UBS Made “Clear Attempts” to Manipulate Precious Metals Fixes

UBS has been taken to task for misbehavior at its precious metals spot-trading desk. Meanwhile, First Majestic has released its Q3 results, noting that it’s sold the silver it was holding back.

News surfaced Wednesday that regulators in the US, Britain and Switzerland have fined six banks a total of $4.3 billion for trying to manipulate foreign exchange markets.

The culprits are Citigroup (NYSE:C), JPMorgan Chase (NYSE:JPM), the Royal Bank of Scotland Group (LSE:RBS,NYSE:RBS), HSBC Holdings (NYSE:HSBC), the Bank of America (NYSE:BAC) and UBS (NYSE:UBS), a Bloomberg report states. They were investigated by the US Commodity Futures Trading Commission, the UK Financial Conduct Authority and the Swiss Financial Market Supervisory Authority (FINMA).

In addition, UBS has been taken to task for misbehavior at its precious metals spot-trading desk, which has been part of its foreign-exchange desk since 2008. According to the Financial Times, that’s in contrast to other banks, where precious metals and forex businesses are not closely integrated.

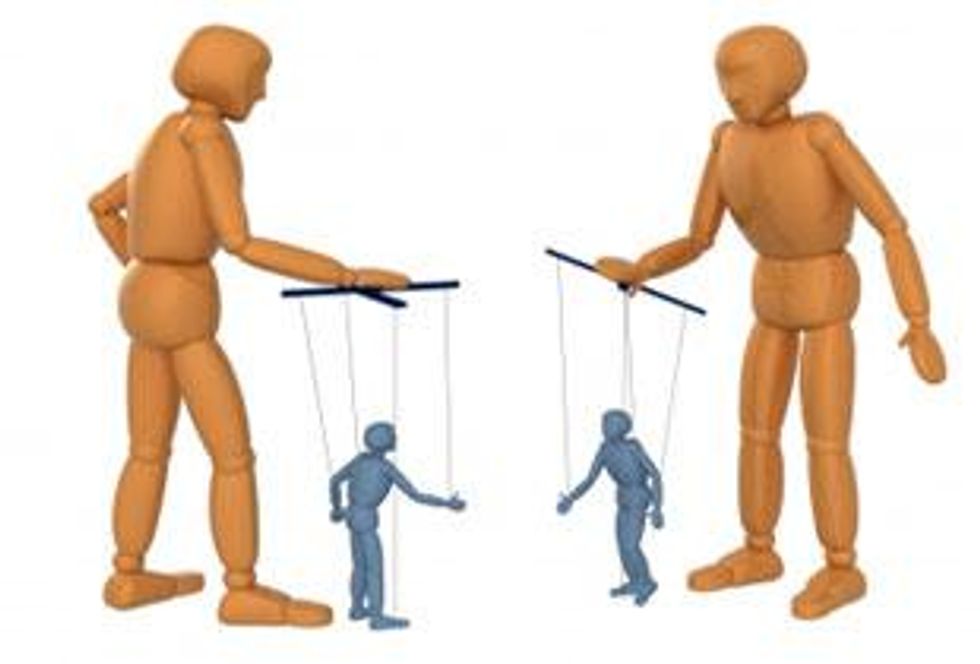

It’s that closeness that seems to have tripped up UBS. A recently published Bloomberg Businessweek article quotes Mark Branson, FINMA’s CEO, as saying, “[t]he behavior patterns in precious metals were somewhat similar to the behavior patterns in foreign exchange.” He added, “[w]e have also seen clear attempts to manipulate fixes in the precious metals markets.”

Specifically, FINMA uncovered “front running” on the now-disbanded silver fix — in layman’s terms, trading on advance information not available to clients. ”Electronic chats” reportedly played a big role in that activity.

UBS will pay a price of $800 million for its transgressions. That said, more punishment may be in store. Bloomberg notes that “[b]anks and individuals could face further penalties and litigation,” while Tim Dawson, an analyst at Helvea, told the news outlet that the banks are “likely to face a heavy burden of potential litigation in coming years.”

Company news

On the company side, one of the biggest pieces of news in the silver space this week came from First Majestic Silver (TSX:FR,NYSE:AG), which has been a hot topic since President and CEO Keith Neumeyer announced back in October that the company would be holding back the sale of nearly a million ounces of silver in “an attempt to maximize future profits.”

While many market participants have since lauded his declaration, identifying it as a sign of silver producers beginning to take a stand against low prices, there’s also been some speculation about how big of an impact the move would have on the company’s revenues.

That question was answered Thursday with the release of First Majestic’s unaudited interim consolidated financial results for Q3. They show that revenues came to just $40.8 million, down 39 percent from the previous quarter. According to the company, the main reason for the drop was indeed its suspension of silver sales

What’s perhaps more interesting, however, is that following the end of the quarter the company sold those ounces “for an average price of $17.29 per ounce increasing [its] cash balance by $16.1 million.”

The move might come as a surprise to some — is $17.29 per ounce a high enough price to hold out for? — but for others it was something of an inevitability. One such person is well-known silver analyst Ted Butler, who was quoted by Ed Steer of Casey Research and GATA in a newsletter Thursday.

According to Steer, Butler said this week that “withholding production alone is not the best way of fighting back, simply because the extremely low price of silver is not caused by overproduction, but by COMEX dealings. And forget about any illegal cartel of silver miners. As I’ve suggested previously, the best thing for the primary silver miners to do, either individually or collectively, is to openly petition the regulators to address the price manipulation on the COMEX.”

Essentially, in his opinion silver producers’ best bet in terms of addressing the low silver price is to go to regulators. Certainly some food for thought not only in light of First Majestic’s release, but also in light of the UBS fine.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.