December 12, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to announce that it has entered into a Services Agreement with Havoc Services Pty Ltd, an operating subsidiary of Havoc Partners LLP (Havoc) to provide corporate advisory and technical exploration services to assist GLV in developing its 4,858km2 Technical Evaluation Agreement (TEA) offshore oil and gas block in Peru (GLV 80% working interest).

Highlights

- Highly experienced oil and gas group with proven experience in frontier offshore oil and gas projects.

- Havoc Services Pty Ltd is an advisory practice owned and operated by the Perth based partners of Havoc Partners LLP, the natural resources investment group.

- Dr Alan Stein one of the founding partners appointed as Senior Advisor to the Board.

- Track record of discovering more than 2 billion barrels of oil equivalent in new discoveries and greater than US$1 billion of investment capital raised.

- Havoc’s interest in the Tumbes TEA, offshore Peru, validates GLV’s move into Peru and highlights the exploration potential.

- Havoc, now in receipt of key historical data, are working with project partners Jaguar Exploration to progress the project.

Havoc is a natural resources investment group founded in 2014 by a team of geoscientists that have worked together for more than 20 years; with collectively greater than 100 years of international upstream experience.

The Havoc team has led, and participated in, highly successful oil and gas exploration in various frontier offshore projects, discovering more than 2 billion barrels of oil equivalent (boe) and raising more than US$1 billion in investment capital through their role as the founders of UK listed Fusion Oil & Gas and Ophir Energy plc, as well as Harmattan Energy Limited and various other ventures.

More recently, Havoc’s wholly owned subsidiary Harmattan Energy was the Operator of PEL 90 in the Orange Basin, Namibia immediately adjacent to the giant discoveries made by Shell and Total. Harmattan was sold to Chevron late in 2022.

The Perth-based Havoc team for the Tumbes TEA project comprises Dr Alan Stein, Dr Richard Higgins and Mr Mark Sofield. Dr Stein will lead the Havoc team and will be appointed as a Senior Advisor to the Global Board. He has more than 30 years’ experience in the international oil and gas industry. Dr Stein was one of the founding partners of the London and Perth based geoscience consultancy IKODA Limited and was the founding Managing Director of Fusion Oil & Gas plc, Ophir Energy plc and Calima Energy Limited.

Fusion was listed on the UK AIM market in 2000 and made several discoveries offshore Mauritania before being sold in 2003. In early 2004, following the sale of Fusion, Dr Stein was one of the founding executive directors of Ophir Energy plc which was listed on the London Stock Exchange (LSE) in 2011 for more than £1 billion – then the largest Exploration and Production (E&P) IPO in LSE history. Ophir, as operator spearheaded by Dr Stein and his team, made several material discoveries offshore Equatorial Guinea and Tanzania in excess of 18 trillion cubic feet of natural gas.

Ophir’s highly successful exploration teams were overseen by Mr Mark Sofield as Ophir’s Exploration Manager, West Africa and Dr Richard Higgins as Ophir’s Exploration Manager, East Africa.

Dr Stein and the Havoc team will provide co-ordination and, where required, direction of geoscience activities undertaken in the TEA, support and assistance to the Company’s technical team, input into the proposed work programs as well as assistance with the preparation of marketing and promotional materials to support the Company in securing investor support and/or additional joint venture partners.

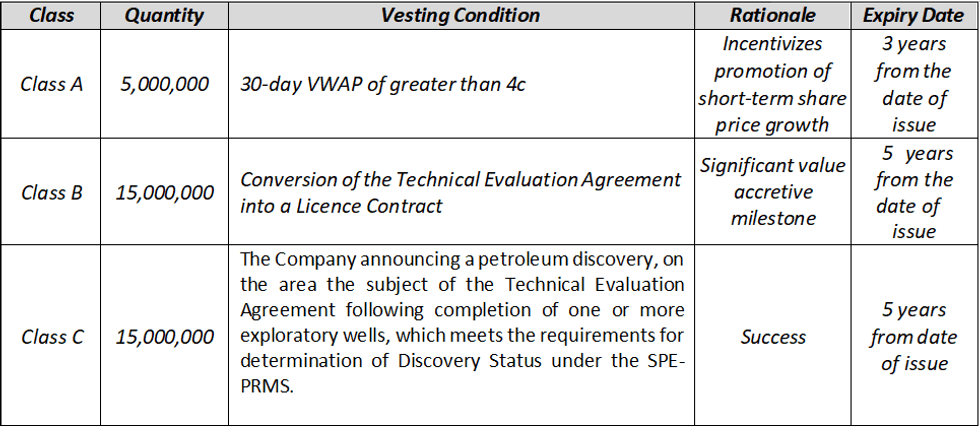

The remuneration for the services to be provided by Havoc will consist of a monthly retainer of $10,000 excl GST, 25,000,000 GLVOA listed options (4c strike, Expire 31 Dec 2025) vesting after 6 months of service and the performance rights (subject to good leaver provisions) listed below.

Director Scott Macmillan commented:

“The Havoc team are highly experienced and have an outstanding track record in identifying, discovering and monetising oil and gas assets from all over the globe, particularly in frontier basins. Havoc bring a wealth of experience to the Company by virtue of the sheer number of oil and gas projects, developments and transactions they have successfully completed and are a perfect fit to assist with the development of the Company’s Tumbes TEA.

Global is very pleased to welcome Havoc to the team and looks forward to the next step in the development of the TEA.”

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00