Nickel Outlook 2021: Strong Demand Recovery Ahead, Supply to Increase

What’s in store for nickel in 2021? Experts share their nickel outlook, from supply and demand dynamics to price predictions.

Click here to read the latest nickel outlook.

Despite the uncertainty brought by the coronavirus pandemic, nickel rebounded sharply this year from Q1 lows seen after COVID-19-related lockdown measures.

Positive investor sentiment around the use of nickel in electric vehicle (EV) batteries surged, although analysts still expect demand from the battery industry to lag behind steel demand for some time.

As the year comes to a close, the Investing News Network (INN) asked analysts in the field for their thoughts on what’s ahead for the base metal. Read on for their predictions.

Nickel outlook 2021: Price performance review

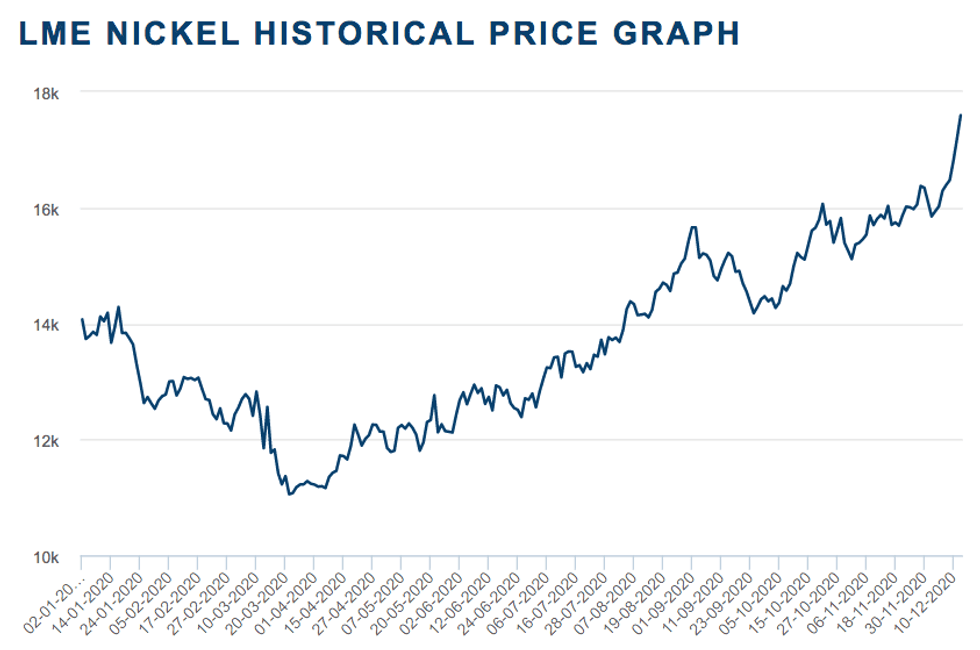

Nickel started the year trading at US$14,070 per tonne, but plummeted to US$11,055 by March, when markets started to feel the impact of coronavirus containment measures and lockdowns.

2020 nickel price performance. Chart via the London Metal Exchange.

The second quarter saw the metal start a sharp rebound that ultimately led to its highest point year-to-date: US$17,650 on December 15.

For Roskill’s Jack Anderson, the nickel price lived up to its volatile reputation through the year — it was able to rise from a COVID-19 low in March despite the market being in oversupply.

“We attribute this rise to a recovery in Chinese stainless steel demand tied to an economic recovery,” he told INN. “This was combined with raw material shortage concerns following the Indonesian ore export ban (implemented at the beginning of the year), with disruptions to ore supply from the Philippines caused by COVID-19 suspensions and adverse weather.”

Speaking with INN, Benchmark Mineral Intelligence analyst Greg Miller said that all things considered, nickel has outperformed expectations in 2020.

“From a battery perspective, I think overall COVID-19 has had less impact on the industry than had originally been anticipated at the start of the pandemic,” he said. “The substantial growth in European EV sales in H2 in particular has surprised many, helping buoy expectations of nickel demand from the battery industry heading into 2021.”

Nickel outlook 2021: Demand to improve

When looking back at 2020, coronavirus-related measures globally brought pressure to nickel consumption, something that could not have been predicted at the start of the year.

“However, despite the overall drop in demand, consumption by the battery sector this year has remained strong,” Anderson said.

Looking back at forecasts for 2020, Adrian Gardner, principal analyst for nickel markets at Wood Mackenzie, said demand was much more negatively affected than his firm expected when it first started to analyze the potential impact of COVID-19.

However, in 2021, Woodmac is forecasting that nickel demand will strongly recover by between 9 and 10 percent to reach 2.5 million tonnes. The improvement will come on the back of a very poor 2020.

“Most of this increase in demand (about 160,000 to 170,000 tonnes of it) will come from nickel in stainless steel because this is by far the single largest segment of nickel use,” Gardner said.

Roskill is also expecting demand to recover in 2021, with economic growth expected to bounce back as well. The lockdown measures used to slow the spread of COVID-19 dragged down demand significantly in 2020, but these measures are unlikely to reappear in 2021, according to Roskill’s Olivier Masson.

“Demand is expected to recover in all sectors, but the stainless steel and battery sectors are expected to perform the best,” he said.

When looking at demand from the battery sector, nickel use in batteries is expected to go up, but the transition to higher-nickel cathodes will take time. Even so, 2020 saw investor speculation jump on hopes of increased demand from the battery sector.

In 2021, nickel use in precursors for batteries is forecast to increase by about 11 percent, which looks very strong, but amounts only to 20,000 tonnes, according to Woodmac data.

“It is still early days for the EV precursor segment, but everyone is excited by it because of the strong year-on-year growth potential,” Gardner said.

For his part, Miller said nickel demand from the battery sector has continued to grow this year, albeit at a slower pace than was originally anticipated in Benchmark Mineral Intelligence’s pre-COVID-19 forecasts.

“Looking ahead, we believe that nickel demand from the battery sector will accelerate next year, stimulated by EV-focused policies introduced as part of ‘green’ recovery plans in Europe, strengthening demand from the EV industry in China and the changing political landscape in the US,” he said.

Nickel outlook 2021: Mixed forecasts for supply

At the start of 2020, Roskill expected Indonesia to almost entirely dominate refined nickel supply growth.

“This materialized despite the impact of the COVID-19 pandemic,” Anderson said. “However, perhaps the speed at which Indonesian nickel pig iron (NPI) production ramped up, and resilience to the impact of COVID-19, was surprising.”

Following a rise in 2020, Roskill expects a continued ramp up of NPI capacity in Indonesia to feed the domestic stainless steel industry, plus rising exports to supply mills in China.

“We expect the market to witness another year-on-year drop in NPI supply from China as port and consumer ore stocks decline further and production remains constrained by the levels of imported ore from the Philippines, New Caledonia and other smaller producing regions,” Anderson said.

Despite the expected drop in NPI supply in China, the opposite is anticipated for Chinese production of nickel sulfate.

“Roskill forecasts Chinese production of the battery-grade chemical product from all feedstock types to continue to grow strongly year-on-year over the next decade to meet demand from lithium-ion batteries with increasingly nickel-rich cathode chemistries used in EVs,” Anderson said.

Indonesia produced 800,000 tonnes of nickel in 2019, as per the US Geological Survey, making it the top producer. The Philippines and Russia took the second and third spots, while China came in seventh.

Woodmac is expecting saleable refined nickel production in Indonesia to increase considerably in 2021, rising to about 815,000 tonnes from 2020’s 630,000 tonnes because of continued investment in new NPI production capability.

Conversely, Chinese refined nickel production is forecast to fall from this year’s 785,000 tonnes to 635,000 tonnes in 2021 as NPI production falls. Elsewhere, Woodmac is expecting to see smaller production increases in Finland and Brazil.

“But the main story for 2021 is a constrained supply-side growth increase of 1 to 1.5 percent only, given the facilities which can expand and those in decline,” Gardner said.

Benchmark Mineral Intelligence also expects growth in Indonesian NPI supply to continue into 2021.

“The first high-pressure acid leach (HPAL) projects in Indonesia targeting the battery supply chain are expected to come online in 2021, and the success of these projects in ramping up production will determine the outlook for ‘battery-suitable’ nickel supply over the coming decade,” Miller said.

For investors, there are a number of projects in Australia and Canada that have the potential to provide additional nickel units to the market, which will be particularly important as battery supply chains become increasingly “localized,” Miller added.

Following a year of excess supply, Roskill forecasts that the market will remain in surplus in 2021, although it is expected to be significantly smaller than the surplus anticipated in 2020. Benchmark Mineral Intelligence is also expecting a surplus next year, while Woodmac is calling for a balanced market.

Nickel outlook 2021: What’s next for prices

As 2021 kicks off, questions remain as to whether nickel’s current price level can be sustained or has been driven purely by speculation.

For Miller, ultimately current nickel prices do not reflect the market fundamentals.

“However, news of the COVID-19 vaccine and the resulting economic recovery, the introduction of further stimulus measures aimed at ‘green’ industries and concerns about long-term nickel supply could help support prices in 2021,” he said.

With the market expected to remain in surplus in 2021, Roskill believes the rally in the nickel price in the second half of 2020 is unlikely to be sustainable.

“It is therefore likely that prices in 2021 will be below current spot prices, on average,” Masson said.

Nickel prices crossed the US$17,500 mark on December 14 ― their highest point so far this year.

“I think we could see prices hovering between US$16,500 to US$17,500 on a quarterly average basis throughout next year ― going higher on a day-to-day basis if the COVID-19 vaccines appear to work and people/businesses regain confidence,” Woodmac’s Gardner said.

Nickel outlook 2021: Challenges ahead

Despite all the opportunities on the horizon for the nickel market, there are some challenges the industry could face as 2021 begins.

One of the more significant challenges will be faced by Class II producers selling product into China, according to Woodmac’s Gardner.

“Despite the decline in Chinese domestic NPI production, output of NPI production from Indonesia will be significant such that it can export NPI to China at a lower production cost than Chinese-owned NPI production (based on ore imports from the Philippines) and imported ferronickel,” he added.

For Anderson, the amount of potential battery-grade supply coming from the Indonesian HPAL projects, as well as the speed and price environment in which they can be developed, is worth watching.

“But one saving grace and potential advantage for some of the juniors could come from the opportunity through positive environmental, social and governance (ESG) credentials that their projects may offer. ESG has really developed as a major factor in raw material procurement priorities for OEMs this year.”

Miller agreed, saying that from a battery perspective, alongside the ramp up of new projects, ensuring the ESG credentials of new supply coming to market in 2021 and beyond is one of the biggest challenges the industry faces.

“I think ultimately securing financing remains the biggest challenge for juniors,” he said. “We continue to see midstream/downstream commitments in the battery supply; however, the COVID-19 pandemic has had a particularly negative effect on the upstream side of the industry, where capital commitments for new projects have been reined in.”

Gardner also pointed to financing as a big hurdle for junior miners. “They need to show that there is a market for their products. The financial community is becoming more astute in asking, ‘Which type of nickel product do you intend to make and where do you think you can sell it?,'” he said.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.