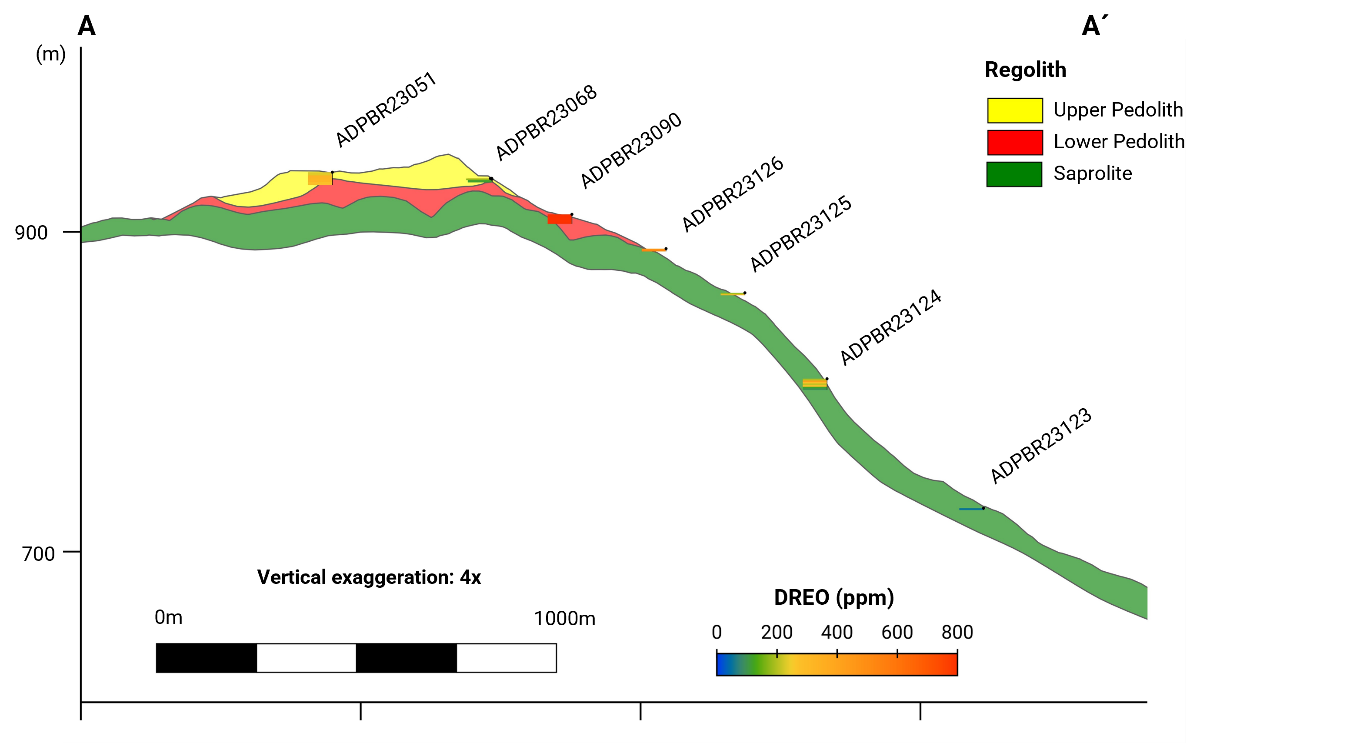

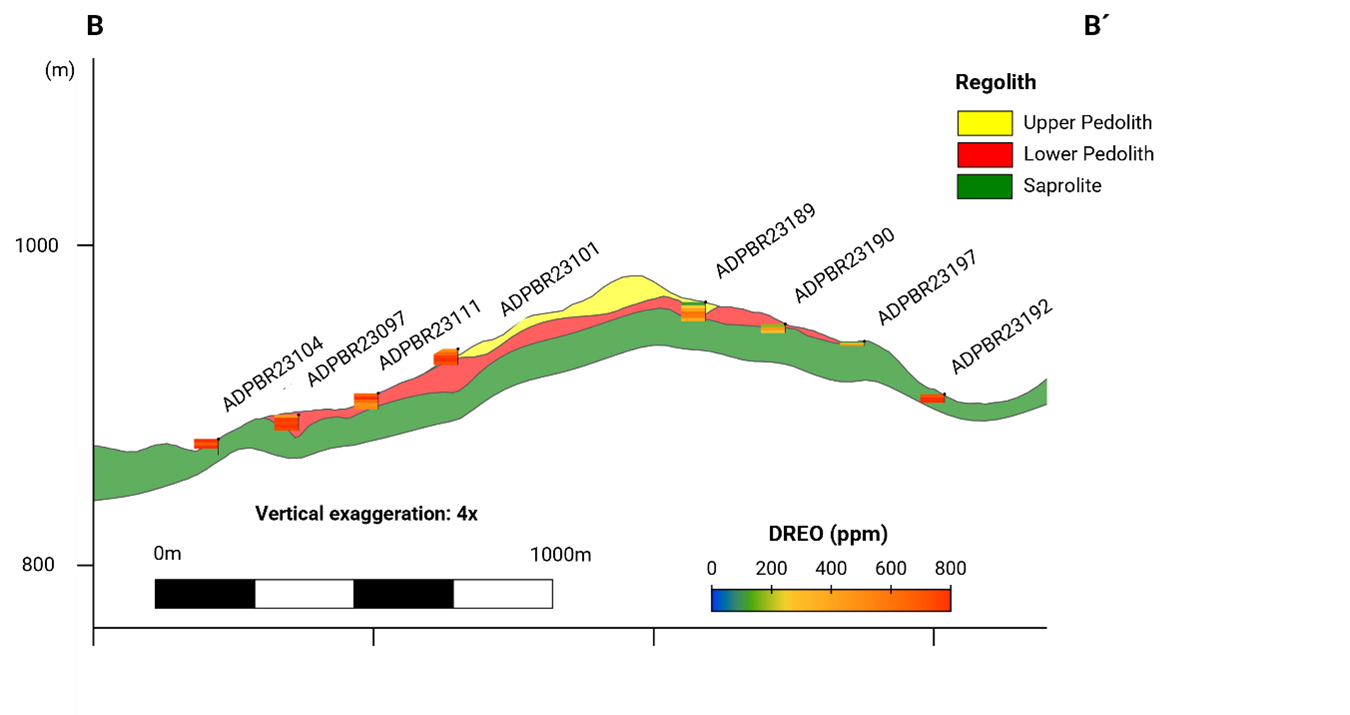

Figure 3. The Upper Pedolith, Lower Pedolith and Upper Saprolith regions and the locations of the cross sections A-A ´and B-B´ are shown in the map.

The distribution of the exchangeable REE fractions obtained from the auger drilling campaign are also plotted in the A-A´ and B-B´ cross-sections, indicating that the deposit is open to depth and laterally (some drill holes are pending analytical results). The drillholes shown in the A-A´ and B-B´ cross-sections have not intercepted the whole regolith profile. The exchangeable REE fractions show good values open to depth. A reverse circulation drilling campaign will be executed here to understand the full potential of the deposit at depth.

Figure 4. Drillholes ADPBR23011, ADPBR23094, ADPBR23103, and ADPBR23106, show Dy2O3 D (ppm; dysprosium exchangeable fraction curve) values open to depth. These drill holes have only intercepted part of the Lower Pedolith (yellow portion of the vertical bar represents the interval of the Upper Pedolith and the red portion of the vertical bar represents the interval of the Lower Pedolith).

Next Steps

The results from the initial auger campaign have provided the Company with a basis to further pursue the Project, which is expected to include the following activities:

- the issuance of a maiden mineral resource estimate during Q4 2023;

- the issuance of a NI 43-101 Preliminary Economic Assessment during Q1 2024;

- the execution of a 1,500-meters reverse circulation drill campaign to confirm the mineralized potential at depth. The campaign is expected to start at the end of October 2023 and is the initial phase of a reverse circulation campaign of 7,590 meters within 253 drillholes to convert the full potential of the deposit to an inferred mineral resource category; and

- the execution of a pilot test campaign during Q1 2024 in our fully owned pilot plant in Chile, utilizing a 25-ton sample of clay extracted from the Project area. This campaign will aim to demonstrate on a semi-industrial scale the feasibility of processing the ionic clays extracted from the Carina Module. Additionally, it will serve the purpose of producing commercial samples and further enhancing the value chain development efforts that were initiated with the Penco Module samples.

Geological Overview

The dominant lithologies of the Project are pink porphyritic monzogranite composed of quartz, oligoclase, microcline, and annite as essential minerals. Leucosienogranite is the secondary lithology, characterized by quartz, albite, and microcline. Using the historical and present auger drilling results, a thick regolith development has been interpreted ranging from 45 to 60 meters in thickness. This hypothesis will be tested with the execution of the upcoming reverse circulation drill campaign.

All the lithologies recognized in the Project have shown evidence of thick regolith profiles, secondary minerals such as the ionic clays, and the release of interesting REE fractions such Nd, Pr, Dy, and Tb. As part of the initial auger drilling campaign, the bottom limits of the lower Pedolith and Saprolite were not reached; however, the last intervals of the drill holes show exchangeable REE fractions open to depth.

Sampling and Assay Protocols

The 238 auger drill holes were sampled at intervals of 0.5 meters to 2 meters, for a total of 1,344 samples, which were sent for total REE analysis (REY T) to the ALS laboratory in Lima, Peru, and desorption (REY D) analysis to AGS laboratory in La Serena, Chile. The same sampling and analytical protocols were followed as indicated in the Company's Amended and Restated NI 43-101 Technical Report, Preliminary Economic Assessment for Penco Module Project, prepared by Ausenco Engineering Chile Limitada with an effective date of September 15, 2021. The QA/QC program indicates high levels of accuracy for Dy, Tb, Nd, Pr and Lu. Overall, the database for total grades similarly shows high accuracy. The Company contracted the services of GeoAnsata to review the data quality and QA/QC protocols.

Comparison: Carina Module vs. Penco Module

In an effort to facilitate the understanding of Carina Module results, Table 2 below has been prepared to compare the results obtained from the Carina Module drilling with those used for the Penco Module. The Penco Module information has been referenced from the Mineral Resource Update released on December 1, 2022.

Table 2. Comparison of Carina Module vs. Penco Module on selected parameters

Size: The mineralized footprint of the Carina Module covers approximately 1,400 hectares, which is an area 10 times larger than the Penco Module mineralized area.

Grades: TREO grades are lower than at the Penco Module, however, the focus needs to be set in the desorbable grades (DREO), which represent the recoverable fraction from TREO. Applying the same metallurgical process as employed by the Penco Module (ammonium sulphate leaching), the Carina Module's DREO grades are slightly lower than those found in the Penco Module mineralised area. It is important to note, however, that the Carina Module mineralization has only been tested to a depth of approximately 5.7 meters whereas the Penco Module has an average depth of approximately 24 meters. This has prompted the decision to initiate a deeper drilling campaign to determine the full potential of the Carina Module mineralisation with regards to both size and grades. As demonstrated in Figures 3 and 4, the mineralised area remains open at depth.

Metallurgy: The metallurgical process used to determine the DREO grades at the Carina Module is the same as that used on the Penco Module, which has previously been successfully validated through a semi-industrial scale pilot plant operation. This metallurgical methodology represents a proven concept with positive environmental attributes and cost-effectiveness. The Company remains optimistic that further enhancements can be made to the metallurgical process which will improve recoveries and, to this end, plans to conduct a research and development programme to optimize the metallurgical formula for the Carina Module clays.

REE content: The Carina Module shows attractive REE contents, with a NdPr to DyTb ratio of approximately 5.8. This positions the asset as a potential net contributor of heavy rare earths essential for manufacturing high-performance permanent magnets, especially those needed for electric vehicles ("EVs"). For further insights, please refer to the Rare Earth Market section below.

Barry Murphy, COO, commented:

"We're excited about the results from the initial round of drilling at the Carina Module. The deposit identified through this initial drilling looks promising in terms of its size, the amount of contained dysprosium and terbium, and how compatible the clays are to the application of our demonstrated metallurgical flowsheet. While it's still early days for the Carina Module, the Company has a detailed exploration and metallurgical development plan over the following nine months aimed at confirming its full potential."

Concessions and Land Ownership

On February 27, 2023, the Company entered into an earn-in agreement with a Brazilian mining company that provides the Company the right to acquire up to 100% of the 8,490 hectares of mining concessions over the target area of the Project.

Qualified Person

The technical information in this news release, including the information related to geology, drilling, and mineralization, has been reviewed and approved by Luiz Jorge Frutuoso Junior, current Aclara Exploration Manager, with more than 20 years of relevant experience. Mr. Frutuoso is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and Fellow of Australian Institute of Geoscientists (AIG) and is a Qualified Person (QP) as defined by National Instrument 43-101 -Standards of Disclosure for Mineral Projects.

Mr. Frutuoso confirms that he visited the project area on May 24, 2023 and was supported by the Chief of Geology at Aclara, Juan Pablo Navarro, who reviewed and analyzed the relevant project information. Carlos Santos, Database and QA/QC Geologist of the Company provided an analysis of the QA/QC work over the Carina Module.

Rare Earths Market

The global transition to clean energy has helped to drive an expanding market for REE due to their valuable properties. Dysprosium and terbium, which are HREE, and neodymium and praseodymium, which are LREE, have magnetic attributes and are critical components in the production of high-performance permanent magnets. Neodymium-based permanent magnets ("Nd magnets") offer superior performance as they are lighter and stronger compared to other type of magnets and have the ability to be engineered into any shape or size. The predominant uses of Nd magnets are in the EV industry and in wind turbines. In EVs, permanent magnets result in increased range autonomy, better use of space, lower weight and lower battery costs, the latter as a result of reduced lithium, cobalt and nickel content. Neodymium permanent magnet motors offer the best performance and optimization potential in electric motors, with approximately 90% of EV models using them as part of their drivetrain.

Incorporation of dysprosium and terbium into neodymium magnets delivers enhanced operating performance by enabling them to operate at higher temperatures (magnets with HREE can operate up to 240 °C as compared to approximately 80 °C for magnets without HREE), without losing their magnetic properties (high coercivity). An average Nd magnet contains approximately 30% NdPr, 3% DyTb, 1% Boron ("B") and 66% Iron ("Fe"). The desired ratio between NdPr and DyTb is 10:1, however most deposits in the world offer ratios that are over 100:1.

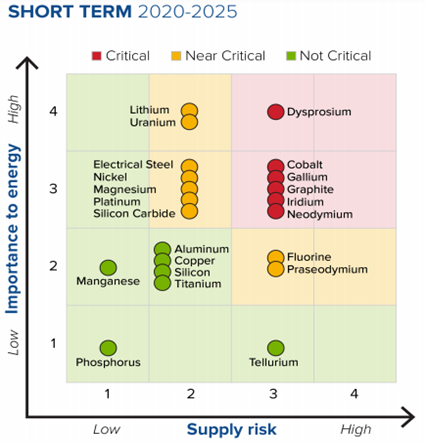

Supply of HREE is currently dominated by China, which in 2022, was estimated by the U.S. Geological Survey to contribute 70% of global TREO production. Furthermore, it is estimated that China imported 100% of REO produced from Myanmar's ionic clay production facilities, increasing their supply control of dysprosium and terbium to approximately 90%. The remaining 30% of global TREO production comes primarily from two operations, one of which is located in the United States and the other one in Australia, which mainly produce LREE. In May 2023, the U.S. Department of Energy evidenced this by established dysprosium as the most important element for the energy transition, and suggested securing its sourcing is at its highest risk.

Figure 5. US Department of Energy, Critical Materials Assessment (May 2023)

About Aclara

Aclara Resources Inc. (TSX: ARA) is a development-stage company that focuses on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. Its primary project is known as the Penco Module and is located in the BioBio Region of southern Chile. The Company is also evaluating a second module, the Carina Module, located in the State of Goiás in central Brazil.

Presently, Aclara has a strong focus on the development, construction, and future operation of the Penco Module, with the primary objective of establishing a processing plant designed to produce heavy rare earths concentrate.

Aclara's extraction process offers several environmentally attractive features. It does not involve blasting, crushing, or milling. Additionally, it does not generate tailings, eliminating the need for a tailings storage facility. The Company utilizes 100% recycled water and minimizes water consumption through high levels of water recirculation. The ionic clay feedstock is amenable to leaching with a fertilizer, and harmful radionuclides are not produced.

Simultaneously, alongside the development of the Penco Module, the Company intends to identify and evaluate further opportunities, such as the Carina Module, for increasing production of heavy rare earth elements. This will involve intensive greenfield exploration programs and the development of additional project "modules" within the Company's concessions in Brazil, Chile and Peru.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, and upside at the Penco Module and Carina Module, the Company's exploration plan and activities in Brazil and the expectations of the Company's management as to the results of such exploration works and drilling activities; timing, cost and scope in respect of the exploration activities in Brazil, the issuance of a Mineral Resource Estimate and Preliminary Economic Assessment relating to the Carina Module, , and the contemplated development of greenfield targets and expected reduction in permitting risk. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Chile and Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Penco Module and/or the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 28, 2023 filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this news release is provided as of the date of this news release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Bonzi Yokomizo Baptista

Brazil General Manager

investorrelations@aclara-re.com

Aclara Resources has engaged Reflex Media to provide marketing services in connection with a digital marketing campaign aimed at increasing the knowledge and awareness of the Company to new audiences.

Table 3. Complete list of drillholes from the auger drilling campaign at Carina Module (February - August 2023)

[1] Auger Drilling Campaign; Results consider Total Rare Earths Oxides ("TREO") of 100% of the auger drillholes of the drilling campaign and 81.8% of desorbable results, with the remaining18.2% pending the final assay results.

[2] TREO: Considers all rare earths elements represented in oxide form (Lanthanum - La2O3, Cerium - Ce2O3, Praseodymium - Pr6O11, Neodymium - Nd2O3, Samarium - Sm2O3, Europium - Eu2O3, Gadolinium - Gd2O3, Terbium - Tb4O7, Dysprosium - Dy2O3, Holmium - Ho2O3, Erbium - Er2O3, Thulium - Tm2O3, Ytterbium - Yb2O3, Lutetium - Lu2O3).

[3] DREO: Desorbable Rare Earth Oxide is the recoverable fraction of the total contained rare earths ( TREO) using the Penco Module´s ammonium sulfate based metallurgical process.

[4] Exchangeable fraction: The exchangeable fraction refers to the percentage (%) of recoverable grade from TREO using the Penco Module´s ammonium sulfate based metallurgical process.

SOURCE: Aclara Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/791900/aclara-announces-the-discovery-of-a-new-heavy-rare-earths-deposit-hosted-in-ion-adsorption-clays-in-brazil