What Was the Highest Price for Copper?

Copper prices have been trending higher in recent years. Find out the highest price for copper, why the red metal hit that point and the factors driving copper in the years to come.

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.

With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global economic health, earning the red metal the moniker “Dr. Copper.” Rising prices tend to signal a strong global economy, while a significant longer-term drop in the price of copper is often a symptom of economic instability.

After bottoming out at US$2.17 per pound, or US$5,203.58 per metric ton (MT), in mid-March 2020, copper has largely been on an upward trajectory.

Why is copper so expensive in 2026? Higher copper prices over the past few years have largely been attributed to a widening supply/demand gap. Copper mining and refining activities simply haven’t kept up with the rebound in economic activity in recent years, and rising demand from AI infrastructure and electrification are raising demand even higher.

Now, global copper mine supply is tightening at a time when US President Donald Trump's tariffs are placing further strains on copper supply. In response, copper prices hit multiple new records in 2025 and 2026.

But what was the highest price for copper? The Investing News Network (INN) will answer that question, but first, let’s take a deeper look at what factors drove the price of copper higher, as well as historical movements in the price of copper.

In this article

What key factors drive the price of copper?

Robust demand has long been one of the strongest factors driving copper prices. The ever-growing number of copper uses in everyday life — from building construction and electrical grids to electronic products and home appliances — make it the world’s third most-consumed metal.

Copper’s anti-corrosive and highly conductive properties are why it’s the go-to metal for the construction industry, and it's used in products such as copper pipes and copper wiring. In fact, construction is responsible for nearly half of global copper consumption. Rising demand for new homes and home renovations in both Asian and Western economies is expected to support copper prices in the long term.

In recent decades, copper price spikes have been strongly tied to rising demand from China as the economic powerhouse injects government-backed funding into new housing and infrastructure. Industrial production and construction activity in the Asian nation have been like rocket fuel for copper prices.

Additionally, copper’s conductive properties are increasingly being sought after for use in renewable energy applications, including thermal, hydro, wind and solar energy.

However, the biggest driver of copper consumption in the renewable energy sector is rising global demand for electric vehicles (EVs), EV charging infrastructure and energy storage applications. As governments push forward with transportation network electrification and energy storage initiatives as a means to combat climate change, copper demand from this segment is expected to surge.

New energy vehicles use significantly more copper than internal combustion engine vehicles, which only contain about 22 kilograms of copper. In comparison, hybrid EVs use an average of 40 kilograms, plug-in hybrid EVs use 55 kilograms, battery EVs use 80 kilograms and battery electric buses use 253 kilograms.

In 2025, EV sales worldwide increased by 20 percent over 2024 to come in at about 20.7 million units, and analysts at Rho Motion expect that trend to continue in the coming years despite some headwinds in the near-term.

On the supply side of the copper market, the world’s largest copper mines are facing depleting high-grade copper resources, while over the last decade or more new copper discoveries have become few and far between. This is a challenging problem considering it can take as many as 10 to 20 years to move a project from discovery to production.

There have also been ongoing production issues at copper mines over the past few years. In late 2023, First Quantum Minerals (TSX:FM,OTCPL:FQVLF) was forced to shut down its Cobre Panama mine by the government following wide-spread protests. Then, in 2025, accidents at Ivanhoe's (TSX:IVN,OTCQX:IVPAF) Kamoa-Kakula mine in Mali and Freeport-McMoRan's (NYSE:FCX) Grasberg mine in Indonesia wiped out hundreds of thousands of metric tons of production.

While all three mines are expected to return to production, it will take time before they reach full capacity and will continue to exacerbate supply deficits in the copper market.

The International Energy Agency (IEA) is forecasting a 30 percent shortfall in the amount of copper needed to meet demand by 2035. “This will be a major challenge. It’s time to sound the alarm,” IEA Executive Director Fatih Birol said.

This has increased the need for end users to turn to the copper scrap market to make up for the supply shortage. Sometimes referred to as “the world’s largest copper mine,” recycled copper scrap contributes significantly to supplying and balancing the copper market.

Eleni Joannides, Wood Mackenzie's research director for copper, told INN by email at the end of 2024 that there is recognition of the underinvestment in copper exploration, but she sees a new dawn emerging for the sector.

“We are seeing signs this could change. Much of the growth over the last five years has come from brownfield expansions rather than greenfield/new discoveries," she said. "Technology will likely help increase the chance of discovery, and broadly I would say that policymakers are now more supportive of mineral exploration as the push to secure critical raw materials supply has moved up the agenda."

Joannides offered some examples of greenfield projects in the pipeline: Capstone Copper’s (TSX:CS,OTC Pink:CSCCF) Santo Domingo in Chile, Southern Copper’s (NYSE:SCCO) Tia Maria in Peru and Teck Resources' (TSX:TECK.A,TECK.B,NYSE:TECK) Zafranal in Peru.

How has the copper price moved historically?

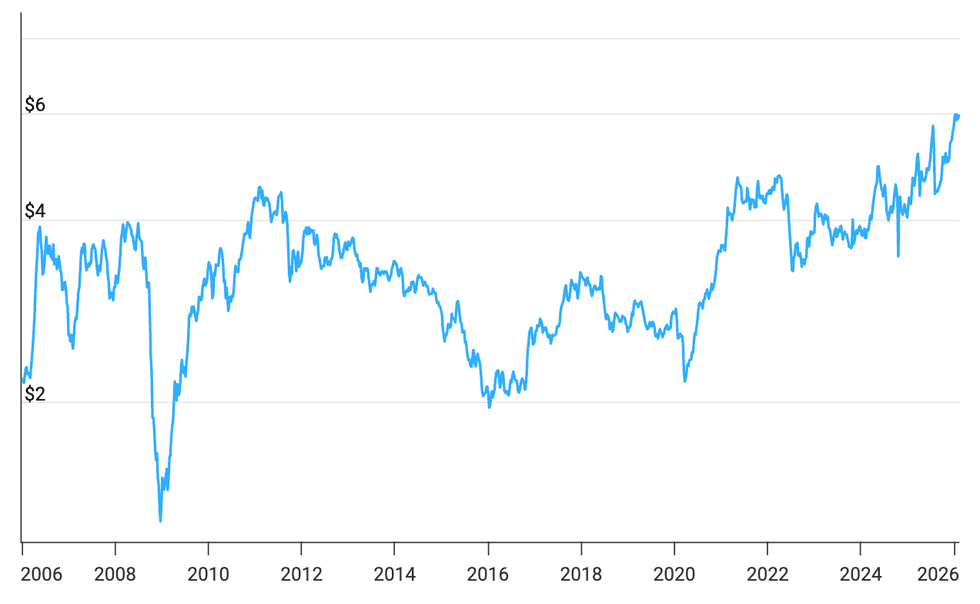

Taking a look back at historical price action, the copper price has had a wild ride for more than two decades.

Sitting at US$1.38 per pound in late January 2005, the copper price followed global economic growth up to a high of US$3.91 in April 2008. Of course, the global economic crisis of 2008 soon led to a copper crash that left the metal at only US$1.29 by the end of year.

Once the global economy began to recover in 2011, copper prices posted a new record high of US$4.58 per pound at the start of the year. However, this high was short-lived as the copper price began a five year downward trend, bottoming out at around US$1.95 in early 2016.

Copper prices stayed fairly flat over the next four years, moving in a range of US$2.50 to US$3 per pound.

20 year COMEX copper price chart, 2006 to 2026.

Chart via Macrotrends.

The pandemic’s impact on mine supply and refined copper in 2020 pushed prices higher despite the economic slowdown. The copper price climbed from a low of US$2.17 in March to close out the year at US$3.52.

In 2021, signs of economic recovery and supercharged interest in EVs and renewable energy pushed the price of copper to rally higher and higher. Copper topped US$4.90 per pound for the first time ever on May 10, 2021, before falling back to close at US$4.76.

Also affecting the copper price at that time was expectations for higher copper demand amid supply concerns out of two of the world’s major copper producers: Chile and Peru. In late April 2021, port workers in Chile called for a strike, while in Peru presidential candidate Pedro Castillo proposed nationalizing mining and redrafting the country’s constitution.

In early May 2021, news broke that copper inventories were at their lowest point in 15 years. Expert market watchers such as Bank of America commodity strategist Michael Widmer warned that further inventory declines into 2022 could lead to a copper market deficit.

After climbing to start 2022 at US$4.52, the copper price continued to spike on economic recovery expectations and supply shortages to reach US$5.02 per pound on March 6. Throughout the first quarter, fears of supply chain disruptions and historically low stockpiles amid rising copper demand drove prices higher.

However, copper prices pulled back in mid-2022 on worries that further COVID-19 lockdowns in China, as well as a growing mortgage crisis, would slow down construction and infrastructure activity in the Asian nation. Rising inflation and interest hikes by the Fed also placed downward pressure on a wide basket of commodities, including copper. By late July 2022, copper prices were trading down at nearly a two year low of around US$3.30.

In the early months of 2023 the copper price was trading over the US$4 per pound level after receiving a helpful boost from continuing concerns about low copper inventories, signs of rebounding demand from China, and news about the closure of Peru's Las Bambas mine, which accounts for 2 percent of global copper production.

However, that boost turned to a bust in the second half of 2023 as China continued to experience real estate sector issues, alongside the economic woes of the rest of the world. The price of copper dropped to a low for the year of US$3.56 per pound in mid October.

Elevated supply levels kept copper trading in the US$3.50 to US$3.80 range for much of Q1 2024 before experiencing strong gains that pushed the price of the red metal to US$4.12 on March 18.

Those gains were attributed to in part to tighter copper concentrate supply following the closure of First Quantum Minerals' Cobre Panama mine, guidance cuts from Anglo American (LSE:AAL,OTCQX:AAUKF) and declining production at Chile’s Chuquicamata mine. In addition, China’s top copper smelters announced production cuts after limited supply led to lower profits from treatment and refining charges.

BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) attempted takeover of Anglo American also stoked fears of even tighter global copper mine supply. These supply-side challenges continued to juice copper prices in Q2 2024, causing a jump of nearly 29 percent from US$4.04 per pound on April 1 to a then all-time high of US$5.20 by May 20, 2024.

After starting 2025 at US$3.99 per pound, copper prices were lifted in Q1 by increasing demand from China’s economic stimulus measures, renewable energy and artificial intelligence (AI) technologies and stockpiling brought on by fear of US President Trump’s tariff threats.

At the time, Trump had said the US was considering placing tariffs of up to 25 percent on all copper imports in a bid to spark increased domestic production of the base metal.

In late February, he signed an executive order instructing the US Commerce Department to investigate whether imported copper poses a national security risk under Section 232 of the Trade Expansion Act of 1962. The price of copper reached a new high price of US$5.24 per pound on March 26 as tariff tensions escalated.

Trump's tariff talk sparked yet another copper price rally in early July when he announced he plans to impose a 50 percent tariff on all imports of the red metal, and it moved higher towards the end of the month in anticipation of them entering effect. By the end of the month, the copper price had climbed to US$5.96 per pound.

However, copper's price plummeted back toward the US$4 mark on July 31 following the reveal that tariffs would not be imposed on imports of raw or refined copper, instead targeting semi-finished copper products.

The price began to rebound once again in September following the accident at Freeport McMoRan's Grasberg mine, ultimately tipping the market from a surplus position into a deficit.

The price crossed back above the US$5 mark by the end of October, and, with supply and demand fundamentals fueling its momentum, copper was trading at US$5.60 by the end of 2025.

What was the highest price for copper ever?

The highest ever copper price on the COMEX is US$6.61 per pound, while the highest LME copper price is US$14,527.50 per metric ton. Copper hit both of these new all-time highs on January 29, 2026, during intraday trading. Read on to find out how the copper price reached those heights.

Why did the copper price hit an all-time high in 2026?

The new copper high on January 29, 2026, resulted from a buying spree driven by speculative trading, primarily out of China amid growing expectations of higher growth in the US economy and an increased global spending on data centers and power infrastructure projects.

That day, copper prices on the LME jumped 11 percent, although the gain had lessened to a 4 percent jump by the close of trading.

Looking at the bigger picture, copper’s rally in recent years has encouraged bullish sentiment on prices looking ahead. In the longer term, the fundamentals for copper are expected to get tighter as demand increases from sectors such as EVs and energy storage.

A May 2024 report from the International Energy Forum (IEF) projected that as many as 194 new copper mines may need to come online by 2050 to support massive demand from the global energy transition.

Additionally, a January 2026 report from S&P Global stated that the world will need 14 million more metric tons of copper annually to meet demand compared to 2025's 27 million MT of copper. The firm reports that supply is expected to peak in 2030 without expansion.

Looking at renewable energy, according to the Copper Development Association, solar installations require about 5.5 MT of copper for every megawatt, while onshore wind turbines require 3.52 MT of copper and offshore wind turbines require 9.56 MT of copper.

The rise of AI technology is also bolstering the demand outlook for copper. Commodities trader Trafigura has said AI-driven data centers could add 1 million MT to copper demand by 2030, reports Reuters.

Where can investors look for copper opportunities?

Copper market fundamentals suggest a return to a bull market cycle for the red metal in the medium-term. The copper supply/demand imbalance also presents an investment opportunity for those interested in copper-mining stocks.

Are there any copper companies on your radar? If you’re looking for some inspiration, head on over to INN's articles on the top copper stocks on the TSX and TSXV, the biggest copper stocks on the ASX, and our list of 27 advanced US copper projects to watch.

If you're looking to diversify your portfolio with other investment options, check out copper ETFS and ETNs or copper futures contracts.

This is an updated version of an article first published by the Investing News Network in 2021.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Copper Price Forecast: Top Trends for Copper in 2026 ›

- Copper Price 2025 Year-End Review ›

- What Factors Affect Copper Supply and Demand? ›

- LME Copper vs. COMEX Copper ›

- When Will Copper Go Up? | INN ›