February 25, 2024

Enova Mining Ltd (ASX: ENV) is pleased to advise that it has entered into a binding option to acquire 100% of the CODA Rare Earth Prospect.

KEY HIGHLIGHTS

- Enova has entered into a binding option agreement to acquire 100% of the CODA prospect with a combined area of 15,334 Ha or 153.3 sq.km.

- To date eleven (11) shallow auger holes were drilled within the CODA prospect. Significant results for these tenements are summarised below:

- 10.5m @ 2,567 ppm TREO1 incl. 4.5m (6m to EOH2) @ 4,157 ppm TREO1

- 10.0m @ 3,218 ppm TREO1 including 6m (4m to EOH2) @ 3,608 ppm TREO1

- 10.0m @ 2,414 ppm TREO1 including 4m (6m to EOH2) @ 4,401 ppm TREO1

- 11.0m @ 2,840 ppm TREO1

- The highest assaying drill intercepts were recorded at end of hole:

- 0.5m @ 5,697 ppm TREO1 and 1.0m @ 5,078 ppm TREO1

- Mineralisation remains open in all directions and at depth, with grades significantly increasing at depth. (Refer to Table 2 for list of drilling intercepts and REE data.)

- The Option Agreement is subject to a 30-day Due Diligence period, with acquisition subject to Shareholder Approval. The CODA tenements offer an immediate walk- up drilling opportunity to commence an aggressive exploration campaign with a ready to mobilize on-ground team.

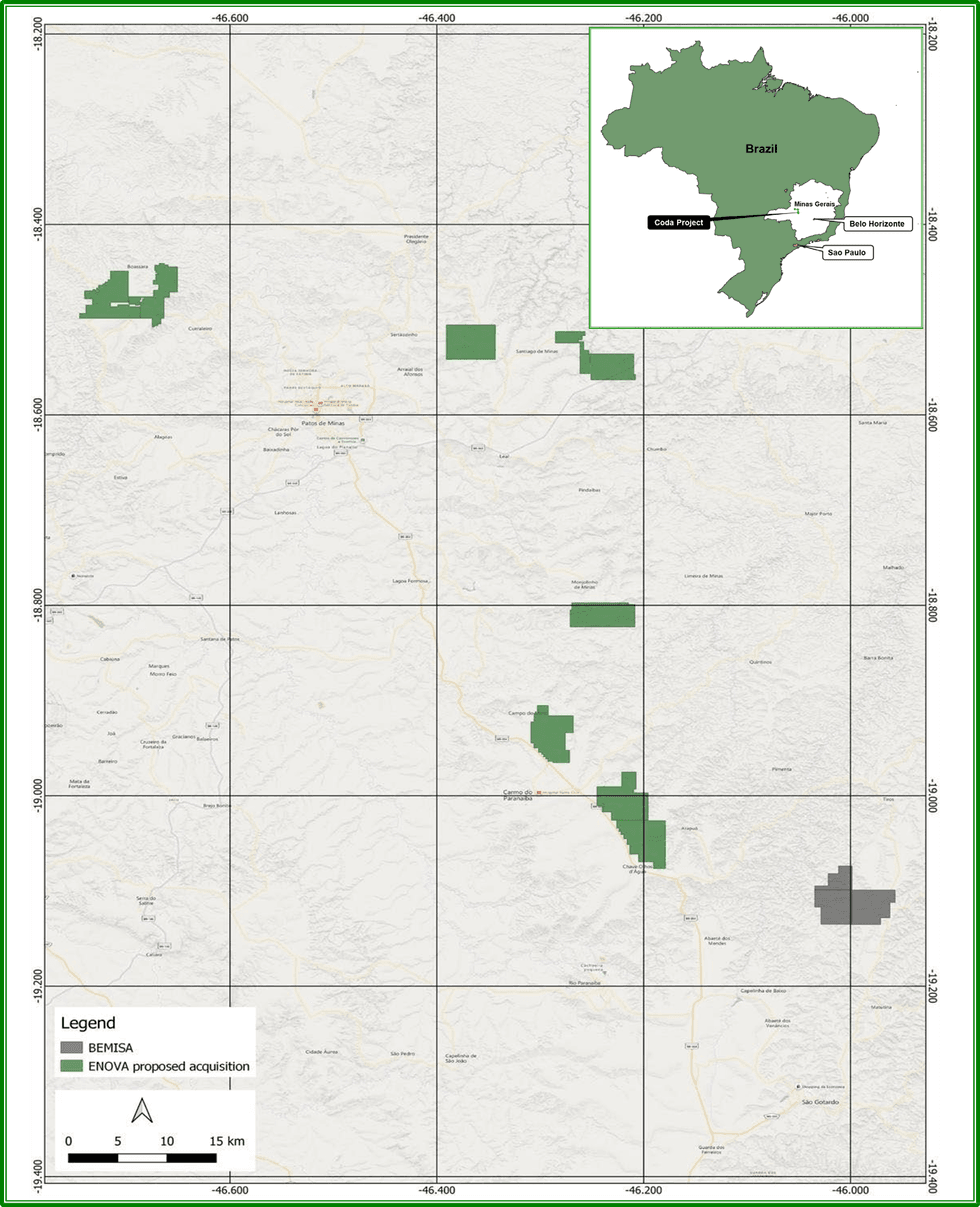

- The tenements are strategically located nearby to well-developed highways, infrastructure, water access, hydro-electric/wind power and proximity to regional centres, 300km north-west of Belo Horizonte in the mining friendly state of Minas Gerais.

- Enova has received firm commitments from investors requesting to exercise options, thus bolstering its cash balance and remains fully funded to carry out Phase 1 Exploration and Drilling at both POÇOS and its newly optioned CODA tenements. Option conversion will be conducted at end of each calendar month.

OUR OPPORTUNITY

Enova Mining Ltd (ASX: ENV) (“Enova” or the “Company”) is pleased to advise it has entered into a binding option agreement (“Option Agreement”) with private individual Rodrigo de Brito Mello. (“RBM”) under which it has been granted an option to acquire a 100% interest in the CODA tenements.

Through this Option Agreement, Enova gains greater exposure to prospective Rare Earth enriched Ionic Absorption Clay (IAC) exploration tenements situated in the mining friendly state of Minas Gerais, Brazil. Highly impressive exploration drilling results confirm the potential for REE enriched IAC in two of the CODA tenements and likely continued success in the remaining tenement areas.

GBA Capital acted as Lead Advisor to the acquisition as well Lead Manager to the Capital Placement in August 2023.

Mr. Eric Vesel Managing Director of Enova, commented:

“This opportunity has emerged as a result of Enova’s recent exploration activity in the highly prospective mineral rich state of Minas Gerais State. The tenements under consideration offer Enova access to a new region of IAC potential. The company considers this the most advanced exploration land package considered so far, with two tenements having impressive drilling results. Once satisfied with our team’s findings from the due diligence (DD), we would seek Shareholder approval to proceed with acquisition. We expect the DD will confirm that the southern Coda tenements are potentially “walk-up” drill targets which will quickly evolve to a resource drilling campaign within several months of acquisition. Enova has already established a network of local expertise and support that will provide good grounding to operate in this progressive mining state. This potential expansion of Enova’s REE IAC land holdings builds on an already exciting and prosperous future ahead.”

TENEMENT OVERVIEW

Enova is encouraged by the location and size of the tenements in relation to prospective geological features. The prospective geological unit present in the Coda project is composed of the Patos Formation. It formed during the Upper Cretaceous period, when a massive volcanic event occurred in the western part of Minas Gerais state. The volcanic activity exhibited both effusive (lava flows) and explosive (pyroclastic deposits) eruptions. The predominant rock type in this formation is kamafugite, which is classified as an alkaline- ultramafic rock. Rare earth elements (REE) are also enriched in this formation.

The prospective unit consists of a horizontal bed of kamafugite, which can be up to 40 metres thick, overlain by overburden that varies from 0 to 50 metres. Weathering processes with thick clay zones are prevalent throughout this profile, leading to the accumulation of REE elements closer to the upper part of the formation. The rocks within this formation are predominantly soft and friable, with an extremely fine particle size. These characteristics are considered advantageous for the exploration of Ionic Clay REE deposits.

Figure 1 (following) illustrates the locations of the tenements.

The mining/extraction of REE from enriched IAC’s are relatively low-cost, in comparison to production from other styles of REE deposits, with negligible levels of uranium and thorium.

Click here for the full ASX Release

This article includes content from Enova Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00