Drill Tracker Weekly: NuLegacy Intersects Highest-grade Gold to Date at Iceberg Project

NuLegacy recently announced results from the first six of 24 diamond drill holes on its Iceberg property in Nevada. Here, geologist Wayne Hewgill weighs in.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

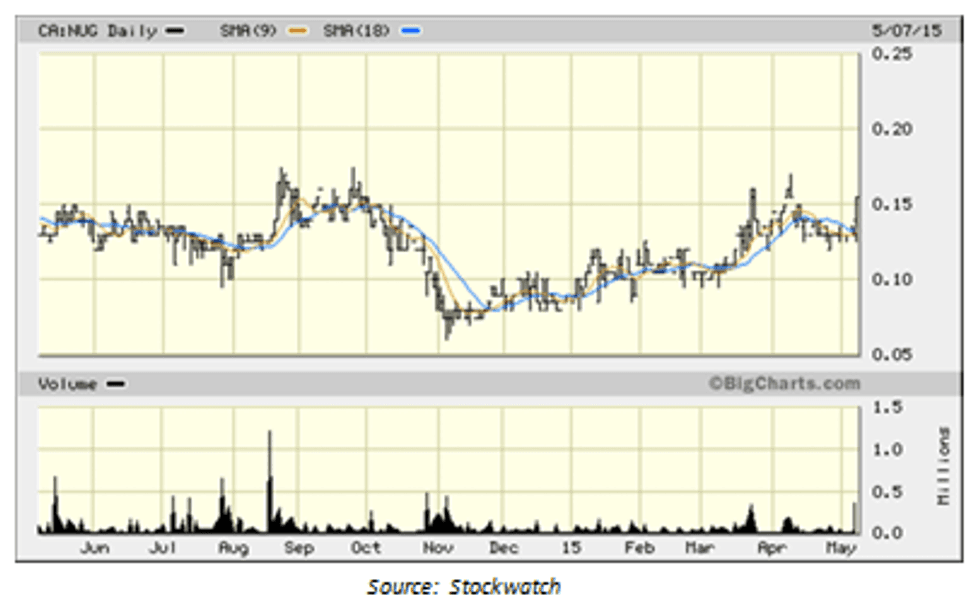

NuLegacy Gold (TSXV:NUG)

Price: $0.155

Market cap: $21 million

Cash estimate: $2.7 million

Project: Iceberg

Country: Nevada, US

Ownership: Option to earn 70 percent

Resources: N/A

Project status: Exploration

- NuLegacy announced the first six of 24 diamond drill holes on its Iceberg property on the Cortez gold trend in Nevada. The property is located 4 kilometres to the southwest of Barrick Gold’s (TSX.ABX) recently discovered 15 million ounce Goldrush deposit. NuLegacy optioned the project from Barrick in 2010 the year prior to Barrick’s discovery of the high-grade mineralization in 2012. To earn a 70% interest in the project, the Company has $1.3 million in expenditures remaining of the initial $5.0 million commitment. Upon earning the 70% interest, Barrick may choose to fund an additional $15 million to back into a 70% interest thus reducing NuLegacy’s interest to 30%. NuLegacy will then be carried to production.

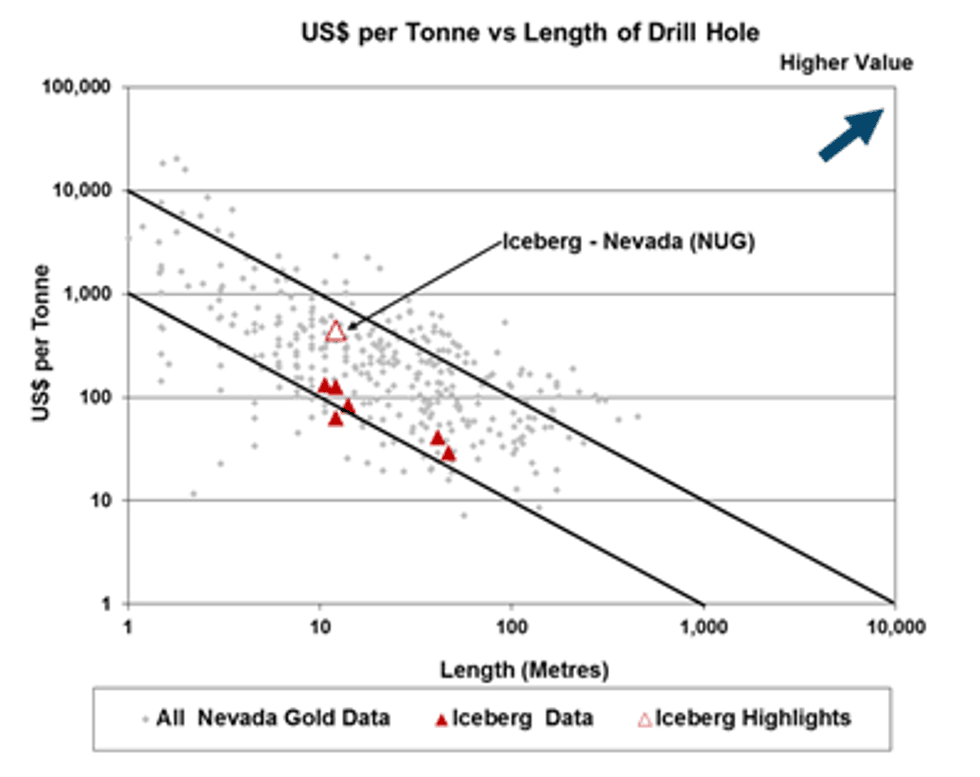

- Highlights of the current drilling in the North Zone include 41.2 metres grading 3.9 g/t Au starting at a depth of 97 metres including 4.6 metres of 25.2 g/t Au. The mineralization is hosted within silicified and oxidized sediments in the same Wenban stratigraphic unit that hosts the Goldrush deposit. In 2014, the Company drilled a limited number of diamond drill holes on the property to better understand the geology. Prior to this drilling the core was reverse circulation drilling, which while more cost effective in the short term, returns small chips rather than drill core making the geological interpretation more difficult. The Company believes that the core drilling has allowed for more accurate targeting high-grade zones based on lithology and structure commonly seen at Goldrush and other Carlin type deposits.

- The Cortez Trend hosts over 50 million ounces in three deposits (Pipeline, Cortex Hill and Goldrush) over a strike length of 20 kilometres occurring as en echelon type Carlin gold deposits related to anticlinal folds. Barrick currently has 9 drill rigs on the Goldrush property and a $80 million 2015 budget

- While the Company has yet to complete a 43-101 complaint resource (or a 43-101 Technical Report) they have announced an exploration target of 90 to 110 million tonnes grading 0.9 to 1.1 g/t Au. The estimate is qualified as being “conceptual in nature and it is uncertain if further exploration will result in a resource being defined”.

- Results from the next six holes in progress at Iceberg are expected in June.

Discovery (June 2012): Explored by Homestake in 1980′s; 2.74 metres @1.40 g/t Au

Current drilling: 41.2 metres @3.91 g/t Au including: 4.6 metres @ 25.21 g/t Au; 51.8. 51.8 metres @ 0.52 g/t Au

Risks Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

1. The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies: Fission Uranium Corp. (TSX.FCU), Roxgold Inc (TSX:ROG).

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.