March 19, 2024

C29 Metals Limited (ASX:C29) (C29, or the Company) is pleased to announce it has entered into a binding share sale and purchase agreement (Acquisition Agreement) with CA Metals Pty Ltd (CA Metals) and Ulytau Resources Ltd (Ulytau Resources) to acquire a 100% legal and beneficial interest in a granted exploration licence located in Kazakhstan (Ulytau Uranium Project).

INVESTMENT HIGHLIGHTS

- Transformative transaction to acquire a 100% interest in the high grade Jusandalinskoye (Ulytau) Uranium Project located in Kazakhstan with all due diligence having been completed.

- The Ulytau Uranium Project contains a Non-JORC foreign estimate of 9.85M/lbs Uranium @ 2,790ppm. *

- Multiple Non-JORC foreign drill intersects greater than 40m and above 6,000ppm U308 from 3m below surface have been recorded. *

- Independent Geology report confirms that the foreign estimate appears open in most directions offering significant future foreign estimate upgrade potential.

- Kazakhstan is the largest and lowest cost Uranium producer globally producing approximately 43% of the global supply1.

- Experienced mining executive, Shannon Green, joins the Company as the Managing Director.

- C29 has received firm commitments for a placement to raise $3m (before costs), which will be completed in two tranches.

*Cautionary statement: The foreign estimates and foreign exploration results in this announcement are not reported in accordance with the JORC code 2012. A competent person has not done sufficient work to classify the foreign estimate as a Mineral Resource, or disclose the foreign exploration results, in accordance with the JORC Code 2012. It is uncertain that following evaluation and/or further exploration work the foreign estimate will be able to be reported in accordance with the JORC Code 2012, and it is possible that following further evaluation and/or exploration work that the confidence in the prior reported foreign exploration results may be reduced when reported under the JORC Code 2012. Nothing has come to the attention of the Company that causes it to question the accuracy or reliability of the foreign exploration results, but the Company has not independently validated the foreign exploration results and therefore is not to be regarded as reporting, adopting or endorsing the foreign exploration results.

Project Location

Ulytau is located near Lake Balkhash in South Kazakhstan and situated 15 km south of Bota- Burum mine, one of the largest uranium deposits mined in the former Soviet Union. Geological surveying and prospecting works have been carried out in the Bota-Burum mineralisation field since 1957.1

Foreign Estimate & Drilling

The foreign estimate of mineralisation in respect to the Ulytau Uranium Project reported in this announcement are “foreign estimates” for the purposes of the ASX Listing Rules. The foreign estimate is not reported in accordance with the JORC code 2012.

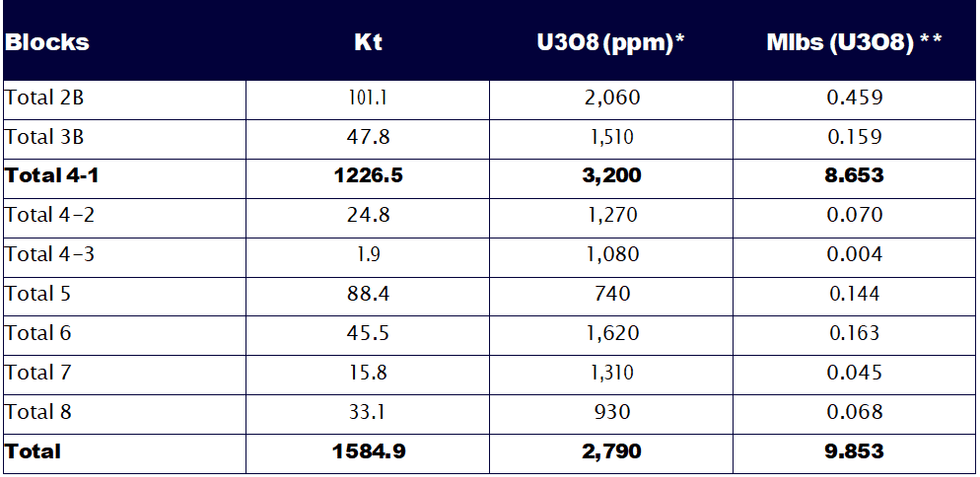

Table 1 below presents the foreign estimate.

Non-JORC Foreign Estimate

- * Grade conversion factor Uranium (1) to Uranium Oxide (1.1792)

- ** Mlbs conversion factor 1kt @0.1% U3O8 = 0.002205 Mlbs or 1kt @ 1% = 0.02205Mlbs

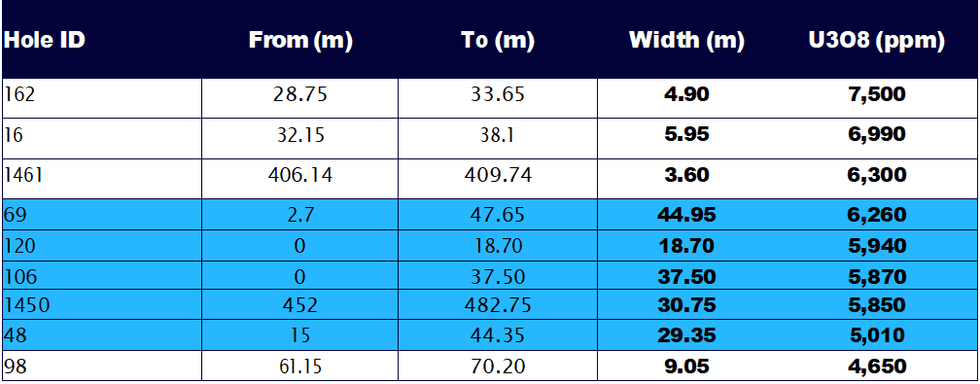

Table 2 below presents some examples of the Non-JORC foreign high grade drill intersections.

Non-JORC Foreign High-Grade Drill Intersects

Project Geology

The Ulytau discovery is a part of a larger Bota-Burum uranium mineralisation district, with the mineralised section covering the eastern contact of the Dzhusandalinsky granitoid massif. The contact is located 1 km east, with the enclosing effusive-sedimentary formations of Lower- Middle Devonian age. From the surface, the massif is represented by leucocratic (alaskite) granites of the Bota-Burum intrusive complex of Upper Devonian age, containing large (up to 100m-1500m in diameter) remnant xenoliths host rocks.

Ulytau mineralisation consists of two echelon zones - Southern and Northern, confined to the intersection of tectonic faults of the Dzhusandala and Dyke fault zones. Each zone consists of a series of individual mineralisation areas with complex stockwork. These mineralisation areas are steeply dipping lenses, confined by tectonic faults and dyke contacts within albitization zones. Mineralisation is widespread almost from the surface to a depth of 660 m. The sizes of individual mineralised areas vary in thickness from 0.5m to 30m–40 m, with a strike and dip length of 80m–350m. The uranium content varies from 0.03% to 1.4%, the average for the deposit is 0.239%. Uranium mineralisation is developed in the form of metasomatic segregations in the zones of granite albitization.

The southern part of the field as well as east and west of known mineralisation remain underexplored with potential significant upside.

Figure 2 below shows a plan view of the location of the foreign estimate in relation to the tenement boundaries and demonstrates that the mineralisation appears open in most directions offering significant future mineralisation upgrade potential.

Click here for the full ASX Release

This article includes content from C29 Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00