Sabina Releases Positive Feasibility Study for Back River Gold Project in Nunavut

Sabina Gold & Silver released a feasibility study for its Back River gold project in Nunavut on Wednesday. The project has the potential to produce an average of 350,000 ounces of gold per year over a 10-year mine life.

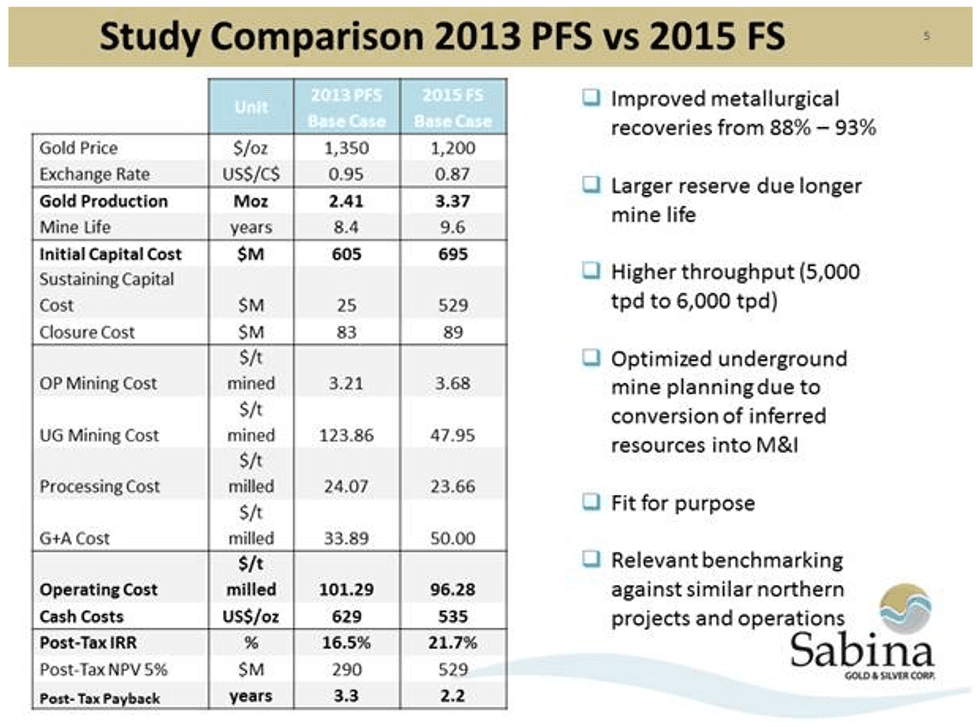

Sabina Gold & Silver (TSX:SBB) released a feasibility study for its Back River gold project in Nunavut on Wednesday, basing it on a relatively conservative gold price of $1,200 per ounce and a Canadian exchange rate of $0.87.

A mineral resource estimate done for Back River last October points to measured and indicated reserves of 5.3 million ounces at 5.7 g/t gold, plus an additional 1.9-million-ounce inferred resource at 7.4 g/t gold. That’s a total of over 7 million ounces. According to the feasibility study, the project has the potential to produce an average of 350,000 ounces of gold per year over a 10-year mine life; output should average 413,000 ounces of gold during the first four years of production.

Meanwhile, Back River’s post-tax IRR clocks in at 21.7 percent, and it has a post-tax NPV of $535 million. The project is expected to generate life-of-mine, post-tax net cash flow of $914 million on gross revenues of $4.5 billion with a 2.2-year payback period.

All in all, the numbers in the feasibility study have improved in various ways compared to a 2013 prefeasibility study. Expanding, Bruce McLeod, president and CEO of Sabina, said during a conference call, “when compared to our previous studies, the feasibility provides for improved economics, even using the lower gold price.”

He added, “we’ve also benchmarked the study against relevant northern mining operations and projects and believe that this is a sound feasibility that demonstrates the potential of Back River to be a significant Canadian gold producer.”

Image courtesy of Sabina Gold & Silver (note: cost shows 25 under 2013 PFS, but is actually 325).

Money matters

But while the Back River feasibility study offers strong economic results, initial capex of C$695 million is a little steep. As the company states in Wednesday’s release, “financing such a project in current market conditions would be challenging.”

Luckily, JDS Energy & Mining, which prepared the feasibility study, has identified a smaller-throughput, higher-grade, lower-capex startup operation. That option “would require less initial capital which in these markets may enhance shareholder value,” according to Sabina. The company also said, “[t]his high level, while very preliminary and not to be relied upon, showed the potential for project scalability targeting a CAPEX in the $300 million range and production of approximately 150,000 – 200,000 ounces of gold annually for over 10 years.”

JDS has recommended that further work be undertaken to evaluate this lower-cost project, which may be easier to finance.

That said, it’s worth noting that while the higher-throughput project may be difficult to finance, it isn’t impossible, and may garner interest from larger companies looking to acquire Sabina. Investors will likely be keeping an eye out for what Sabina plans to do next, and if further work will be put into the lower-capex study.

By end of day Thursday, Sabina’s share price was up 11.69 percent at $0.43.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

Gold Price Hits Five-week High on Lackluster US Jobs, Retail Data