March 02, 2023

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQX: APAAF) (FSE: A0I0) (FSE: A0I0.F) (FSE: A0I0.MU) (FSE: A0I0.BE) (the "Company" or "Appia") is excited to announce the release of assay results from 2022 diamond drilling of the Wilson and AMP zones of the WRCB area at its 100%-owned Alces Lake Rare Earth Elements (REES) Property, Northern Saskatchewan.

Wilson Zone Highlights from the program include:

- All newly drilled mineralization intervals occur near surface from 15 to 85 meters depth (Table 1)

- 8.98m @ 9.46 wt.% TREO including 0.87m @ 17.1 wt.% TREO in hole 22-WRC-024

- 7.02m @ 1.37 wt.% TREO including 0.59m @ 11.88 wt.% TREO in hole 22-WRC-022

- 2.92m @ 7.99 wt.% TREO in hole 22-WRC-029; one of multiple mineralized intervals

AMP Zone Highlights from the program include:

- Mineralization intervals occur from near surface to 200 meters depth (Table 1); open in all directions

- 12.13m @ 0.33 wt.% TREO including 5.7m @ 0.55 wt.% TREO from hole 22-WRC-016

- 10.3m @ 0.42 wt.% TREO including 4.3m @ 0.61 wt.% TREO from hole 22-WRC-008

- 8.83m @ 0.36 wt.% TREO including 4.43m @ 0.55 wt.% TREO from hole 22-WRC-003B

- AMP Zone expands from that first reported June 1, 2022

- More drilling is warranted to the southeast along the >20 km structural corridor

Final assays for Appia's 2022 Alces Lake diamond drilling program have been received, compiled, and interpreted zone-by-zone. The first results from the final assays are reported here. Further results will follow once all the results are finalized. The Company received additional highly-mineralized results from new sections in the Wilson zone and doubled the strike length of the newly identified, underlying AMP zone to 300 metres, which continues to remain open down plunge and along strike. This zone extends south-southeast to Magnet Ridge, which occurs at the same structural level, but near-surface. Table 1 below highlights the most significant geochemical assay results from these two zones, AMP and Wilson. Table 2 provides the collar information for all of the drill holes from the 2022 Wilson and AMP (WRC) diamond drilling program. The complete assays results are available in Table 3 by clicking on this link.

Vice-President Exploration Irvine Annesley says, "The identification of the AMP zone (a new exploration target with metallogenic targeting implications) is an important development at Alces Lake. This style of mineralization (i.e., mineralized anatectic melt rocks within high-strain melt-transfer zones) is common to all previously discovered targets at WRCB and opens new mineralization potential for our 38,522.43-hectare property."

Appia President Stephen Burega says, "Impressive high grades from new sections in the Wilson Zone continue to add volume to the WRCB's low- to high-grade REE mineralization. The Alces Lake 2022 exploration program provided new discoveries, expanded existing mineralization zones, and delivered encouraging assay results for our exploration investment. From this, we added to our pipeline of drilling targets for 2023 and beyond (previously reported)."

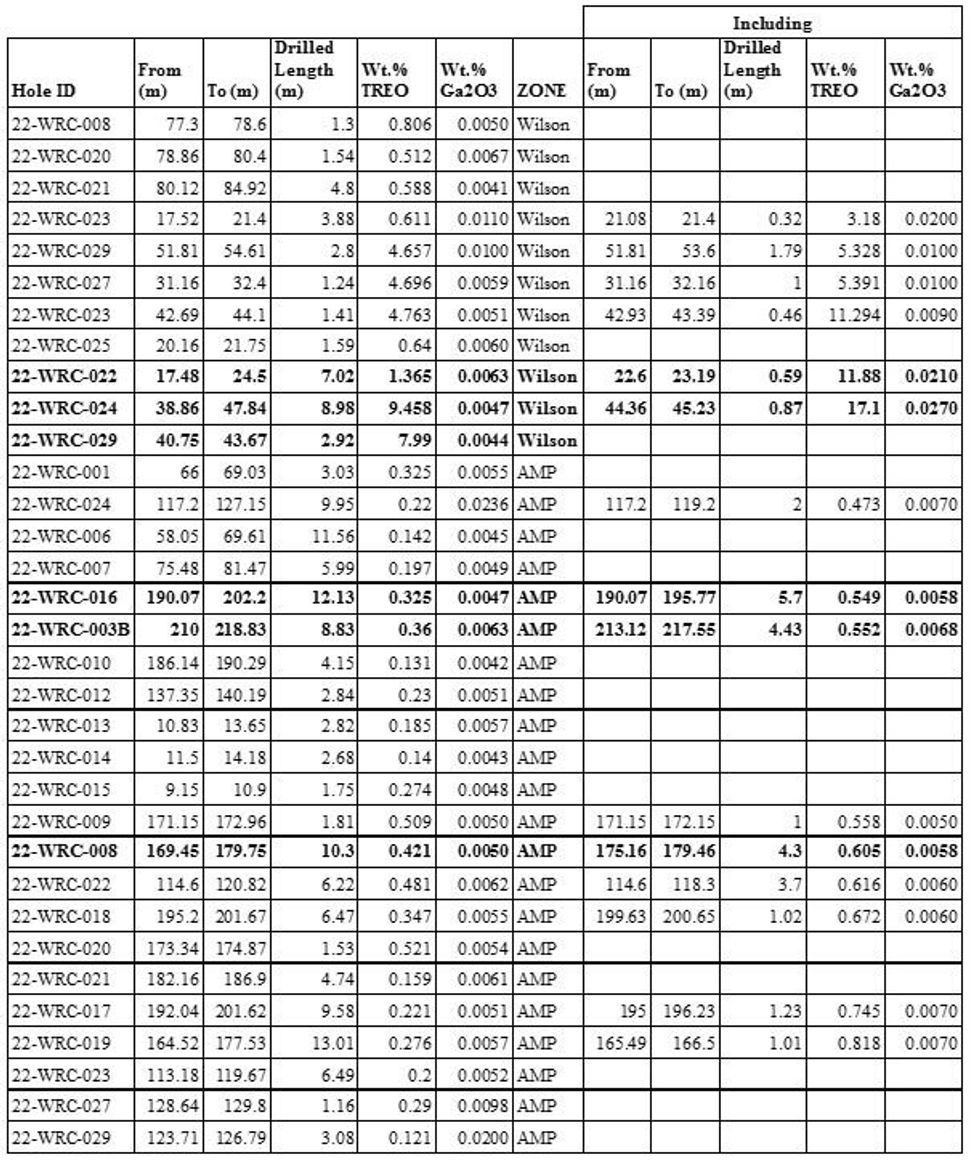

Table 1. Significant Highlighted Drillhole Composites

Table 1. Highlighted assay composites from 2022 diamond drillholes in the WRCB area. wt.% TREO = ([CeO2 ppm] + [Dy2O3 ppm] + [Pr6O11 ppm] + [La2O3 ppm] + [Nd2O3 ppm] + [Sm2O3 ppm] + [Eu2O3 ppm] + [Gd2O3 ppm] + [Tb4O7 ppm] + [Ho2O3 ppm] [Er2O3 ppm] + [Yb2O3 ppm] + [Lu2O3] ppm + [Y2O3 ppm] ) / 10000

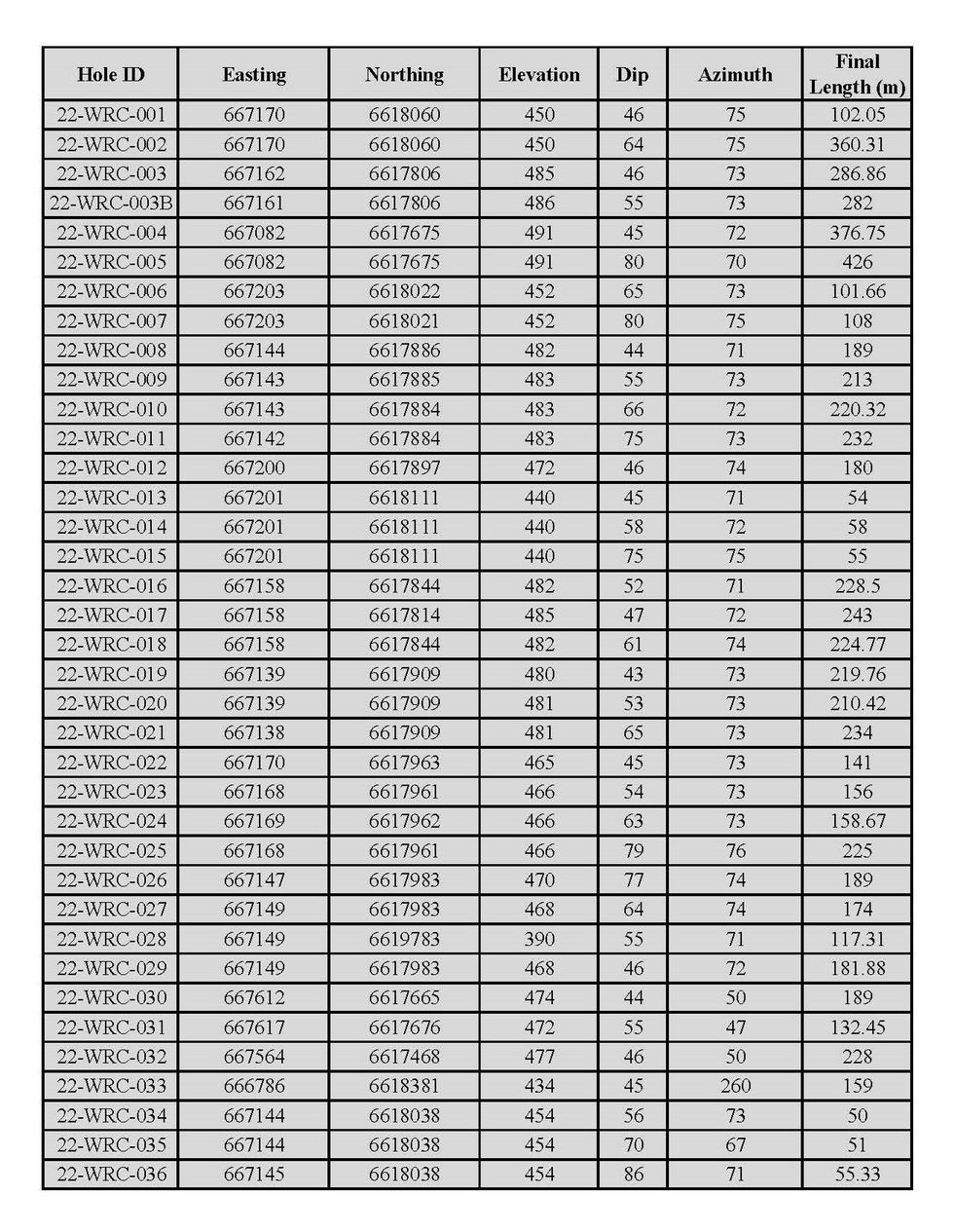

Table 2 - Drill hole collar details for 2022 WRCB drilling, including those of reported intercepts.

Table 3 - Assay Results for 2022 WRC Diamond Drill Holes - The complete assays results are available by clicking on this link.

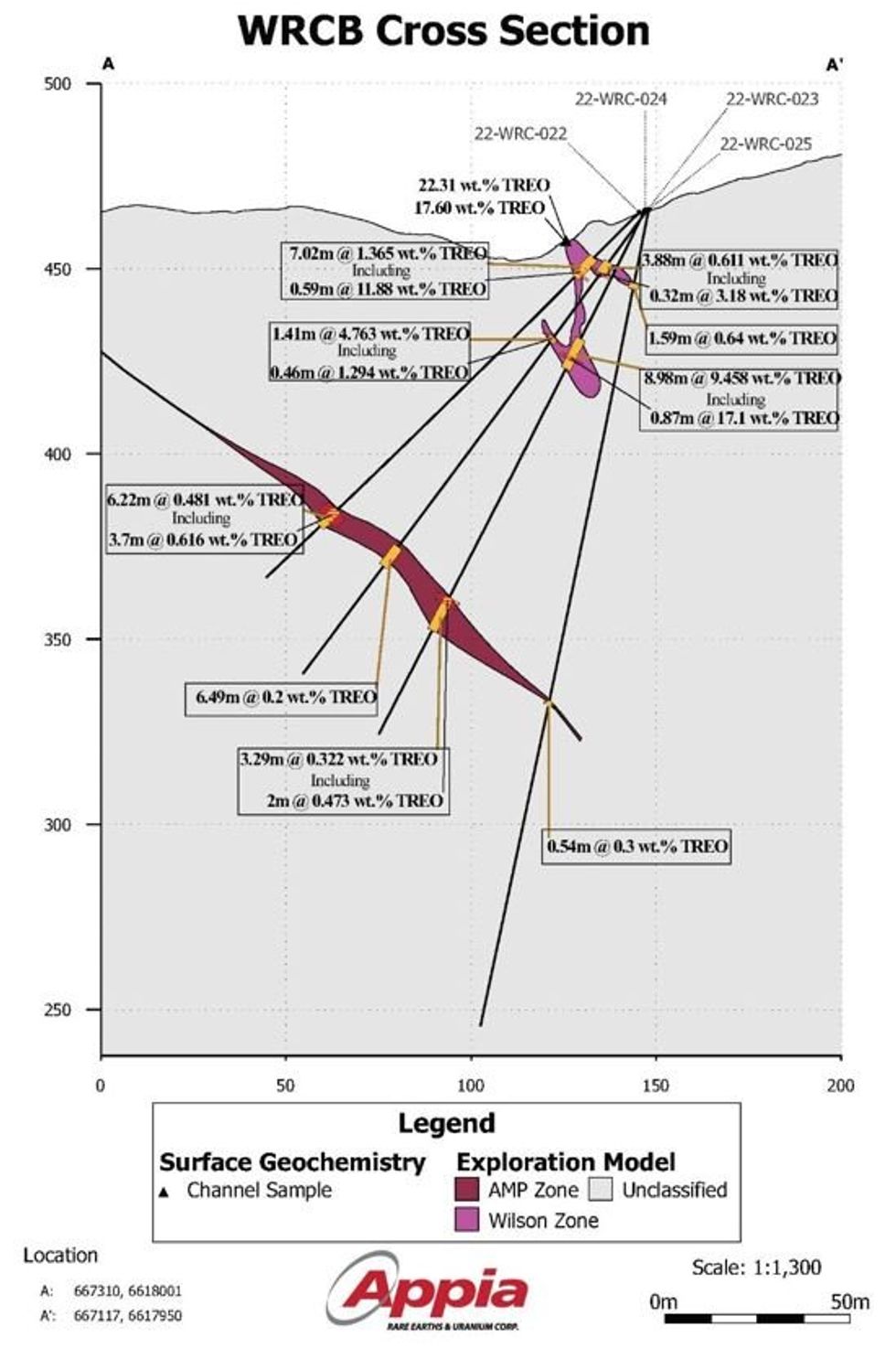

Figure 1. Cross Section of Holes 22-WRC-022, 22-WRC-023, 22-WRC-024, and 22-WRC-025 in the WRCB Area. Vertical 10m thickness section looking 165 degrees.

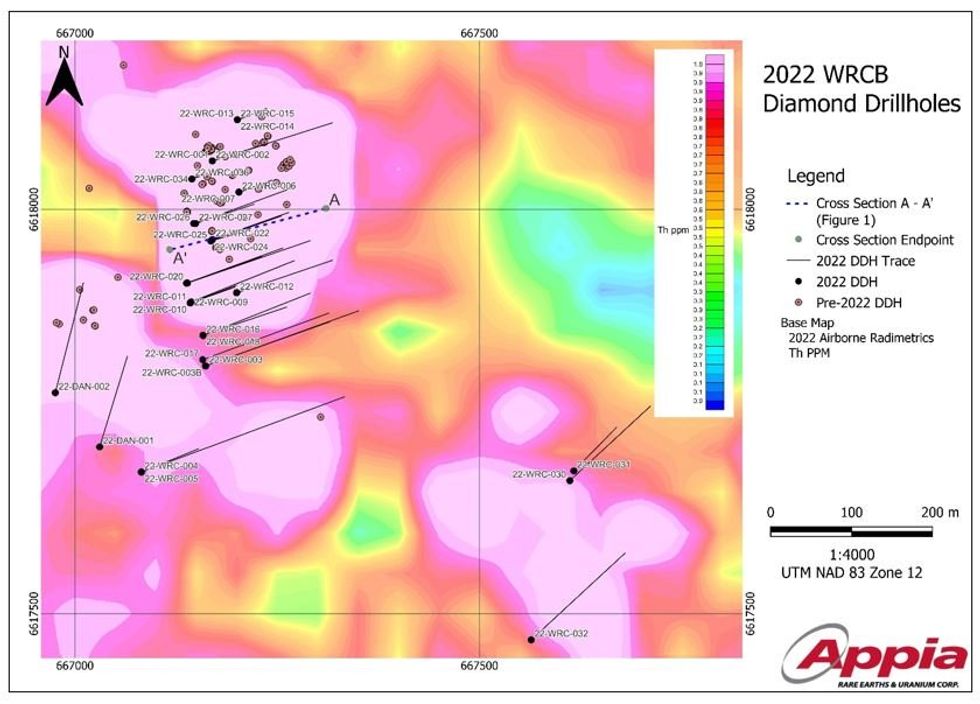

Figure 2. Map of 2022 diamond drill holes (DDH) in the WRCB area. Map base illustrates approximate Thorium (Th) abundances as determined by airborne radiometric surveys. Th is an important pathfinder element (i.e. a proxy to monazite mineralization) at Alces Lake.

About the Alces Lake Project

The Alces Lake project encompasses some of the highest-grade total and critical* REEs and gallium mineralization in the world, hosted within several surface and near-surface monazite occurrences that remain open at depth and along strike.

* Critical rare earth elements are defined here as those that are in short-supply and high-demand for use in permanent magnets and modern electronic applications such as electric vehicles and wind turbines (i.e: neodymium (Nd), praseodymium (Pr), dysprosium (Dy) and terbium (Tb)).

All lithogeochemical assay results of core samples were provided by Saskatchewan Research Council's Geoanalytical Laboratory, an ISO/IEC 17025:2005 (CAN-P-4E) certified laboratory in Saskatoon, SK. All analytical results reported herein have passed internal QA/QC review and compilation.

The technical content in this news release was reviewed and approved by Dr. Irvine R. Annesley, P.Geo, Vice-President Exploration, and a Qualified Person as defined by National Instrument 43-101.

About Appia Rare Earths and Uranium Corp (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Alces Lake project area is 38,522.43 contiguous hectares (95,191.00 acres) in size and is 100% owned by Appia. The Company holds the surface rights to exploration for 113,837.15 hectares (281,297.72 acres) in Saskatchewan. The Company also has a 100% interest in 12,545 hectares (31,000 acres), with rare earth element and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario.

Appia has 130.5 million common shares outstanding, 153.8 million shares fully diluted.

Cautionary Note Regarding Forward-Looking Statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words "believes", "expects", "anticipates", "estimates", "intends", "plans" or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward-looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Tom Drivas, CEO and Director: (cell) 416-876-3957, (fax) 416-218-9772 or (email) tdrivas@appiareu.com.

Stephen Burega, President: (cellular) 647-515-3734 or (email) sburega@appiareu.com.

Irvine R. Annesley, Ph.D., P.Geo., Vice-President, Exploration: (tel.) (416) 546-2707 or (email) jnrirvine@appiareu.com.

API:CA

The Conversation (0)

07 November 2023

Appia Rare Earths & Uranium

Sustainable exploration for High-grade REE and Uranium Deposits in Canada and Brazil to Support Clean Technologies

Sustainable exploration for High-grade REE and Uranium Deposits in Canada and Brazil to Support Clean Technologies Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00