Overview

The project generator model has become one of the resource industry’s best strategies for minimizing risks associated with exploration-stage projects. Analysts point out that much value in prospective companies is its team’s intellectual capital and prospecting talents that can develop a portfolio of 100 percent owned projects with world class discovery potential that minimizes risk for investors.

Investors in project generators get an opportunity to capitalize on some of the most prospective exploration and mining companies in the world under highly favorable conditions but also leverage talented teams. Full ownership provides flexible alternatives for delivering discoveries.

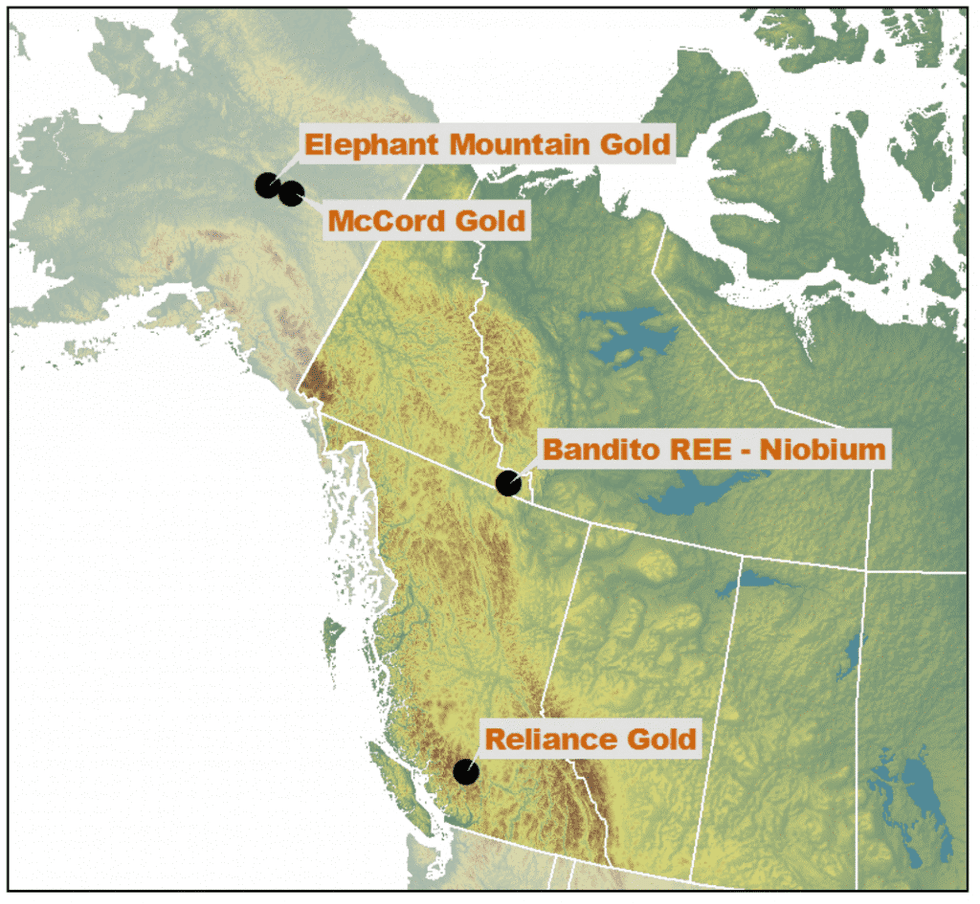

One such project generator that has an impressive portfolio of 100 percent controlled projects is Endurance Gold (TSXV:EDG), a precious metals exploration company focused on project generation, exploration and development of highly prospective projects in top jurisdictions in BC, Alaska and the Yukon.

Endurance Gold – 100 Percent Owned Projects

Endurance Gold – 100 Percent Owned Projects

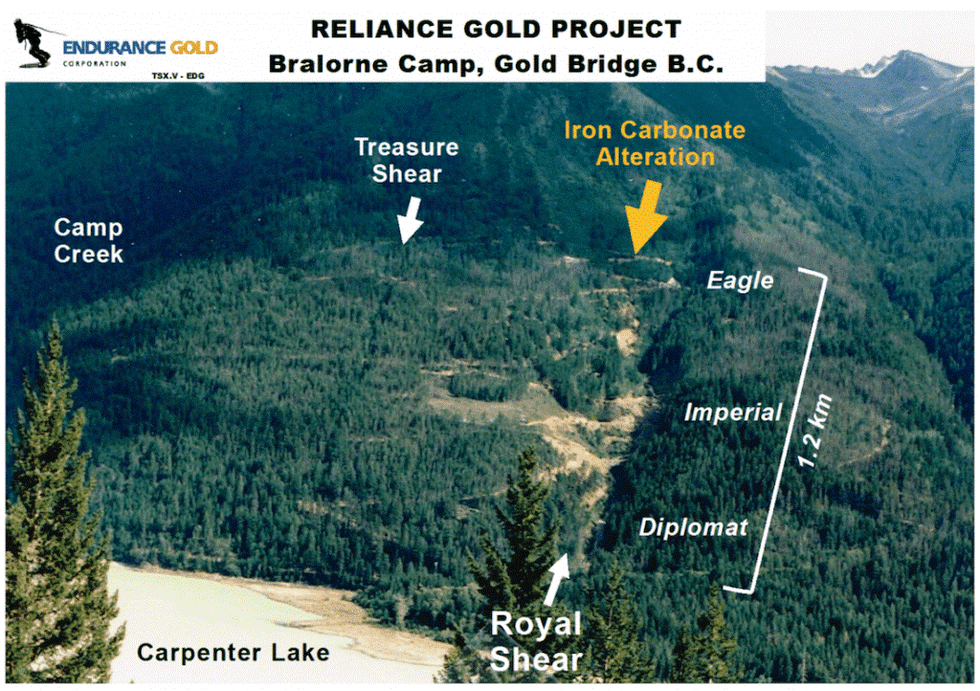

The company’s primary focus is to advance the Reliance Gold project near Gold Bridge, BC, in the historic Bralorne-Pioneer gold camp. The Reliance property has already delivered high grade orogenic-type gold at surface in recent drilling, hosted within a powerful alteration system with significant strike and outstanding depth potential, similar to the nearby Bralorne-Pioneer mine that has already produced over 4.2 million ounces of gold.

The company’s other key projects include the Elephant Mountain gold project in Alaska and the Bandito REE-Niobium project in Yukon, Canada. All three projects are 100% controlled.

Enduranc’s expert business development, prospecting and technical team have primed the company to expose investors to high-quality exploration and development across its robust asset portfolio. Each key property leverages strategic positioning in productive geological environments that are road and infrastructure accessible. On the gold projects there is widespread alteration and mineralization indicating multi-million ounce potential.

These results helped precipitate the company’s announcement of the completion of its non-brokered private placement financing of CAD$2,114,200 through the sale of 6,820,000 units at CAD$0.31 per unit. Endurance intends to put the proceeds from the financing towards funding its exploration activities and general corporate capital, with a focus on expanding the discoveries at Reliance.

Endurance Gold has a very tight capital structure with a large shareholder ownership by directors and insiders. This structure and project generator model prime the company for significant economic prosperity.

“Our prime strategy is to focus on generating high quality assets with prudent management of shareholder funds including cost effective exploration to add value and deliver discoveries to shareholders.. Our collective large shareholding means we are very engaged in wanting to make this company a success,” stated Endurance Gold CEO Robert Boyd.

Company Highlights

- Endurance Gold is a project generator focused on exploring, acquiring majority control and developing high quality mineral projects near existing infrastructure within the best mining friendly jurisdictions of North America.

- The company’s flagship Reliance gold project in British Columbia leverages a new high-grade discovery on a parallel orogenic-type structure only 10 kilometres from the former high-grade Bralorne-Pioneer gold mine. The Reliance property is relatively underexplored and presents Endurance Gold with exceptional discovery potential.

- Its other key projects include the Elephant Mountain gold project in Alaska and the 100% owned Bandito REE-Niobium project Yukon, Canada.

- The company has a tight capital structure with 123.8 million shares outstanding and a market cap of CAD$33 million. Insider holdings stand at over 55%

- Exploration plans for 2021 include at least two campaigns of drilling, IP surveying, lidar, orthophotography, channel sampling, and geochemistry.

- Endurance extended its Reliance gold-in-soil anomaly to 1.2 km with 450 m of horizontal width and over 750 m of the vertical extent. The company confirmed gold in drilling at the Eagle Zone, Imperial Zone, Diplomat Zone and the Treasure Prospect with drill assays of 16.39gpt gold over 4.6 metres at the Diplomat Zone and 14.08gpt gold over 15.24 metres at the Eagle Zone.

- The company also signed a diamond drill contract for the Reliance project which will commence in August.

Get access to more exclusive Gold Investing Stock profiles here