Overview

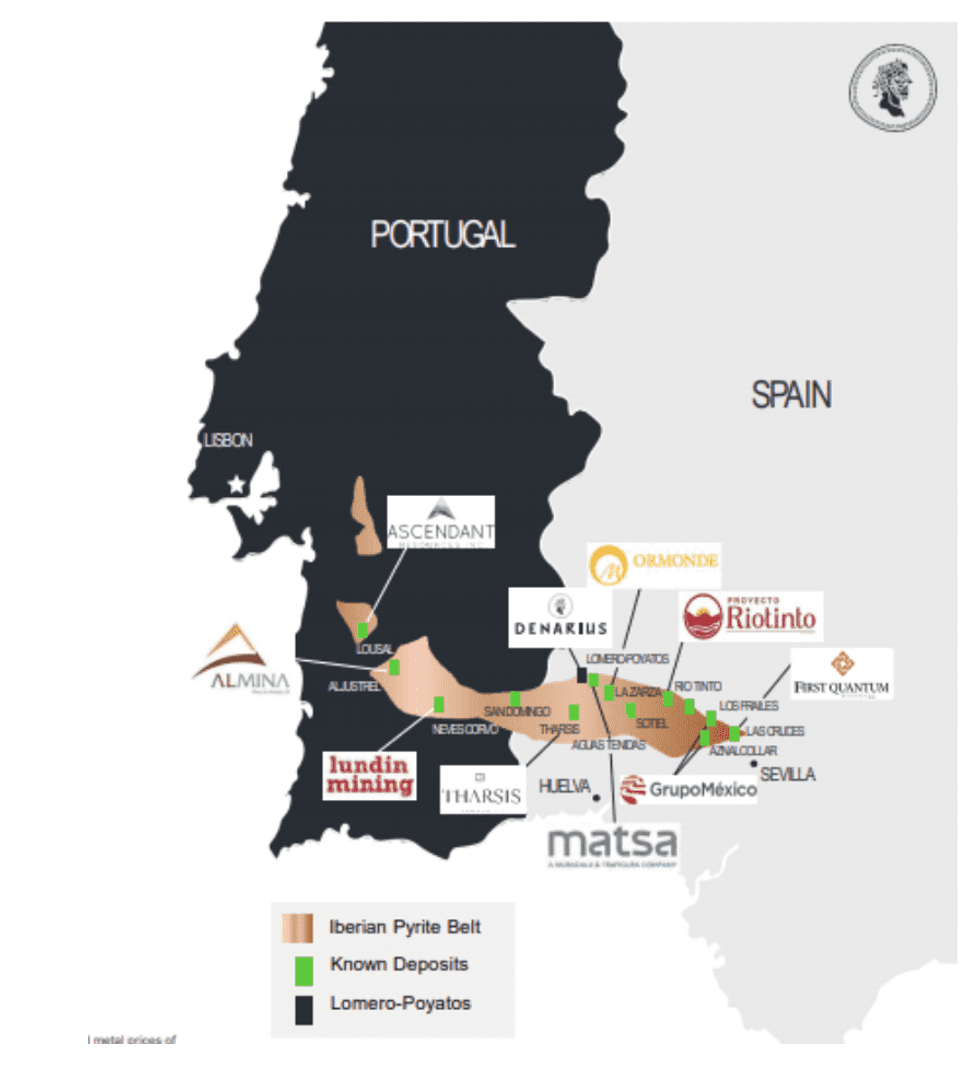

The Iberian Pyrite Belt is globally recognized as having one of the highest concentrations of volcanogenic massive sulfide deposits on Earth. The entire belt has more than 2 billion tonnes of ore, with an estimated 400 million tonnes remaining. Prior exploration also indicates that the Iberian Pyrite Belt contains gold, silver, copper, lead and zinc.

The Iberian Pyrite Belt is located across Spain and Portugal. It features a rich history of productive mining that dates all the way back to the Roman Empire. Overall, the average mineral production in Spain is 20,400,119 tonnes between 2009 and 2018. Over 100 minerals can be mined through Spain, with many of these minerals being located on the Iberian Pyrite Belt.

Denarius (TSXV: DSLV; OTCQB: DNRSF) is a Canadian junior exploration company dedicated to advancing mining projects that are located in high-grade mining districts. Its portfolio contains international projects ranging from exploration to near-term production of metal assets that can be leveraged across multiple markets.

Denarius’ flagship project is the Lomero-Poyatos Project, which is located in the Iberian Pyrite Belt in Spain. The historical production at this site was a minimum of 2.6 million tonnes of massive sulphide ore. In August 2021, Denarius received a mining permit for its Lomero-Poyatos project, allowing for exploratory drilling in select historical holes.

The Lomero-Poyatos project is a polymetallic asset that will allow Denarius to mine green metals, such as lead, zinc and copper, in addition to gold. Mining copper directly supports the global initiative towards embracing environmental technologies since copper is required for electric vehicles, wind turbines, solar powers and electric vehicle batteries. It’s estimated that copper demand will increase by 900 percent by 2030. Denarius is poised to capitalize on the increased demand for copper through its Lomero-Poyatos project.

Denarius also has two additional mining projects located in Colombia. Colombia is an OECD member country and has one of the lowest inflation rates in Latin America. Some experts predict that Colombia’s GDP will recover from the 2020 pandemic-induced plunge with a projected increase of 6.5 percent in 2021.

The two projects located in Colombia, Guia Antigua and Zancudo, are both located in historically productive high-grade mining districts. The Guia Antigua project is located in a mining district that has been in continuous operation for 150 years and has produced approximately 6 million ounces of gold, while the Zancudo project is located in a mining district that has been producing ore since 1793.

“Silver is becoming not only such an important thing as a metal but as an industrial metal. As part of all this new green energy that is going to be created, it’s going to be an important element in the making of batteries and conductors,” said Denarius Executive Chairman Serafino Iacono in a recent interview.

Denarius has issued 205,076,865 shares (299,300,565 on a fully diluted basis), creating a market capitalization of C$80 million. Approximately 27 percent of these shares have insider ownership, which shows the confidence of the management team. As of Q1 2021, it reports having US$32.4 million in total cash, US$10 million was used in April 2021 in connection with the acquisition of the Lomero Project and the balance is available to fund the Company’s exploration programs at Lomero and Guia Antigua.

Serafino Iacono is currently the executive chairman and interim CEO. Iacono brings over thirty years of experience throughout numerous natural resource projects around the world. He has raised billions of dollars for these projects throughout his career.

Company Highlights

- Denarius is a Canadian junior exploration company with a diverse portfolio of high-grade mines. It is focused on developing projects located in historical productive districts in Spain and Colombia.

- Each of the company’s assets is located near existing projects that are massively productive, which creates an existing robust infrastructure that allows Denarius to quickly advance their projects.

- All three of the company’s projects have historically returned high-grade minerals that are consistent with their neighbors’ production.

- The company has a management team that has international experience and brings plenty of operational expertise that may enable them to quickly advance projects.

- Denarius completed 22,543 meters of drilling in 75 drill holes, including twinning of historical drill holes at Its Polymetallic Lomero-Poyatos Project in Spain.

Get access to more exclusive Silver Investing Stock profiles here