When Will Copper Go Up?

Copper prices are rising in 2024. Find out more about the strong fundamentals supporting its rally and experts' outlooks on how high copper could go this year.

Copper is the third most-used metal in the world, and experts believe demand for this important commodity is set to rise in the coming years. At the same time, the supply situation is expected to tighten up.

For that reason, market watchers may be asking, “When will copper go up?” The general consensus is that while prices may not break out in the near term, they will rise once the market truly starts to enter a deficit.

In Q2 2024, copper prices swung upwards more quickly than anticipated. The Comex price climbed as high as US$5.20 per pound, or US$11,464 per metric ton, a new all-time high, and the LME three month price set an all-time high of US$11,104 per metric ton the same day. They have since pulled back as of June, but the fundamentals remain.

“Most analysts are modeling growing deficits in the copper market balance by 2027-2028, with a near-term forecast (2024-2026) hinting at surpluses until then; however, recent developments suggest a shift toward deficits by late 2024 due to production shortfalls by large producers," Joe Mazumdar of Exploration Insights said via email.

These concerns have driven copper to highs several times in recent years. A copper supply/demand imbalance sparked a record-breaking rally in 2021, pushing prices to a then all-time high of US$10,724.50 per metric ton (MT) — a record that the metal broke in March 2022, when it hit US$10,730.

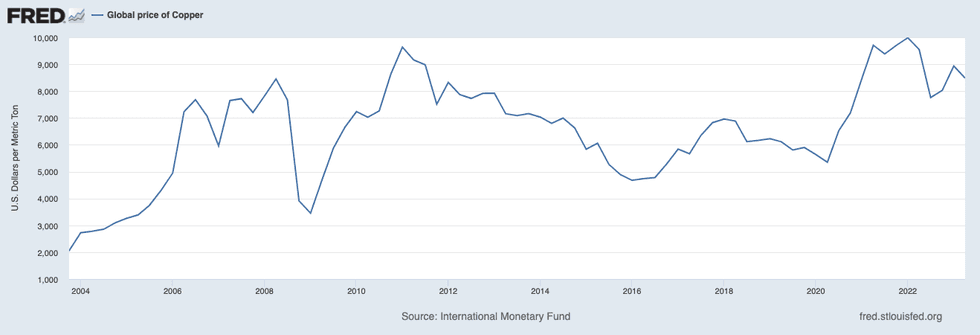

20 year copper price chart.

Chart via Federal Reserve Economic Data.

Copper had pulled back to about US$8,000 by mid-August 2022 on growing fears of a global recession. In early 2023, prices mounted a campaign to breach the US$9,300 level, once again giving market watchers a reason to believe highs for the metal would soon to be retested. However, that reason soon faded as rising interest rates dampened the outlook for copper-dependent industries globally. China's ongoing real estate crisis also hit copper demand hard in 2023.

With the demand picture unclear, copper couldn't hold above the US$9,000 level. As a result, it went on a slide, reaching US$7,910 as of early October 2023. Copper managed to close the year close to the US$8,500 mark.

This trajectory continued into the first quarter of 2024, keeping copper trading in a range of US$8,000 to US$8,500. Recent production curbs out of top Chinese copper smelters are also helping to support prices.

The closure of First Quantum Minerals' (TSX:FM,OTC Pink:FQVLF) Cobre Panama copper mine last year and Anglo American (LSE:AAL,OTCQX:AAUKF) revised 2024 copper production target were also significant factors behind copper's price momentum.

It began climbing in earnest in Q2 on building anticipation that the Federal Reserve may soon launch its rate cut cycle alongside a worsening supply side picture. On May 20, 2024, the price of copper reached its highest recorded price of US$5.20 per pound, or US$11,464 per MT.

However, the price of the base metal moved back under US$10,000 by the end of the month.

Is the optimism of an impending bull market for the red metal still warranted? Let’s look at the current supply and demand factors that could influence copper prices to the upside.

Green energy in driver’s seat for copper demand

Copper’s many useful properties have translated into demand from diverse industries. Construction and electronics have long been the main drivers for copper demand, and with a conductivity rating that's second only to silver, it’s no wonder copper is also an ideal metal for use in energy storage, electric vehicles (EVs) and EV charging infrastructure.

Energy storage may prove to be one of the most copper-intensive markets in the 21st century. According to a 2022 report on the future of copper by S&P Global Market Intelligence, “The rapid, large-scale deployment of these technologies globally, EV fleets particularly, will generate a huge surge in copper demand.”

The firm is projecting that global refined copper demand will nearly double from 25 million MT in 2021 to about 49 million MT in 2035. Energy transition technologies are expected to account for nearly half of that demand growth. “The world has never produced anywhere close to this much copper in such a short time frame,” the firm notes in its report.

China is the world's largest consumer of the metal, and unsurprisingly its zero-COVID policy wreaked havoc on its economy and demand for copper. When China ended that policy in early 2023, it contributed to the boost seen in copper prices at the time. However, repercussions continue to be seen in the country, particularly in its real estate market.

China's property sector turmoil is in its third year, with housing starts down by more than 60 percent compared to pre-pandemic levels, as per the International Monetary Fund. However, analysts are starting to call for a bottom as China's aggressive efforts to energize the sector slowly right the ship — property investment in China fell by just 9 percent year-on-year in the first two months of 2024, compared with a 24 percent fall in December 2023, reported Reuters.

Property sector aside, copper demand out of China is likely to get a boost from the Chinese government's commitment to investing in its electrical infrastructure and green energy economy.

This push can be seen in ongoing structural reforms intended to secure the nation's place as a global economic powerhouse — these include the Made in China 2025 and China Standards 2035 initiatives. A part of the country's 14th five year plan, these policies target sectors that are heavily reliant on copper, such as 5G networks, robotics, electrical equipment, EVs, industrial internet, intercity transportation and rail systems, ultra-high-voltage power transmission and EV charging stations.

While the next five-year plan is still in the works, there are indications that measures to achieve carbon neutrality and increase renewable energy consumption are still very much a part of China's long-term economic objectives.

On the EV side, S&P Global projects that sales in China will reach 11.5 million units in 2024, up 22 percent from 2023. The country's photovoltaic market is also expected to remain strong in 2024.

The EV market is a growing global source of demand for copper outside China as well. As the Copper Alliance has noted, EVs can use three to four times as much copper as an internal combustion engine passenger car.

Automakers are making large investments in growing their EV production capacity, with some even looking to secure copper supply. Last year, McEwen Copper, a subsidiary of McEwen Mining (TSX:MUX,NYSE:MUX), received a US$155 million investment from Stellantis (NYSE:STLA), the fourth largest carmaker in the world.

Watch the full interview with Rob McEwen and Michael Meding above.

In a recent interview, Rob McEwen and Michael Meding discussed McEwen Copper's plans to release a feasibility study for the company's Argentina-based Los Azules copper project by the first quarter of 2025.

Companies struggling to keep copper supply coming

Of course, demand is just one side of the story for copper prices. For more than a decade, the world’s largest copper mines have struggled with steadily declining copper grades and a lack of new copper discoveries.

The alarm bells have been ringing for a few years now. In a mid-2020 report, S&P Global Market Intelligence metals and mining analyst Kevin Murphy painted a “dismal” picture for copper mine supply. He stated that out of the 224 copper deposits discovered between 1990 and 2019, a mere 16 were discovered in the last decade. These circumstances have led to questions about whether peak copper has arrived.

The COVID-19 pandemic further exacerbated challenges in the global copper supply chain as both mining and refining activities in several top copper-producing countries were slowed or halted altogether. The economic uncertainty also led miners to delay further investments in copper exploration and development — a complicating factor given that it can take more than 15 years to develop a newly discovered deposit into a producing mine.

Speaking at the Prospectors & Developers Association of Canada (PDAC) convention in March 2024, Murphy discussed another factor influencing new copper supply coming to market: inflation. He presented data highlighting how inflation has hamstrung the mining sector. In 2023, exploration budgets for all metals totaled US$12.8 billion, down 3 percent over the previous year.

Murphy also suggested that current economic trends are not only preventing projects from entering the pipeline, but also sandbagging current projects.

“Drilling has been in a downtrend as well, and it’s a bit worse than budgets in 2023, which indicates some inflation has hit the mark," he stated. "It’s a hard industry. The standard is about 3 percent, (and) at the moment we’re thinking that budgets are probably down 5 percent (in 2024)."

Supply instability out of the world’s largest copper-producing countries, Chile and Peru, has also weighed heavily on the market in the past few years. Together, they represent a combined 40 percent of global output.

In Chile, some of the world’s biggest copper miners, including BHP (ASX:BHP,NYSE:BHP,LSE:BHP) and Anglo American (LSE:AAL,OTCQX:AAUKF), are facing royalty rate increases due to a tax reform bill. The country is also dealing with water woes as drought intensifies, causing tension for miners that rely on water to pump copper to the surface, and for the smelting and concentration processes.

To the north, in Peru, copper miners have been nervous about the sociopolitical unrest following the impeachment and jailing of former President Pedro Castillo in December 2022, including protests against the mining industry.

However, mining investment is still alive and well in Peru, especially when it comes to copper, and current President Dina Boluarte supports the industry. According to EY, "Of the new mining investments, US$38.5 billion is expected to be allocated to mining projects in Peru, with copper projects accounting for 72 (percent) of the total."

The supply side of the copper market is also being impacted by production challenges out of some of the world’s major producers. Facing sociopolitical pressure, First Quantum Minerals had to shut down its Cobre Panama mine in late 2023; it accounted for about 350,000 MT of annual global copper production.

Furthermore, Anglo American revised down its 2024 copper production target to a range of 730,000 to 790,000 MT of copper compared to the previous guidance of 1 million MT. This was due in large part to production shortfalls at its Los Bronces copper mine, which is expected to continue into 2025.

Bull market for copper or bust?

So when will copper go up? Together, strong demand and tight supply can create the right market environment for higher prices.

Copper’s strong rally in recent years has encouraged the idea that even higher copper prices are ahead, which could be a golden opportunity for junior copper companies in the long-term. At a Vancouver Resource Investment Conference copper panel, one speaker explained why this segment of the metals market has piqued his interest.

“I’m a copper bull, it’s a long-term performing asset, but 'quality' is what you have to add to the phrase, and I think copper is essential. As we all see the population growth, modernization, electrification, it’s going to be a key metal going forward,” said panelist Ivan Bebek, chairman of Torq Resources (TSXV:TORQ,OTCQX:TRBMF).

"Copper is the new oil," declared Jeff Currie, chief strategy officer of Energy Pathways at Carlyle, during his mid-May Bloomberg TV interview. The analyst is pointing to the explosion of AI technology, the energy transition and military spending as top drivers of copper demand that could push prices for the red metal up to US$15,000 per MT in the near future.

The Bank of America sees potential for copper prices to reach US$12,000 per MT for 2026. As demand is set to increase, the bank's analysts have said the severe lack of new copper projects is "finally starting to bite."

For its part, Citigroup (NYSE:C) is also projecting a copper price of US$12,000 by 2026 in its base-case scenario on higher demand for the red metal from the green energy revolution. The firm's analysts do see a more bullish case for US$15,000 copper over the next two to three years in the event of a strong economic recovery.

This is an updated version of an article first published by the Investing News Network in 2021.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Copper Prices Could See "Astronomical Rise" as Supply Concerns Increase ›

- Is Now a Good Time to Invest in Copper? Panelists Tout Long-term Fundamentals ›

- Copper Short-term Worries Unlikely to Derail Long-term Outlook ›

- Is the World Running Out of Copper? ›

- Copper Price Forecast: Top Trends That Will Impact Copper in 2024 ›

- Copper Price Forecast and Market Predictions | S&P Global ›

- Copper Prices May Jump 20% by 2027 as Supply Deficit Rises ... ›

- Copper Outlook for 2024 Dominated by Uncertain Supply, Green ... ›

- Copper Outlook & Forecast Reports | Wood Mackenzie ›

- Copper - 2023 Data - 1988-2022 Historical - 2024 Forecast - Price ... ›