April 01, 2024

Global Oil & Gas Ltd (ASX:GLV) (Global or the Company) is pleased to provide an update on exploration activities on its (80% held) 4,585km2 Tumbes Basin Technical Evaluation Agreement (TEA or block) offshore Peru.

Highlights

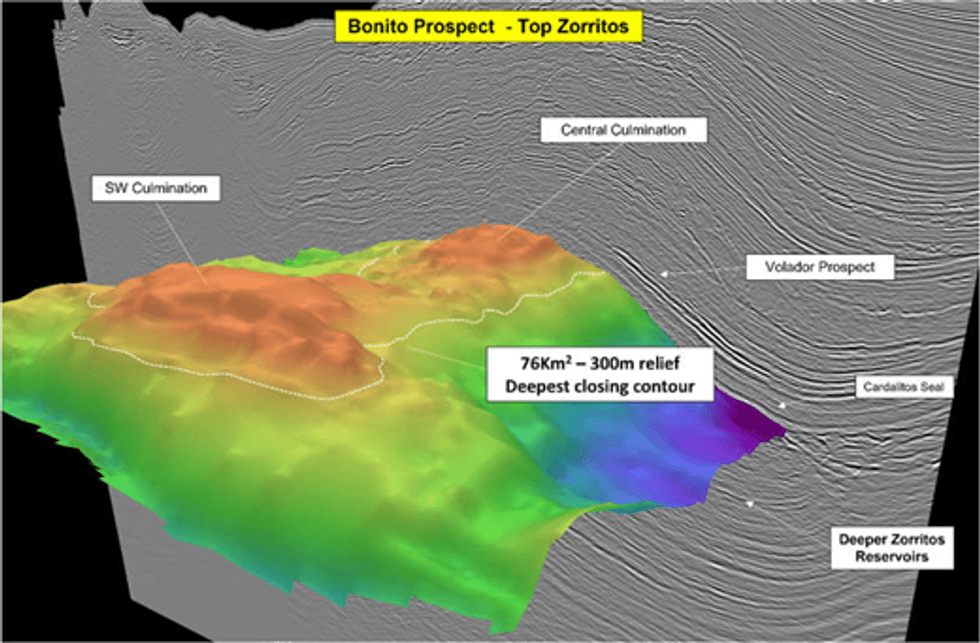

- Additional deeper stacked targets identified in the proven oil-bearing Zorritos Formation represents significant upside for the Bonito Prospect

- Deeper targets proven in adjacent producing oil fields evident on seismic data at Bonito

- Reprocessing of 3D seismic data over Bonito area is well advanced

- Prospective Resource estimates will incorporate reprocessed seismic data and deeper targets

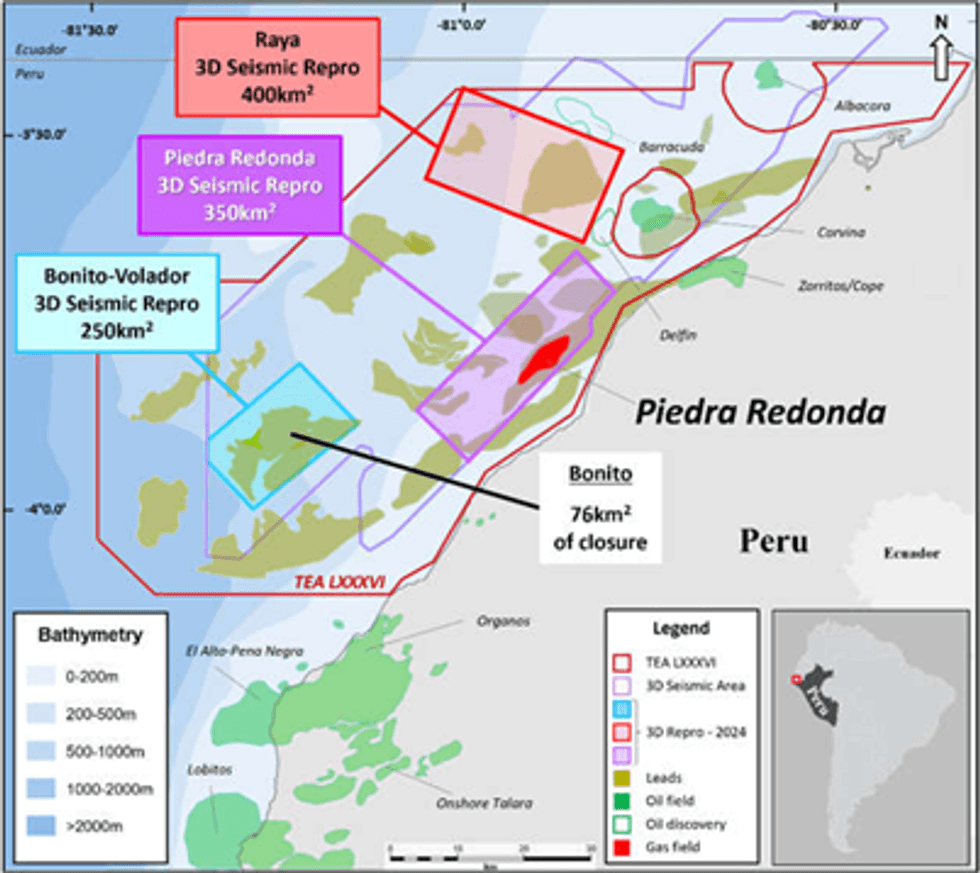

The block incorporates over 3,800km2 of existing 3D seismic data which the Company is currently reviewing; with an aggregate of 1,000km2 currently prioritised and undergoing reprocessing and interpretation across three discrete highly prospective areas (one of which includes the Bonito Prospect) (see Figure 2). Reprocessing will include pre-stack depth migration (PSDM) work across each of the three areas.

The Bonito Prospect was first identified in the early 2000s. Previous Operators focussed exclusively on the Upper Zorritos reservoir demonstrating that it had potential to contain significant hydrocarbon volumes.

However, deeper Zorritos Formation reservoirs have also been identified and proven in discoveries and other wells drilled in the Tumbes Basin, as demonstrated by production from the Lower Zorritos Formation in the Albacora field, as well as pay zones identified in the Delfin discovery and non-pay reservoirs identified in the Piedra Redonda gas field (Figure 3). Further, intra-formational seals identified within the Zorritos Formation in the Delfin discovery, suggest that the Lower Zorritos levels possess genuine potential as independent targets.

At the Upper Zorritos level the faulted three-way dip closure trapping geometry at Bonito measures 76km2 with approximately 300m of vertical relief. Should the lower Zorritos levels prove viable, the additional vertical relief of the stacked reservoirs could be substantial.

Seismic reprocessing of the Bonito area (250km2) is well underway and will result in improvements in data quality that will facilitate precise depth mapping and enhance lithology and fluid discrimination.

It is anticipated that a Prospective Resource estimate for the Bonito Prospect incorporating the reprocessed seismic data and the newly identified deeper targets will be released once completed and additional work undertaken to mature Bonito to drill-ready status.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00