What Was the Highest Price for Silver?

What was the highest silver price ever and when was it reached? Learn about the white metal’s historic and current price movements.

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset.

Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway.

Experts are optimistic about the future, and as the silver price's momentum continues in 2026, investors are looking for price forecasts and asking, “What was the highest price for silver?”

The answer reveals how much potential there is for the silver price to rise.

Read on for a look at silver's historical moves, its new all-time high price and what they could mean for both the price of silver today and the white metal’s price in the future.

In this article

How is silver traded?

Before discovering what the highest silver price was, it’s worth looking at how the precious metal is traded. Knowing the mechanics can be useful in understanding why and how its price changes on a day-to-day basis and beyond.

Silver bullion is traded in dollars and cents per ounce, with market activity taking place worldwide at all hours, resulting in a live silver price. Key commodities markets like New York, London and Hong Kong are just a few locations where investors trade the metal. London is seen as the center of physical silver trade, while the COMEX division of the CME Group's (NASDAQ:CME) New York Mercantile Exchange, called the NYMEX, is where most paper trading is done.

There are two popular ways to invest in silver. The first is through purchasing silver bullion products such as bullion bars, bullion coins and silver rounds. Physical silver is sold on the spot market, meaning that to invest in silver this way, buyers pay a specific price for the metal — the silver price per ounce — and then have it delivered immediately.

The second is accomplished through paper trading, which is done via the silver futures market, with participants entering into futures contracts for the delivery of silver at an agreed-upon price and time. In such contracts, two positions can be taken: a long position to accept delivery of the metal or a short position to provide delivery.

Paper trading might sound like a strange way to get silver exposure, but it can provide investors with flexibility that they wouldn’t get from buying and selling bullion. The most obvious advantage is perhaps the fact that trading in the paper market means silver investors can benefit long term from holding silver without needing to store it. Furthermore, futures trading can offer more financial leverage in that it requires less capital than trading in the physical market.

Market participants can also invest in silver through exchange-traded funds (ETFs). Investing in a silver ETF is similar to trading a stock on an exchange, and there are several silver ETFs to choose from. Some ETFs focus on physical silver bullion, while others focus on silver futures contracts. Still others focus on silver stocks or follow the live silver price.

What is silver's all-time high price?

The silver all-time high was US$121.62, which it set on January 29, 2026.

The silver price has continued its rally into 2026, gaining 70 percent in January alone as of its new high.

Silver's strong performance has been driven by a variety of factors, including widespread geopolitical uncertainty, a weak US dollar, speculation around US Federal Reserve interest rate cuts and increased investor interest. We break down the news driving its price performance and new highs in the section below.

After opening 2025 at US$30, silver's bull run in 2025 saw the white metal gain more than 279 percent at its highest point.

Prior to October 9, 2025, silver's all-time high had been the same for 45 years at US$49.95, and it was set on January 17, 1980.

It's worth unpacking what happened, because the price didn’t exactly reach that level by honest means.

As Britannica explains, two wealthy traders called the Hunt brothers attempted to corner the market by buying not only physical silver, but also silver futures — they took delivery of those silver futures contracts instead of taking legal tender in the form cash settlements. Their exploits ultimately ended in disaster: On March 27, 1980, they missed a margin call and the silver market price plunged to US$10.80. This day is infamously known as Silver Thursday.

That record silver price wouldn’t be tested again until April 2011, when it reached US$47.94. This was more than triple the 2009 average silver price of US$14.67, with the price uptick coming on the back of very strong investment demand.

So what happens next? While silver has officially broken its 1980 peak, it is still well below that price point adjusted for inflation, but its rise above US$71 has officially topped its inflation-adjusted peak from 2011.

It remains to be seen just how high silver can go.

Silver's price performance in 2025 and 2026

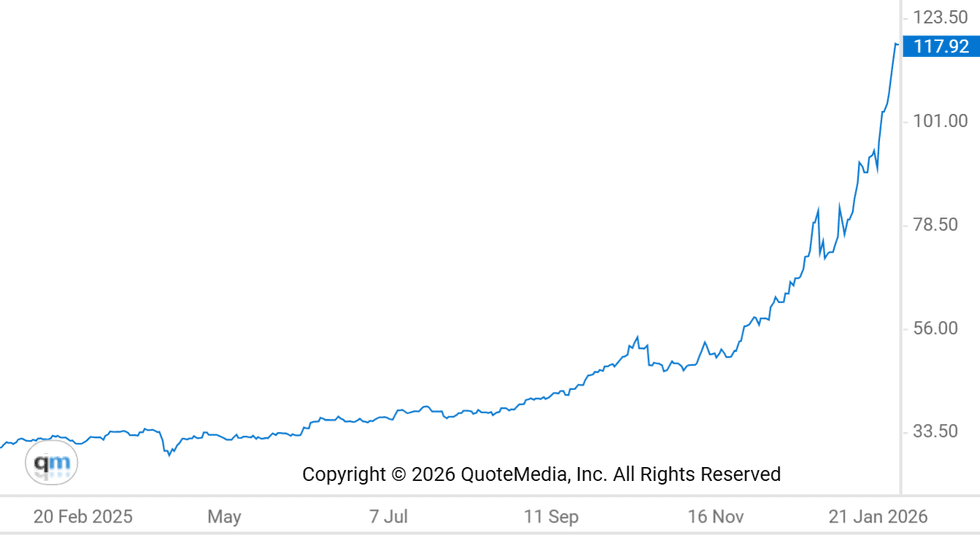

Silver price chart, January 28, 2025, to January 28, 2026.

Chart via the Investing News Network.

The silver price experienced a momentum shift at the start of 2025, breaking through the US$30 barrier as early as January 5, and reaching US$31.31 by January 29. The metal continued to post gains through much of February and March, climbing to US$32.94 on February 20 and then peaking at its quarterly high of US$34.21 on March 28.

Following Trump's tariff announcements on April 2, silver slumped to below US$30. While the Trump administration’s tariff policies have been largely beneficial for safe-haven assets like precious metals, there were concerns that the threat of tariffs could weaken industrial demand, which could cool price gains in the silver market.

Yet those concerns were pushed to the back burner as recent economic and geopolitical events have raised analysts’ expectations of a September rate cut by the Fed. The benchmark rate has not changed since November 2024.

On June 5, the silver price rose to a 13 year high of US$36.05 in early morning trading, before retreating toward the US$35.50 mark. By June 16, the white metal had broken through the US$37 mark for the first time since May 2011.

In July, increasing geopolitical strife in the Middle East and Russia-Ukraine coupled with a positive outlook for China’s solar power industry proved price positive for both silver’s precious metals and industrial angles.

The silver price overtook the US$39 level to reach US$39.24 on July 22.

These same forces, coupled with the nearly unanimous rate cut expectations, launched the price of silver to over US$40 on August 31 for the first time since 2011, and by September 3 it had climbed as high as US$41.45. Silver continued climbing through September, progressively breaking level after level to top US$47 by the month's end.

The white metal broke its all-time highs in most currencies, including Canadian dollars and Australian dollars, on September 22. Silver started Q4 by continuing its ascent, breaking through its 2011 peak and topping US$48 on October 3, before climbing above US$51 to beat its US dollar high on October 9.

It continued climbing even higher on the safe-haven demand fundamentals behind its 2025 momentum. Helping drive that demand in October was escalating trade tensions between the US and China, leading to export controls on additional rare earth metals by China and threats of 100 percent tariffs on Chinese imports by the US.

While silver pulled back to around US$48 in late October, news that the US government shut down had come to an end on November 9 drove the silver price back above US$50.

Silver's foray above the US$56 level on November 28 came on the back of an outage at the Comex, where trading was briefly halted due to a "cooling issue" at a CyrusOne data center used by the exchange.

Silver continued even higher through early December, and on December 10 it broke above US$60 for the first time, alongside the Fed deciding to once again cut interest rates. Less than two weeks after breaking US$60, the silver price passed US$70 on December 23 as investors continued piling in and the situation between the US and Venezuela ramped up. On December 28, silver started the week by breaching US$83 on surging interest in China.

To start the final week of December, silver broke through US$80 and hit a 2025 peak of US$83.90 on December 28. However, over the following day, silver and its fellow precious metals pulled back significantly.

2026 has just begun, but it's already brought a slew of positive price drivers for silver. Geopolitical concerns remain front and center, and US-global relations were a significant talking point as leaders from global governments and businesses met in mid-January at the World Economic Forum in Davos, Switzerland.

Trump's push to take control of Greenland has added pressure between the US and Europe in recent weeks. He threatened to add tariffs on eight of the European countries that opposed the move, but changed his tune at the World Economic Forum on January 21, saying he would not use force to take Greenland and backing down on tariffs.

A significant silver surge from US$80 on January 12 to over US$93 by January 14 came in the days after the US Department of Justice launching a criminal probe into Fed Chair Jerome Powell.

Powell said the threat of charges is a consequence of the Fed not lowering rates as quickly as the Trump administration prefers, and instead setting them based on evidence and economic conditions.

News on January 22 that Trump is suing JPMorgan Chase (NYSE:JPM) and its CEO Jamie Dimon also ramped up market tension. The lawsuit alleges that the firm closed accounts belonging to Trump and related entities in early 2021 for political reasons, with Trump saying that Dimon "debanked" him. Silver broke through US$100 for the first time on January 23.

Kicking off the week of January 26, silver and gold both rose higher on a number of factors. Trump is continuing his tariff spat with Canada, this time over a deal with China. The US Senate is in a gridlock over Department of Homeland Security funding that threatens to result in another US government shutdown. Additionally, the US dollar weakened on signs the Federal Reserve is stepping in to ease volatility for the Japanese yen.

On January 28, silver set its newest high as the Fed decided to maintain interest rates and Trump considers military airstrikes on Iran targeting its leaders responsible for mass-killings of civilian protestors, on nuclear sites and on government institutions, CNN reported.

Silver supply and demand dynamics

Like the prices of other metals, the silver spot price is most heavily influenced by supply and demand dynamics. However, as the information above illustrates, the silver price can be highly volatile. That's partially due to the fact that the metal is subject to both investment and industrial metal demand within global markets.

In other words, it’s bought by investors who want it as a store of wealth, as well as by manufacturers looking to use it for different applications that are incredibly varied. For example, silver has diverse technological applications such as batteries, solar panels, microchips and catalysts, but it’s also used in medicine and in the automotive industry.

In terms of supply, the world’s three top producers of the metal are Mexico, China and Peru. Even in those countries silver is usually a by-product — for instance, a mine producing primarily gold or lead might also have silver output.

The Silver Institute's latest World Silver Survey, put together by Metals Focus, outlines a 0.9 percent increase in global mine production to 819.7 million ounces in 2024. This was in partly the result of a return to operations at Newmont's (TSX:NGT,NYSE:NEM,ASX:NEM) Peñasquito mine in Mexico following a suspension of activity brought about by strike action among workers and improved recoveries out of Fresnillo (LSE:FRES,OTC Pink:FNLPF) and MAG Silver's (TSX:MAG,NYSEAMERICAN:MAG) Juanicipio. Silver output also increased in Australia, Bolivia and the US.

The firm is forecasting a 1.9 percent rise in global silver mine production to 823 million ounces in 2025. Much of that growth is expected to come out of Mexico, and it is also projecting output will rise in Chile and Russia. Lower production from Australia and Peru will offset some of these gains.

Looking at demand, Metals Focus sees growth in 2025 flatlining as industrial fabrication takes a hit from the global tariff war. This could be tempered by an anticipated rebound in demand from physical investment in silver bars and coins.

The silver market is expected to experience a substantial deficit of 117.6 million ounces in 2025, amounting to the sixth straight year of supply shortage for the metal.

Is the silver price manipulated?

As a final note on silver, it’s important for investors to be aware that manipulation of prices is a major issue in the space.

For instance, in 2015, 10 banks were hit in a US probe on precious metals manipulation. Evidence provided by Deutsche Bank (NYSE:DB) showed “smoking gun” proof that UBS Group (NYSE:UBS), HSBC Holdings (NYSE:HSBC), the The Bank of Nova Scotia (TSX:BNS) and other firms were involved in rigging silver rates from 2007 to 2013. In May 2023, a silver manipulation lawsuit filed in 2014 against HSBC and the Bank of Nova Scotia was dismissed by a US court.

JPMorgan Chase & Co. (NYSE:JPM) has been long at the center of silver manipulation claims as well. For years the firm has been in and out of court for the accusations. In 2020, JPMorgan agreed to pay US$920 million to resolve federal agency probes regarding the manipulation of multiple markets, including precious metals.

In 2014, the London Silver Market Fixing stopped administering the London silver fix, which had been used for over a century to fix the price of silver. It was replaced by the LBMA Silver Price, which is run by ICE Benchmark Administration, in a bid to increase market transparency.

Market watchers like Ed Steer have said that the days of silver manipulation are numbered, and that the market will see a significant shift when the time finally comes.

Investor takeaway

Silver's new all-time highs have brought the metal into uncharted territory, and as momentum continues for the silver price in 2026 investors are wondering how high it could go.

It is worth keeping in mind that silver has yet to break its inflation-adjusted high; considering its previous peaks can offer investors a look into how silver's gains in 1980 and 2011 stack up to its run in 2025 and 2026.

While it's impossible to know for sure what's next for silver, keeping an eye on the factors driving its performance, including gold's performance, geopolitics, the economy and industrial demand, will help investors make decisions on when to buy and sell.

Additionally, keeping up-to-date on what precious metals experts are predicting for gold and silver in INN's expert interviews and 2026 silver forecast can help investors stay on top of the market.

This is an updated version of an article first published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Lauren Kelly, currently hold no direct investment interest in any company mentioned in this article.