June 06, 2022

Valor Resources Limited (Valor) or (the Company) (ASX:VAL) is pleased to announce the completion of an extensive data review and targeting process on the Cluff Lake Uranium Project (the Project) in the western Athabasca Basin. This work has highlighted a significant number of very prospective targets, which will be followed up on-ground in the coming few weeks. In addition, an extensive airborne gravity gradiometry survey has recently been completed at the Project, with additional targets expected to be identified when the final data is reviewed".

HIGHLIGHTS

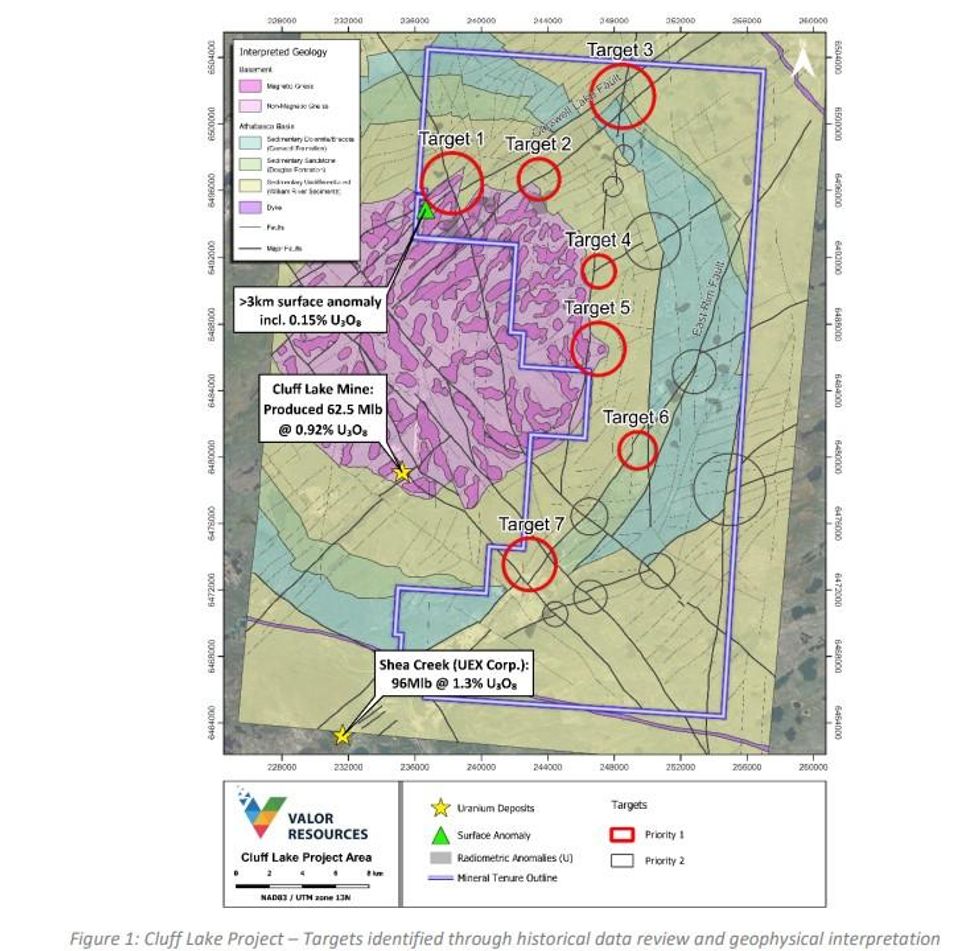

- Seven high-priority targets defined based on historical data and geophysical interpretation

- Highlighted by surface geochemical anomalies up to 0.15% U3O8

- Airborne gravity gradiometry (AGG) survey completed to identify further targets

- Project located 7km east of Orano’s Cluff Lake Mine which produced 62.5 Mlbs @ 0.92% U3O8

- Potential for both Athabasca basement-hosted and unconformity-style uranium deposits

- Permitting well advanced to start on ground exploration activity in June including mapping and sampling, to design drilling program

Executive Chairman George Bauk comments “The data review has highlighted excellent targets including several key structures, and this combined with outputs from the recently completed airborne gravity gradiometry survey will provide us with the priority targets that require on-ground follow-up leading to drilling. The gravity survey provides the third dimension (depth) to the other geological data sets to assist with identifying and prioritising drill targets.”

“We are within 7km of a significant historical uranium mine, which was operated by Areva (now Orano), the leading French nuclear organisation. This group of deposits produced over 62m pounds of U3O8 at 0.92% U3O8 (or 9,200ppm U3O8). These deposits were small in terms of physical size, but due to their high-grade nature, were economically significant. We are targeting our exploration activity to account for the physical size of known resources in the area.”

“We are also working through compiling all the historical exploration data from our eight projects in the Athabasca Basin, and we plan to release the reviews of all projects in the next three months. During this time, the exploration team will continue on-ground exploration and interpretation of the new airborne survey data from Cluff Lake, Hook Lake and Hidden Bay.”

Airborne gravity survey – recently completed

An airborne gravity gradiometry (AGG) survey has been completed across approximately 80% of the Cluff Lake Project area (622km2). A total of 2,755 line kms were flown in the survey, at a line spacing of 200m. To the Company’s knowledge, this is the first modern airborne gravity survey completed over the project area. The preliminary data is currently being compiled and reviewed, with the results expected later this month.

The AGG data will help delineate geology and structure that are potentially important in the formation of a uranium deposit. Gravity anomalies can provide direct detection of the hydrothermal alteration associated with a uranium deposit. Hydrothermally altered (de-silicified) rocks have a lower density then the unaltered host rocks and can therefore be identified as gravity lows. An example of this is the basement-hosted Arrow Uranium Deposit, which has a Total Mineral Resource of 337.4 million pounds U3O8 at a grade of 1.8%, which was discovered in 2014 by NexGen Energy Ltd. The discovery of the Arrow Deposit was, in part, the result of drill testing a circular gravity low with a diameter of around 1km. (sourced from Arrow Deposit, Rook I Project, Saskatchewan, NI 43-101 Technical Report on Feasibility Study).

Historical data review targets

The following targets are based on a thorough review of historical exploration data which has been integrated with a detailed geological interpretation of all publicly available geophysical data completed by Valor’s consultant geophysics team, Terra Resources. The historical exploration data is from the 1960s through to the 1980s. Between the 1990s and the present day, little uranium exploration has been carried out in this area. Details of relevant drill holes and surface sampling information that have been used in determining some of these targets, have been included in Appendices 1 and 2. All diamond drill holes have been reported and other drillholes with maximum U assay of >1ppm have been reported. The surface samples reported have been filtered based on: Organic samples >5ppm U, Soil samples > 2ppm U, rock chip(boulder) and unknown sample types > 5ppm U. Due to the historical nature of some of this data, some aspects of the sampling and drilling cannot be verified and therefore some caution must be applied. The Company intends to carry out on-ground work to verify aspects of the historical data before advancing targets to the drilling stage.

Click here for the full ASX Release

This article includes content from Valor Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00