June 22, 2023

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to advise it has entered an agreement to acquire rights to lithium and rare earth related minerals over M15/1893, covering approximately 7.4km2 of ground, located 30km south of Mineral Resources Mt Marion Mine.

HIGHLIGHTS

- CuFe acquires further exploration tenure within the emerging Southern Yilgarn Lithium Belt, located approximately 48km SSE of Coolgardie, in the Goldfields region of Western Australia via lithium and rare earth mineral rights deal over M15/1893

- The mining lease covers 7.4km2 and to date has been primarily explored for Gold. Acquisition has no upfront consideration and takes the form of a rights swap with CuFe providing vendor with gold rights over E15/1495 as consideration

- Located within 30km of the Mt Marion Lithium Mine and 2km along strike from CuFe’s recently acquired tenement E15/1495 and immediately along strike from Marquee Resources West Spargoville Lithium Project

- Initial field work at E15/1495 underway

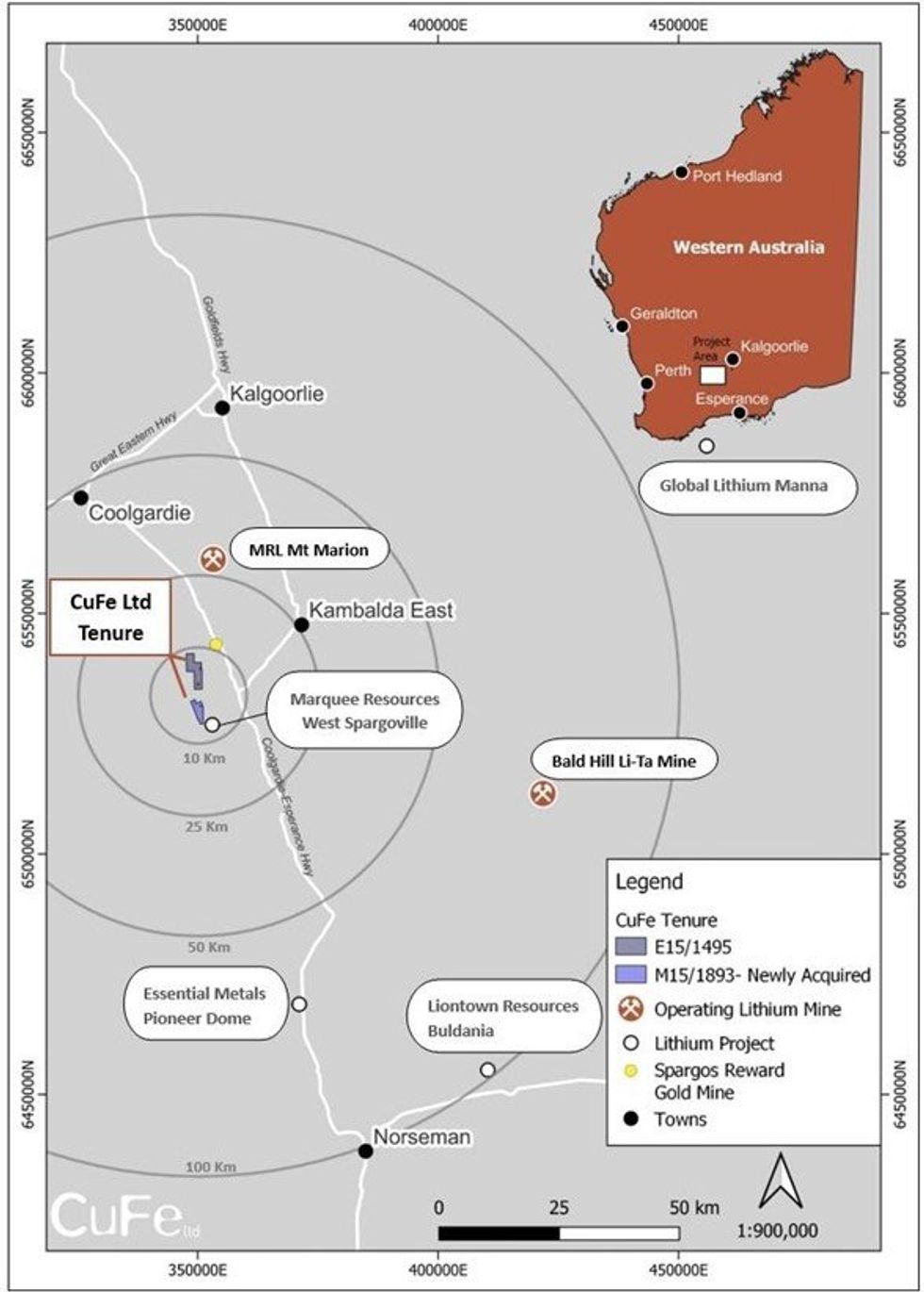

The tenement is approximately 48km SSE of the township of Coolgardie, within the Southern Yilgarn Lithium Belt that includes the known spodumene deposits and projects such as the Bald Hill Mine, the Mt Marion Mine, the Pioneer Dome Project, Manna Lithium Project and the West Spargoville Project - Marquee Resources (see Figure 1). The area over which the newly acquired rights is located 2km south and along strike of E15/1495, which was recently acquired by the Company (refer ASX announcement dated 9 May 2023). The addition of this tenure gives CuFe over 12km of strike length exposure to a 30km corridor that is proven to host Lithium-Caesium-Tantalum (LCT) bearing pegmatites.

Under the terms of the agreement, CuFe acquires rights to lithium and rare earth related minerals over M15/1893 (a mining lease which is presently under application pending finalisation of native title negotiations) from Rosa Management Pty Ltd (“Rosa”), and in return CuFe assigns Rosa rights to gold on the recently acquired E15/1495. The parties each assume the obligations to pay a $300,000 milestone payment payable to the previous owner in the event production occurs in the future from the tenure and a 1% gross sales royalty. Completion of the transaction is expected occur within 30 days.

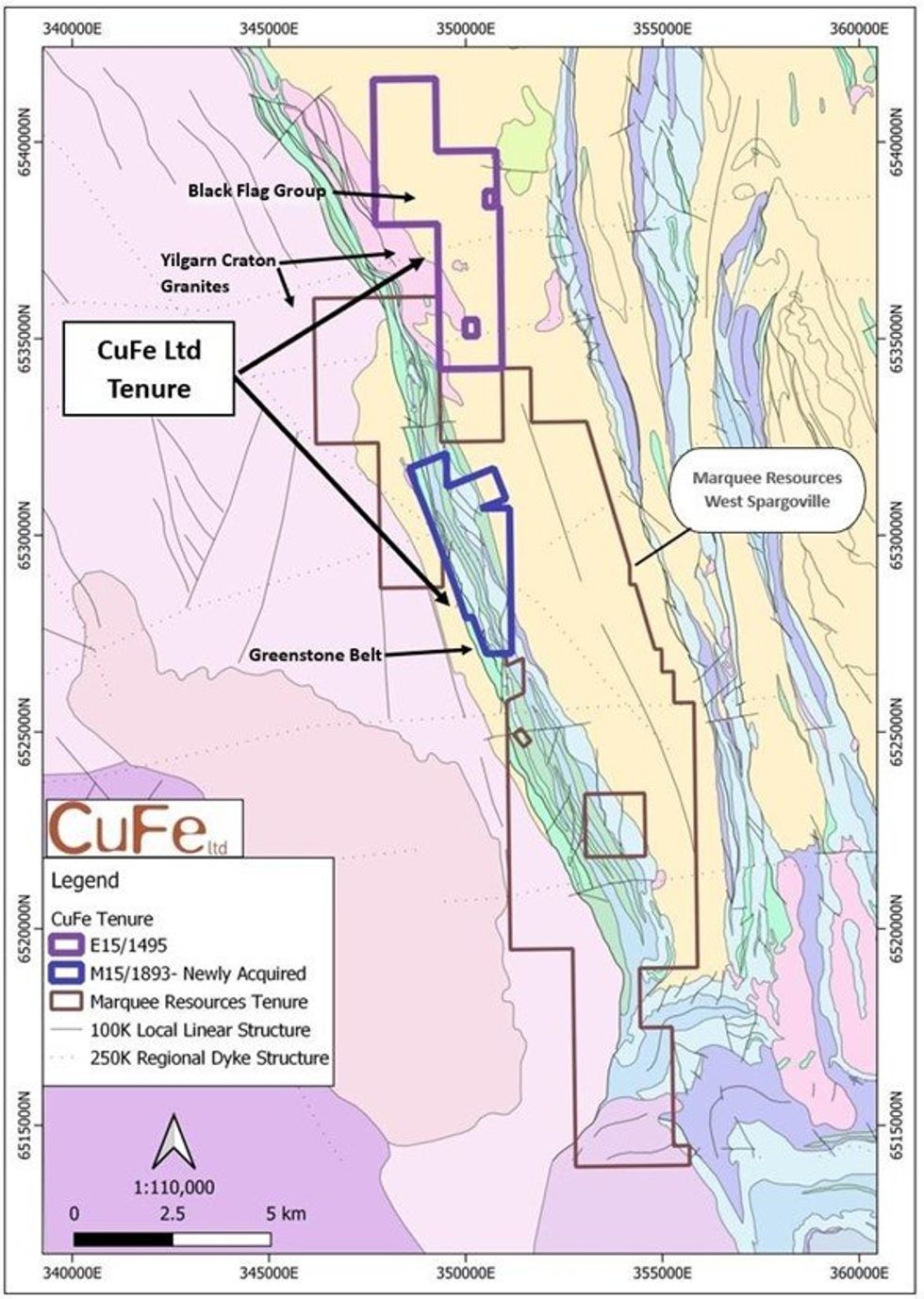

The local geology comprises mafic and ultramafic intrusive within felsic volcanics and siliciclastics of the Black Flag Group and is characterised by NNW trending networks of pegmatites (see Figure 2).

Initial visits to the site have occurred, with more detailed field work including detailed mapping and rock chip sampling planned across both tenements over the next 2-3 weeks.

CuFe Executive Director, Mark Hancock, commented “We are pleased to secure these rights in a commonsense way that enables each company to focus on their commodities of choice and maximise use of the ground. There is a lot of activity in the region, as illustrated by the recent acceleration of Mineral Resources farmin to the Marquee Resources tenure which surrounds our ground so that encourages us that we are in the right region. We look forward to the outcome and results of the planned field work across this tenement package.”

Released with the authority of the CuFe Board.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00