Platinum Price Forecast: Top Trends That Will Affect Platinum in 2023

2022 saw the platinum market fall into deficit. Find out how impactful this shortfall will be in the year ahead.

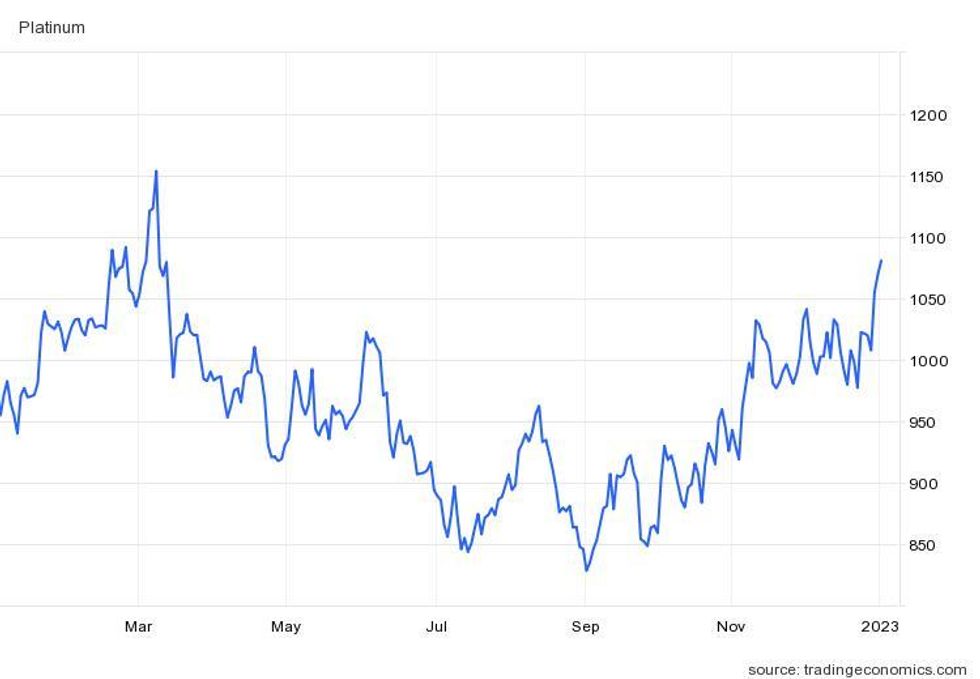

The platinum price saw a value spike early in 2022 following Russia’s invasion of Ukraine. Russia’s role in platinum-group metals (PGM) production pushed the metal to US$1,152 per ounce in March, its highest point since June 2021.

However, concerns around Russian platinum supply subsided quickly, even though the nation ranks second in terms of annual output. By the end of March, the precious metal had slipped back below US$1,050, where it remained for the rest of the year.

With global economic turbulence running high due to inflation and other factors, platinum remained well off its 2021 high of US$1,303. At the same time, broad demand growth ate away at supply, creating a market deficit.

Platinum's price performance in 2022.

Chart via TradingEconomics.

“Platinum has shifted into a small deficit this year,” said Wilma Swarts, director of PGMs at Metals Focus.

“While we have seen positive growth in the automotive sector, the underlying factors driving the market balance this year are heavily weighted towards weaker supply rather than stronger demand. Global demand for 2022 will be flat on 2021 at 7.4 million ounces, while global supply is forecast to decline by 11 percent to 7.3 million ounces.”

Platinum production challenges deplete surplus

As mentioned, worries over Russian platinum supply quickly waned, but other production issues emerged in 2022.

“Operational challenges meant refined platinum production declined 11 percent (-171 koz) year-on-year in Q3’22,” the World Platinum Investment Council’s (WPIC) Q3 platinum report reads. “Maintenance and power supply challenges in South Africa — supplier of over 70 percent of mined supply — resulted in an 18 percent decline during the quarter.”

The firm points to the rebuilding of Anglo American Platinum’s (LSE:AAL,OTCQX:AAUKF) Polokwane smelter and flooding at Sibanye-Stillwater’s (NYSE:SBSW,JSE:SSW) Montana mine as major factors in the production decline.

Q3’s output reduction contributed to 2022's 9 percent year-on-year fall in platinum mine supply.

For its part, the recycling segment contracted by 13 percent, or 61,000 ounces, in 2022. Fewer scrapped autocatalysts and less Chinese jewelry being sold back made up the largest portion of the shrinking segment.

“Both the mining and recycling constraints are themes that are expected to continue through the end of 2022 and into 2023, with total supply for 2022 expected to be down 10 percent on 2021 at 7,306 koz,” the WPIC's forecast reads.

Automotive demand for platinum still recovering

By September, platinum had sunk to its lowest point in almost two years, coming in at US$828.47. But this low was short-lived as the metal's price rebounded to the US$927 level at the start of the fourth quarter.

Following two years of pandemic disruptions, automotive demand began to recover during the second half of 2022.

“Automotive production numbers have been constrained by semiconductor and other supply chain challenges,” said Ed Sterck of the WPIC. “We see those easing into next year. But production is still struggling to get back to pre-COVID levels.”

The fragility of re-established supply chains, lingering chip scarcity and the current economic environment are all headwinds that could prevent platinum price growth in 2023.

“Given that we've had several years of automotive production falling below demand levels, we've got some elements of pent-up demand,” added Sterck, whose role at the WPIC is director of research. “But even looking past that, we think that automotive production rates are remaining below recessionary levels of consumer demand.”

On the flip side, some of that repressed demand and the ongoing substitution of palladium for platinum helped push platinum demand from the auto sector up 25 percent year-over-year.

For Swarts, the primary catalyst behind this uptick is tighter emissions standards. “By mid-July (2021), all heavy-duty vehicles in China had to comply with China VIa emissions legislation,” she said. “This means that 2022 was the first full year in which all heavy-duty vehicles produced would have had to be fitted with a China VI-compliant aftertreatment system.”

With platinum being prized for its ability to reduce vehicle emissions, many automakers have chosen to increase platinum loadings or replace pricey palladium loadings with platinum.

“The substitution of platinum in place of palladium in light-duty vehicles ensured the demand in the light-duty segment grew, despite the acceleration of battery electric vehicle production and the lingering chip and other part shortages,” Swarts said.

Weak platinum investment demand outweighs strong industrial use

2021 was a record year for platinum industrial demand, and while 2022 brought a contraction of 14 percent, Sterck expects 2023 to be another period of record-setting buying from this segment.

“There are quite a number of capacity additions in the chemical and glass subsectors for industrial demand, which are helping drive 2023 to being the second strongest year for industrial demand on record,” he said.

He went on to point out that Chinese platinum imports have ballooned in recent years, similar to palladium in the 2010s.

“China's appetite for platinum has just skyrocketed since the middle of 2021,” he said. “And China has been importing significant amounts of platinum well in excess of identified demand — about 1.2 million ounces — since the beginning of last year.”

This could pose a problem as the market swings into deficit following several years of surplus.

“That material is now graphically captured in China because regulations make it very difficult, if not impossible, to export it once it's in the country,” Sterck said. “So the rest of the world is certainly not going to have platinum to meet a shortfall.”

Whether Chinese imports are going to the automotive sector, stockpiling or to build the nation’s hydrogen sector is unknown. The latter is an area that Sterck sees having potential around the world.

“There are lots of investors looking at platinum at the moment for that hydrogen angle," explained the director of research. "Whether they feel like it's ready to be used as a proxy for hydrogen yet, I think that is still a bit of an open question. But certainly, investors are doing the background work now to be comfortable.”

For its part, the platinum exchange-traded fund (ETF) segment continued to see outflows for the fifth consecutive quarter.

“There's an opportunity cost of holding an ETF where you're paying an annual management fee, and any cash that's associated with that investment isn't actually generating an income,” Sterck said, adding that some investors have sold for yields.

He went on to say that the rotation out of ETFs has led a portion of investors to the forwards and futures market, where they can retain exposure in a much more “cost-effective fashion.”

In previous years, there has also been an exodus from platinum ETFs into mining equities, but that didn't happen in 2022.

“Rotation to mining equities was not a major theme for the 575 koz liquidation we have seen,” Swarts said. “It is more likely that the current inflationary concerns and rising interest rates pushed investors away from the precious metals complex this year.”

As platinum ETFs faced more drawdowns, bar and coin demand made an incremental move, growing by 2 percent to hit 340,000 ounces in 2022. Purchases are expected to strengthen in 2023, with the bar and coin sector anticipated to see a 49 percent uptick.

“Retail investments are often good barometers of safe-haven demand and countermeasures against rising inflation,” Swarts commented. “The positive growth comes from continued interest in the US market and our expectation of a reversal from net selling this year to net buying in Japan in 2023.”

Sterck also cited the Japanese market, which he described as “mature,” as a leading factor in the segment’s growth. After spending the early part of 2022 selling bars and coins, Japanese investors pivoted and began buying again.

“I think that investors in Japan have kind of become normalized to higher price levels in yen terms,” Sterck said.

Platinum production challenges to persist as demand increases

Looking further into 2023, mining production is a factor investors should keep an eye on, according to the WPIC.

“South Africa’s struggles with load shedding, which increased significantly quarter-on-quarter, are expected to continue to negatively impact refined metal output for the foreseeable future,” the firm's report states. “Whilst output from Russia is currently forecast to remain flat year-on-year in 2023.”

For Swarts of Metals Focus, the instability in South Africa’s electric grid is expected to weigh on the nation’s output. “We will pay close attention to the country's social stability as election campaigning starts ahead of the 2024 national elections," she said.

The director of PGMs also said secondary supply will remain an important issue this year.

“This was severely impaired as fewer cars were scrapped, leading to lower spent autocatalyst recycling," she said.

Swarts went on to say that Metals Focus will also be keeping a close eye on the demand side of the market.

“The unwinding of the chip and other part shortages will remain on the radar,” she said. “We will also keep close track of the rate of powertrain electrification and the implications of higher battery material costs.”

Longer term, the PGMs specialist expects platinum's place in the hydrogen economy to play a role in its growth.

“Developments in investment in the hydrogen economy will be important,” she said. “Platinum will be a critical raw material for the production and consumption of green hydrogen.”

Platinum ended 2022 trading for US$1,068.38.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Platinum Price Update: H1 2022 in Review ›

- How to Invest in Platinum ›

- PGMs Prices Soar Amid Potential Supply Challenges Out of Russia ›

- Will Platinum be Impacted by Electric Cars? ›

- Palladium Price Forecast: Top Trends That Will Affect Palladium in 2023 ›