Biotechnology stocks are like smoldering fires. Some will burst into flame. Most will just give off a lot of smoke before they die out.

Biotechnology stocks are like smoldering fires. Some will burst into flame. Most will just give off a lot of smoke before they die out.

Separating the few from the many is the key to investing success in the sector.

No question that the biotech industry is exciting. It combines the cutting edge of science and technology with the world of finance to create the medicines of tomorrow. And it can provide investors with mammoth returns in short order, if you know what you’re doing.

You can also lose your shirt investing in biotech. Even if you know what you’re doing, you will have losers. The challenge is to tip the odds in your favor and position yourself so your winners outnumber your losers. And there’s one simple rule that can help make that happen.

The good news is that you don’t need an M.D. or Ph.D. to become a savvy biotech stock investor. (Not that you should rush out and buy a bunch (or any) of them simply because you read this article. You shouldn’t.) But keeping our one simple rule in mind will give you a firm foundation as you venture into this volatile arena.

Let’s start with a picture.

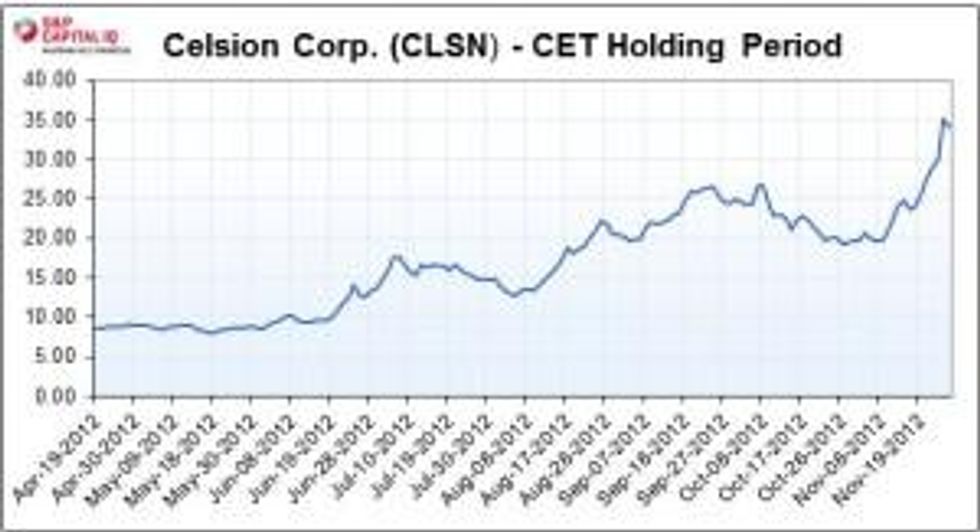

This chart shows the performance of a biotech company called Celsion (CLSN) over the period that we held it in our Casey Extraordinary Technology (CET) portfolio. We recommended buying the stock on April 19, 2012, at a split adjusted $1.91. In July we took a Casey Free Ride, selling our risk capital and riding the gains, an advisable strategy with high-volatility stocks. Finally, we exited the position on November 27, 2012 at $7.58—handing our subscribers a solid 167% gain within just seven months.

Now, one more picture.

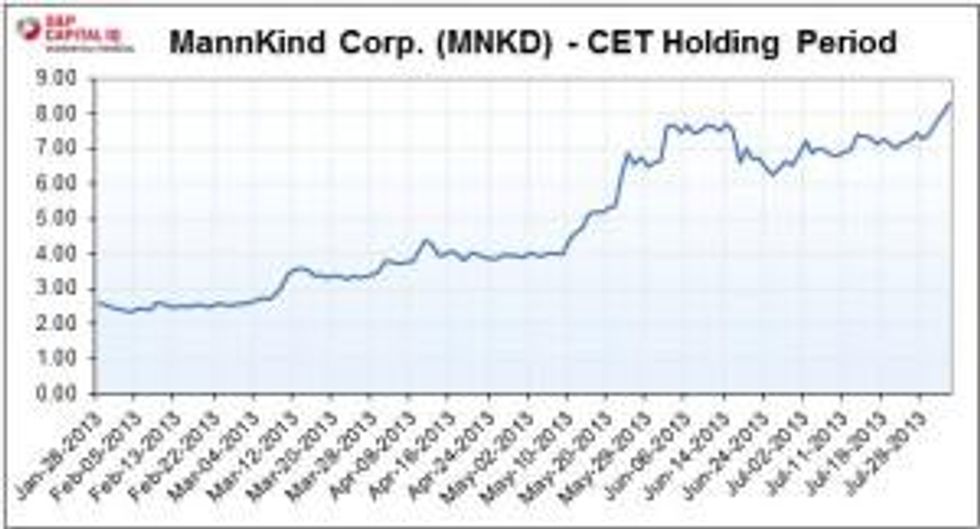

This chart shows the performance of another one of our recent investments, MannKind (MNKD). We bought MNKD on January 28, 2013 at $2.56, took another Free Ride, and sold it on August 2, 2013 for $8.29—a realized gain of 197% within six months.

How did we manage to capture such large gains in such a short period of time?

We applied one simple rule: Only invest in biotech stocks with at least one near-term, value-driving catalyst.

A catalyst in this sense is basically just a value inflection point for the stock, a milepost on the calendar that is bound to move the share price. When it comes to small biotechs, there are a number of such catalysts along the road that a company must follow as it advances a drug from the lab to the clinic and hopefully to commercialization.

After a company files an investigational new drug (IND) application with the FDA and gets the go-ahead for human testing, the new drug passes through three major stages, and then a final evaluation, before it can go to market. The four major turning points in the process—during which the safety and efficacy of the drug are tested—are usually Phase I, II, and III trial results, and FDA approval/denial.

Each step can act as a boom or bust catalyst. Success or failure at the various stages can (and often does) translate into big gains or big losses for investors.

Often, a biotech stock’s share price stabilizes in the “dormant” periods between the various clinical trial results and/or FDA news. But when a major catalyst approaches, and with it the chance of a positive outcome, the price will run up as investors are on the edge of their seats. Then—depending on how the trial results are received by the market, or if FDA approval is granted or denied—the share price either continues to rise or it tanks.

The trick is to find a biotech stock that is in what we call the “sweet spot.” That is, it’s currently off the market’s collective radar because it’s between catalysts. But it’s not so far from the next value-driving event that the company is in danger of running out of money before it happens. The need for a serious round of fundraising could cause a dilution to the point where even a huge jump in the stock price can’t drag your investment out of the red.

Both Celsion and MannKind fell into that “sweet spot” category.

In Celsion’s case, when we recommended buying shares in April of last year, we were expecting results from a major Phase III trial by the end of 2012. We also knew that the firm had enough cash on hand to fund operations well into 2013. The stock had been all but forgotten by investors and looked extremely cheap given the potential for Celsion’s drug.

It was the same with MannKind. When we recommended buying MNKD shares in late January 2013, results from two ongoing phase III trials were pending for August or September. Again, the stock was in the doldrums and looked extremely undervalued given the opportunity.

Of course, finding companies in such a favorable situation is just the beginning. The next catalyst event must be a positive one, pushing the stock price higher—and foreseeing that takes intensive research into the new drug’s potential and its performance in previous tests.

There’s also the question of when to sell. We often choose to sell our shares on a run-up in price before the actual catalyst event (as we did with CLSN andMNKD). That may sacrifice some of the upside, but it substantially reduces risk.

Keeping your eye on biotech catalysts may sound like obvious advice, and in a way it is. Nevertheless, investors all too often ignore it. We have seen many seasoned investors (and quite a few experienced analysts) fall for a company’s technology and management team, and fail to see the proper time to get in or out. Then they make or recommend bad trades because they lose sight of our one simple rule.

Trading and investing in small biotech stocks is not for the faint of heart. It requires copious amounts of due diligence, patience, market awareness, timing, and luck. But if you always remember to first consider the upcoming catalysts before investing, you’ll be off to a better start than most.

If you want to get off to an even better start, consider letting the pros help. We do this for a living, and our track record speaks for itself. Since we started Casey Extraordinary Technology just four years ago, we’ve closed 41 positions, with 31 winners (i.e., a 76% success rate) and an average return for all closed positions of 43%.

If you look at just our biotech investments, our average return on these closed positions is 80%.

But let bygones be bygones – because we have several new recommendations that have just as much potential. One of them is a cancer immunotherapy company with a new kind of drug in phase III trials that looks extremely attractive at its current valuation. We expect this brand-new pick to do just as well (or better) as our previous winners, Celsion and MannKind.