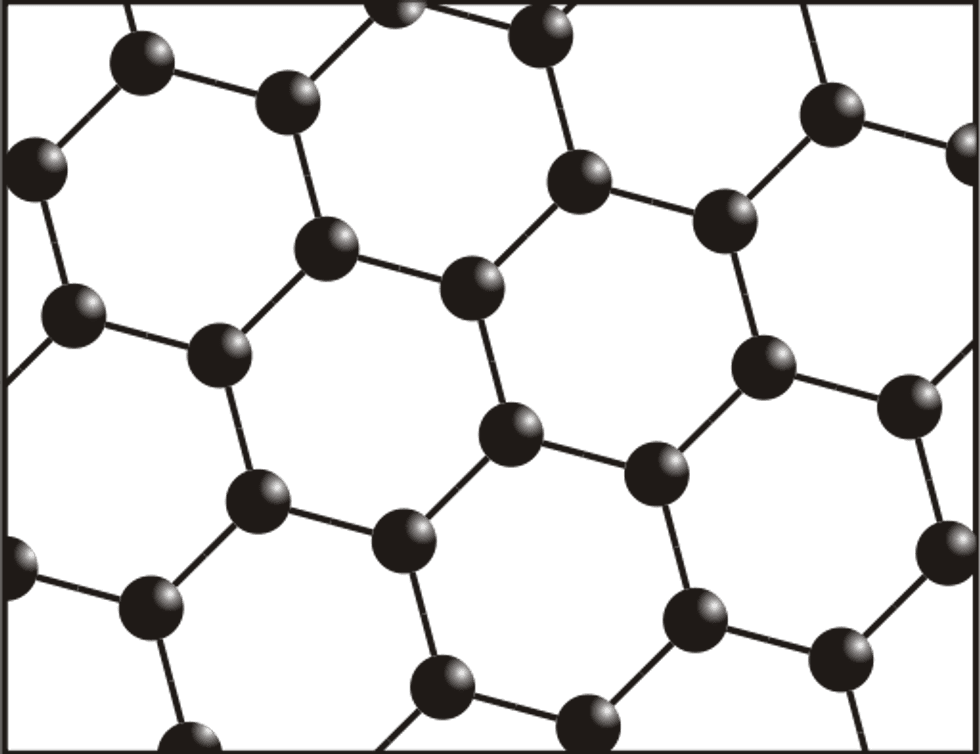

Graphene Making Inroads in Lithium-ion Battery Market

New uses for “wonder material” graphene are popping up left, right and center, most recently in the lithium-ion battery market. But is now the time for investors to get involved?

As investors who take even a passing interest in the graphite market likely know, graphene, which is derived from graphite, is being heralded as this century’s “wonder material.” A quick glance at the news surrounding the material makes it easy to see why. In the past year alone, research has shown that graphene may be able to revolutionize the technology surrounding telecommunications, artificial photosynthesis and desalination.

Most recently, graphene has been making inroads into improving the amount of energy that lithium-ion batteries can hold. SiNode Systems, a start-up company out of Northwestern University, is addressing the problem by building a lithium-ion battery using a piece of graphene drilled with tiny holes, GigaOM reported. Across the globe, in China, a team from the University of Science and Technology is doing so by using graphene to prevent the issue of pulverization, the process through which “flimsier electrodes become damaged due to … the swelling from a battery’s charge-discharge cycle,” according to ExtremeTech.

Graphene improves anode structure

Using the research of Harold Kung, a professor at Northwestern, SiNode is developing a lithium-ion battery with an anode that can hold 10 times more energy than usual and that can be charged significantly faster than conventional lithium-ion batteries.

GigaOM notes that lithium-ion batteries currently on the market have anodes made of graphite, while their cathodes are made of either cobalt oxide, iron phosphate or manganese oxide. SiNode has improved on this type of battery by creating a new type of anode made of silicon, which can hold more lithium ions than graphite. Silicon can be problematic in that it swells when ions enter it; however, as a MacroCurrent article explains, “SiNode uses sheets of graphene to support the silicon, giving it space to swell as ions enter.”

Last month, SiNode won $911,400, the grand prize in the Rice Business Plan Competition; it is working on raising a further $1.5 million so that it can bring its technology out of the lab.

Avoiding pulverization with graphene

Researchers at China’s University of Science and Technology are addressing the battery storage capacity issue in a different way.

A Chemistry World article notes that part of the energy storage issue is that while “flimsier” nanostructured electrons can hold more lithium ions — and in doing so, provide greater energy storage capacity — they are easily damaged by pulverization, with the end result being a reduction in the electrode’s capacity.

In constructing one-atom-thick sheets of cobalt oxide, which ExtremeTech describes as “not exactly graphene, but close enough to be considered an analog,” the researchers have been able to bypass the pulverization issue, thereby “increas[ing] the surface area of storage capacity.”

Like SiNode’s technology, the Chinese university’s work is still in the early stages of development; the researchers may even opt to use a different graphene analog in the long term.

Limitations remain

As the above examples highlight, investors would do well to remember that while graphene clearly has much potential, that doesn’t mean products that contain it will be hitting the shelves in the near future. In fact, Chris Berry of House Mountain Partners told Graphite Investing News last year, “I am not aware of any widespread commercial use of graphene by any firms.”

More recently, Gary Economo, president and CEO of Focus Graphite (TSX:FMS, OTCQX:FCSMF), emphasized in an article published on ProEdgeWire that graphene will be of most benefit to those countries that promote research on the material. For example, he notes that the European Union has announced a “billion euro, 10-year funding grant for the investigation of graphene for commercial development application,” while China is attempting to establish graphene industrial zones throughout China. The US is also “heavily engaged” in the commercial and industrial development of the material.

Canada, on the other hand, needs to “up its game … and do more to support graphene research and development,” according to Economo. While he thinks the country has the ability to become a leader in graphene application development, it will need to follow the examples of the EU, China and US and bring academics and commercial developers together.

Investors should thus think of graphene as a longer-term investment and consider taking an interest in companies located in countries that are actively involved in funding research on the “wonder material.”

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Graphene: Key to Revolutionizing Telecommunications?

Graphene Could Make Artificial Photosynthesis More Efficient

Production Costs Need to Drop to Support Widespread Graphene Use