How should investors approach the lithium space after Tesla’s Battery Day? INN caught up with experts, analysts and market watchers to talk all things lithium.

Tesla’s (NASDAQ:TSLA) Battery Day has left the lithium market with more questions than answers, and many want additional details before making new predictions and investments.

Sourcing lithium from clay, building a cathode plant and expanding its battery cell capacity to 3 TWh by 2030 were just a few of the announcements Tesla made as it outlined plans to achieve its main goal ― producing an affordable US$25,000 electric vehicle (EV) in the next three years.

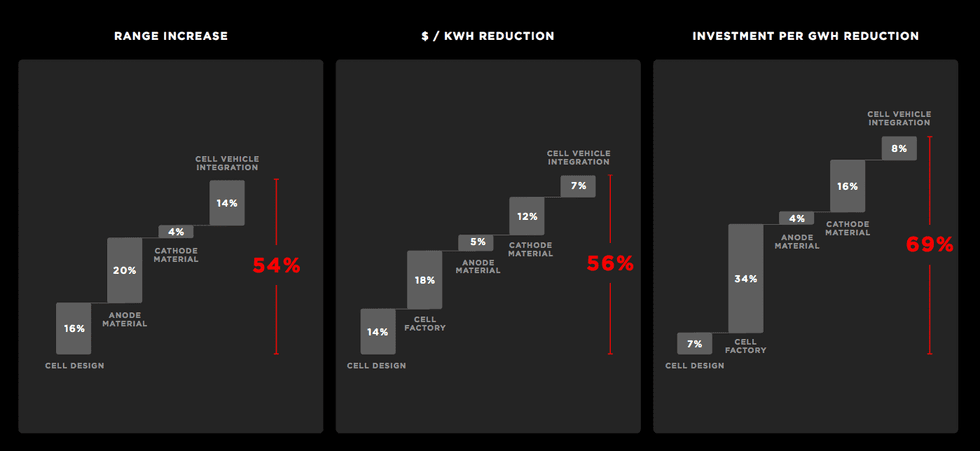

For once, all eyes were on the lithium-ion battery and its raw materials, including lithium. As CEO Elon Musk gave details on how his company plans to cut battery costs by more than 50 percent, investors from around the world had the opportunity to hear about lithium mining, processing and its supply chain, as well as the key role the material plays in the EV future.

For new and seasoned investors interested in lithium, the Investing News Network (INN) reached out to analysts and market watchers to understand Tesla’s announcements and the current investment opportunities in the battery metals space.

Tesla’s aspirations versus reality

Tesla’s Musk had no shortage of announcements during Battery Day, including many related to specific cathode improvements and cost reductions.

Speaking with INN, Daniel Jimenez of iLi Markets said his takeaway from the event was that price parity between internal combustion engine vehicles and EVs is going to come at an accelerated speed.

“The efforts Tesla is making in reducing costs of batteries and of the vehicle itself … will make the decision to buy an electric car over an internal combustion engine easier,” he told INN.

Chart via Tesla.

Also commenting on Tesla’s announcements, Howard Klein of RK Equity said the company’s target of 3 TWh of battery cell capacity by 2030 translates into about 2.5 million tonnes of lithium for Tesla alone.

“Obviously, these are aspirations, (Musk) sets big, audacious goals … but even if he gets half of that, it just demonstrates the movement to the displacement of internal combustion engine cars with EVs is probably happening sooner,” he said.

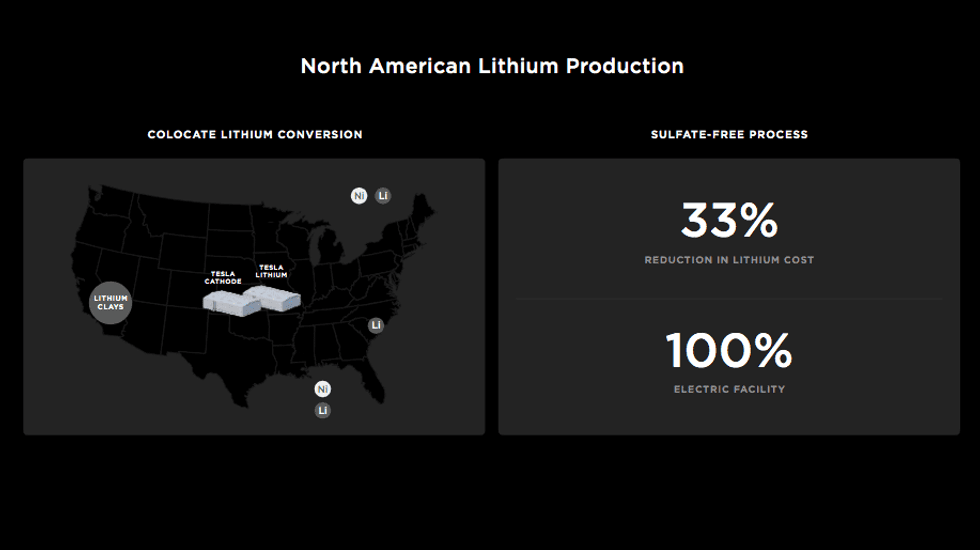

As part of its battery cell production plans, Tesla will build a cathode plant in Texas and a lithium hydroxide chemical facility, where it will turn hard rock spodumene concentrate into lithium hydroxide for direct use in its battery cells.

For Simon Moores of Benchmark Mineral Intelligence, the highlight from the event was that Tesla is officially upstream.

“It’s the first time an automaker, an EV maker, but an automotive maker, period, has moved into the upstream of the lithium-ion battery supply chain,” he told INN. “And a really important part of that is Tesla now is looking to build chemical plants; a cathode plant first, so the step before the lithium-ion battery, and then of course a lithium hydroxide chemical plant.”

Watch Tesla’s Battery Day presentation above.

Talking on Battery Day about sourcing lithium specifically, Musk said Tesla has acquired the rights to lithium-rich clay deposits in Nevada, and said the company has found a way to mine it in a sustainable and simple way — using table salt and water.

“Tesla’s plans to mine its own lithium from clay using only water and table salt … struck me as overly simplistic and given that Lithium Americas (TSX:LAC,NYSE:LAC), in particular, has spent years cracking the code on high-purity lithium from clay, Tesla’s announcement here was hard to take seriously without much more detailed information,” Chris Berry of House Mountain Partners said.

For the expert, Tesla won’t realistically be mining its own lithium until several years from now.

“In the industry today, there’s an acceptance and an understanding of what Tesla’s talking about isn’t the reality of today — that type of scale, that type of buildout isn’t going to happen overnight,” Andrew Miller of Benchmark Mineral Intelligence told INN days after the event.

“As the Tesla team knows incredibly well by now, there’s a huge difference between there being a lot of lithium in the ground, and there being a lot of available battery spec lithium hydroxide for their needs.”

For the analyst, one of the more credible announcements was Tesla’s involvement into refining, giving the company some control over its input chemicals.

“If you’re refining those chemicals yourself, presumably you can meet your exact specifications rather than relying on a group of other companies that are also trying to refine for a number of other converter consumers out there,” he said. “It also gives them the ability to perhaps source from various different areas for its raw materials.”

That said, Miller doesn’t expect to see Tesla converting its own lithium before 2023 to 2024.

Not all lithium processing is equal but all lithium is needed

Lithium is at the heart of all the cathode chemistries used and being developed for Tesla’s batteries ― perhaps the reason why easing concerns about its supply chain was crucial at Battery Day.

As mentioned, Tesla said it has acquired the rights to lithium claims in Nevada, where it is looking to extract the raw material from clays. Furthermore, the company believes there’s enough lithium in Nevada to electrify its entire US fleet, emphasizing how abundant the material is on the Earth.

By implementing its new acid-free process to extract lithium, Tesla said it could reduce lithium costs by 33 percent, and adding all other cathode improvements it could see a 12 percent reduction in battery costs per KWh.

Currently, the whole lithium industry is set up around either various forms of brine extraction, or the conversion of spodumene concentrates, which are the established supply chains that have a track record of producing battery-grade chemicals, Miller explained.

On the other hand, extracting lithium from clays is a process that has not been completed on a commercial scale, especially when producing battery-grade material.

In particular, the process that Musk indicated — mixing the clay with salt and adding water — has certainly raised some eyebrows, James Jeary of CRU Group said.

“As an idea for what is being looked at already in this space, Lithium Americas — which is developing the Thacker Pass clay project in Nevada — is targeting an acid leaching process,” he told INN. “Besides that, lithium grades in clay deposits are typically lower than spodumene deposits.”

Clays can also require additional processing to remove magnesium, as is the case for brines, because it is an impurity in battery-grade lithium compounds.

“That obviously adds further steps to the processing route,” Jeary added.

For Klein, one of the reasons behind Tesla’s lithium message could be a negotiation tactic, with another possibility being that the company is interested in Lithium Americas.

“I think the clay narrative is going to dissipate over the coming weeks … I may be wrong … but I just don’t believe they have cracked the code as simple as they (said they) did. So I believe it’s seven to 10 years away,” he added.

Meanwhile, Benchmark Mineral Intelligence believes that new processing routes and new technologies that unlock different types of lithium resources will be crucial to the buildout of the supply chain.

“Because ultimately, brine and spodumene aren’t going to be able to absorb all of the growth that is planned for the coming decades,” Miller said.

Despite Tesla’s talk about its land in Nevada, a few days after the long-awaited battery event, junior miner Piedmont Lithium (ASX:PLL,NASDAQ:PPL) signed a deal with the EV maker to supply lithium spodumene concentrate from its deposit in North Carolina starting in 2022.

The news was a little confusing at first, Berry said, in that it is a binding agreement, but conditional upon Piedmont achieving production within a specified timeframe. “Despite that, I thought the deal was a strong validation for Piedmont’s team and asset location.”

Building supply chains in North America

China’s dominance of the EV space has been established for awhile, with the buildout of less dependant and resilient supply chains taking center stage in recent years. During Battery Day, Musk said his company is looking to source lithium and nickel from North America for its North American operations.

Chart via Tesla.

“The rationale for this strategy is to vertically integrate its supply chains on a regional basis and lower overall costs,” Berry said. “China is the largest EV market in the world today and likely will be for some time until Europe builds out its own EV supply chain (which is well underway).”

Tesla is well positioned to achieve its vertical integration goal. As the largest automaker in the world by market cap, it could source world-class talent to achieve vertical integration and a competitive cost structure, Berry added.

“(Tesla’s) technological lead over its competitors is well known and coupled with a low cost structure would only cement that lead,” he said.

For Klein, Musk made a point that if the company sources in North America, it could reduce the kilogram times kilometer metric by 80 percent.

“He’s very focused on shortening supply distances for sustainability reasons, manufacturing scalability reasons. And he didn’t say it, but I definitely think security of supply reasons as well,” he said.

Investing in junior miners around the world

Tesla’s quest to source raw materials in North America could have a silver lining for miners around the world, as it could pave the way for more localized supply chains, which would offer support to juniors in different regions, Jeary of CRU said.

“The lithium sector will require cyclical waves of investment to meet demand requirements — but it could be a few years down the line,” he said. “OEMs investing in the upstream supply chain offers further sources of funding for miners.”

It is also important to remember that the EV story isn’t just a Tesla story.

“Even if Tesla gets to whatever TWh scale they are targeting, there are still a huge number of other automotive companies out there that are going to be needing supplies,” Miller said.

For Berry, much of the market is still in a “wait-and-see” mode given the low pricing for various battery metals. “Those companies with large and scalable assets with promising mineralogy that can manage their balance sheets are going to surprise a lot of the sceptics,” he said.

For his part, Klein believes there’s a very good opportunity for Canadian projects, for US projects and select European projects.

“I think that those shouldn’t be overlooked,” he said. “Which suppliers of lithium and nickel are best placed geographically, have the best projects that can be sustainable, that could be low cost — those are the ones that you should be looking for.”

And of course, lithium majors could also benefit from the plans of Tesla and other OEMs.

“Lots of majors have expansion plans in the pipeline, which represent a major source of supply growth over the next few years,” Jeary said.

Looking at the big picture, Moores said it is important to remind seasoned and new investors that the lithium space is not easy.

“It’s a long-term investment. It takes seven years for a lithium miner at best to fund and build a new mine, and it takes 18 months to build a battery plant. So the takeaway is, it’s not easy, it takes time, you need integrated partners on this,” he said.

Lithium outlook after Tesla’s Battery Day

For most analysts, the announcements made by Tesla have not changed the course on which lithium is heading in the coming decade.

“I still think the next 10 years in this sector are going to be amazing in the changes and opportunities they will present,” Berry said. In particular, he is looking very carefully at the technological side of this shift — specifically cathode and anode development.

“I don’t see a new revolutionary battery chemistry on the horizon, but do see changes and margin expansion achieved through optimization of battery components,” he added.

When looking at lithium prices, Miller said there is more growing positivity in the industry, just off the back of the Chinese EV industry rebound and the growth in European EV sales seen this year.

“I think we are at a point now, or certainly coming towards the point, where there’s an acceptance that prices can’t go any lower, you’ve stopped seeing the majors invest to expand at the rate as needed. I think that makes cathode and battery producers very uncomfortable,” he said.

Meanwhile, Jimenez said Tesla’s event does not change the fact that the market is in oversupply today, and it will probably take one year or more for that oversupply to be consumed.

“But after that, demand will be growing at a much higher pace, and additional capacity will be required for the industry as of 2024 — those investments need to be done today,” he said.

Speaking about Tesla’s news and its impact on raw materials, Moores said the announcements might impact prices due to the size of the Terafactory and the speed at which it’s being built.

“That is a new layer of demand for the industry, and for all raw materials, especially lithium,” Moores said, adding that it is not just Tesla looking to ramp up battery capacity. “Bear in mind that if plants are operating in Q4 2022, or 2023, then they’ll be having to acquire the raw materials a good six to nine months earlier, and have to be having the conversations a good 18 months earlier.”

For Moores, all of this points to the next step up in demand for the EV space and for everything associated: lithium, graphite anode, cobalt, nickel, manganese and copper.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Piedmont Lithium is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.