Zinc Price Forecast: Top Trends for Zinc in 2026

The zinc market is facing another surplus in 2025, with an even larger overhang projected in 2026.

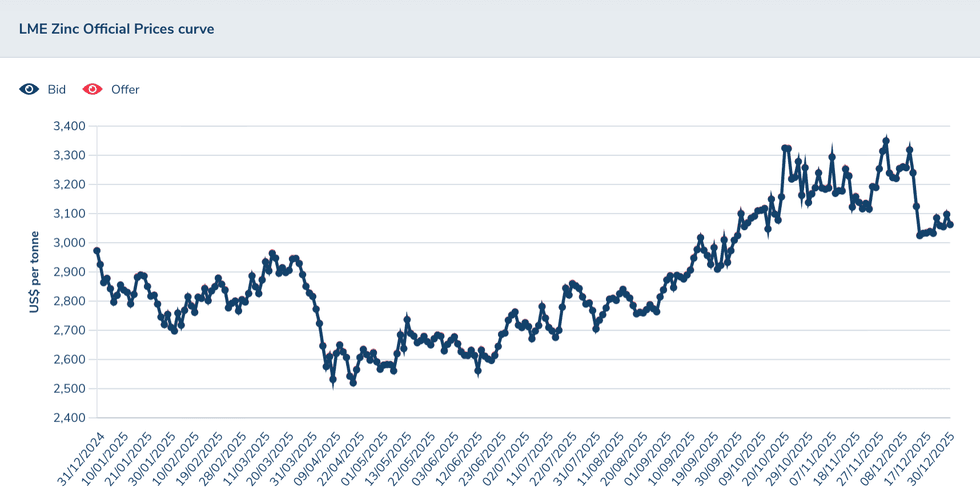

After a steep decline during the first half of 2025, the zinc price is ending the year close to where it started.

Because it’s used to make galvanized steel, the majority of zinc demand is closely tied to the housing and manufacturing sectors, which have recently faced pressure from a combination of high inflation and interest rates.

Additional pressures have come from evolving US trade policies, causing uncertainty among investors who have turned away from real estate, as well as consumers who have reduced spending.

What happened to the zinc price in 2025?

The zinc price was relatively flat at the start of 2025, beginning the year at US$2,927 per metric ton (MT) on January 2 and closing the first quarter at US$2,855 on March 30. However, the second quarter brought a broad rout for base metals prices, and by April 9 zinc had fallen to a yearly low of US$2,562.

Since then, zinc has gained steadily, ending the second quarter at US$2,753 on June 30. The price rise continued through Q3 and Q4, with zinc reaching US$2,954 on September 30 and US$3,088 on December 29.

Key trends for zinc in 2025

As mentioned, zinc saw a major price decline at the start of April, falling 14 percent as the base metals sector responded to US President Donald Trump’s “Liberation Day” tariffs announcement.

At the time, analysts predicted that the proposed reciprocal tariffs could trigger a recession, impacting consumer spending on new homes and cars, both of which have significant inputs of galvanized steel.

While the threat of a significant global recession eased as the proposed tariffs were dialed back, considerable uncertainty among both investors and consumers remained. This was evident in the US housing market, where affordability challenges persist, leading to stagnation in new housing starts and a glut of unsold homes.

Likewise, a stalled Chinese housing market persisted throughout 2025. The country's real estate market collapsed in 2020 as Evergrande and Country Garden filed for bankruptcy. Over the past five years, the government has implemented several measures to stimulate the beleaguered sector, but they have had little effect.

According to CNBC, November sales from China's top 100 developers declined 36 percent over 2024, and were down 19 percent through the first 11 months of 2025 — a "real and concerning" worsening.

Against that backdrop, the International Lead and Zinc Study Group (ILZSG) is predicting a 2025 zinc market surplus of 85,000 MT. It notes that during the first 10 months of the year, zinc mine production rose to 10.51 million MT, up from 9.87 million MT in 2024. Refined zinc production was also up, rising slightly to 11.52 million MT from 11.12 million MT in the same period last year. Zinc demand reached 11.44 million MT, up from 11.19 million MT in 2024.

Despite the oversupply situation, London Metal Exchange (LME) stockpiles fell from 230,325 MT on January 2 to come in at just 33,825 MT on November 1.

Zinc surplus expected in 2026

Oversupply is likely to persist as newly mined metal enters the market, while demand growth remains modest.

The ILZSG is predicting that global refined zinc demand will increase by 1 percent to 13.86 million MT in 2026.

The group notes that while it anticipates Chinese demand posting a 1.3 percent gain in 2025, it believes usage from the country will be flat in 2026 as the slump in the Chinese real estate sector persists into 2027.

Additional challenges are arising from a slowdown in the US housing market, with new buyers facing high home prices and elevated mortgage rates. However, policy proposals from the Trump administration on December 17 could give the sector a much-needed boost and potentially increase downstream demand for zinc.

Likewise, European zinc demand is likely to grow next year following predicted 0.7 percent growth in 2025.

However, the ILZSG is predicting a more significant upward trend in zinc mine supply in 2026 — the organization is anticipating that output will increase by 2.4 percent to 12.8 million MT. This will come on the back of higher output from existing operations in Europe, Australia, Brazil, the Democratic Republic of Congo and China.

Additional zinc supply will come from a recent restart at the Almina-Minas Aljustrel mine in Portugal, commissioning of Bunker Hill Mining's (CSE:BNKR,OTCQB:BHLL) namesake mine in Idaho and the start of commercial production at the Xinjiang Huoshaoyun mine in China, which will be the sixth largest lead-zinc mine in the world.

Refined zinc output is also expected to increase by 2.4 percent in 2026, reaching 14.13 million MT from the anticipated 13.8 million MT in 2025. The higher levels are owed to the greater availability of concentrates in Brazil, Canada, Norway and China. Overall, the ILZSG predicts a global zinc supply surplus of 271,000 MT in 2026.

Zinc price forecast for 2026

In terms of the zinc price in 2026, a December report from Fastmarkets suggests that upward momentum from the 2025 LME average of US$3,218 is expected to continue through the first half of the year.

The firm points to regional disparities as Chinese production runs at a surplus, while the rest of the world falls short.

However, the expectation is that the zinc market will achieve a better balance in the second half of the year and into 2027 as global surpluses begin to emerge. Zinc prices are then seen declining as a result.

For its part, Morgan Stanley (NYSE:MS) recently revised its zinc price outlook for 2026, calling for a yearly average of US$2,900 for the base metal, as per a mid-December Reuters article.

Additionally, according to a November Argus report, long-term zinc contracts have slowed amid low LME inventories, creating near-term uncertainty and driving prices higher.

Argus suggests that manufacturers have been slow to issue sales orders, which has caused uncertainty among producers, leaving them to take a wait-and-see approach to determine if low inventories persist.

It’s also important to note that zinc is listed as a critical mineral in the US for its use in the production of galvanized steel for infrastructure and defense projects. The US has already given South32's (ASX:S32,OTC Pink:SHTLF) Hermosa project FAST-41 approval, giving it access to streamlined regulatory processes.

With building regional disparities and a tense relationship between the US and China, the world’s top zinc producer, deteriorating trade relations could be a boon for US and western producers of the metal.

However, as long as refined supply of zinc remains in surplus against a backdrop of weak demand growth, investors can expect more of the same from the zinc market in the near term. This may open up opportunities for patient or less risk-averse investors who are willing to take a wait-and-see approach to how the sector evolves.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

- Why Invest in Zinc? ›

- Top 10 Countries for Zinc Production ›

- Zinc Stocks: 5 Biggest Canadian Companies in 2025 ›

- Top Zinc Producing Companies ›

- Understanding the Zinc Spot Price and Zinc Futures ›