What happened to silver in Q3 2019? Our silver price update outlines key market developments and explores what could happen moving forward.

Click here to read the latest silver price update.

Unlike Q2, which was relatively slow for silver, Q3 brought major moves from gold’s sister metal, spurred on in part by two US Federal Reserve interest rate cuts.

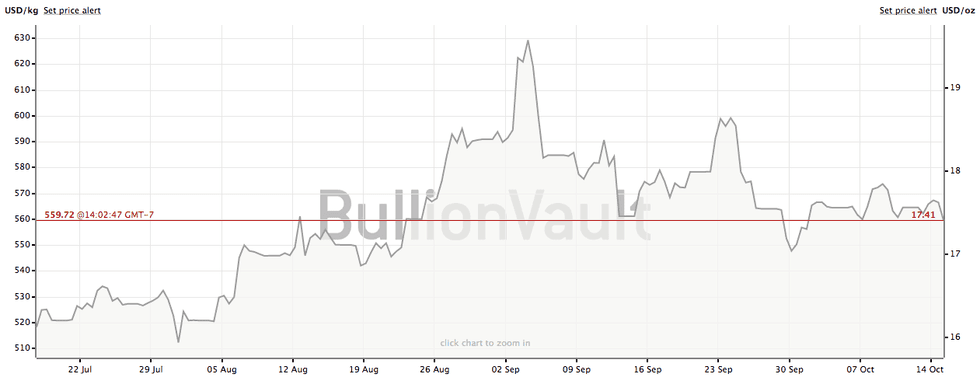

The precious metal, which was also driven by gold’s gains, started the three month period selling for US$15.11 an ounce and spent much of July trending higher.

The August story was similar, with silver hitting US$18.34 by the end of the month. September offered a little more volatility for the currency metal, which started the month at US$18.43 and subsequently climbed to US$19.23 before sliding down to US$17.62.

Read on for an overview of the factors that impacted the silver market in Q3, plus a look at what investors should watch out for in the months to come.

Silver price update: Q3 overview

The third quarter of 2019 was eventful for silver, which rallied to highs unseen since 2016.

The white metal, which is impacted by many of the same issues that affect gold, responded well to the uncertainty brought on by the ongoing trade dispute between China and the US, as well as tensions between Tehran and Washington.

At this year’s Sprott Natural Resource Symposium, the Investing News Network (INN) spoke with EB Tucker, director at Metalla Royalty & Streaming (TSXV:MTA,OTCQX:MTAFF), about the trajectory of the precious metals. He sees the current period as the calm before the storm.

“It’s happening right now,” he said. “(Gold is) going to hit US$1,500 (per ounce), silver’s going to hit US$20 and there’s not going to be a break before that happens.”

The biggest impact on the silver sector during the month of July was the interest rate cut from the Fed, which occurred late in the month.

The Fed’s move to cut rates by a quarter point to a range of 2 to 2.25 percent marked the first cut since the 2008 financial crisis, but it was not to be the last rate reduction of the year — or even the quarter.

Initially, the precious metals space responded negatively to the cut, with both silver and gold slipping slightly following the announcement; however, both regained any lost ground quickly.

By the end of July, silver had gained US$1.19 and was trading for US$16.30.

Chart via BullionVault.

Like Tucker, Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), sees value in investing in the silver space, especially with the metal making gains.

“Silver is the high beta play on precious metals. One of the reasons that silver moves like that is because so much of it is produced as a by-product from lead–zinc mines and copper mines,” he said at Sprott.

“Those mines don’t change their production, so that just results in a very delayed response on the supply side … so silver always lags gold, but then it outperforms, and it has done that for the last 50, 60 years. It’s going to continue to do that; silver is a good place to play.”

For August, there was much anticipation around how high silver could go, with some speculating it might approach highs not seen since 1980 and 2011, when silver was trading at historic prices.

“(The) gold silver ratio is the highest it has been in 26 years,” Tucker said. “And what it tells you is that silver is drastically undervalued to gold … I’m not going to be surprised at all until we hit US$20.”

During the 30 day cycle, silver gained US$2.04, moving from US$16.30 to US$18.34 by August’s end.

Silver price update: Another interest rate cut

Heading into the official start of autumn, silver had surpassed the US$18 threshold, riding the success gold experienced in August and banking on its safe haven nature.

“It’s obvious that the US-China trade dispute is a big driver for gold right now. But I think silver’s significant outperformance is a clear sign that monetary concerns are also sparking demand, and that the rally will be a long-term, secular move as a result,” Brien Lundin, editor of Gold Newsletter, told INN in an email at the time.

He noted that the white metal’s quarterly growth might be indicative of longer-term monetary factors.

“In my opinion, the main reasons for silver’s appreciation in price are the same as gold; however, because silver has a component of industrial demand, its market dynamics are much different,” he said. “The biggest difference lies in the silver market’s volatility. Historically, silver outperforms both to the upside and the downside depending on the direction of the market.”

In 2019, silver has outperformed itself, spending the majority of the year trading at prices higher than those seen in 2018, despite a slight year-over-year decrease in consumption. And, according to market watchers, there is more room for the precious metal to go.

“It’s well known … how silver tends to lag gold. Gold moves first and then silver more than catches up,” said Lobo Tiggre, CEO of Louis James LLC, at Sprott. “If gold goes bananas, silver will go bananas — no question in my mind, and it will go more bananas than gold.”

Silver’s varied uses and the fact that it is a by-product of gold and base metals mining are seen having an impact on consumption and demand as the final quarter of 2019 begins, and likely beyond that.

Tiggre pointed out that if copper production declines that could propel silver higher.

“We have that now: copper under pressure, global economic slowdown, people are worried. Copper producers, if they cut back, that massively cuts back the silver supply. And if that happens when silver prices are rising, you can see silver prices really go nuts.”

After spending much of August climbing, silver descended slightly to hit US$17.01 on August 22. It steadily trended higher until September 3, when it reached US$19.23, its highest point in the period.

Mid-September also saw the US Department of Justice (DoJ) lay charges against three JPMorgan Chase & Co (NYSE:JPM) executives. It is alleged that the trio manipulated the prices of precious metals over an eight year period between 2008 and 2016.

According to the DoJ, the three men were engaged in “spoofing,” a process where a trader places bids to buy or sell contracts that they have no intention of keeping, and in fact plan to cancel before the transaction goes through. The move manipulates other buyers into contracts at inflated prices.

This isn’t the first time the investment bank has found itself in a precious metals scandal.

As Bill Murphy of the Gold Anti-Trust Action Committee told INN, this story represents only part of a vast criminal enterprise in which JPMorgan plays a role.

“It is one trader after another at JPMorgan getting in trouble for market manipulation, with their superiors in on the case about what is going on. Ironically, these trader operations are rinky-dink compared to the overall rigging of the gold and silver prices, which involves massive price suppression (and) has been ongoing for a very long time.”

Murphy said that JPMorgan traders rigging deals is indicative of the company’s larger part in a gold price fixing cartel, one that is centered largely around the COMEX.

“If it were not for these operations, the gold and silver prices would be much higher than they are now. As is, gold has made all-time highs in 73 other countries,” he said.

After reaching its year-to-date high in the first week of September, the price of silver began to slip and continued to slide lower over the 30 day period.

Following some speculation that it would cut interest rates again before the end of 2019, the Fed reduced interest rates by 25 basis points to a new target range of 1.75 to 2 percent.

“The rate cut was widely expected given deflationary pressures driven by the recent weak US manufacturing data, the simmering trade tensions with China and the mounting geopolitical issues in the Middle East,” Nigel Green, CEO of deVere Group, said in a statement. “There’s much uncertainty amongst economists, and within the Fed itself. It’s an unusual environment.”

Silver price update: What’s ahead?

Despite mixed opinions on how high silver could go, most experts believe now is a good time to get exposure in the market — especially with gold retaining the majority of its quarterly gains.

As a whole, precious metals are poised to remain strong well into the first reporting period of 2020.

“In this third quarter, it looks like we got some rotation into the silver stocks and the silver price went up. I think that it’s around US$18 (September 30). And that really kind of woke up the market,” said Ralph Aldis, portfolio manager and senior mining analyst at US Global Investors (NASDAQ:GROW).

“Then you started seeing money also move over to platinum and palladium.”

While the tensions brought on by trade disputes have died down for the moment, market watchers expect silver and its precious metal counterparts to trade steadily for the rest of the year, with silver edging higher due to its use in industrial applications.

“Going forward, prices are seen remaining relatively stable, propped up by a recovery in industrial production next year,” states a recent FocusEconomics report. “The evolution of the US-China trade war will be a key factor to watch in coming months, due to its potential to affect both safe haven and industrial demand.”

The firm, which is known for its economic analysis, expects silver prices to average US$17.30 in the last quarter of 2019. Silver ended Q3 just below US$18.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.