Goldcorp to Invest $1 Billion in Chile via Barrick, Exeter Deals

A series of transactions announced March 28 will see Goldcorp and Barrick Gold join forces to develop projects in the Maricunga Gold Belt.

In a move that will require spending about $1 billion over the next six to eight years, major miner Goldcorp (TSX:G,NYSE:GG) is teaming up with Barrick Gold (TSX:ABX,NYSE:ABX) to develop projects in northern Chile’s Maricunga Gold Belt.

The companies said Tuesday (March 28) that they plan to enter into a 50/50 joint venture, and will focus in particular on Cerro Casale, one of the largest undeveloped gold projects in the world. They will also advance the Caspiche project, located about 19 kilometers north of Cerro Casale. It is held by Exeter Resource (TSX:XRC,NYSEMKT:XRA), which Goldcorp announced plans to acquire in another Tuesday release.

“We’re very excited about the opportunity to put these two projects together,” said Russell Ball, Goldcorp’s CFO and executive vice president of corporate development, in an interview with BNN. “No one’s looked at combining that Maricunga Belt, and we see that as the real opportunity here — to take significant, costs both on the capital and operating side, out of the business, [and] also to reduce the environmental footprint and extend the mine life.”

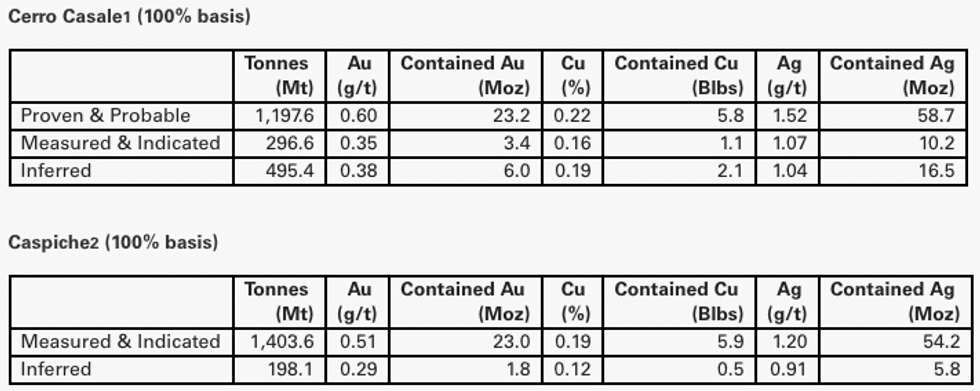

According to Goldcorp, mineral reserves and resources at Cerro Casale and Caspiche are as follows:

Charts via Goldcorp.

A feasibility study was completed for Cerro Casale in 2010, but Goldcorp Chief Executive David Garofalo told Reuters that with Caspiche now in the picture a total cost “re-think” will be required. He also said he doesn’t see a construction decision coming for another five to seven years.

To bring their partnership to life, Goldcorp and Barrick will complete a series of transactions over the next few months. The major points of these deals are as follows:

- Goldcorp will acquire Kinross Gold’s (TSX:K,NYSE:KGC) 25-percent stake in Cerro Casale and 100-percent interest in the Quebrada Seca project. Those purchases will cost the company an initial $260 million in cash, plus other deferred payments and a royalty.

- Goldcorp will purchase a further 25-percent interest in Cerro Casale from Barrick. That stake is also valued at $260 million, but Goldcorp will spend that money on Cerro Casale rather than giving it to Barrick. This transaction also involves other deferred payments and a royalty.

- Goldcorp will acquire Exeter and the Caspiche project for share consideration of about $185 million on a fully diluted basis.

All in all, the news has been well received, with some market watchers suggesting that Goldcorp and Barrick’s partnership is another sign that the resource sector is turning around. The world’s major miners have cut costs extensively over the last few years, and the fact that they are now beginning to invest in new areas is being viewed as positive.

Exeter’s part in the deal has also not been overlooked, as the tweet below from GoldSeek.com Founder and President Peter Spina shows:

Wow! Congrats to team at Exeter! To be Acquired by Goldcorp — a premium of 67% over yesterday’s close, C~$1/4B$XRA $GG

— Peter ⚒ Spina (@goldseek) March 28, 2017

As of 12:45 p.m. EST on Tuesday Goldcorp and Barrick had both seen slight share price drops on both the TSX and NYSE. Meanwhile, Exeter’s share price was up 54.55 percent on the TSX, at $2.38, and up 53.45 percent on the NYSEMKT, at $1.78.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Exeter Resource is a client of the Investing News Network. This article is not paid-for content.