(TheNewswire)

March 21, 2023 - TheNewswire - Kiplin Metals Inc. (TSX-V:KIP) (the " Company " or " Kiplin ") to build 2023 work program with a focus on recent results announced by F3 Uranium Corp. (" F3 ") on their Patterson Lake North (" PLN ") Project, immediately adjacent to the Company's Cluff Lake Road (" CLR ") Uranium Project, located in northwestern Saskatchewan.

The CLR Project covers ~531 hectares in the southwestern Athabasca Basin in northern Saskatchewan, where several new discoveries, including the Arrow and Tripe R Uranium deposits have been made.

-

On February 2nd, 2023 F3 reported a new high-grade uranium discovery in hole PLN22-038. The drill hole targeted up dip from hole PLS22-035 and returned an 11.0 m interval averaging 4.20% U3O8 including a high-grade 4.5 m interval averaging 9.8% U3O8, which further includes the ultra-high-grade core which assayed 22.9% over 1.5 m.

-

On November 21st and 30th, 2022 F3 reported a new high-grade uranium discovery in hole PLN22-035 on the PLN Project on the A1 conductor (ground ("EM") electro-magnetic survey), which intersected 3.48 metres of total composite mineralization with greater than 10,000 counts per second, including 2.5 metres of total off-scale radioactivity (greater than 65,535 counts per second), occurring as pitchblende patches. Drill hole PLN22-035 is located approximately 15 kilometres South-Southwest of the Company's CLR Project.

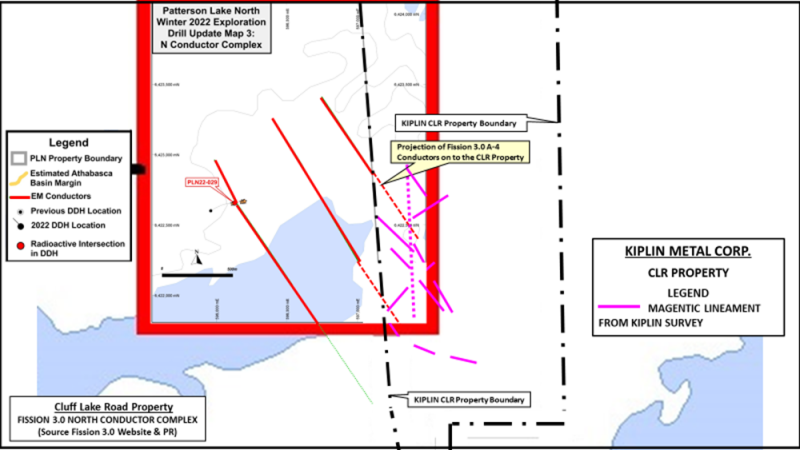

The new uranium discovery by F3 related to the North-Northwest A-1 ground EM conductor is very encouraging, and the North Conductor Complex also identified by F3, with a similar strike and which trends onto the CLR Project, represents a high priority drill target for the Company in 2023.

The Company is the beneficiary of a 100% interest in the CLR Project and controls all exploration and development of the Project. The recently completed exploration program will assist in defining drill targets. The Company is applying for the requisite permits and expects to be drilling when permits are received. Readers are cautioned that the presence of mineralization in areas adjacent to those held by the Company is not necessarily indicative of mineralization that may existing on property held by the Company.

Dr. Peter Born, P.Geo., is the designated qualified person as defined by National Instrument 43-101 and is responsible for, and has approved, the technical information contained in this release.

About Kiplin Metals Inc.

Kiplin Metals Inc. is a mineral exploration company. We create value for our shareholders by identifying and developing highly prospective mineral exploration opportunities. Our strategy is to advance our projects from discovery all the way to production. This vertically integrated strategy allows Kiplin Metals to achieve exceptional shareholder value through the entire life-cycle of the mining process.

Cluff Lake Road Uranium Project. Kiplin Metals has the right to earn a one-hundred percent interest in the Cluff Lake Road Uranium Project (the "CLR Project"). The CLR Project covers ~531ha in the southwestern Athabasca Basin in northern Saskatchewan, where several new discoveries, including the Arrow and Tripe R Uranium deposits have been made. The CLR Project is 5 km east of the Cluff Lake Road (Hwy 955), which leads to the historic Cluff Lake Mine, which historically produced approximately 62,000,000 lbs of yellowcake uranium.

For further information, contact the Company at info@kiplinmetals.com , or visit the Company's website at www.kiplinmetals.com .

On behalf of the Board,

For further information, contact the Company at 604-622-1199.

On behalf of the Board of Directors,

"Peter Born"

Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

Copyright (c) 2023 TheNewswire - All rights reserved.