Kivalliq Discovers more Uranium on Lac Cinquante Trend

Kivalliq Energy Corporation (KIV:TSX-V) has a small near-surface and relatively high grade uranium resource. It is actually the highest grade uranium resource in Canada if you discount the Athabasca basin uranium deposits. Currently the company is in the midst of an aggressive 35,000 metre drilling campaign on a portion of its 910 sq. km Angilak …

Kivalliq Energy Corporation (KIV:TSX-V) has a small near-surface and relatively high grade uranium resource. It is actually the highest grade uranium resource in Canada if you discount the Athabasca basin uranium deposits.

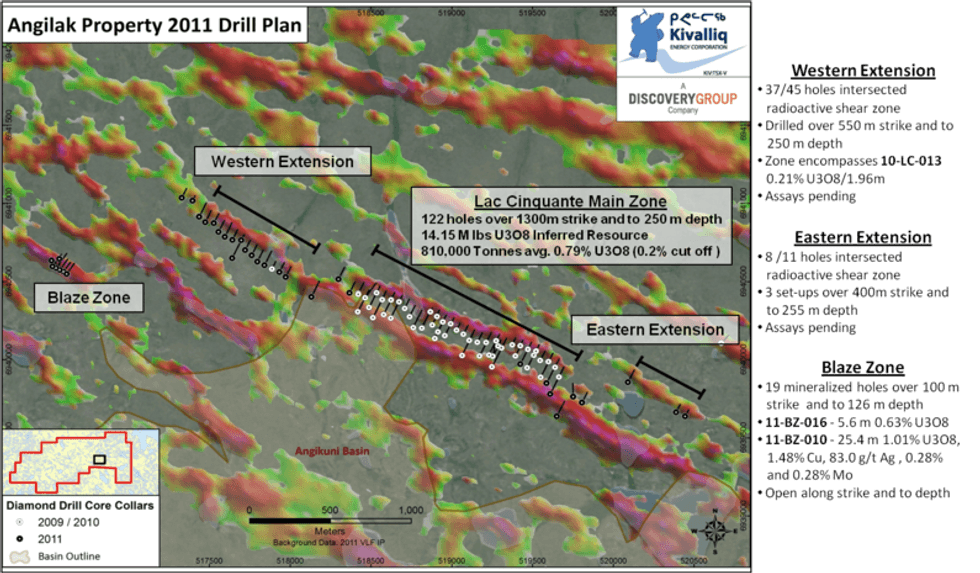

Currently the company is in the midst of an aggressive 35,000 metre drilling campaign on a portion of its 910 sq. km Angilak uranium property in Nunavut, Canada. So far, 115 diamond drill holes (17,425 meters) have been completed as well as 70 Reverse Circulation drill holes (5,146 meters).

Recent assay results have confirmed three new uranium discoveries; the Western Extension, the Eastern Extension and the Blaze Zone.

Lac Cinquante Resource

The company has already delineated a NI 43-101 inferred resource on its Lac Cinquante zone. That resource outlines 810,000 tonnes averaging 0.79% U3O8 (or 17.5 lbs. uranium per tonne). The current resource contains 14.15 million lbs. of Uranium.

Uranium and associated sulphide mineralization at Lac Cinquante occurs in a tabular zone measuring 1.35 km long and up to 7.9 meters wide. The mineralized zone strikes between 110 to 120 degrees and has a variable dip that ranges from -45 to -80 degrees to the south. The resource remains open for expansion along strike to the east, west and at depth.

Western Extension Discovery

The Western Extension discovery was made by testing a NW trending VLF electromagnetic conductor that was similar to that identified over the Lac Cinquante zone. The zone is located 450 meters to the west, and along strike of the Lac Cinquante resource.

Kivalliq Energy has drilled 45 holes (6,705 meters) to date on the Western Extension and delineated mineralization for a distance of 550 meters. Mineralization is hosted within a shear zone in highly altered volcanic rocks.

Eastern Extension Discovery

The Eastern Extension discovery was made by testing a similar VLF EM conductor 450 meters east and along strike of the Lac Cinquante resource. Mineralization is similar to the Lac Cinquante zone.

Kivalliq Energy has now completed 11 diamond drill holes (1,525 meters) at the Eastern Extension discovery and eight of these holes have intersected anomalous radioactivity. The company believes that both the Western Extension and Eastern Extension zones are part of the same northwest–southeast trending geological structure which hosts the high grade Lac Cinquante uranium resource.

The Blaze Discovery

The Blaze Zone is located approximately two kilometers west of the Lac Cinquante uranium resource and Kivalliq has so far outlined a 100 metre-long zone of mineralization. Uranium is commonly found in two separate zones (upper and lower), occurring as clusters of stockwork veins or fracturing, crosscutting the southwest dipping sequence of host volcanic rocks.

So far 19 holes have been drilled (2,692 meters) and geologists believe the initial 15 holes may have been drilled sub-parallel to some of the mineralized trend. To gain a better understanding of the controls of mineralization the remaining 4 holes were re-oriented to determine the true width of mineralization.

Other Targets

To date, Kivalliq has identified 9 high-priority target zones that will see follow up work this year. All are within 28 km of the main Lac Cinquante resource.

Uranium Outlook

According to research completed by Versant Partners, the fundamentals for the nuclear and the uranium market remain largely unchanged despite the Fukushima tragedy.

Even though Germany, Italy and Switzerland have declared their exit strategy from nuclear energy their combined shut downs tally to just 5% of current operating reactors.

Despite the planned shut downs, global nuclear reactor growth has continued and there are now a total of 558 reactors that are currently in the construction, planned or proposed stage as opposed to 540 at the beginning of the year.

Based on current use, there is a 40 million lb. uranium shortfall per year. This yellowcake deficit is being made up by US-Russian nuclear weapon downgrade program. However, this program will be terminated by the end of 2013.

More production is needed to meet current supply demands. Majors like the Areva Group and Cameco will be hunting for quality projects that they can develop into mines. This trend has already been evidenced by Cameco’s recent $520 million all cash bid for Hathor Exploration.

Bottom Line

Based on the new discoveries made around Lac Cinquante, there is excellent potential for continued expansion of the resource.

In this remote region of Canada, major uranium producers like Areva or Cameco will most likely need to see at least 30 to 40 million lbs. of contained uranium in a near surface resource to consider Kivalliq Energy a takeover candidate. With 14.5 million lbs. U3O8 outlined so far, Kivalliq is almost half way there.

The uranium majors are very active in Nunavut and I am sure they are watching how Lac Cinquante progresses. Areva is currently in the permitting phase of its bulk-tonnage low-grade Kiggavik uranium deposit (127 million lbs. U3O8 with an average grade of 0.55% U3O8). This deposit lies just 214 km north of Lac Cinquante.

With a growing high-grade, near surface uranium resource and a market cap of only $45 million, Kivalliq Energy is a company to keep an eye on.

Thomas Schuster, Analyst Bio:

With a degree in Geological Sciences from the University of Toronto,

Thomas started his career in the 1990s as an exploration geologist in

the famous Timmins mining camp in Northern Ontario. He then moved to

Vancouver and took a position as staff Journalist at the well-known

mining publication, The Northern Miner, reporting the merits and

shortcomings of Canadian exploration and mining projects worldwide.

This built a foundation for his later work as a Mining Analyst for the

Toronto-based institutional investment firm, Fraser Mackenzie. Thomas

is currently based in Vancouver working as an independent mining

analyst.

Disclosure: No positions at time of writing.

Kivalliq Energy Corporation is a client of Dig Media. Dig Media was paid a fee for the creation and dissemination of this commentary.