Gold Price Hits Five-week High on Lackluster US Jobs, Retail Data

Investors let out a sigh of relief last Friday when US jobs data revealed only a small gain in employment across the country. The news gave the gold price a nice boost, and on Wednesday, the yellow metal saw another jump when news hit that US retail sales for April were unmoved.

On Wednesday, the yellow metal saw another jump when news hit that US retail sales for April were unmoved; they’ve now been either down or flat in four out of five months, and the news has reignited fears that the nation’s economy has yet to recover.

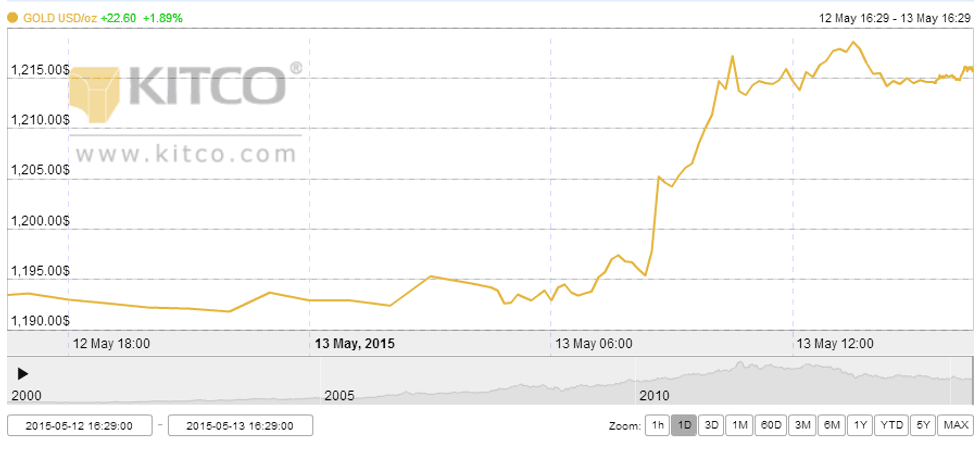

Specifically, spot gold hit a five-week high of $1,219.90 per ounce during the day and was trading up 1.92 percent, at $1,216.90, by 4:30 p.m. EST. Meanwhile, COMEX gold futures for June delivery rose 2.2 percent, to $1,218.20 — that’s their highest level since April 6.

Spot gold price, May 12 to 13, 2015. Chart courtesy of Kitco.

US data in depth

As mentioned, poor retail sales data indicates that the US economy isn’t in the best place. What’s perhaps most interesting about the data, however, is that some market watchers believe it should be better. After all, even with April’s poor jobs data, overall there has been a steady increase in job creation lately, and coupled with lower gas prices, that should translate into increased consumer spending.

“The disappearance of consumer spending in early 2015 has now become even more mysterious, as some of the excuses shopped around earlier, like bad weather, are looking more stretched with the passage of time,” Paul Ashworth, chief US economist at Capital Economics, told The Wall Street Journal.

Uncertainty or not, the data, coupled with last week’s less-than-stellar US jobs data and a dive in the US dollar, has raised uncertainty about when exactly an interest rate increase will occur.

“Those retail sales numbers in April were poorer than expected,” Tai Wong, director of commodity products trading at BMO Capital Markets in New York, told Bloomberg. “The market may now start to reconsider if even September will be a sure thing for a rate hike.”

Rising energy costs have also contributed to gold’s price increase, with WTI crude oil for June delivery reaching over $60 per barrel and stirring up inflation concerns in the process.

Company news

Gold companies have also been having a positive week, with a couple posting promising first-quarter financial results. One example is Klondex Mines (TSX:KDX,OTCQX:KLNDF), which reported net income of $10.1 million, or $0.08 per share, on Tuesday.

McEwen Mining (TSX:MUX,NYSE:MUX) also saw a financial gain in the first quarter, posting net income of $6 million.

There was also a fair amount of M&A activity in the gold space this week, with First Mining Finance (TSXV:FF) entering a definitive arrangement agreement to acquire Coastal Gold (TSXV:COD). Newmarket Gold (TSXV:NGN) also made a big move when it agreed to merge with Crocodile Gold (TSX:CRK) to create “a new gold industry consolidator solidly positioned to acquire high quality gold assets in the world’s best mining jurisdictions.”

Finally, Kapuskasing Gold (TSXV:KAP) commenced a summer drill program at the Borden North property in Ontario.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

Gold Prices See Another Boost on US Trade Deficit and Oil Price Gains

Gold Price at Three-week Low as US Housing Market Gains Strength