April 10, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide a further update on the significant potential of its Auld Creek Prospect.

Highlights

- Auld Creek is the mineralised extension of the historical Globe Progress Mine which produced 1.1Moz at 10 g/t Au (open pit and underground).

- Trench FTTR018 at the southern end of the Fraternal Shoot intersected 8.3m @ 2.1g/t Au, 0.45% Sb for 3.3g/t AuEq. This trench has extended the strike of the Fraternal Shoot to 200m.

- BZTR008, the second trench in the Bonanza Shoot, intersected 6.0m @ 4.9g/t Au, 0.30% Sb for 4.9g/t AuEq, extending the strike of the shoots to 125m; and

- BZTR002 on the Bonanza West Shoot was extended now intersecting 3.4m @ 4.1g/t Au, 0.26% Sb for 4.8g/t AuEq.

- Drilling commenced with the first diamond hole targeting the Fraternal Shoot approximately 50m down plunge from trench FTTR001 which intersected 8.4m @ 19.7g/t Au, 5.3% sb for 32g/t AuEq.

Executive Chairman Brian Rodan commented:

“The Auld Creek prospect is located within 3km of two mines that collectively produced 1.6Moz at 10g/t Au. Siren has confirmed that high-grade gold and antimony (Sb) is evident along the mineralised trend that extends from Siren’s Big River project a further 12km to the south to Auld Creek where Siren currently has 22 granted drill pads. The recently commenced Diamond Drilling programme is presently focused on depth and strike extensions of the Auld Creek high-grade gold and antimony mineralised system. Previously reported Fraternal diamond drillhole true width intercepts include:

- 12.0m @ 4.1g/t Au, 2.9% Sb for 11.0g/t AuEq;

- 4.5m @ 3.0g/t Au, 3.2% Sb for 10.6g/t AuEq;

- 3.0m @ 4.1g/t Au, 4.1% Sb for 13.8g/t AuEq;

We look forward to updating the market as the current drilling program advances”.

Background

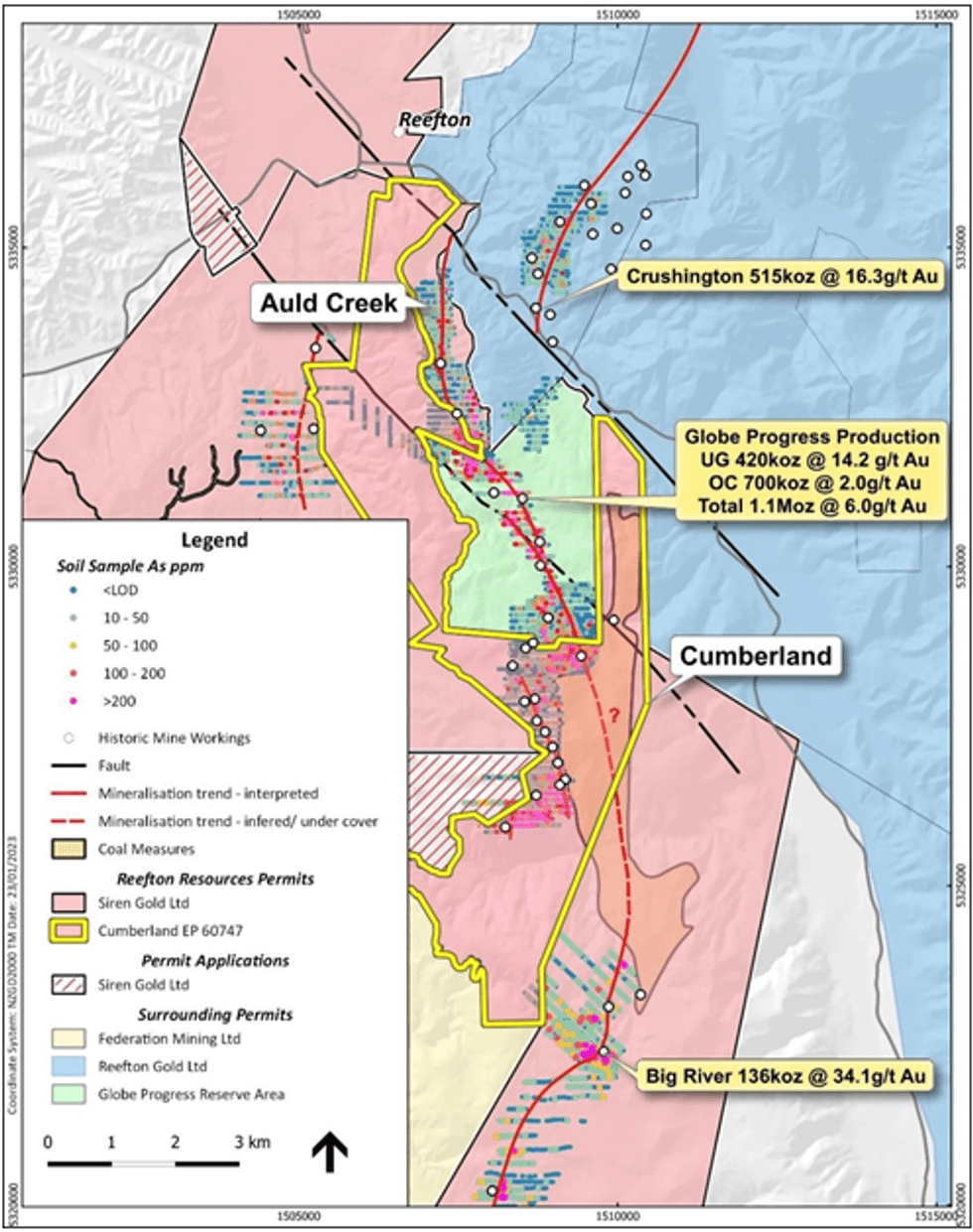

The Auld Creek Prospect is contained within Siren’s Golden Point exploration permit and is situated between the highly productive Globe Progress mine, which historically produced 418koz @ 12.2g/t Au, and the Crushington group of mines that produced 515koz @ 16.3g/t Au (Figure 1). More recently OceanaGold (OGL) mined an open pit and extracted an additional 600koz of gold from lower grade remnant mineralisation around the historic Globe Progress mine.

The Auld Creek mineralisation extends for over 2kms and appears to represent a block that was potentially offset to the west, along NE-SE trending faults between Globe Progress and Crushington. Siren has recently acquired the Cumberland exploration permit that was part of the Globe Progress mining permit (Figure 1). Siren now holds the ground immediately to the north (Auld Creek) and south of the Globe Progress mine.

The gold-antimony mineralisation extends from Auld Creek south through Globe Progress and the Cumberland prospects and on to Big River, a strike length of 12kms with 9kms in Siren’s permits and the remaining 3kms in the Globe Progress reserve area. The Globe progress mineralisation extended for over 200m vertically below the bottom of the open pit before it was offset by the Chemist Shop Fault (CSF). The offset mineralisation of the other side of the CSF has not been found.

Trenching

The Auld Creek arsenic soil anomaly now extends for over 700m along strike. Trenching along the soil anomaly has clearly defined the high-grade Fraternal, Fraternal North, Bonanza and Bonanza West Shoots (Figure 2).

Previously reported Fraternal surface trenches include:

- 8.4m @ 19.7g/t Au, 5.3% Sb for 32.0g/t AuEq;

- 2.0m @ 14.2g/t Au, 13.0% Sb for 44.9g/t AuEq;

- 8.4m @ 2.8g/t Au, 0.24% Sb for 3.2g/t AuEq, and

- 6.0m @ 2.5g/t Au, 1.6% Sb for 6.2g/t AuEq.

Siren has excavated a number of new trenches across all the mineralised zones, with FTTR018 at the southern end of the Fraternal Shoot intersecting 8.3m @ 2.1g/t Au, 0.45% Sb for 3.3g/t AuEq (Figure 2 and Table 1). This trench has extended the shoot strike length by approximately 25m to around 200m. The true height of the shoot is estimated at 125m (Figure 3).

Click here for the full ASX Release

This article includes content from Siren Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

30 January

Is it Time to Take Profits? Experts Share Gold and Silver Strategies in Vancouver

Optimism was building at last year’s Vancouver Resource Investment Conference (VRIC), with fresh capital flowing back into the mining sector, lifting project financings and investor portfolios alike.This year's VRIC, which ran from January 25 to 26, saw that optimism tip into outright... Keep Reading...

30 January

Adoption of Omnibus Incentive Plan & Private Placement Update

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company"). The Company confirms shareholders approved the adoption of a new omnibus incentive plan (the "Plan") at the annual general and special meeting (the "Meeting") of shareholders held on August 7,... Keep Reading...

30 January

Flow Metals Announces Closing of Shares for Debt

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce that, further to its news release dated January 23, 2026, it has closed a debt settlement transaction (the "Debt Settlement") with certain insiders' of the Company pursuant to which the Company settled... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00