Zinc Outlook 2021: Concentrates Market to Remain Tight

What’s the zinc outlook for 2021? Experts and CEOs share their thoughts on what’s ahead for the base metal next year.

Click here to read the latest zinc outlook.

Like most base metals, zinc felt the impact of COVID-19 during the first few months of the year.

Demand for zinc declined on the back of global lockdowns and containment measures, with supply also constrained in top-producing countries.

With the year now almost over, the Investing News Network (INN) caught up with analysts, economists and executives from mining companies to find out what’s ahead for zinc supply, demand and prices.

Zinc outlook 2021: The year in review

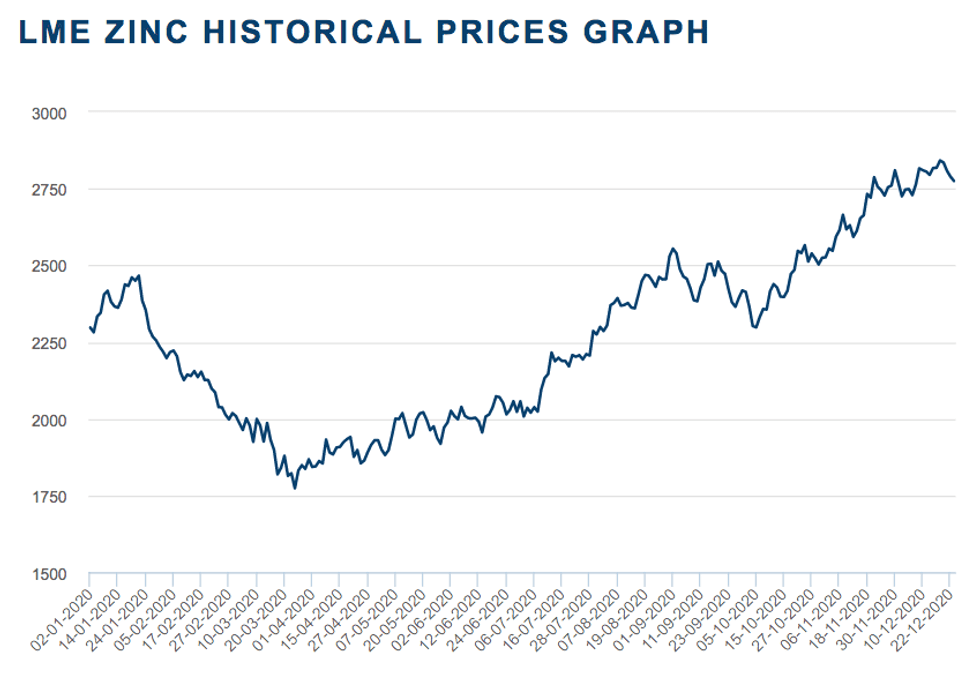

After a volatile 2019, zinc prices started the year trading at US$2,297 per tonne. With the coronavirus hitting the market hard, by March prices had sunk to their lowest level of the year at US$1,773.50.

But the second half of 2020 told a different story for zinc, with prices touching their highest point and rising above the US$2,800 mark.

“Zinc’s price rise has rallied far above our expectations,” Helen O’Cleary of CRU Group told INN.

“Some price support has come from a tight concentrates market, but zinc has traded in tandem with copper this year, and commodities markets across the board have benefited from a weaker US dollar, huge stimulus and more recently the COVID-19 vaccine rollout.”

2020 zinc price performance. Chart via the London Metal Exchange

In terms of market fundamentals, COVID-19 caused huge disruptions to refined zinc demand in China in Q1 and then the rest of the world in Q2, O’Cleary said.

“At the start of the year, we were expecting modest refined zinc demand growth this year, but now we expect a global contraction of 5.1 percent year-on-year,” she said. “The expected large increase in zinc mine output did not materialize due to COVID-19 lockdowns and some price-induced closures, but zinc smelters continued to operate more or less normally.”

As a result, the concentrate market has registered a deficit this year, but the refined market is in a 550,000 tonne surplus.

When looking back at his expectations at the end of 2019, Ryan Cochrane of Open Mineral said the world looked very different at that time.

“Expectations were for tremendous concentrate surpluses, and this almost universal outlook led to benchmark treatment charges (TCs) being set at just under US$300 per dry metric ton. COVID-19 flipped supply forecasts on the head and led to a very tight concentrate market where spot TCs plummeted.”

Zinc outlook 2021: Supply and demand

As 2020 wraps up, market watchers are looking for signs about how zinc will perform next year.

“We expect Chinese demand to remain strong, at least into 2021 H1 as targeted infrastructure stimulus will continue to be supportive,” O’Cleary said. “We also expect a strong rebound in India in 2021, but the demand recovery in Europe and the US may be hampered by a slow auto sector recovery.”

Looking over to supply, Open Mineral’s Cochrane is expecting mine output to recover.

“However, don’t expect a major surge. Many of the disrupted mines in South America should recover lost output, but there isn’t a strong pipeline of large new incremental suppliers for 2021,” he said. “Uncertainty is still there, and COVID-19 will likely continue to disrupt mine supply in 2021 as vaccines take longer to be administered in the major supplier countries from South America.”

China is the world’s top zinc producer, with output reaching 4.3 million metric tons in 2019. Peru came in second, producing 1.4 million metric tons last year, according to US Geological Survey data.

CRU also sees mine supply growing next year, but there are still risks from isolated COVID-19 closures.

“The concentrates market is likely to remain tight in 2021, and this could be exacerbated by a longer-than-expected outage at Gamsberg,” O’Cleary said. Vedanta’s (NYSE:VEDL) Gamsberg mine was shut down following an accident. The mine was in the process of ramping up first-stage production capacity of 250,000 tonnes per year.

This tight concentrate market through H1 2021 will see spot TCs remain low, with benchmark terms likely to settle below US$200 per dry metric ton, according to Open Mineral.

“Spot TCs should begin to recover next year as mine supply improves, and there is an expectation that benchmark TCs could be far higher than current spot,” CRU’s O’Cleary added.

CRU is expecting the concentrates market to remain in a small deficit, but anticipates that the refined market will register a surplus of 350,000 tonnes.

For Cochrane, a likely hub of refined metal oversupply will be Europe and the Commonwealth of Independent States.

“So the market will look to refined export data from Spain and Kazakhstan as useful markers ― it’s likely large swathes of this metal will end up in China,” he said.

Zinc outlook 2021: What’s ahead

As 2021 kicks off, investors are wondering where zinc prices are headed and if the upward trend seen in the second half could be sustained.

Cochrane said prices have possibly run ahead of refined market fundamentals, but that could persist for a while. “I think the concentrate market will remain tight through at least H1 2021; this along with the potential for Chinese smelter cuts … will be a neat mechanism to support prices and drag much of the excess refined surplus in Europe into China,” he said.

He added that US dollar weakness will be a tailwind for zinc. “(I think) the outlook for zinc prices must be positive at least through the first half of 2021.”

CRU is expecting prices to average US$2,550 next year.

Moving forward, miners should have a very good year, particularly the first half of 2021, Cochrane said.

“High zinc prices and low TCs suggest a relative windfall is on the cards for zinc concentrate suppliers,” he said. “Investors should look for whether miners ‘go to market’ more than previous years, tender more material to traders, enter into spot-related contracts and ultimately unhinge themselves from benchmark-term-related contracts.”

That said, junior miners have mixed expectations for zinc next year.

Patricio Varas, CEO of Norden Crown Metals (TSXV:NOCR,OTCQB:BORMF), said there seems to be no interest in that commodity from the investment public, but he expects a better market for zinc in 2021.

“If job creation means an increase in infrastructure projects on a global basis, then the metal markets will have a bull run,” he said. “The hit on the global economy caused by the COVID-19 pandemic will demand a significant stimulus for job creation, and this will have an impact on metal demand.”

When looking at the most challenging aspects of the market in 2020, Bruce Downing, CEO of Jaeger Resources (TSXV:JAEG), said raising money for exploration was a hurdle for juniors.

Downing anticipates a neutral zinc market in 2021, with the risk of some mines shutting down next year.

John Mirko of Rokmaster Resources (TSXV:RKR,OTCQB:RKMSF) was a bit more optimistic, saying exploration is resulting in fewer discoveries with demand growing.

When asked about factors investors should pay attention to in 2021, CRU’s O’Cleary said that in terms of supply, downside risk could come from an extension of the outage at Gamsberg and isolated COVID-19-related closures, which could lead to a tighter concentrate market.

“(The upside risk could come from) high prices lead(ing) to some price-induced cutbacks being rescinded and better concentrates availability,” she said.

On the demand side, investors should keep an eye out for potential COVID-19 disruptions, and whether more stimulus measures could help support a faster recovery.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Jaeger Resources, Norden Crown Metals and Rokmaster Resources are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.