October 16, 2023

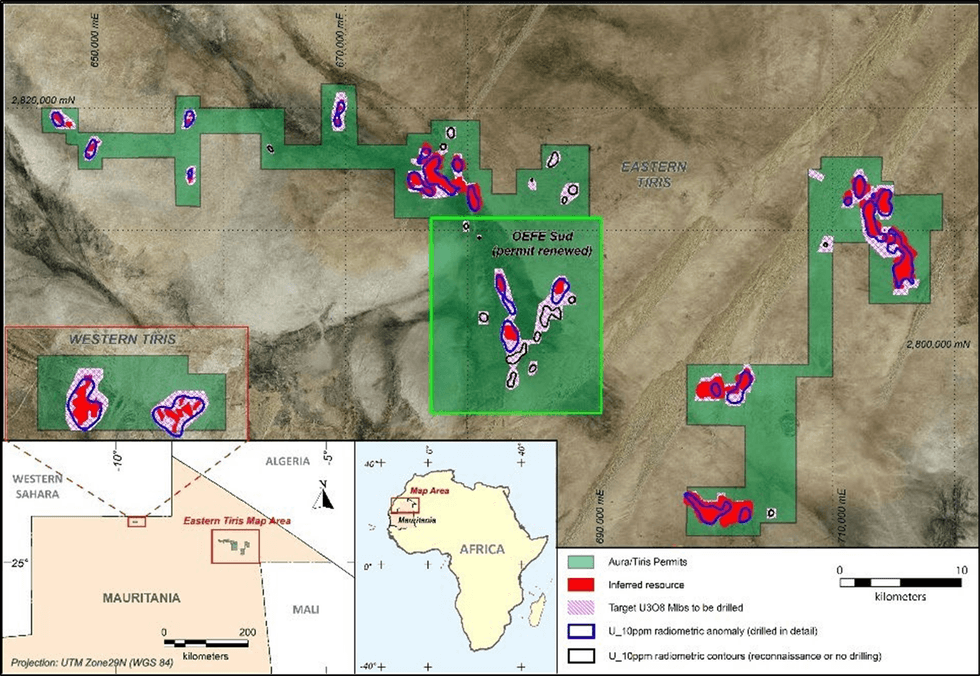

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce it has acquired additional radiometric survey data, reviewed historical drilling results, and identified strong indications of mineralisation extensions on Aura’s existing tenements that could significantly expand Aura’s current Tiris Project (“Project”) 58.9 Mlbs U₃O₈ resource.

KEY POINTS:

- Aura identifies an Exploration Target aimed to expand the existing 58.9 Mlbs U3O8 Tiris Project Resource (113Mt at grade of 236ppm U3O8), which was defined at an exploration cost of ~US$0.20 per lb U3O8.

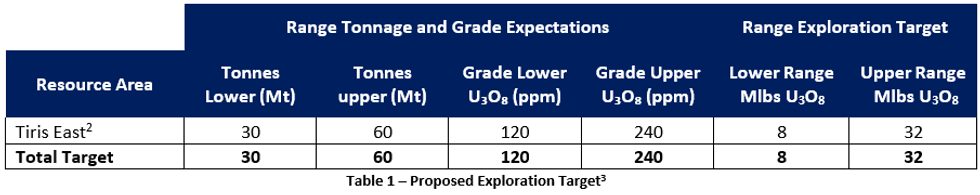

- Preliminary work has identified seven Exploration Targets in Tiris East as extensions of the existing resources 30 – 60 Mt at 120 - 240 ppm U3O8 for 8 - 32 Mlbs U3O8.

- The new Exploration Targets highlight the potential for the Tiris Project to achieve world-class scale.

- Exploration Target will be tested with a 15,500m drilling exploration program planned to commence imminently.

- Proving up additional resources is likely to expand the ore available to the Tiris Project and potentially facilitate modular expansion. The Front-End Engineering Design (FEED) study is 80% complete, and pre- construction activities will commence at the Tiris Project.

Aura has signed contracts for an exploration program of 15,500m air core drilling over approximately 78 km2 on existing tenements, aiming to significantly increase the Inferred Mineral Resource at the Tiris Project in Mauritania by extending the existing resources. The mobilisation of the drilling contractor commenced on October 16th, with the program commencing soon after.

The potential quantity of the Exploration Target is conceptual in nature. There has been insufficient exploration of these targets to estimate a Mineral Resource, and it is uncertain whether this exploration effort will result in an estimation of a Mineral Resource.

Aura Managing Director David Woodall said,

“Aura’s strategy is to be development-ready in relation to our Tiris Project, and this strategy is progressing and accelerated as we aim to expand our mineral resource.

The near-term, low-cost, producer status of our Tiris Project was confirmed by our March 2023 Enhanced Definitive Feasibility Study1. Further resource expansion towards 100m lbs of U3O8 progresses the project towards a global scale and reinforces the potential for Mauritania to be a material producer in the near term. The robust economics of our Tiris Uranium Project will be further enhanced by increasing our mineral resources and reserves. Due to the modular nature of the project, we see outstanding opportunities to grow the annual production capacity of the project to 3.5Mlb per annum, equivalent to the planned back-end plant capacity.”

“To that end, Aura will commence key pre-construction activities, including the geotechnical drilling of the proposed plant site, and allow some trial mining to provide valuable data in the production planning for the Tiris operation once developed.”

The exploration program will be conducted on existing granted tenements targeting the expansion of the Mineral Resources at the Tiris Project. It will focus on the Exploration Target shown in Table 1 below.

Exploration Target Estimate

A significant level of exploration has previously been undertaken by Aura on the currently held tenements, resulting in a Global Mineral Resource Estimate (MRE) of 113Mt at an average grade of 236ppm U3O8 containing 58.9 Mlbs U3O84, which was reported in a market announcement (“Major Resource Upgrade at Aura Energy’s Tiris Project”), dated 14th February 2023. The MRE has been based on 21,990 metres of drilling in 5,619 holes for a total project cost of US$11.9M or US$0.20 per lb U3O8.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

19h

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00