Tech 5: TSMC, ASML Release Latest Results, NVIDIA to Resume Sales to China

Elsewhere in the tech space, Apple said it will invest US$500 million to support a US rare earths supply chain, and OpenAI and AWS launched new AI agent features.

Investors honed in on tech stocks as Q2 earnings season kicked off on Monday (July 14).

Some experts believe the rallying market is showing signs of frothiness.

Apollo Global Management (NYSE:APO) Chief Economist Torsten Sløk highlighted concerns about overvaluation mid-week, comparing the current tech craze to the dotcom bubble of the 1990s.

“The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 (INDEXSP:.INX) today are more overvalued than they were in the 1990s,” he wrote on Wednesday (July 16).

Moor Insights & Strategy founder Patrick Moorhead expressed similar thoughts last week.

However, Sanctuary Wealth's chief investment strategist, Mary Ann Bartels, told CNBC’s Power Lunch team that valuations are justified by the technology that’s being unleashed. Major financial firms like Citigroup (NYSE:C), Bank of America (NYSE:BAC) and Morgan Stanley (NYSE:MS) also said they are increasingly exploring digital asset offerings, signaling traditional finance's growing involvement in crypto and the broader adoption of innovative technologies.

These announcements came alongside positive earnings reports and mixed inflation data that helped lift markets to renewed highs, culminating in global manufacturer 3M (NYSE:MMM) raising its full-year profit forecast on Friday.

The company is projecting a smaller tariff-related hit to its 2025 earnings.

1. TSMC, ASML release latest quarterly results

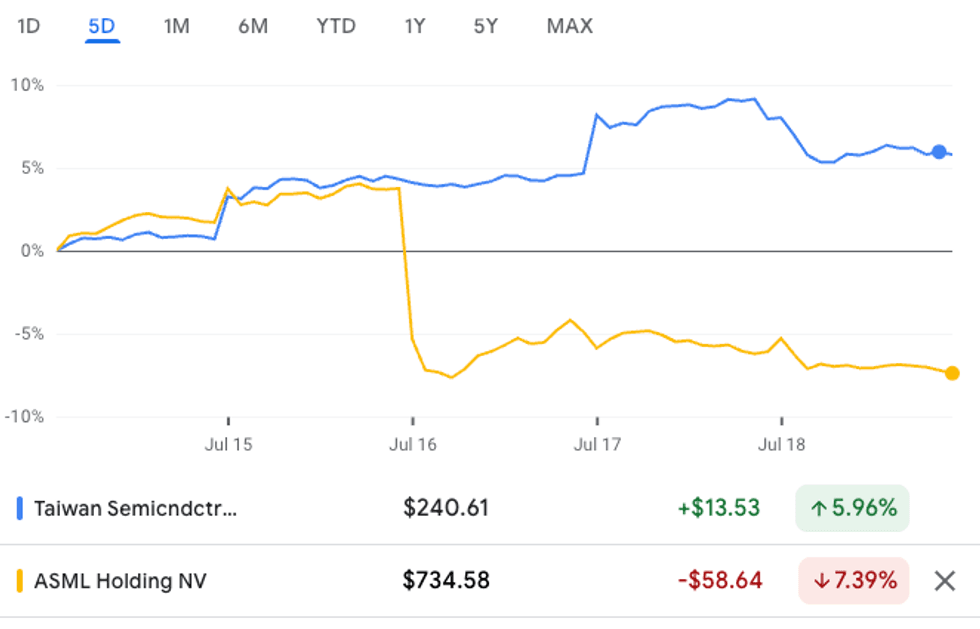

This week saw semiconductor giants Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE:TSM) and ASML Holding (NASDAQ:ASML) report their latest quarterly earnings.

The companies received vastly different reactions from the market. Contract chipmaker TSMC saw its valuation soar on Thursday (July 17) morning after it posted record profits that exceeded expectations and raised its full-year revenue forecast by 30 percent due to demand for artificial intelligence (AI) chips.

While the chipmaker addressed minor concerns about US tariffs and inventory, AI-driven growth dominated investor sentiment. Shares of TSMC opened 4.51 percent higher from Wednesday’s (July 16) closing price.

Positive sentiment spilled over into other chip stocks, with NVIDIA (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO) also seeing gains. TSMC maintained its position to close up 5.87 percent for the week.

TSMC and ASML performance, July 15 to 18, 2025.

Chart via Google Finance.

Conversely, ASML, a lithography systems monopolist, saw its share price plunge more than 8 percent ahead of Wednesday’s open, despite solid Q2 numbers, due to a cautious outlook for late 2025 and 2026.

In a statement, the company said it cannot confirm growth in 2026 due to current macroeconomic and geopolitical developments. ASML closed the week 7.39 percent below its Monday opening price.

The divergence highlights their supply chain positions: TSMC directly benefits from the immediate AI boom, while the prospects for ASML, a step removed, remain uncertain.

2. US announces major investments in Pennsylvania

US President Donald Trump joined Pennsylvania Senator Dave McCormick (R) at the inaugural Energy and Innovation Summit at Carnegie Mellon University in Pittsburgh on Tuesday (July 15).

He announced an investment amounting to over US$90 billion in AI and energy infrastructure in the state.

The sum outlined by Trump covers several multibillion-dollar spending plans from the likes of Google (NASDAQ:GOOGL), Blackstone (NYSE:BX), Anthropic, GE Verona (NYSE:GEV) and others for power generation and grid modernization. It also includes natural gas production to help power data centers.

Additionally, the preview mentions AI training programs and apprenticeships for businesses.

“These commitments will create tens of thousands of construction jobs and thousands of permanent jobs, signaling Pennsylvania’s readiness to power the AI and energy revolution, further strengthening America’s resilience and independence,” McCormick’s office wrote in a press release.

Separately, Google and Brookfield Asset Management (NYSE:BAM) announced on Tuesday that they have entered into a framework agreement to provide up to 3,000 MW megawatts of domestically produced hydropower from Brookfield's Holtwood and Safe Harbor hydroelectric facilities in Pennsylvania. The agreement allows for future expansion, with an initial focus on the mid-Atlantic and mid-continent electricity markets.

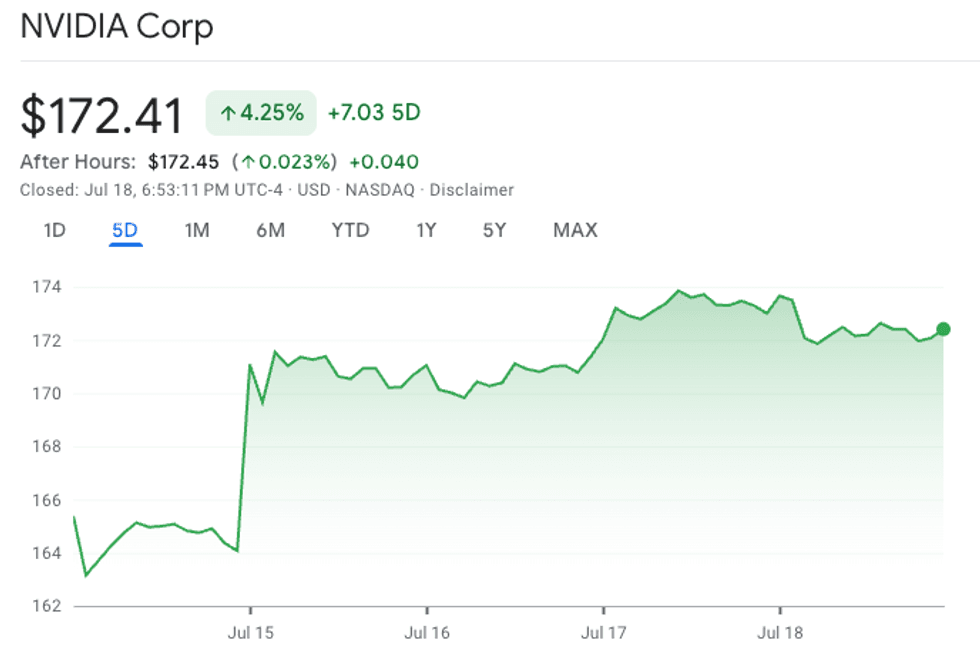

3. NVIDIA to resume chip sales to China

On Monday, NVIDIA CEO Jensen Huang said his company will resume H20 GPUs sales to China after productive meetings with government officials from the US and Beijing earlier this month.

In a press release, the company said it has been assured by the US government that licenses will be granted.

NVIDIA performance, July 15 to 18, 2025.

Chart via Google Finance.

Shares of the chipmaker opened 4.27 percent higher on Tuesday and closed the week up 4.25 percent.

4. Apple to invest in US rare earths miner

On Tuesday, Apple (NASDAQ:AAPL) said it will invest US$500 million in rare earths miner MP Materials (NYSE:MP) as part of an effort to strengthen the American rare earths supply chain.

MP is the only fully integrated rare earths miner operating in the US. Last week, the US Department of Defense said it would buy a direct equity stake in the company, becoming its largest shareholder.

The company's Apple collaboration includes plans to build out MP’s neodymium magnet manufacturing lines at its Texas factory specifically for Apple products. This expansion is slated to boost production and create jobs in advanced manufacturing and research and development, helping to meet global demand.

Apple and MP will also collaborate to establish a rare earths recycling line in Mountain Pass, California, and will develop new magnet materials and processing technologies to improve magnet performance.

“American innovation drives everything we do at Apple, and we’re proud to deepen our investment in the U.S. economy,” said Tim Cook, Apple’s CEO.

5. OpenAI and AWS launch new AI agent features

Open AI has launched a powerful new Agent mode in ChatGPT for pro, plus and team users.

It can autonomously complete tasks across the web, and also includes productivity tools.

The new feature enables AI agents that can help automate workflow by creating and editing spreadsheets and presentations, generating reports, analyzing data and managing calendars on users’ desktops; agents can also browse websites and fill out forms with user approval. The company has plans to add e-commerce checkouts.

Aside from that, the Financial Times reported this week that OpenAI plans to take a cut of online shopping purchases made within its chatbot as a way to generate revenue from people using AI for shopping inspiration.

Amazon (NASDAQ:AMZN) also made major announcements around AI agents this week. At its Amazon Web Services (AWS) Summit in New York, the company launched Bedrock AgentCore, a suite of enterprise-grade services that will allow developers to build, deploy and run scalable agents. AWS also introduced AI Agents & Tools, a new category on AWS Marketplace. It features pre-built agents from partners like Anthropic, IBM (NYSE:IBM) and Stripe.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.