As the EV battery sector continues to evolve, exploration companies are increasingly playing a crucial role in the value chain.

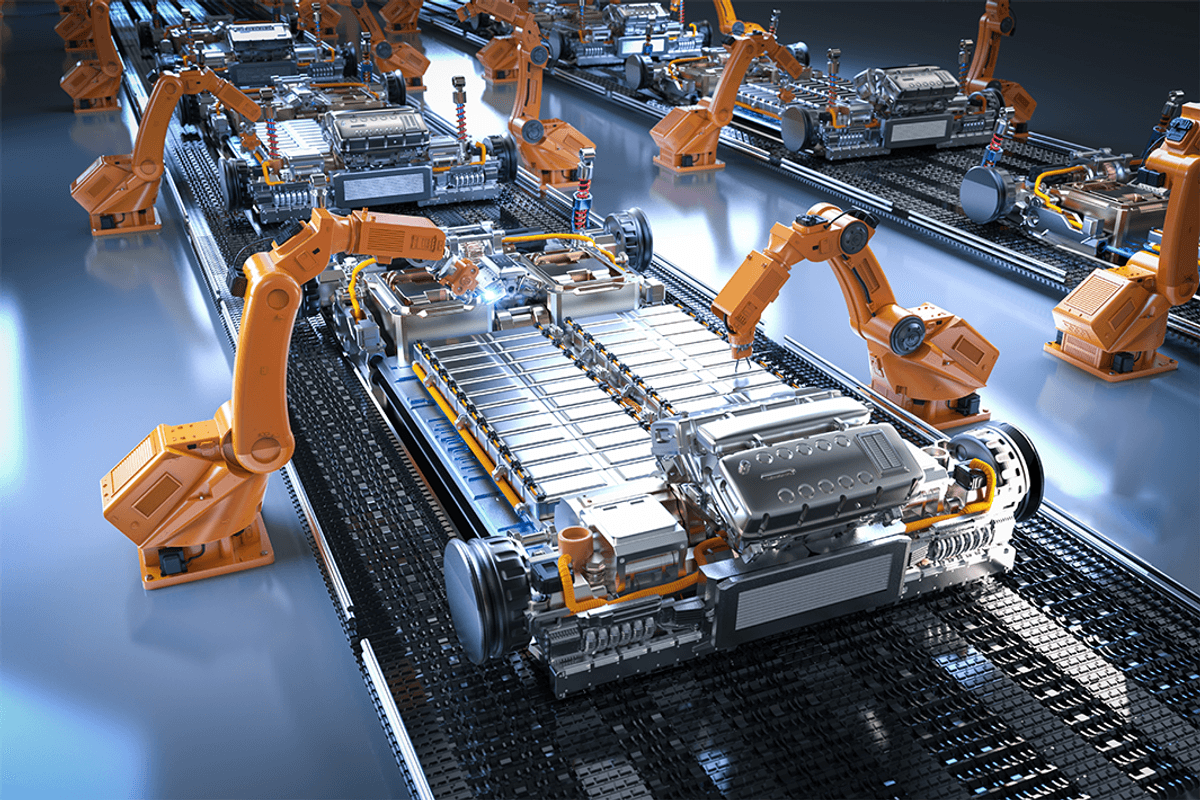

As governments redouble their sustainability efforts, demand for electric vehicles (EVs) is expected to increase exponentially. To serve this anticipated growth, battery manufacturers are constructing scores of factories and gigafactories. The US alone hosts over 30 such facilities, with some operational and others still under construction.

By 2030, battery manufacturing capacity in North America is projected to be at least 20 times greater than in 2021. That's assuming global production capacity for critical minerals and battery metals such as lithium can keep pace. Unfortunately, that's not happening at the moment.

There's a supply gap that's growing progressively larger than demand. To secure the raw materials they need, companies within the downstream value chain are becoming more vertically integrated.

Understanding the changing dynamic between battery manufacturers, automakers and senior mining companies is essential for investors looking to invest in the EV battery market.

Growing capacity concerns

Historically, both North America and Europe have relied heavily on China for almost everything, from lithium mining to battery manufacturing. Due to concerns about supply chain stability, sustainability and ethical production, governments in both regions are now seeking to end that reliance. Measures like the US Inflation Reduction Act include incentives such as a US$35 per kilowatt hour tax credit for battery cell production capacity.

Additionally, in early December 2023, the US government introduced new legislation to restrict the domestic sale and distribution of Chinese-made batteries.

The guidelines, released jointly by the US Department of the Treasury, the US Department of Energy and the Internal Revenue Service, name several foreign entities of concern. Vehicles constructed with components sourced from foreign entities of concern are ineligible for any EV tax incentives. Beginning in 2025, this mandate will extend to raw materials as well.

This has created a surge in domestic investment. Alongside battery makers, companies such as BMW (ETR:BMW), General Motors (NYSE:GM), Ford (NYSE:F) and Tesla (NASDAQ:TSLA) have committed to investing nearly US$100 billion in US-based battery and module manufacturing. This is in addition to the US$430 billion pledged by the US government.

Roughly US$15 billion was invested into US gigafactories from July to August 2023. Benchmark Mineral Intelligence notes that this investment alone is enough to build more than the country's entire current production capacity. Currently, the US has an annual production capacity of roughly 60 gigawatt hours.

Canada has seen its share of investment as well. Most recently, Swedish battery maker Northvolt signed a deal to construct a C$7 billion battery cell factory near Montreal, Quebec. The Canadian government committed C$2.7 billion toward the project's construction, in addition to production incentives of up to C$4.6 billion.

Canada's government has also pledged support for two additional battery projects, with the total cost of provincial and federal support reaching C$43.6 billion.

Partnership-based battery value chain

Provided all projects proceed as scheduled, analysts are sounding the alarm for a worldwide lithium shortage as early as 2025. Lithium producer Albemarle (NYSE:ALB) expects that by 2030, global lithium demand could exceed supply by up to 500,000 metric tons. Battery manufacturers may also have to contend with shortages of other materials, such as graphite and phosphorus.

What this means is that the price of raw materials will continue to climb, potentially reaching a point where companies will have to buy them at a loss — provided they can purchase anything in the first place. Automakers and battery manufacturers will need to establish their own direct supply. Vertical integration may soon be the only way to remain competitive in the EV market.

The problem isn't that mining and exploration companies aren't making an effort to address the supply shortage. They simply aren't moving fast enough. The lithium market especially is overflowing with incomplete, stalled and/or delayed projects.

By establishing supply partnerships with exploration companies, automakers and battery manufacturers are taking matters into their own hands — to the benefit of all involved. The exploration company gains access to the funding it needs for discovery, development and operation. The battery manufacturer establishes its own source of materials, eliminating the need to rely on fluctuating market prices. The automaker gains a similar benefit, with ready access to components for its vehicles.

And for investors, the deals could generate considerable returns.

The future of EV battery production

While there are some notable supply partnerships between senior mining companies and vehicle manufacturers, such as Tesla and Vale (NYSE:VALE), the exploration sector can also offer some lucrative propositions.

Investing in exploration can potentially grant a company exclusive access to incredibly promising deposits. For example, Chariot Corporation's (ASX:CC9) flagship Black Mountain project has had early surface samples indicating lithium grades of up to 6.68 percent, while its Resurgent project represents the second largest land position in the lithium-rich McDermitt Caldera in Nevada.

As the holder of the largest land position for lithium exploration in the US, it’s only a matter of time before Chariot catches the eye of a battery manufacturer or automaker for potential deals.

Such partnerships can add to a growing list of prominent joint ventures and supply agreements already underway.

Liontown Resources (ASX:LTR,OTC Pink:LINRF) has an agreement with Tesla that promises a third of its production capacity to the company, in addition to offtake agreements already in place with LG Energy Solution (KRX:373220) and Ford. Lithium Americas (NYSE:LAC), meanwhile, will receive a US$650 million equity investment from General Motors to develop its Thacker Pass mine. Finally, European junior mining and exploration company Vulcan Energy Resources (ASX:VUL,OTC Pink:VULNF) has lithium supply agreements with Volkswagen (OTC Pink:VLKAF,FWB:VOW), Renault (EPA:RNO) and Stellantis (NYSE:STLA), as well as offtake agreements with Umicore (EBR:UMI) and LG Energy Solutions.

Investor takeaway

We can expect to see a considerable increase in EV battery manufacturing capacity over the next several years. This growth is expected to strain already limited supplies of critical raw materials such as lithium. By establishing supply agreements with mineral exploration companies, automakers and battery manufacturers not only gain access to the resources they need to stay operational, but also help address ongoing shortages.

That's very good news for investors, as it means more capital is likely soon to come.