Platinum Price Update: H1 2022 in Review

What happened to platinum in H1 2022? This platinum price update outlines market developments and explores what could happen moving forward.

Click here to read the previous platinum price update.

Auto sector demand for platinum saw a bit of a rebound in the first half of the year, but industrial fabrication declines weighed heavily on prices, keeping the metal's value below US$1,160 per ounce.

Supply chain issues have hurt the market, and they have been compounded by inflation and rising energy prices, which have driven costs for transporting commodities higher. According to a platinum-group metals (PGMs) report from Metals Focus, container freight costs remain six times higher than they were before the pandemic.

H1 2022 has also been marked by uncertainty brought on by factors like market volatility, Russia's invasion of Ukraine, rising interest rates and new COVID-19 lockdowns, particularly in China.

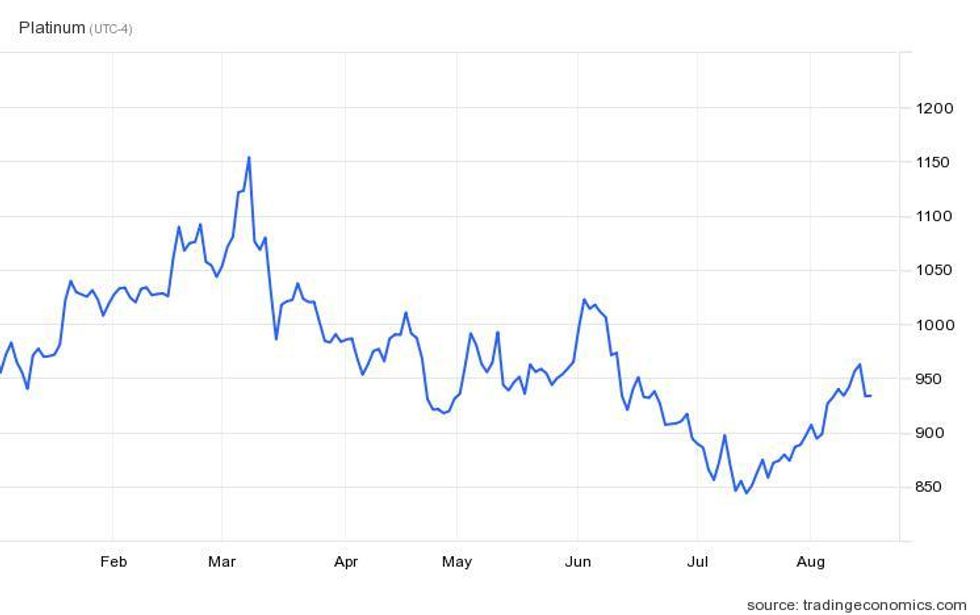

Platinum prices started 2022 at US$952.87, facing demand constraints from 2021 with production of internal combustion engine (ICE) vehicles still 14.8 million units short of pre-pandemic levels.

Platinum price performance, H1 2022.

Chart via TradingEconomics.

Following Russia’s advance into Ukraine, platinum values surged to a H1 high of US$1,154 as concerns about the future of supply out of Russia intensified. Russia ranks second in terms of annual production of both platinum and palladium, outputting 19,000 kilograms of platinum in 2021.

Platinum price update: Auto sector a key end-use segment

Q1 saw total platinum demand contract by 10 percent despite strength in the automotive segment. According to the World Platinum Investment Council (WPIC), the decline has been attributed to a reversal in industrial demand from 2021’s record highs, along with flat jewelry consumption and weakness on the investment side.

“The strength in automotive demand is notable considering production capacity constraints due to the ongoing semiconductor shortages and the negative effects of Russia’s invasion of Ukraine, and reflects increased loadings and ongoing substitution for palladium in gasoline vehicles,” the organization's first quarter review states.

For Metals Focus, an anticipated 7 percent increase in automotive production this year is seen bolstering platinum autocatalyst demand by 16 percent year-over-year.

“Higher platinum loadings, particularly in China from last year’s China VI roll-out, also contribute significantly to autocatalyst demand’s growth,” its PGMs report notes.

The metals consultancy points out that substitution of palladium with platinum should be a tailwind for platinum prices, particularly in China, where the market is more price sensitive and responsive.

“We need, however, to acknowledge considerable downside risks to the forecast caused by the impact of China’s COVID lockdowns and the Ukraine crisis on the supply chain and the chip shortage,” the firm added.

Platinum price update: Palladium substitution a potential long-term catalyst

On March 8, palladium prices soared to an all-time intraday high of US$3,189 per ounce.

Platinum was trading for US$1,154.20 that same day, and palladium’s sustained high price level has prompted many auto manufacturers to begin the process of substituting platinum for palladium in catalytic convertors, especially as emissions standards become more stringent and loading levels need to increase.

While some parts of the auto industry will help platinum demand, a decline in other segments will weigh on the market in the coming years, according to Rohit Savant, vice president of research at CPM Group.

“Another factor that's been hurting platinum demand has been the shrinking market share of diesel passenger vehicles in both Europe as well as India, where market share at the end of 2021 was back down to levels that we saw in the 1990s,” he said during a July 27 PGMs webinar. "This is something that we think will continue in the coming years, and will also act as a headwind to platinum fabrication demand,” he said.

As diesel vehicle demand retracts, the market for gasoline-powered vehicles “seems to have stabilized,” he explained, noting that PGMs will also be needed for some of the alternate auto propulsion technologies that are becoming a larger segment of the market.

Both hybrids and fuel cell vehicles require PGMs in some capacity, which bodes well for the market; however, battery electric vehicle demand could offset some of this growth as those vehicles use no PGMs.

Regardless, the alternate propulsion market remains a small segment of the auto sector at the moment. Savant believes ICE vehicles, which comprise the lion's share of the market, will drive fabrication and investment demand.

“Fabricators in the auto industry, for example, have started to reintroduce platinum in gasoline autocatalysts, which is one of the most positive fabrication demand fundamentals for platinum in the medium to long term,” Savant said. Platinum’s value compared to palladium will continue to facilitate this change.

"The platinum-to-palladium price ratio, which remains historically low, has clearly been something that has benefited platinum with increased interest for platinum both from investors as well as fabricators,” he added.

Platinum price update: Investment demand to face headwinds

The investment demand side of the platinum market continues to be divided as investors look to bars and coins while turning away from exchange-traded funds (ETFs) and products. In fact, purchases of bars and coins grew by 39,000 ounces in the first quarter of 2022 compared to the year-ago period.

“However, despite particularly strong demand in North America, global demand growth was limited by US dollar price strength sustained by a significant subsequent weakening in the yen which drove local platinum prices to their highest since May last year and which encouraged profit-taking among Japanese investors,” a May press release from the WPIC states. Total global bar and coin demand for the full year is anticipated to fall by 23 percent.

Additionally, after registering three consecutive years of gains, 2021 marked a year of net outflows in the ETF segment, and it appears 2022 will be much the same.

“Liquidations in Q1’22 stemmed primarily from one European ETF issuer and were contrary to investors’ finding hard assets attractive due to surging inflationary worries and elevated geopolitical and economic uncertainties,” notes the WPIC. It predicts 50,000 ounces worth of outflows for the entire 2022 year.

Platinum price update: Potential future drivers

Similar to most commodities, platinum is battling inflation, interest rate hikes and supply challenges.

However, overall demand is forecast to grow 2 percent year-over-year for the metal. Residual production challenges out of South Africa paired with uncertainty around Russian supply are expected to manifest as a 5 percent reduction in supply, which will shrink the surplus to 627,000 ounces, down from 2021's 1.1 million ounces.

“With the backlog of semi-finished inventory built up during the 2020 Anglo American Platinum (LSE:AAL,OTC Pink:AGPPF) converter plant outages now processed, we are left with the stark reality that South African production is actually below where it was in 2019,” wrote Paul Wilson, CEO of the WPIC.

“This, combined with a massive drop in recycled material, points to constrained supply for the coming months, as demand continues to grow,” he continued.

After falling to a H2 low of US$899.04 on June 30, platinum prices have begun to recover, edging as high as US$950 in mid-August. Although the metal is still well off its all-time high of US$2,171, set in early 2008, Wilson is optimistic about its role in the growing green economy, as well as its place in the energy security narrative.

“In addition to decarbonisation, security of energy supply for all Governments is now a far greater issue than it was,” the CEO of the WPIC added.

“The role of green hydrogen in reducing European gas imports could drive a strategic acceleration of electrolyser construction, which would benefit platinum directly but also support the infrastructure needed for broad-based commercial adoption of FCEVs (fuel cell electric vehicles).”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top 5 Palladium- and Platinum-producing Countries (Updated 2022) ›

- Palladium Outlook 2022: Auto Demand to Determine Price Movement ›

- Platinum Outlook 2022: Rising Demand to Offset Supply Surplus ›

- How to Invest in Platinum ›

- Platinum ETF Outflows Continue, Chinese Demand Grows ›

- Platinum Price Forecast: Top Trends That Will Affect Platinum in 2023 ›